Under the multi-chain structure of the blockchain world, how to achieve safer and more convenient cross-chain intercommunication has always been a challenging problem. With the increasing demand for cross-chain transactions by blockchain users, the challenges faced in cross-chain intercommunication have become more prominent. Common challenges include:

■ Security

Security is the most common challenge in cross-chain transactions. The cross-chain bridge protocol that can attract large-scale assets to stay has been the primary target of hacker attacks in recent years.

Blockchains rely on validators to verify and execute transactions, and cross-chain bridge protocols also need to rely on trusted third-party validators to verify and process cross-chain transactions. In this process, if the incentives for the cross-chain bridge are insufficient, the number of validators is small, or the trust model is too centralized, hackers may destroy the cross-chain bridge by attacking the validator, thereby stealing assets. In addition, the contract loopholes of the cross-chain protocol itself often become the entry point for hackers to launch attacks.

On the afternoon of August 6, 2024, Ronin Bridge was suspected of being hacked, and about 4,000 ETH and 2 million USDC were stolen, with a loss of about 12 million US dollars. In March 2022, Ronin Bridge had already experienced a security incident known as the "biggest loss in DeFi history". Hackers attacked 5 of the 9 validators and stole a total of 173,600 Ethereum and USD 25 million worth of USDC, with a total value of more than 600 million US dollars.

■ High Gas Fees

Cross-chain transactions will incur relatively high Gas fees. Because users need to calculate the actual transaction cost based on the Gas fees paid for operations on the two chains before and after the cross-chain.

■ Complexity

Each blockchain is an independently operated chain, and each blockchain network has its own consensus mechanism and protocol. This fragmented and isolated state between chains will cause users to need to perform relatively complex and cumbersome operations when transferring assets and data across chains. In cross-chain transactions, users with frequent trading needs are more likely to encounter asset price slippage, increasing transaction difficulty.

In response to the above problems, Uniswap Labs and the interoperability protocol Across jointly proposed a new standard solution, ERC-7683, on May 20, 2024, aiming tomake cross-chain transactions simpler, faster and safer through a shared execution network.

ERC-7683

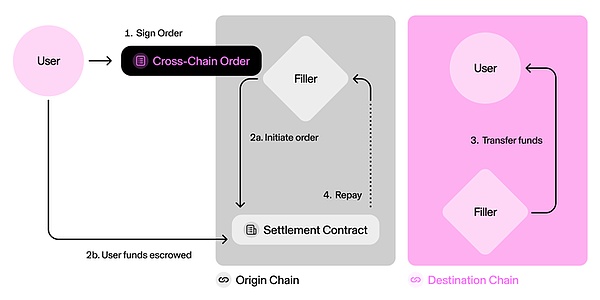

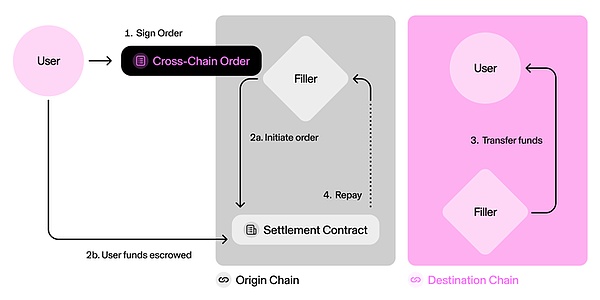

The ERC-7683 standard is created based on the CrossChainOrder structure and will provide an ISettlementContract smart contract interface that allows the implementation of a standard API for a cross-chain transaction execution system.

The core technical proposal of the ERC-7683 standard is that all "cross-chain intentions" follow the same order structure, an approach that can greatly improve the flexibility and user-friendliness of cross-chain operations.

As Uniswap Labs demonstrated its goal on its social platform X: The ERC-7683 standard provides a clear path to unify Ethereum.

△ Figure 1: Schematic diagram of cross-chain order structure under the ERC-7683 standard

Source: Uniswap Labs

Development and application status

On August 21, 2024, Layer 2 solution Optimism announced the adoption of the ERC-7683 cross-chain standard, aiming to achieve more efficient transfer operations of ETH and USDC on Superchain, and further promote application layer interoperability of the broader Ethereum ecosystem. At present, Optimism has integrated the cross-chain solution of the interoperability protocol Across.

In May 2024, when Uniswap Labs released the ERC-7683 standard, it stated that it would adopt the standard in cross-chain cooperation with UniswapX.

It is worth noting that since the ERC-7683 standard only implements a standard API for the cross-chain transaction execution system, that is, the implementation of the entry standard, it can ensure the consistency of the user experience. However, even if ERC-7683 is implemented, it is difficult to avoid a common challenge of cross-chain transactions: Is it possible to obtain sufficient cross-chain liquidity?

For the implementation of the ERC-7683 standard, if the cross-chain liquidity is not enough, it means that the standard will be difficult to obtain enough active "Fillers" (refer to Figure 1 in the article) to support the user's "cross-chain intention" during implementation. If there are not enough "Fillers", the user's "cross-chain intention" cannot obtain better costs or better experience through the competition mechanism.

This means that the implementation of the ERC-7683 standard needs to form a wide-area effect - more use cases access the standard, more users use the standard, there will be more Fillers, and ultimately the overall efficiency of cross-chain transactions can be improved.

▶ For more information about ERC-7683, please visit: https://www.erc7683.org

▶ View the Ethereum comment request jointly issued by Uniswap Labs and Across to the Ethereum Magicians forum

Please visit: https://ethereum-magicians.org/t/erc-7683-cross-chain-intents-standard/19619

Support from Ethereum founder

Public media reports indicate that Ethereum co-founder Vitalik Buterin particularly supports the development of the new cross-chain transaction standard ERC-7683 through social platforms, pointing out that according to ERC-7683 Operations performed by the standard can include batch transactions, Merkle proofs, and other on-chain activities, and he gave examples of how the ERC-7683 standard will work. He said: "With the ERC-7683 standard, users can paste an ERC-7683 address into their wallet, and then easily transfer assets on any chain to another account with just one click." The multi-chain structure is an inevitable development in the Web3 era, and for the next development of the Web3 world, whether cross-chain transactions can be optimized, simplified, and further release liquidity will be a very critical challenge. The ERC-7683 standard directly hits the pain points of cross-chain transactions and can significantly improve the interoperability between blockchains. Its application will have a far-reaching impact on the blockchain world. At present, users can expect that the improvement in user experience brought about by the application of the ERC-7683 standard can bring direct benefits to more DeFi projects-injecting more liquidity support and accelerating development.

JinseFinance

JinseFinance