Original Title: Ethena - Synthetic Dollars Challenge Stablecoin Duopoly

Source: Multicoin Capital; Compiled by: Jinse Finance

We are proud to announce that Multicoin Capital's liquidity fund has invested in the ENA token—ENA is the native token of the Ethena protocol, the issuer of USDe, which is a leading synthetic dollar stablecoin.

In our article "The Endgame of Stablecoins," we pointed out that stablecoins are the largest potential market in the crypto space, and yield is its ultimate competitive frontier. While our assessment of the development direction of yield stablecoins was correct, we underestimated the market size of synthetic dollars.

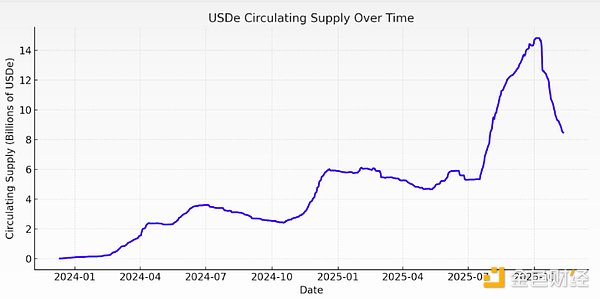

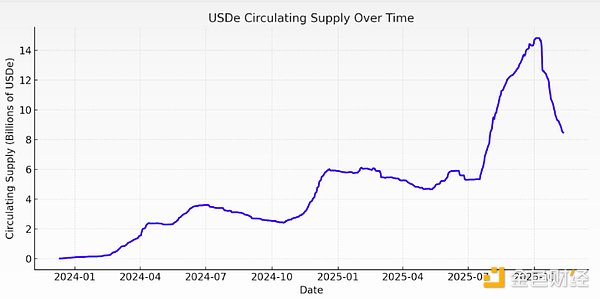

We categorize stablecoins into two types: - Stablecoins that share yields - Stablecoins that do not share yields Stablecoins that share yields can be further subdivided into: - Stablecoins fully backed 1:1 by government-backed Treasury bonds - Stablecoins not fully backed by government bonds, i.e., synthetic USD Synthetic USD is not fully backed by government-backed Treasury bonds, but rather achieves yield generation and price stability by implementing a Delta-neutral trading strategy in the financial market. Ethena is a decentralized protocol and the operator of the largest synthetic USD, USDe. Ethena aims to provide an alternative stablecoin option to traditional stablecoins such as USDC and USDT—these traditional stablecoins' reserve assets generally only yield short-term US Treasury bonds. Ethena's USDe reserves achieve yield generation and target stability through one of the large-scale and proven strategies in traditional finance—basis trading. The basis trading volume in US Treasury futures alone reaches hundreds of billions (and possibly trillions) of dollars. Currently, only accredited investors and institutional buyers have access to hedge funds with the infrastructure to execute basis trades on a large scale. Cryptocurrencies are fundamentally reshaping the financial system, making this type of investment opportunity available to everyone through tokenization. Our team has been focusing on basis trading-based synthetic dollar projects for years. Back in 2021, we published an article outlining this market opportunity and announced our investment in the UXD protocol—the first token fully backed by basis trading. While the UXD protocol's concept was ahead of its time, in our view, Guy Young, founder and CEO of Ethena Labs, has brilliantly realized this vision. Today, Ethena is the largest issuer of synthetic dollars: its circulating supply grew to $15 billion within two years of its launch, and after recovering to approximately $8 billion following the October 11 market crash, it remains the third largest digital dollar stablecoin after USDC and USDT.

USDe Circulation Change (Data Source: DefiLlama)

Systemic Benefits of Synthetic Dollar

Ethena is precisely at the intersection of three powerful trends reshaping modern finance: stablecoins, perpification, and asset tokenization.

Stablecoins

Currently, the total circulating supply of stablecoins exceeds $300 billion and is expected to grow to trillions of dollars by the end of this decade. For the past decade, USDT and USDC have dominated the stablecoin market, accounting for more than 80% of the total supply.

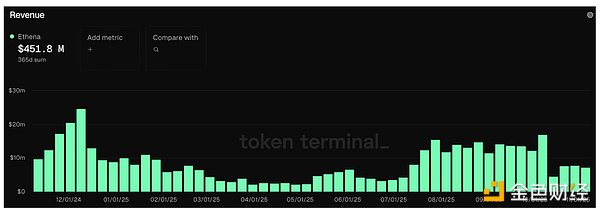

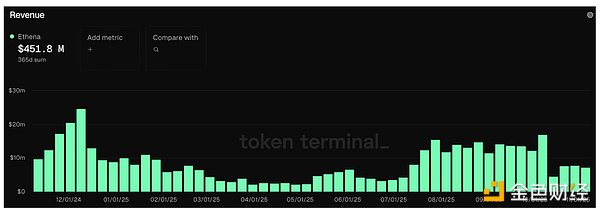

Data Source: Token Terminal

We believe the real test for the adaptation of synthetic USD lies in its acceptance as collateral by mainstream exchanges. Ethena excels in this regard, having successfully integrated USDe into one of the core collateral assets of major centralized exchanges such as Binance and Bybit, which is also a key driver of its rapid growth.

Another unique aspect of Ethena's strategy is its mild negative correlation with the federal funds rate. Unlike Treasury-backed stablecoins, Ethena is expected to benefit from declining interest rates—because low interest rates stimulate economic activity, increase leverage demand, push up funding rates, and strengthen basis trading that supports Ethena's yield.

A similar situation occurred in 2021, when the spread between funding rates and Treasury bond yields widened to over 10%. While the integration of cryptocurrencies with traditional financial markets will lead to more funds flowing into the same basis trading, narrowing the spread between basis trading and the federal funds rate, this integration process will take several years. [Image source: Bitcoin funding rates, Treasury bond yields] Finally, J.P. Morgan predicts that interest-bearing stablecoins could account for up to 50% of the stablecoin market in the coming years. With the total stablecoin market expected to surge to trillions of dollars, we believe Ethena is well-positioned to become a major player in this transformation.

Perpetual Contractification

Perpetual futures have achieved strong product-market fit in the crypto space. In the approximately $4 trillion crypto asset class, perpetual contracts have a daily trading volume exceeding $100 billion, and the total open interest on centralized exchanges (CEXs) and decentralized exchanges (DEXs) exceeds $100 billion. They provide investors with a simple way to leverage exposure to the price volatility of underlying assets. We believe that more asset classes will adopt perpetual contracts in the future, which is what we call “perpetual contractification.”

Regarding Ethena, a common question is its potential market size—because its strategy size is limited by the open interest in the perpetual contract market. We acknowledge this is a reasonable constraint in the short term, but believe it underestimates the market opportunities in the medium to long term.

Perpetual Contracts for Tokenized Stocks

The global stock market is approximately $100 trillion, almost 25 times the size of the entire crypto market, with the US stock market alone reaching $60 trillion.

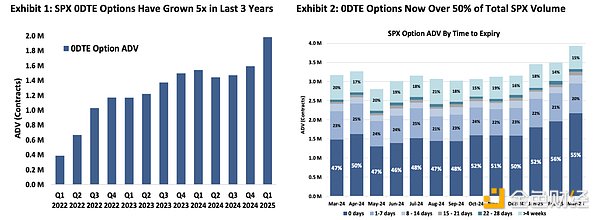

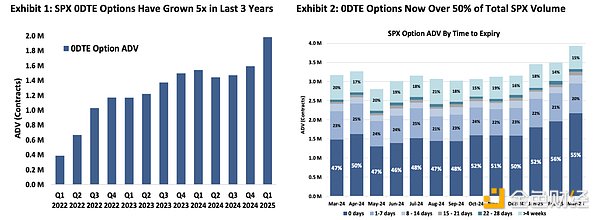

Similar to the crypto market, stock market participants also have a strong demand for leverage. This is evidenced by the explosive growth of zero-date-to-expires (0DTE) options—these options are primarily traded by retail investors, accounting for over 50% of S&P 500 (SPX) options trading volume. Retail investors clearly want to gain exposure to the price volatility of the underlying asset through leverage, and perpetual contracts for tokenized stocks directly meet this need.

Data source: Chicago Board Options Exchange/Cboe

For most investors, perpetual contracts are easier to understand than options.

For most investors, perpetual contracts are easier to understand than options.

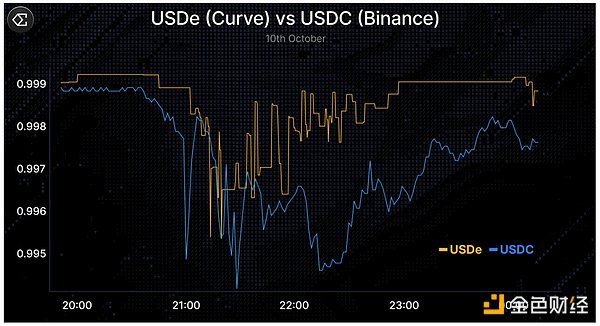

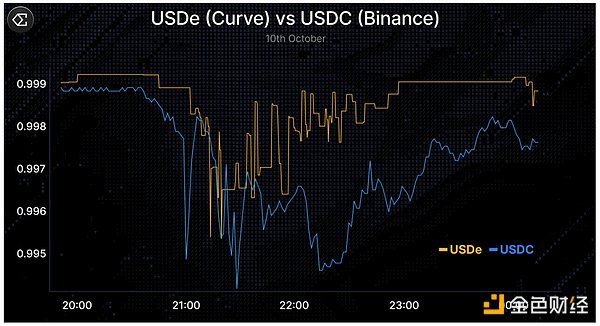

Data source: X platform

In both incidents, the Ethena team communicated transparently and no user funds were lost. Meanwhile, the protocol continued to operate normally, processing billions of dollars in redemption requests within hours, all of which were verifiable on-chain. Such moments test the risk discipline of any protocol. Successfully handling such stress events on a large scale not only strengthens trust and credibility but also builds brand equity and competitive barriers—creating a strong moat for DeFi protocols like Ethena. To be clear, we have reason to expect the Ethena protocol to face more stress tests in the coming years. We are not suggesting that the risks are nonexistent or have been completely eliminated, but rather emphasizing that Ethena has demonstrated strong performance and resilience during some of the most significant market stress events recently. Value Capture Potential We believe that Ethena has the capacity to charge higher fees compared to stablecoins like USDC. Unlike USDC, Ethena actively manages market risk, provides users with higher returns in most cases, and is likely to be negatively correlated with interest rates in the near to medium term—all of which enhance its ability to capture and sustain long-term value. While the ENA token currently functions primarily as a governance token, we believe it has a clear path to value accumulation. Ethena generated approximately $450 million in revenue over the past year, none of which has been distributed to ENA token holders. A fee switch proposal put forward in November 2024 outlined several milestones that needed to be met before ENA holders received value distributions. All of these conditions were met before the October 11th crash. The only remaining metric is the circulating supply of USDe—we expect it to exceed $10 billion before the fee switch begins. The risk committee and community are currently reviewing the implementation details of the fee switch. Our assessment is that these developments are likely to be viewed positively by the public markets, as they will strengthen Ethena's governance synergy, expand the long-term holder base, and reduce token selling pressure. Long-Term Growth Potential Ethena is already one of the highest-revenue protocols in the crypto space based on its existing business alone. Ethena is leveraging its leading position, building on its core strengths in stablecoin issuance and crypto perpetual contract exchange expertise, to launch multiple new product lines. These product lines include:

Ethena Whitelabel: A "stablecoin-as-a-service" solution where Ethena customizes stablecoins for large blockchains and applications. Currently, Ethena has whitelabel partnerships with megaETH, Jupiter, and Sui (via SUIG).

HyENA and Ethereal: Two third-party perpetual contract decentralized exchanges built on USDe collateral, both expanding the application scenarios of USDe and generating transaction fee revenue for the Ethena ecosystem. Both projects were developed by external teams but directly create value for Ethena.

These potential product lines will further solidify Ethena's leading position in the synthetic dollar space.

With all new product lines built on Ethena, Ethena is expected to gain economic benefits from these initiatives, complementing its existing strong revenue streams.

Why We Are Bullish on Ethena in the Long Term

In a stablecoin market long dominated by USDT and Circle, Ethena has carved out a unique niche, becoming the clear market leader in the synthetic dollar category.

With the surge in stablecoins, the tokenization of traditional assets, and the rise of decentralized exchanges for perpetual contracts, we believe Ethena is uniquely positioned to capitalize on these trends—translating global leverage demand into attractive and easily accessible returns for users and global fintech companies.

The protocol’s robust risk management culture has withstood real-world stress tests and continues to succeed, helping Ethena build deep trust and credibility among its users and partners.

In the long term, Ethena can leverage its scale, brand, and infrastructure to expand into other product areas, diversify its revenue streams, and enhance its resilience to market shocks.

As the fastest-growing issuer of synthetic USD within the fastest-growing stablecoin category (yield stablecoins), Ethena is perfectly positioned to incubate new business lines, thereby driving additional growth in the most lucrative sectors of cryptocurrency, exchange, and deposit/withdrawal channels, while simultaneously increasing the supply of USDe. The future opportunities are immense, and as long-term holders of ENA tokens, we are extremely excited.

Brian

Brian