2. text="">From past experience, when the entry threshold is gradually lowered (anyone can issue coins without any obstacles) and the supply of underlying assets continues to expand, capital will inevitably show a head-gathering effect - high-quality projects not only harvest market liquidity, but also form a structural valuation premium (US and Hong Kong stock trends). Taking the Nasdaq market as a reference, its TOP7 leading companies not only occupy 50%-60% of the market value for a long time, but also take up 30%-40% of the transaction share, and enjoy a 20%-30% valuation premium (in terms of price-to-earnings ratio). Although the team of top companies will also be adjusted, the "winner takes all" feature has never changed. 2. According to Coinglass data, the peak daily transaction volume of the crypto market in March 2024 and November 2024 is about 600 billion US dollars, which is equivalent to the level when the bull market peaked in November 2021. In other words, the market's maximum purchasing power has not increased in the past four years. The market's long-term incremental dilemma usually means that the stage of large-scale capital entry has ended (the population welfare period has passed).

Of course, there is no shortage of speculative opportunities in mature markets, just like when the US stock market is led by technology giants, speculative targets such as GME and AMC will also appear. Therefore, while BTC, ETH, SOL, XRP and others enter a slow bull market, the hype of MEME, AI and other themes will continue. But it is certain that structural market conditions will become the main theme of the market in the long term.

Against the backdrop of Bitcoin's continued rebound, gold, as the leading safe-haven asset, has experienced a correction, which has triggered market concerns about the sustainability of Bitcoin's rise. However, the adjustment of gold does not mean the end of the speculation logic of safe-haven assets, but the result of funds switching between different safe-haven assets.

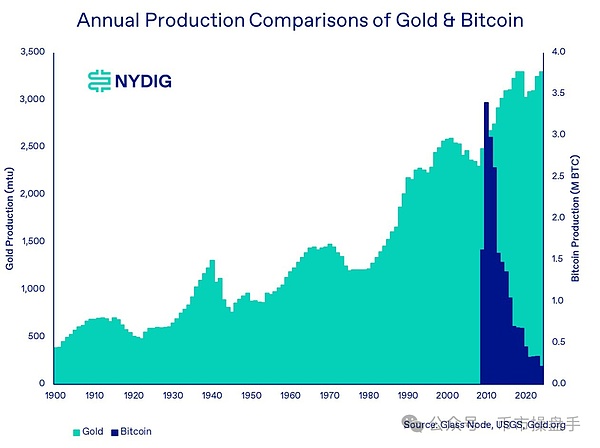

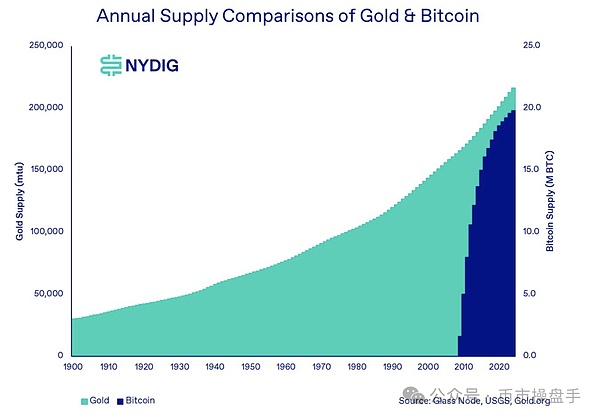

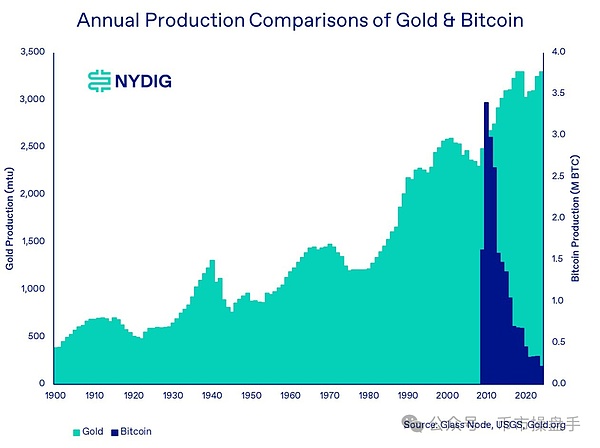

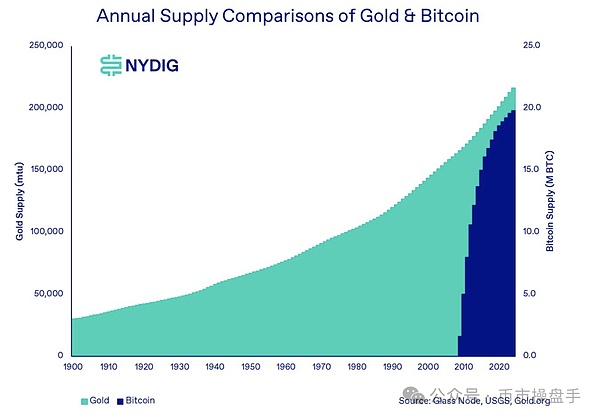

First,Scarcity is an important factor in gold becoming an ideal safe-haven asset, but compared with Bitcoin's fixed total supply of 21 million coins, the proven reserves of gold are still growing at a rate of 3,000 tons per year. In addition, with the advancement of mining technology, the amount of gold mined is steadily increasing at a rate of 1.6% per year, and the cost of mining is decreasing year by year. In contrast, despite the continuous advancement of Bitcoin's mining technology and the continuous increase in the computing power of the entire network, due to the built-in difficulty adjustment mechanism, Bitcoin's production still follows the rule of halving every four years and will stop completely in 2140. This essential difference in supply characteristics makes Bitcoin the first absolutely scarce asset in history with mathematical certainty, while gold always maintains its relative scarcity.

Secondly, against the backdrop of the United States stopping providing dollar output for global trade, new settlement tools will gradually fill the share of dollar withdrawal. However, gold as a traditional settlement tool has many limitations: on the one hand, gold delivery faces the problem of insufficient standardization, and gold bars of different colors and purity require professional identification; on the other hand, the transportation of physical gold relies on professional logistics and armed escort, and cross-border circulation also requires customs procedures, and transaction costs remain high. In contrast, Bitcoin, as a digital asset, perfectly solves these problems: its standards are unified (each Bitcoin is completely equal), delivery is instant (cross-border transfers are completed within 10 minutes), and the cost is low (currently 2-8 US dollars). Especially in high-frequency, large-scale cross-border trade scenarios, Bitcoin has shown more obvious advantages in cost and efficiency than traditional payment systems such as Swift (the average cost is half of Swift and the speed is 100 times faster than Swift).

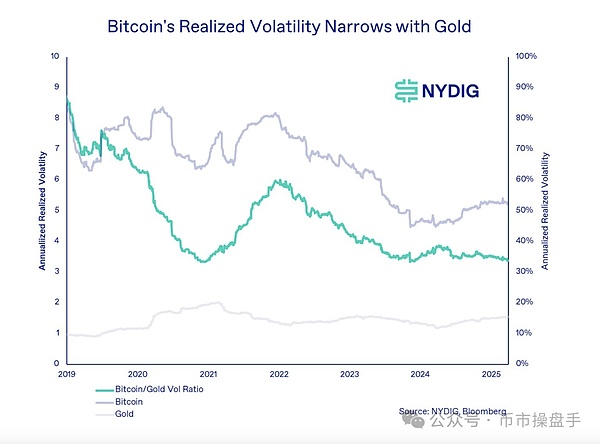

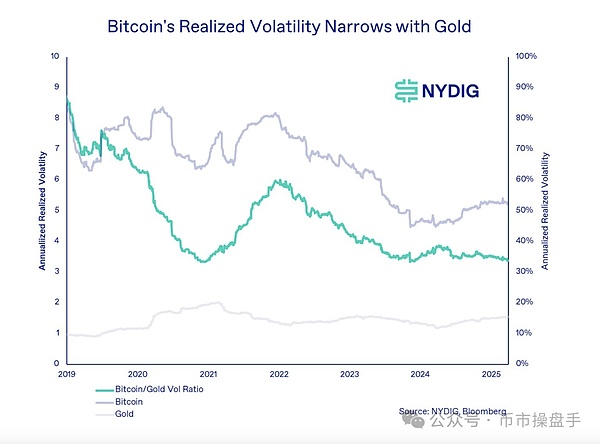

In the past, one of the main reasons why Bitcoin has not been widely promoted as an international settlement tool is that its volatility is too high: before 2024, the volatility often remained between 60% and 80%. However, as the proportion of institutional currency holdings continues to increase, Bitcoin's volatility has dropped to 50% during 2024-2025, and the volatility ratio of Bitcoin to gold has hit a record low of

3.5. This shows that Bitcoin's volatility has converged significantly in the past two years, which will help enhance its status as an international currency.

In the past week, the best performing currencies in the market basically have one thing in common: this round of adjustment is seriously oversold.

For example, the rebound of the AI Agent sector generally reached 200%-300%, but its previous decline was almost more than 90%, which can be called "ankle cut". This is also the reason why many investors are indifferent to the rebound. Since the current prices of a large number of altcoins are still far away from the concentrated lock-in area in November 2024, the rebound of altcoins is likely to continue for some time. But it should be emphasized that this round of rebound is still an opportunity to clear out junk coins and switch to the top 7 cryptocurrencies consisting of BTC, ETH, SOL, XRP, ADA, SUI, and BNB.

Brian

Brian