Author: Robert Greenfield IV Source: medium Translation: Shan Ouba, Golden Finance

Selling pressure is the dark enemy of all asset holders.

While venture capital funds and dishonest KOLs often take the lead in this regard, supply shock stocks, miners, and a growing number of institutional investors have now become the dominant force of fear, uncertainty, and doubt (FUD), commanding billions of dollars in net flows.

However, local selling pressure is a function of the token economics (Tokenomics) of each network and protocol - a mechanism that is encoded in every destruction, minting, and annualized revenue distribution function to incentivize stakeholders while avoiding economic inflation and preventing the price of the system's native token from plummeting.

In this brief, we will analyze the local selling pressure embedded in the Bitcoin, Ethereum, and Solana economies. Okay, enough nonsense, let's get started.

Bitcoin

Bitcoin has a capped supply of 21 million coins, with a pre-set issuance schedule. Every time a new block is generated (on average, every 10 minutes), miners receive an additional block reward, which increases the supply of the coin. This fixed block reward is cut in half every 210,000 blocks (approximately four years), an event known as a "halving." Bitcoin's block reward at creation in 2009 was ₿50.

Zero block reward and a fixed supply cap won't be reached until 2140, but with each halving, inflation will continue to decline and block rewards will be cut in half. However, until the supply cap is reached, Bitcoin will remain an inflationary asset. At the current block reward, ₿164,000 (~$10.3 billion) will be minted each year.

Currently, the main local selling pressure on Bitcoin comes from the following sources:

Miner income (from transaction fees and block rewards)

Market shocks to supply (creditor payments, government expropriations)

Miner selling pressure

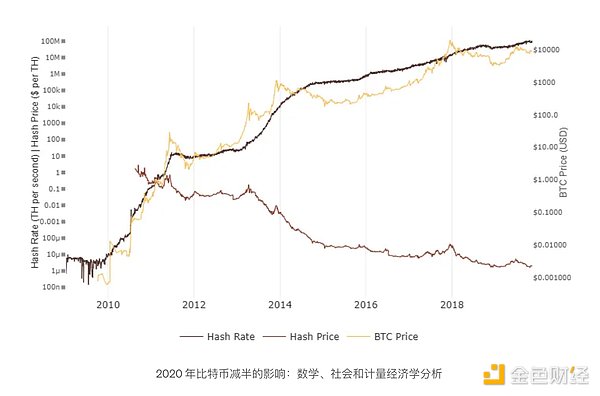

Due to the high operating costs and competitive nature of Bitcoin mining, as well as the need for publicly traded mining companies to report quarterly earnings and maintain stock prices, miners are often forced to sell their mined Bitcoin to realize a profit. This creates constant selling pressure on Bitcoin. The high costs of mining, including financing facilities and ongoing operating expenses (such as electricity, taxes, and personnel costs), force miners to periodically sell some of their mined Bitcoin. On top of that, Bitcoin’s total mining power (i.e., hash rate) has historically increased even as block rewards have decreased, further reducing profitability per unit of hash power.

Since the Bitcoin halving in April 2024, miner revenue (i.e., potential selling pressure) has averaged $218 million per week, compared to a high of $489 million before the April 2024 halving. However, over the same period, the network’s hash rate growth has stagnated, indicating that miners’ profitability has been significantly compressed.

At current Bitcoin prices and hardware costs, it appears that expanding mining capacity has become unprofitable. Profitability compression means that miners may need to sell a larger percentage of Bitcoin to cover operating costs, which are primarily denominated in fiat currency.

Market shock x supply

In the cryptocurrency space, a "market shock supply" refers to a sudden, large influx of a cryptocurrency into the market due to an unexpected event. This supply surge often significantly changes market dynamics, often leading to a sharp drop in the price of the cryptocurrency. Such events can be triggered by the following factors:

Massive sell-offs: When a large holder (such as a whale or institution) decides to liquidate a large position.

Token unlocks: When a large number of previously locked or vested tokens enter the circulation market, increasing the circulating supply.

Regulatory changes or hacks: Regulatory crackdowns, exchange hacks, or other unexpected events can lead to panic selling and rapid liquidation of assets.

This rapid increase in supply, without a corresponding increase in demand, can bring a "shock" to the market, shake prices, and may cause broader market volatility.

For Bitcoin, market shocks to supply usually stem from the collapse of centralized Bitcoin liquidity platforms (such as exchanges, market makers, and lending platforms). Unlike other cryptocurrencies, Bitcoin has no token unlocking plan or smart contracts that can be exploited on its network.

Creditor Repayments (Temporary Risk)

Market shock supply is currently limited to the $10 billion (168,000 BTC) in Bitcoin repayments from the Mt. Gox and Genesis bankruptcies during the 2024 Bitcoin halving cycle. There is concern that these creditors may choose to sell their Bitcoin holdings after being fully compensated, causing market volatility, especially if a recession due to the recent decline in interest rates triggers a sell-off.

Government Seizures and Sell-offs

Bitcoin seized by governments from illegal websites (usually the dark web) also adds to market shock supply.

For example, in February 2024, German authorities seized 50,000 Bitcoins, valued at approximately $2.1 billion, from the former operators of the pirated website Movie2k.to. The cryptocurrencies were voluntarily surrendered by the suspect in the case as part of an investigation into the illegal commercial exploitation of copyrighted works and money laundering. The confiscation was part of a joint investigation by the Dresden Public Prosecutor's Office, the Saxony State Criminal Police and other agencies. After confiscating the Bitcoin, the Saxony government sold it on the market, causing Bitcoin to rise against the US dollar (BTC) left;">) prices fell by 16.89%. However, on the final day of the sell-off, prices rebounded, ultimately narrowing the decline to 8.85%.

Bitcoin Held by Governments

Market shock supply is not limited to the German state of Saxony. As of 2024, several governments around the world hold large amounts of Bitcoin, primarily acquired through confiscations related to criminal activity:

United States: The U.S. government is the world's largest Bitcoin holder, holding approximately 203,129 BTC, valued at approximately $11.98 billion. These Bitcoins were primarily acquired through confiscations related to cases such as the Silk Road darknet market.

China: China holds approximately 190,000 Bitcoins, valued at approximately $11.02 billion. Most of these bitcoins came from the PlusToken Ponzi scheme, one of the largest cryptocurrency scams in history.

UK: The UK holds about 61,000 bitcoins, worth about $3.53 billion. These bitcoins were confiscated from various financial crimes, including major money laundering operations.

El Salvador: As the first country to adopt Bitcoin as legal tender, El Salvador holds about 5,800 bitcoins, worth about $400 million. These holdings are part of the country's financial strategy, including a plan to "buy 1 bitcoin a day."

Ukraine: Ukraine holds about 46,351 bitcoins, including both assets confiscated by police and donations received during the war.

Bitcoin ETF Outflows (Theoretical)

A new Bitcoin price correlation has been introduced in 2024: Bitcoin ETF Net Flows. As cryptocurrencies are increasingly included in structured products, global investment macro trends will increasingly determine their prices in conjunction with the token economics of an asset and its network/protocol performance KPIs.

Ethereum

Originally a Proof-of-Work (PoW) network, Ethereum later moved to Proof-of-Stake (PoS) to better increase transaction throughput and reduce hardware requirements that have led to a centralized network.

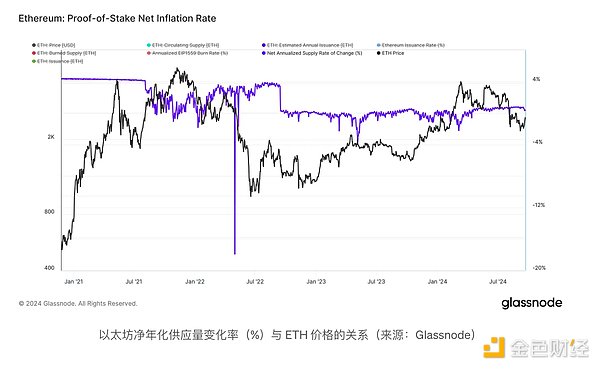

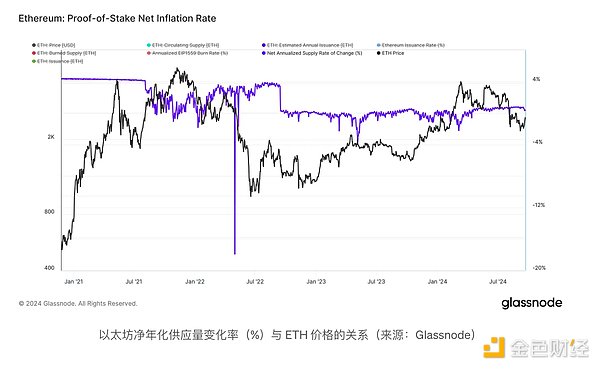

Ethereum is doubly inflationary and uses the following three dynamic supply mechanisms to guide its token economics:

Issuance: Ethereum is issued based on total staked value. Specifically, total issuance is proportional to the square root of the number of validators.

Transaction fee burn: Ethereum burns a portion of the ETH used to pay transaction fees from the circulating supply.

As of this writing, Ethereum has approximately 1.66M validators, with a total issuance of 23,300 ETH per week, resulting in an annualized inflation rate of 0.295%. The annualized yield (APY) earned by staking ETH as a validator or through liquidity staking is 2.8%.

Ethereum's BASE_REWARD_FACTOR controls network inflation. As L2 Rollup usage increases, Ethereum's transaction density and destruction rate have been steadily declining since 2021, leading to higher inflation. If transaction density continues to decline as users opt for lower L2 transaction fees, validator profitability and total ETH will decline unless the BASE_REWARD_FACTOR factor is increased. The amount staked will inevitably fall with it. However, doing so will also increase inflation. Ethereum may need to refocus on better scaling transaction costs on L1, or redefine the relationship between rollups and the base layer to increase the proportion of ETH staked and/or the amount of ETH burned.

Another factor that influences Ethereum's supply and demand dynamics, albeit indirectly, is staking. ~29% of ETH's total supply is staked, and continues to grow. Staking is a large source of net supply for Ethereum and has been widely popularized and simplified through liquid staking protocols such as Lido and Rocketpool, which allow users to stake without setting up their own validators and receive a percentage of validator rewards through APY.

Solana

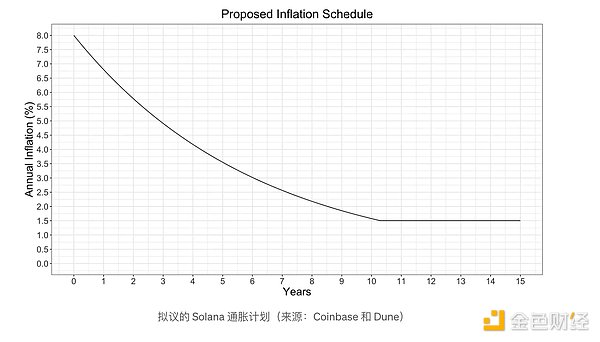

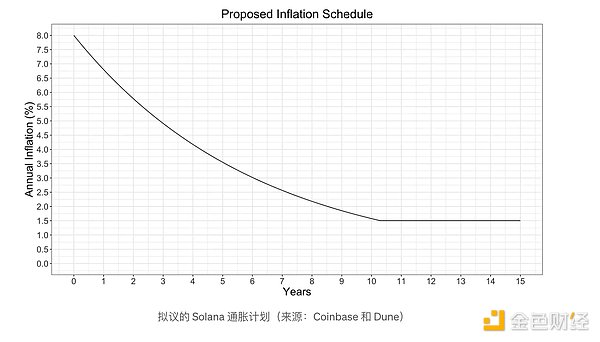

Solana has been a PoS network from the beginning and has a fixed total inflation schedule that does not change based on the number of validators. Currently, Solana’s inflation rate is 5.1%, and will continue to decline by 15% per year until it reaches a terminal inflation rate of 1.5% in approximately 2031.

Solana destroyed 50% of base and priority fees, while Ethereum destroyed 100% of base fees. However, Solana’s destruction rate is much lower, only offsetting 6% of year-to-date issuance (1.1 million SOL destroyed, while 18.2 million SOL issued). Most of Solana’s inflation comes from its fixed issuance schedule, which adds 528K SOL ($84M) per week — higher than ETH’s $46M but lower than BTC’s $198M.

Solana’s staking rate has remained stable, remaining above 60% since September 2021, peaking at 72% in October 2023, and stabilizing at 68% in March 2024. A higher staking rate compared to ETH means more staking rewards are likely to be sold.

Conclusion

Token inflation can have different impacts on flows depending on factors such as issuance costs (mining vs. staking) and variability (burn rate). PoW chains such as Bitcoin face higher selling pressure from miners to cover costs, while PoS stakers can keep more of their earnings. The PoS inflation rate also depends on changes in the staking rate. To fully understand issuance-driven flows, both metrics need to be considered. For example, while staking acts as a liquidity absorber for ETH, this is not currently the case for SOL.

JinseFinance

JinseFinance