Author: Peter Chung, Presto Research; Compiler: Tao Zhu, Golden Finance

Summary

Mt. Gox’s compensation plan will distribute billions of dollars worth of BTC and BCH to Mt. Gox creditors between July 1 and October 31, 2024. During this 4-month period, this may cause changes in the supply and demand dynamics of BTC and BCH, which may open up pair trading opportunities.

Our analysis shows that BCH’s selling pressure will be four times that of BTC. The assumptions are: 1) For BTC, only a small portion will be sold because the creditors are mostly wealthy Bitcoin holders who “hold diamonds”; 2) For BCH, 100% will be sold in the short term given its much weaker investor base.

Long BTC perpetual contracts paired with short BCH perpetual contracts are the most effective market neutral way to express this view, unless there is funding rate risk. Those who wish to lock in funding rates can explore other methods such as short-term futures or borrowing BCH in the spot market.

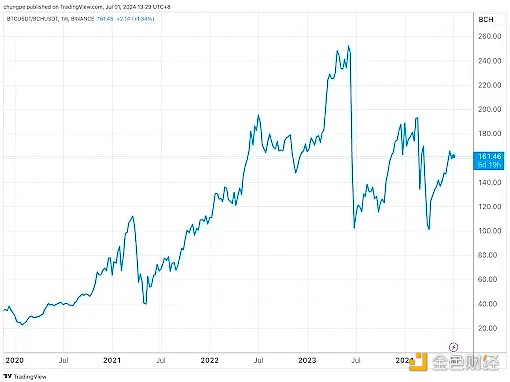

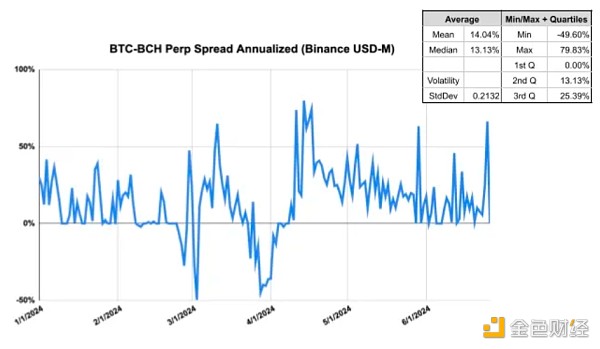

Figure 1: BTC/BCH ratio is on an upward trend

Source: TradingView, Presto Research

Foreword

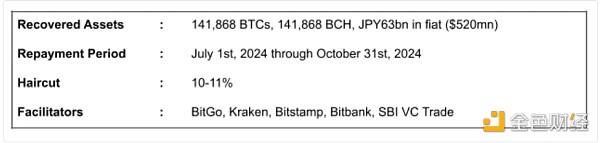

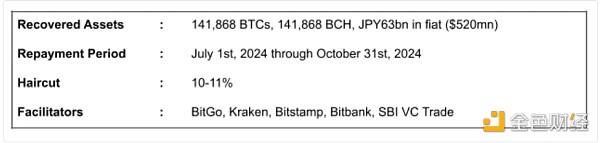

The "Notice on the Start of Repayment Using Bitcoin and Bitcoin Cash" issued by Mt.Gox on June 24 clearly stated that the repayment of the so-called "early lump-sum payment (as described below)" selected by Mt.Gox will be between July 1 and October 31, 2024 16px;">

Mt. Gox Repayment Plan

Mt. Gox was once the world's largest Bitcoin exchange until it closed in early 2014 after losing nearly 1 million Bitcoins held by its customers. Some of these assets were later found. The trustee is working to repay creditors under the plan.

Under the plan, Mt. Gox creditors can choose to receive compensation "in advance" based on a small reduction in assets recovered to date, rather than waiting for "full recovery." This option is often referred to as an "early lump sum payment (ELSP)" and would be preferred by creditors who want certainty of an upfront payment. The other option is to hold out and hope for further progress in asset recovery while taking on various risks that could affect the amount of repayment, such as the ongoing CoinLab lawsuit. As the outcome of both issues is uncertain and there is no clear timeline, most creditors prefer to exit early. The highlights of ELSP are as follows (Figure 2).

Figure 2: ELSP Details

Source: CoinTelegraph, @intangiblecoins, Presto Research

The mainstream narrative at the moment is that billions of dollars in repayments will swamp supply and lead to a sell-off as recipients of the repayments cash out in droves. While such a prospect is certainly unsettling to markets, assessing whether it will actually have a significant impact requires more careful analysis. Generally speaking, so-called “overhang” risk in any market only emerges when 1) sellers are under time pressure, or 2) the opportunity cost of holding the asset is perceived to be high. Evaluating these two points for the two assets in question, namely BTC and BCH, we can observe different dynamics at play.

Analyzing Mt. Gox’s Creditors

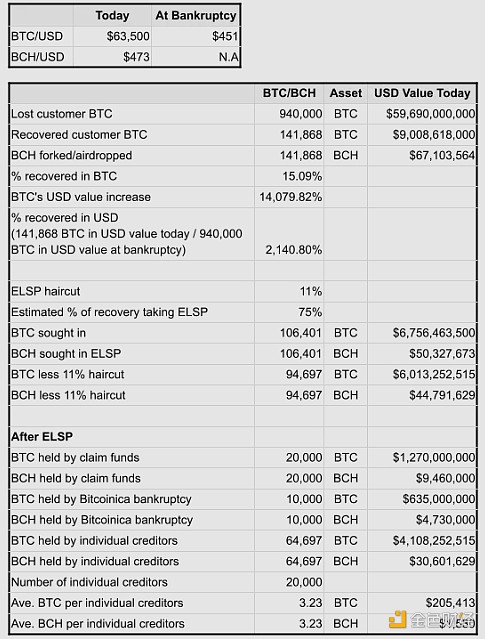

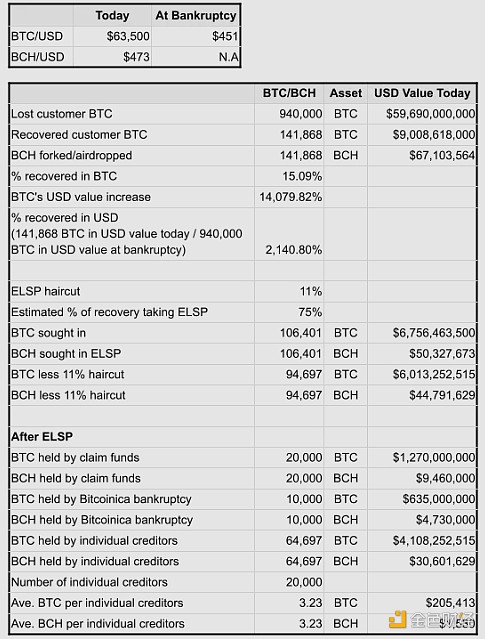

Our analysis was inspired by Galaxy Digital’s head of research Alex Thorn’s “X” theme, which provides an excellent framework for thinking about this issue. We reproduce his table below and supplement it with additional data for clarity.

Figure 3: Analysis of ELSP repayments

Source: @intangiblecoins, Presto Research

Assessing how creditors might behave after receiving repayments requires a closer look at who they are. The table above shows that, in addition to individual creditors, the two largest creditor groups are the “claims funds” and Bitcoinica. Claims funds are essentially institutional “vulture funds” whose purpose is to buy bankruptcy claims at a significant discount. Fortress Investment Group and Off The Chain Capital were major players in the Mt. Gox trade. Over the past few years, claims funds have accumulated a large amount of BTC claims from distressed sellers, now 20,000 BTC according to Alex’s estimate. Bitcoinica, a defunct New Zealand Bitcoin exchange, had as much as 10,000 BTC on deposit with Mt. Gox.

Alex points out in his post:

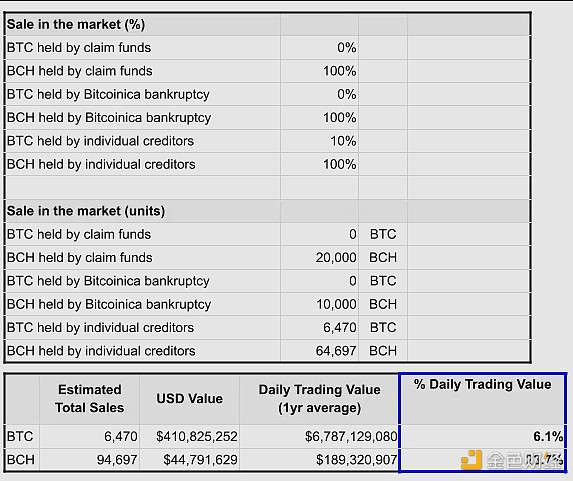

His analysis assumes that 75% of creditors accept ELSP.

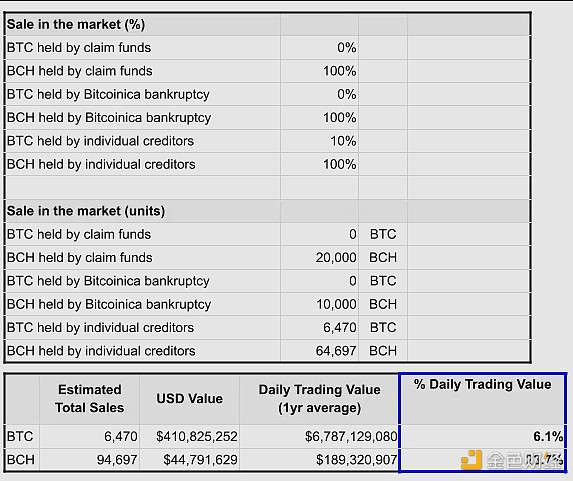

Claims funds are unlikely to sell immediately because their limited partners are made up of early Bitcoin holders who are already wealthy and looking to accumulate more money at a discounted price. As a defunct exchange going through bankruptcy proceedings, Bitcoinica is unlikely to liquidate its holdings. The current group of individual creditors is likely to be “big spenders” in that they have chosen to hold onto their claims for a decade, resisting aggressive bids from bond funds. Weaker creditors had many opportunities to exit, and they may well have done so. Given the above, we extend Alex’s original analysis by adding the assumption that creditors repay the portion that enters the market. Specifically, for BTC, we assume that only a small portion will be sold for the reasons mentioned above. For BCH, we assume that 100% will be sold in the short term (Figure 4). Consider that the Bitcoin Cash fork occurred three years after the Mt. Gox bankruptcy. The assumption here is that Mt. Gox creditors were unaware of the Bitcoin Cash cause and were more likely to treat their BCH payments as any crypto enthusiast would treat an airdrop — i.e., immediately cash out or redeem for BTC. We apply these assumptions to the data in Figure 3 to derive the USD value of possible BTC and BCH liquidations. Compared to BCH, its trading volume is much smaller. Since BCH has much smaller trading volume than BTC, there is much more selling pressure on BCH than BTC — i.e., BTC accounts for 6% of daily trading value, while BCH accounts for 24% of daily trading value.

Figure 4: BCH has 4x the selling pressure of BTC

Source: @intangiblecoins, Presto Research

The best way to exploit this asymmetric supply risk in a market neutral manner is to have long BTC exposure and short BCH exposure. This can be expressed in a few different ways, but the most effective is in the perpetual futures (perps) market. Perpetual operators are exposed to the risk of volatile funding rates, but this risk is easily dwarfed by the convenience of quickly establishing and unwinding bilateral bets.

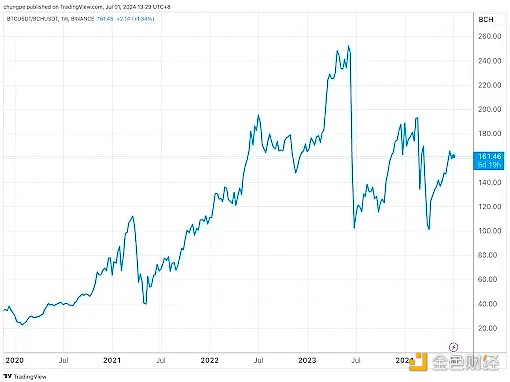

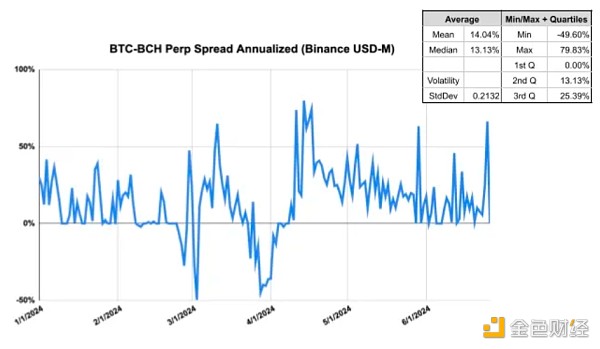

For example, let’s look at expressing this trade via the Binance USD-M futures. In 2024, the average annualized net funding rate for long BTCUSDT perpetuals and short BCHUSDT perpetuals was 13% (Figure 5). If you were 3 months into the trade, the breakeven threshold would be 3.25%. Given that the BTC/BCH ratio is currently at 161, a move to a local high of 193 (+20% upside) would clear the barrier and generate a market neutral return of 17% after funding costs. The all-time high for the ratio is 252 in May 2023.

Figure 5: Funding costs for paired trading

Source: Binance, Presto Research

In addition, those who want to lock in funding rates can explore other methods, such as short-term futures or borrowing the underlying asset in the spot market. Some exchanges offer BCH/BTC pair trading, although liquidity is low (Figure 6).

Figure 6: BCH/BTC trading pair 24-hour trading volume is $2.3 million

Source: Binance

JinseFinance

JinseFinance