Author: Kyle Samani, Managing Partner of Multicoin Capital; Translation: 0xjs@金财经

Filecoin Virtual Machine (FVM) was launched on March 14, 2023 (Pi Day). In the world of cryptography, nothing beats FVM. It allows developers to tie payments and DeFi to real-world primitives on the Filecoin network, starting with storage. Over time, we expect that FVM will also allow direct programming of bandwidth and computing resources.

We initiated the FIL position prior to the launch of FVM. During our research to understand what developers could build with it, we discovered GLIF and made it our first investment in the Filecoin ecosystem.

On February 6, 2024, we are pleased to announce that Multicoin Capital has led a $4.5 million financing in GLIF, Filecoin’s underlying DeFi primitive and the first liquidity for cryptocurrency Rental agreement.

GLIF is the basic DeFi primitive of Filecoin

Today, the main function of the Filecoin network is file storage. Storage providers (SPs) must pledge FIL as collateral on behalf of their customers.

In order to provide storage, the SP must provide two forms of capital: hardware and financial capital (in the form of FIL). GLIF uses FVM to create a permissionless marketplace between people who own FIL and SPs who own the hardware. GLIF solves a core capital efficiency problem in the Filecoin ecosystem, similar to the role Jito and Lido play in their respective ecosystems. Specifically, GLIF allows FIL holders to deposit FIL into a liquidity pool and receive iFIL in return. iFIL operates as a liquid staking token: it earns rewards from SP over time. SPs can lease FIL from the liquidity pool for staking based on the amount of collateral they have locked in the protocol. After leasing, the SP must make weekly payments into the pool. These payments serve as incentives for liquidity providers. Due to the complexity of Filecoin’s underlying cryptoeconomics, the mechanism employed by GLIF is similar to crypto “leasing.”

Flexible Foundation

An interesting and under-observed aspect of GLIF is the protocol’s ability to deploy multiple interoperable capital markets with its own custom assets and rules (Currently there is only one market). This feature opens the door for GLIF to work with LPs and SPs in a customized way, and scale out to accommodate new use cases as Filecoin matures.

For example, GLIF could deploy custom pools specifically designed to lower the barrier to entry for new SPs to join the network, stablecoin-based pools that leverage the SP's storage transaction flow as collateral for borrowing, and/or provide A pool of SP deployed capital is storing a specific data set or running a specific computational program. Ultimately, we imagine a Filecoin economy where many custom pools exist to incentivize niches or specific use cases in data storage, retrieval, and ultimately computation. In this way, GLIF's architecture is completely unique and also able to scale with Filecoin and new use cases that emerge as FVM matures.

Strong growth

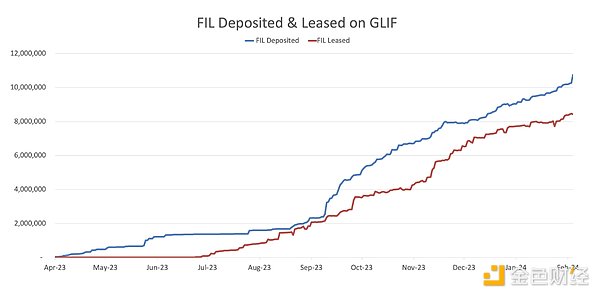

Today, GLIF is the leading DeFi protocol on Filecoin, with approximately 10 million FIL being lent and 8 million FIL being leased.

Source: GLIF Team

GLIF is the leader of the Filecoin ecosystem

The GLIF team is led by Jon Schwartz and Peter Andersen, who have been building foundational products in the Filecoin ecosystem since 2019. Prior to launching GLIF’s liquidity leasing protocol, they built: the first web wallet for the Filecoin mainnet; a multi-signature wallet for Filecoin’s SAFT token distribution (still used by Protocol Labs and the Filecoin Foundation today) wallet to manage payments); the de facto FilecoinRPC service (handling over 85 million requests per day); and several other key applications and tools for the Filecoin network.

We loved working with Jon and Peter as they built the foundational DeFi primitives that power Filecoin.

JinseFinance

JinseFinance

JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance Max Ng

Max Ng Coindesk

Coindesk Coindesk

Coindesk Cointelegraph

Cointelegraph