Author: XP.NETWORK Source: medium Translation: Shan Ouba, Golden Finance

Moonbirds sales surged shortly before Yuga Labs announced the acquisition, sparking accusations of insider trading. How does it work – and can you go to jail for it?

What is insider trading and how does it work with NFTs?

Insider trading is the purchase or sale of assets while using non-public information about the assets to gain an unfair advantage. Or, as the SEC defines it, it is "the purchase or sale of a security based on material nonpublic information about the security, a breach of fiduciary duty or other relationship of trust and confidence."

SEC also includes disclosing security-related information to others (not direct insiders) so that they can gain an advantage. The list of potential insiders is long: company executives and employees, their friends and family, anyone who misappropriated inside information from colleagues or friends, and so on.

To be clear: insiders can trade a company's assets, but must comply with regulatory agency guidelines. For example, in the United States, all details of such a deal (price, amount, etc.) must be determined in advance and reported to the SEC, and insiders are not allowed to have access to any material information that is not public, such as quarterly earnings or an upcoming merger.

So far we’ve been talking about stock trading, but what about NFTs? SEC rules cover company stocks and securities, but NFTs don’t either. In fact, NFT trading is not regulated, so if someone is found to have benefited from non-public information, it is not easy to prosecute them – although there have been cases of successful prosecutions, as we will see soon.

The same applies to NFT wash trading - another type of market abuse, where the same agent uses different accounts to repeatedly buy and sell NFTs to artificially inflate the price . Stock wash trading is illegal in the United States, but as a Chainaanalysis report shows, since there are no such regulations for NFTs, wash traders are making millions in profits.

A recent research paper on NFT market manipulation highlights that insiders are often early investors with access to closed chat rooms, rather than collective creators or markets staff. The paper also found that insider buying is a strong indicator of future returns.

To sum up, NFT insider trading is a kind of market abuse, but it is not necessarily illegal. Due to the overall lack of supervision of the NFT market, there is no clear legal rules to combat it. Of course, employees caught using non-public data may be punished or fired when company rules prohibit it. Regardless, insider trading can cause significant reputational damage if it becomes known to the public.

The biggest NFT insider trading scandal

Moonbirds insider trading accusations

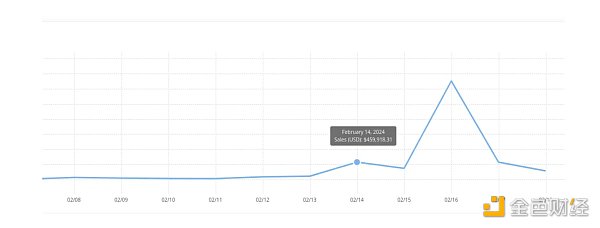

On February 16, Yuga Labs (the company behind Bored Apes Yacht Club) announced that it would purchase the rights to the NFT series Moonbirds. As expected, Moonbirds sales rose immediately after the news broke, but suspiciously high sales were also seen in the days leading up to the announcement.

CryptoSlam data shows that from February 1st to 13th, Moonbirds’ daily trading volume ranged from US$20,000 to US$80,000, except for February 4th. $141,000 and $460,000 on February 14th two days apart. The latter is particularly noteworthy: why did daily trading volume suddenly increase nearly sixfold?

p>

Twitter sleuths were quick to point this out and suggested insider trading was the cause. One user even discovered that one wallet purchased 150 Moonbird and related NFTs in a matter of days, making over $100,000 in profit.

p>

So far, Yuga Labs has not commented, so we'll just have to wait and see how the story unfolds.

OpenSea employee convicted of wire fraud

In groundbreaking case , an NFT insider trader was convicted and sentenced not for securities fraud (which is impossible because NFTs are not classified as securities), but for wire fraud.

Nathaniel Chastain, former head of product at OpenSea, is responsible for selecting which NFT collections appear in the curated section of the marketplace homepage. Featured items often boost sales, but no one knows in advance that a particular collection will become a featured item.

You can probably guess what happens: Chastain will purchase the NFT from the collection, then place it in a coveted featured location, and then Sell when the price goes up and you will usually make a 100% profit. This is insider trading in its purest form

OpenSea fired Chastain after he was exposed on Twitter. In court, he argued that OpenSea's policies did not directly prohibit such conduct, but his former employer testified that the confidentiality agreement he signed did prohibit it (to some extent).

The most interesting part of the case, however, is that Chastain was ultimately found guilty. The jury unanimously found that he misappropriated his employer's property, confidential business information about which collections would appear in the featured section. He was sentenced to three months in prison.

p>

In this case, it doesn’t matter whether the NFT is a security; what matters is whether the NFT is a security. What matters is deceiving the employer. This, of course, opens up broad possibilities for prosecuting insider trading and other employee misconduct in the cryptocurrency and NFT space. We can also expect that marketplaces and other NFT companies will now require employees to sign more detailed confidentiality agreements.

NFT insider trading not only makes unfair profits for criminals, it can also harm ordinary users because it can cause price fluctuations, making them more expensive than Usually buy higher or sell lower. While regulators are unlikely to intervene anytime soon, we hope such scandals will at least make the market revisit its policies and crack down on insider traders. As always, we at XP.NETWORK will be following this story and covering it on the blog.

nftnow

nftnow

nftnow

nftnow TheBlock

TheBlock Beincrypto

Beincrypto Beincrypto

Beincrypto Beincrypto

Beincrypto Cointelegraph

Cointelegraph Cointelegraph

Cointelegraph Bitcoinist

Bitcoinist Cointelegraph

Cointelegraph Cointelegraph

Cointelegraph