Original Title: All Markets Are Not Created Equal: 7 Factors To Consider When Evaluating Blockchain-Enabled Collectibles Marketplaces (BECMs)

Author: Vishal Kankani, Eli Qian; Investment Partner of Multicoin Capital; Translated by: 0xxz@Golden Finance

Collecting is big business. Today, more than a third of Americans self-identify as collectors, and the market size of collectibles is now close to $500 billion by 2024. Collectibles are a booming industry - and blockchain is making its way into it.

More and more collectors in the world are actually traders whose sole purpose is to buy and sell billions of dollars worth of collectibles - from rare whiskeys to luxury watches to handbags - with the goal of reselling them for a profit. While online marketplaces have often evolved from digital classifieds to one-stop shops to vertical markets, they have not yet evolved to serve humanity in the most efficient way.

In order for resale transactions to be as efficient as possible, the collectibles market needs to have 1) instant settlement, 2) physical custody, and 3) authentication capabilities. Leading collectibles marketplaces, such as Bring a Trailer, StockX, and Chrono24, offer all three. Cash settlement is not an option; instead, physical settlement is the default—with settlement times typically measured in days or weeks. For larger collectibles, such as cars, physical storage quickly becomes an issue (where do you put 20 cars when you resell them?). For smaller collectibles, which are often traded through vertical marketplaces such as Facebook groups, fraud is a constant challenge. All of these factors make trading collectibles in today’s market extremely inefficient.

We see a huge opportunity to create an entirely new market design built specifically for collectibles traders, called Blockchain-Enabled Collectibles Marketplaces (BECMs). These marketplaces offer instant trades through cash settlement, use stablecoins to reduce settlement times from weeks to seconds, and use NFTs as digital representations of physical assets held by trusted custodians or certifiers.

BECMs have the potential to reshape the multi-billion dollar collectibles market as they can achieve the following goals: 1) unify the market and increase liquidity (relative to the current fragmented black market); 2) eliminate the need for personal physical storage, thereby encouraging more trading; 3) increase trust by providing identity verification; and 4) financialize the act of collecting by facilitating lending where previously lending was not possible. We believe the result of these efficiencies will greatly expand the total addressable market (TAM) for the entire collectibles market as more traders, liquidity, inventory, and marketplaces come online.

However, while it is technically feasible to build a BECM for any collectibles category, not all BECMs are created equal. The remainder of this article will focus on what qualities make a BECM worthy of venture capital investment. We will break down seven key characteristics along three design dimensions: financial, real-world, and emotional.

Financial Dimensions

Lack of Verticalized Trading Venues

Today, most collectibles do not have dedicated markets or exchanges to aggregate liquidity and facilitate public price discovery; instead, they are traded in many different venues — WhatsApp chats, Facebook groups, auction houses, etc. — which fragment and segment liquidity. This means there is ample opportunity to serve underserved collectibles markets; however, it will be difficult for BECM to compete if existing market structures are already efficient. These markets are less attractive to venture investors.

Based on our initial assessment of the collectibles markets, the wine and spirits, handbags, and watches markets have the greatest potential for improvement. These collectibles are overwhelmingly traded on the black market, lacking liquidity and price discovery, making existing markets vulnerable to disruption.

Right Price Point

For collectibles categories to receive venture funding, prices must be low enough for collectors to own the asset outright. For financial investment, ownership of a fraction of an asset is fine, but for collectors, ownership of half a luxury handbag defeats the purpose of collecting. Additionally, super-high-priced collectibles reduce the overall number of buyers, making these collectible categories less liquid. For example, no one will resell a million-dollar Ferrari because demand does not coincide 24/7.

On the other hand, collectibles need to be expensive enough that owning it confers a certain social status, gives a sense of exclusivity, and provides emotional satisfaction. If something is too cheap and anyone can own it, it will not attract emotionally and status-driven buyers, making the market less liquid. Additionally, price points should be high enough that it is worth it for potential market makers to spend time researching the collectible category. If items are too cheap, they must turn over more times for the unit economics to make sense. However, cheap collectibles do not provide enough social status to attract collectors to form a liquid market.

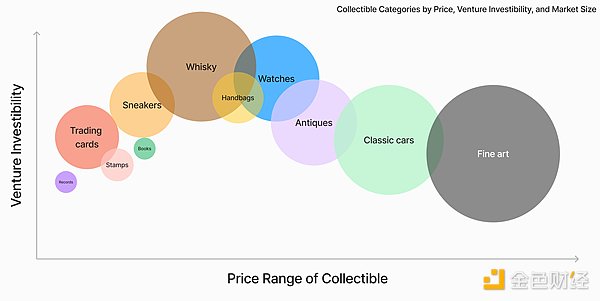

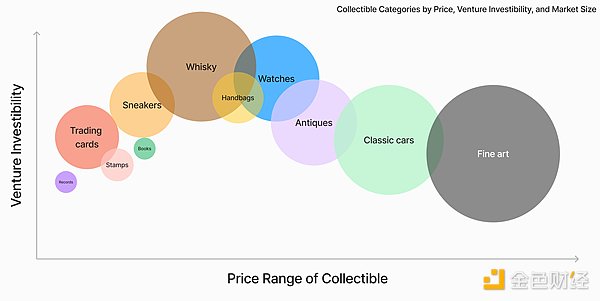

We believe the prime price range for investable BECM is around $1,000 to $100,000. This would make collectibles such as sneakers, watches, handbags, and antiques ideal for BECM. Collectibles such as art and cars are too expensive for most people. Collectibles such as records and stamps may not be a good fit for BECM because of their lower price points. Their niche combined with their low prices make it difficult for the market to generate enough trading volume.

Source: Venture investment feasibility is our subjective assessment, bubble size corresponds to market size,

Source: Venture investment feasibility is our subjective assessment, bubble size corresponds to market size,

Source: Records, trading cards, stamps, rare books, sneakers, whiskey, handbags, watches, antiques, fine art, classic cars

Seen as a means of value storage

Collectors are buyers seeking status. It can be said that they have diamond hands. Their presence is essential to a healthy price floor in the collectibles market. It shows that collectibles are not a passing fad, but rather an item of lasting cultural significance. This is because when enough people believe that an item will be culturally significant long into the future, it has a chance to be seen as a store of value. Collectibles that store value have cross-generational appeal and are generally immune to technological change.

Fine art is a great example. Humans have enjoyed art for thousands of years, and it’s safe to say that people will continue to enjoy it thousands of years from now. Vinyl records are a more ambiguous example. They have broad appeal to older generations, but whether the generation that grew up after the iPod era will continue to value them remains to be seen.

Real World Latitudes

Difficult to Store

Collectibles that take up a lot of physical space or are prone to deterioration in the average home environment are prime candidates for BECM, and therefore a good category to invest in. It’s difficult for the average person to store delicate collectibles like wine and art for long periods of time without taking environmental precautions (humidity, temperature, light, etc.). Even if you could magically solve these problems, you’d quickly run into space constraints — storing more than 50 paintings or 100 bottles of wine would be cumbersome in most people’s homes. Even if you could magically eliminate space constraints, you’d run into insurance issues.

If the managed collectibles category wasn’t difficult, then building a BECM might still be profitable, but the barriers to entry would be much lower, leading to increased competition, fragmented liquidity, and reduced pricing power. NFTs are the best example of this category: they are environmentally insensitive and don’t take up any physical space, and transparent provenance on the blockchain makes fraud nearly impossible, making it difficult to build a defensible NFT market. We believe that collectibles such as wine, whiskey, and cars present the greatest challenges in storage, and therefore collectors of these collectibles will benefit the most from BECM. Wine and whiskey are extremely environmentally sensitive and require special vaults to control temperature, humidity, light, and other factors (our investment in Baxus is solving this precise problem). Cars require large physical garages - most people would have a hard time storing more than 3 or 4 cars at home. Trading cards, sneakers, watches, and handbags are less difficult to store — collectors of these items can still benefit from outsourced storage, but with smaller marginal improvements.

There is a trust problem

In addition to solving the physical custody problem, BECM must also solve the authenticity problem to attract investors.

Today, collectors face a serious trust problem; buyers and sellers in group chats rely on community recommendations and anonymous moderators to vet counterparties. Unsurprisingly, scams exist in almost all collectibles. It is difficult for market participants to have 100% confidence in their purchases. Creating market standards and trusted authenticators is critical to attracting liquidity from collectors, alternative asset investors, and speculators.

There are two ways to authenticate:

In-house authentication — This requires domain expertise and is more complex to operate. If the marketplace misauthenticates an item, it will bear the responsibility of compensating collectors. However, this can be a good moat, especially if the collectible is difficult to authenticate. That being said, marketplaces that do authentication in-house must manage potential conflicts of interest and require some oversight to maintain buyer trust.

Outsourcing—which is easier but reduces the margins that marketplaces can earn—so it makes more sense when the collectible categories are easier to authenticate. Another benefit is that outsourcing authentication naturally separates the marketplace from the authenticator, mitigating potential conflicts of interest.

If BECM can build trust and offer a money-back guarantee, it can build a moat that makes it worthwhile as a venture capital investment. Collectibles such as watches, handbags, and wine are rife with fakes. BECM has a great opportunity to increase trust and attract new collectors who may not otherwise be willing to collect for fear of fraud.

Emotional Dimensions

Time-Based vs. Brand-Based Provenance

In the context of collectibles, provenance refers to how an item acquires its value. For collectibles, provenance is typically time-based or brand-based.

Time-based provenance means that an asset appreciates over time and historical context. Rare books are an example of such an asset. Assets with time-based provenance are traded exclusively on secondary markets - there is no central issuer and the asset is usually one of many, or one of a few. This characteristic can limit secondary market activity because collectors do not need ongoing funds to purchase newly issued assets and diamond-handed collectors suppress the supply available for trading. The Constitution DAO is a good example - the copy of the Constitution they bid on has not returned to the secondary market to this day. Other collectibles with time-based provenance include antiques, fine art, cars, and guns.

Brand-based provenance, on the other hand, is when a brand builds a reputation over time and the market begins to perceive its products as valuable. Watches are a classic example of brand-based provenance. The top luxury watch manufacturers - Rolex, Patek Philippe, Richard Miller, and Audemars Piguet - are major players in nearly half of the luxury watch market because their names have value. Branded collectibles have a central, for-profit issuing body that constantly releases new items. Unlike time-based Provence collectibles, these encourage secondary market activity because collectors need funds to buy new supply and turn to the secondary market for sales.

Therefore, brand-based BECMs are more suitable for venture capital than time-based BECMs.

Communities of Enthusiastic Collectors Do Exist

Venture capitalists want to see that people have strong emotions about collectibles; it is a prerequisite for having a diamond-handed collector. Without them, it is difficult to have organic liquidity. Therefore, BECMs with weak communities will find it difficult to attract large amounts of capital and lose investment appeal.

The best sign of a thriving community is passion, even to the point of debate. We expect to see car collectors arguing about the best supercars ever and the most underrated brands revered by handbag enthusiasts. A group of passionate collectors will be active in all corners of the Internet - subreddits, forums and group chats.

The Cambrian Age of Collecting

The future is not limited to BECMs for watches, handbags and wine. There are hundreds of other investable categories.

The opportunity for BECM lies in opening new markets for collectibles of all kinds, improving access to a new class of alternative investments.

We have long been interested in how cryptocurrencies can impact the real world, starting with our initial investment in Helium back in 2019, spearheading what is now DePIN. We learned a lot from the early development of DePIN and have shared some of our thoughts on the market opportunity for DePIN.

BECM, like DePIN, offers another such opportunity and will fundamentally redefine what it means to own and collect.

Edmund

Edmund