Author: Shayon Sengupta, Multicoin Capital Investment Partner; Tushar Jain, Multicoin Capital Co-founder; Translated by: 0xjs@黄金财经

On March 4, 2025, Multicoin Capital published a 45-page JITO asset valuation report. Multicoin Capital said that it has accumulated a considerable position in Jito Network's native token JTO through its hedge funds and venture capital funds over the past three years.

Multicoin Capital's optimistic valuation of JTO is $11.63, which is 4.45 times the 7-day time-weighted average price (TWAP) of $2.61 as of March 3, 2025. After the Multicoin Capital Jito report was published, the price of JTO quickly rose from $2 to around $2.4, an increase of nearly 20%.

The following is a summary of the Multicoin Capital JTO valuation report. The full report and analysis, including Multicoin Capital’s valuation model and price target, can be found at https://assets.ctfassets.net/qtbqvna1l0yq/1y16WQhzMYGZSWGOC7CQIP/e431ba50cabfedf41520c2252d6924ee/JTO_Asset_Report.pdf, which includes Multicoin Capital’s valuation model and price target. Report Summary Jito has become an integral part of the Solana economic system, and we believe its system is critical infrastructure for processing transactions and generating blocks on the Solana network. Our confidence in Jito (and its native token, JTO) is deeply rooted in the structural lock-in mechanisms Jito has established between stakers, validators, frontends, and users, as well as its dominant position in the transaction supply chain. In short, it is at the core of a multilateral network that keeps Solana running efficiently.

Today, Jito is an integrated software system consisting of three core parts:

The transaction processing and block production architecture, namely the Jito-Solana validator client, and related products Relayer, Shredstream, Block Engine, and Transaction Bundles;

The staking architecture (namely JitoSOL, Jito’s liquidity staking token, and Stakenet, Jito’s autonomous, decentralized staking delegation algorithm);

The re-staking architecture, namely the node consensus network, including the TipRouter and Vaults.

We have repeatedly analyzed and discussed the valuation of asset ledgers using the framework of Maximum Extractable Value (MEV). Throughout 2024, the acquisition and redistribution of MEV has continued to move upward in the technology stack. We expect this trend to continue for the foreseeable future. As the cryptocurrency market structure matures, we believe JTO will be one of the biggest beneficiaries of this development trend.

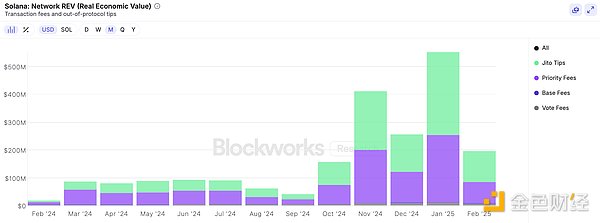

Currently, Solana is the most widely used and productive public chain network, and since Q4 2024, it has far exceeded all other major blockchain networks in terms of transaction revenue (data from Dune Analytics, chart does not include tips) and transaction volume (data from DefiLlama). Since then, Solana's real economic value (REV) has increased significantly with billions of transactions, and more than half of the transaction fees on Solana are processed through the Jito system.

Data source: Blockworks Research, March 3, 2025

In addition to the trend of value capture moving up the technology stack, we believe that JTO is the best way to gain asymmetric risk exposure to the Internet capital markets on Solana in a fundamentally reasonable and risk-adjusted manner.

For the normal operation of a permissionless, high-performance distributed asset ledger, trade execution around fierce competition is critical. The only way for Solana to achieve its original vision of a “Nasdaq-speed blockchain” is to process large volumes of information input and output with low latency. Jito plays a key role in this by categorizing Solana’s transactions based on time preference while stabilizing the network and preventing it from becoming congested due to excessive demand for transaction inclusion.

Jito’s suite of products plays an important role in maintaining the user experience as the Solana system scales. At the time of writing, over 94% of the stake on Solana is running the Jito-Solana client, which provides much-needed reliability for transaction confirmations during high market volatility events with consistently low median fees. We believe this opens up the possibility of exponential growth for the application layer - supporting applications like high-performance derivatives exchanges (capable of prioritizing market maker withdrawals, resulting in tighter spreads, such as Drift), decentralized physical infrastructure networks that rely on large-scale, low-cost token transfers (DePINs, such as io.net, Render, Hivemapper, GEODNET, and Helium), new spot asset issuance and trading platforms (such as Jupiter, Clearpools, and Backpack).

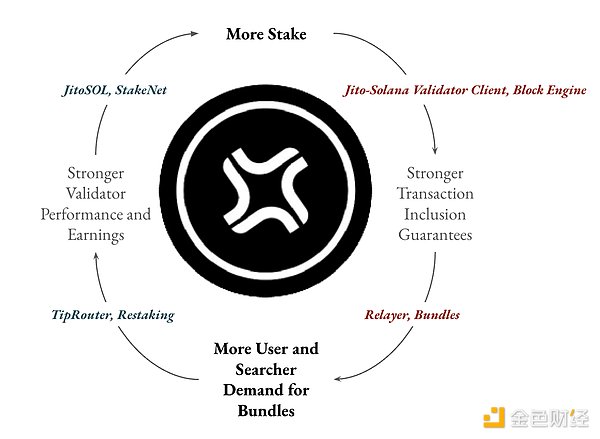

Each of Jito's products promotes each other. The StakeNet staking delegation system and the JitoSOL staking pool encourage validators to run the Jito-Solana client. Running the Jito-Solana client enables validators to earn higher returns and distribute them to stakers by building more profitable blocks. Re-staking helps to decentralize the distribution of returns while adding unique utility to JitoSOL and JTO, further incentivizing user use while generating additional returns for stakers.

Brian

Brian

Brian

Brian Hui Xin

Hui Xin Brian

Brian Joy

Joy Alex

Alex Alex

Alex Hui Xin

Hui Xin Joy

Joy Kikyo

Kikyo Brian

Brian