Major Market Information

The Federal Reserve kept interest rates unchanged, and Powell bluntly stated that he had no communication with Trump, see below for details

Lutnick attacked China on the AI dispute at the hearing

OpenAI and Microsoft launched an investigation into Deepseek

Trump instructed Musk to bring back astronauts stranded on the space station

Ackman tweeted that the Yin-Yang magic square can manipulate the market with DeepSeek

DOGE said it saves taxpayers $1 billion a day and is determined to save $3 billion a day

Canada's central bank cuts rates, says tariffs could spark persistent inflation

ASML CEO predicts low-cost AI models like DeepSeek will create more demand, not less

Gold hoarding in New York leads to shortage in London

Performance of major asset classes

U.S. stocks fell, then recovered slightly after Powell's press conference, Nvidia fell 4%, and European stocks rose.

U.S. bonds fell after the Fed's statement and rose after the press conference.

The U.S. dollar index fluctuated around 108.

Commodities fell across the board, while Bitcoin rose.

Federal Reserve Meeting Notes

After the statement was released, the market considered it hawkish, but the subsequent changes in the text of Powell's statement at the press conference were only for simplification. Personally, I think the Fed's current policy stance is still swinging between the two ends of the risk balance (employment/inflation) - in December, it was more hawkish because it was more hawkish in terms of inflation. This month, the Fed's statement on inflation was optimistic, and the assessment of tariffs is still unclear. Personally, I feel more balanced, and it is not as hawkish as in December.

Original statement (bold indicates changes in wording that are considered hawkish by the market)

Recent economic indicators show that economic activity continues to expand steadily. The unemployment rate has remained stable in the low range in the past few months, and the labor market remains strong. Inflation remains above its longer-run objective.

Recent indicators suggest that economic activity has continued to expand at a solid pace. The unemployment rate has stabilized at a low level in recent months, and labor market conditions remain solid. Inflation remains somewhat elevated.

The Committee is committed to achieving maximum employment and 2 percent inflation in the longer run. Current assessments suggest that risks to achieving its dual employment and inflation objectives are roughly balanced. Given the uncertainty surrounding the economic outlook, the Committee will continue to monitor the two-way risks to its dual mandate. The Committee seeks to achieve maximum employment and inflation at the rate of 2 percent over the longer run. The Committee judges that the risks to achieving its employment and inflation goals are roughly in balance. The economic outlook is uncertain, and the Committee is attentive to the risks to both sides of its dual mandate. To achieve its policy objectives, the Committee decided to maintain the target range for the federal funds rate at 4-1/2 to 4-1/2 percent. The size and timing of future interest rate adjustments will depend on recent data, the evolution of the economic outlook, and the balance of risks. The balance sheet reduction program (QT) will continue, including reductions in holdings of Treasury and agency debt, and agency mortgage-backed securities. The Committee reaffirms its commitment to achieving its maximum employment and 2 percent inflation goals. In support of its goals, the Committee decided to maintain the target range for the federal funds rate at 4-1/4 to 4-1/2 percent. In considering the extent and timing of additional adjustments to the target range for the federal funds rate, the Committee will carefully assess incoming data, the evolving outlook, and the balance of risks. The Committee will continue reducing its holdings of Treasury securities and agency debt and agency mortgage‑backed securities. The Committee is strongly committed to supporting maximum employment and returning inflation to its 2 percent objective.

In assessing the appropriate stance of monetary policy, the Committee will continue to monitor the implications of incoming information for the economic outlook. The Committee would be prepared to adjust the stance of monetary policy as appropriate if risks emerge that could impede the attainment of the Committee's goals. The Committee's assessments will take into account a wide range of information, including readings on labor market conditions, inflation pressures and inflation expectations, and financial and international developments.

Opening Remarks

Good afternoon. My colleagues and I remain steadfastly committed to our twin goals of maximum employment and price stability for the American people.

Overall, the U.S. economy is strong and has made significant progress toward our goals over the past two years.

Labor market conditions have cooled from prior overheating and remain solid.

Inflation has moved closer to our 2 percent longer-run objective, although it remains slightly elevated.

To support these objectives, the Federal Open Market Committee decided to maintain the policy rate unchanged and to work to reduce our securities holdings. I will talk more about monetary policy later.

Recent indicators suggest that economic activity continues to expand at a solid pace. For the full year 2024, GDP increased by 2 percent. Investment in tangible assets appears to have slowed somewhat in the fourth quarter but was generally strong for the full year.

Activity in the housing sector appears to have stabilized after weakness in the middle of last year.

Labor market conditions remain favorable. Nonfarm payrolls have averaged 170,000 per month over the past three months, and after earlier increases, the unemployment rate has remained stable since the middle of last year and, at 4.1 percent in December, remains low.

Nominal wage growth has moderated over the past year, and the gap between job openings and job seekers has narrowed. Overall, various indicators suggest that labor market conditions are broadly balanced.

The labor market has not been a major source of inflationary pressures.

Inflation has eased significantly over the past two years but remains moderately elevated relative to our 2 percent longer-run objective.

Estimates based on the Consumer Price Index and other data suggest that overall personal consumption expenditures prices increased 2.6 percent, and core inflation, which excludes volatile food and energy prices, increased 2.8 percent. Broad surveys of households, businesses, and forecasters, as well as financial market indicators, suggest that longer-term inflation expectations remain well anchored.

Our monetary policy actions are guided by our dual mandate of promoting maximum employment and price stability for the American people.

We view the risks to achieving these two objectives as roughly balanced and monitor risks to both aspects of our mandate closely.

Over the course of our past three meetings, we have lowered the policy rate by a full percentage point from its peak. Given the progress made in inflation and the rebalancing of the labor market, a recalibration of the policy stance is appropriate.

Because our policy stance is significantly less restrictive than before and the economy remains strong, we do not need to be in a hurry to adjust our policy stance.

At today's meeting, the Committee decided to maintain the target range for the federal funds rate at 4-1/4 to 4-1/4 percent. We are aware that reducing policy constraints too quickly or too much could hamper progress on inflation.

At the same time, reducing policy restrictions too slowly or too little could unduly weaken economic activity and employment. In considering the size and timing of additional adjustments to the target range for the federal funds rate, the Committee will assess incoming data, the changing economic outlook, and the balance of risks. We have no preset course.

As the economy evolves, we will adjust the stance of our policy in the manner that best promotes our maximum employment and price stability goals. If the economy remains strong and inflation does not move sustainably toward our 2 percent objective, we could maintain policy restrictions for longer.

If labor market slack or deceleration accelerates more than expected, we could ease policy accordingly. Our policies are well prepared to respond to the risks and uncertainties we face in pursuing both prongs of our dual mandate.

As we have previously announced, our five-year review of the monetary policy framework will occur this year.

At this meeting, the Committee began its discussion by reviewing the background and findings of our previous review, which concluded in 2020, and also reviewed the experience of other central banks conducting reviews. Our review will again include outreach and public activity with a wide range of parties, including at Fed Listens events across the country and a research conference in May.

Throughout the process, we will be open to new ideas and critical feedback and will draw on lessons learned over the past five years as we determine our conclusions.

We intend to conclude the review by late summer. I would note the Committee’s 2% longer-run inflation goal will be maintained and is not a focus of the review.

The Federal Reserve is given two monetary policy goals—maximum employment and price stability. We remain supportive of maximum employment, inflation that is sustained toward our 2 percent objective, and long-term inflation expectations that are anchored.

Our success in achieving these goals is critical to all Americans. We understand that our actions affect communities, families, and businesses across the country. Everything we do is in service of our public mission. We at the Fed will do whatever it takes to achieve our maximum employment and price stability goals.

Thank you, and I look forward to your questions.

Question and Answer Details (QA)

CNBC: Mr. Chairman, at an event in Davos, the President said he would ask for an immediate rate cut. I guess I have a three-part question. Did the President make such a request to you? Second, what is your response to that? And third, what are the policy implications of the President making such remarks? Thank you.

Chairman Jerome Powell: Three questions. But I think that's actually a question, so I'm not going to respond or comment on the President's remarks. It would be inappropriate for me to do so.

The public should have confidence that we will continue our work, as we have always done, focused on using our tools to achieve our goals, and really keep our heads down and work. That's how we best serve the public.

Did he personally convey that request to you?

Chairman Jerome Powell: I have had no contact. Thank you.

WSJ: Chairman Powell, you and several of your colleagues indicated in our last meeting that the stance of policy was meaningfully restrictive. Given the financial and economic market developments that have occurred since then, how has your confidence in your assessment that interest rates are meaningfully restrictive changed?

CHAIRMAN JEROME POWELL: I think my assessment is really -- I think my assessment is really unchanged. Several things have happened. We've had more strong data, but we've seen longer-term interest rates move higher, which could represent a tightening of financial conditions.

If we look back over the last year, you can see the impact of interest rates on spending and housing, and the achievement of our target variables. We've seen the economy move toward 2% inflation and we've basically achieved maximum employment, and so we're really looking at the movement toward our target, and those are the variables that we can use to assess that.

Right now, policy is much less restrictive than it was before we started cutting rates, 100 basis points less. So we're going to be focused on actual progress on inflation, or some persistent softness in the labor market, before we think about making adjustments.

If I could just follow up on that, does the economy here require a meaningfully restrictive interest rate? If you cut rates another 25 basis points, do you still see rates as being materially restrictive?

Chairman Jerome Powell: So I think our stance of policy is well-calibrated, as I mentioned, to balance the achievement of our two objectives.

We want policy to be restrictive enough to continue to promote further progress toward our 2 percent inflation objective. At the same time, we don't need to see further slack in the labor market to achieve that objective.

That's exactly what we've been working towards.

The labor market remains broadly stable. The unemployment rate has been broadly stable for six months, and conditions appear to be broadly in balance. If you look at the last few times of inflation data, you can see that we don't overreact to readings that are too good or too bad, but in any case, the recent data indicate a more positive reading, so I think policy is well positioned.

New York Times: Chairman Powell, how should we interpret the removal of the sentence from the statement that “inflation has made progress toward our 2 percent objective”? Is that no longer the case?

Chairman Jerome Powell: So, if you just look at the first paragraph, we did some language cleanup. We removed the reference to the labor market “since earlier this year.”

We just chose to shorten that sentence. Again, I mean, if you look at the underlying meaning of the data, the data was good, and there was another inflation data before the December meeting, so we got two good data in a row that were consistent with 2 percent inflation.

Again, we don’t read too much into two good readings or two bad readings, but you can take away from all of this that we remain committed to sustainably achieving our 2 percent inflation objective.

Just to add, we've seen a sharp rise in inflation expectations across many measures, partly related to tariff concerns, but also, as you mentioned, encouraging data on the CPI and personal consumption expenditures. How do you think that relates to the policies of the Trump administration?

Chairman Jerome Powell: I would say that you're seeing a slight rise in short-term expectations, but not at the longer end, which is where it really matters.These may be related to some of the new policies that you mentioned.

I think the committee is very much inclined to wait and see what policies are enacted. We don't know what's going to happen with tariffs, immigration, fiscal policy, and regulatory policy.

We're just starting to see, and we haven't really started to see much yet. I think we need to get some clarity on these policies before we can start to make reasonable assessments of their impact on the economy.

So we’re watching closely. As we always do, this is no different than any other set of policy changes in the early days of any administration. We’re going to be patiently watching and understanding and, you know, not rushing to understand what our policy response should be until we see how this plays out.

Bloomberg TV & Radio: You and your colleagues often qualify future policy moves with the phrase “if the economy develops as we expect.”

Given that there are so many unknowns right now, is it fair to say that you don’t have a medium-to-long-term economic forecast you can have confidence in about what fiscal policy will actually look like under this administration?

Or, if that’s not true, can you articulate what you think is going to happen to the economy? How do you see it developing? CHAIRMAN JEROME POWELL: Well, at any given time, forecasts are subject to at least a range of expectations. And they're highly uncertain in both directions. We know that. Economic forecasts are really hard to get beyond just a month or two. So, in the current situation, there may be some uncertainty because, you know, there are significant policy shifts in those four areas that I mentioned. Tariffs, immigration, fiscal policy, and regulatory policy. So, there may be some additional, but that should pass. We should get through that, and then we'll go back to our regular level of uncertainty. So, what forecasters are doing, and it's not just us, but what everybody is doing, is they have a range of assumptions about what might happen, but they're really more of a placeholder, meaning, you know, it might be plausible, but honestly, you wouldn't back it up because you just don't know. You're just kind of waiting and seeing what happens.

You know, this is a very large economy and policy is working at the margins, but we'll see.

If I could just follow up, do you think the economy -- the idea that policy is restrictive suggests that the Fed, in general, wants to continue to lower interest rates. When you look at the data that you rely on, are you looking for data that tells you that you can cut rates or are you looking for data that tells you that you should keep them the same?

Chair Jerome Powell: You know, we're looking for -- it's more like the other -- the way it works is that we're looking at the data for guidance on what we should do. You know, that's what we do.

Right now we feel like we're in a very good place. Policy is well positioned and the economy is actually in a pretty good place.

We expect to see further progress in inflation, you know, as I mentioned, when we see that or see slack in the labor market, that could prompt further adjustments, but right now we're not seeing that. We think things are in a very good place both for policy and for the economy.

So we don’t feel we need to make any adjustments in a hurry. (But right now, we don’t see a need to hurry.)

Reuters: Thank you very much. In 2021, at a central bank conference, you said, "In my career in both the public and private sectors, I have seen that the best and most successful organizations are often those that have a strong and sustained commitment to diversity, equity and inclusion (DEI). These organizations attract the best talent by investing in and retaining a world-class workforce." Do you still believe that? If so, how do you plan to practice that in light of the recent executive order to reduce diversity, equity, and inclusion efforts?

Chairman Jerome Powell: To the first question, I would say yes.

Second question, we are reviewing these orders and the related details as they are released. As we have done through many administrations, we are working to align our policies with the executive order and within applicable law.

I would like to add that I will not be providing you with more specific information on this line of question today.

If I could just quickly follow up, I'm wondering how you are aligning this with the Dodd-Frank Act's provision to maintain the Office of Women, Minorities, and Inclusion.

Chair Jerome Powell: I did mention consistency with applicable law, right?

Thank you very much, CBC News. What assurances can you give -- ABC News that the Federal Reserve will continue to operate independently of politics under this administration?

Chairman Jerome Powell: As I've said countless times over the years, this is who we are, this is what we do. We look at the data, we analyze how it's going to affect the outlook and the balance of risks, and we use our tools to the best of our understanding and to the best of our ability to achieve our goals. That's what we do. That's what we've always done. Don't expect us to do anything else.

Many studies have shown that this is the best way for a central bank to operate. That will give us the best chance of achieving those goals for the benefit of the American people. That's what we will always do, and people should have confidence in that, as I said a few minutes ago.

You said that the Fed is in wait-and-see mode, based on the policies that this administration has put in place. Have you begun modeling what the policies of this administration, such as mass deportations and other policies, would look like for the workforce?

Chairman Jerome Powell: Our staff looks at a range of possible outcomes. They tend to range from very good to very bad. (Our staff runs simulations from "really good to really bad." This is one of the best things they do. In every Beige Book, you can look at the Beige Book from five years ago and see that they are all alternative simulations. There would be a baseline, and they would show six or eight alternatives, both very good and not so good.

What they do is they push policymakers to think about and understand the uncertainty around this.

So, yes, the staff does that, and we are all very aware that the possibilities are always wide. And, not just now, but always. You have to -- it's hard to be open-minded about what the possibilities are for an economy. You know, no one saw this coming, and it changed everything.

So, things happen, and yes, we do. But it's one thing to do these things to assess what might happen and start thinking about what you might do in that scenario. But you don't act until you see more than we're seeing right now.

Bloomberg News: Last month, you talked about future rate cuts being very much contingent on further progress on inflation. With the tightening labor market and today's statement, would you say that's even more true now?

Chairman Jerome Powell: I would say the same. We want to see further progress on inflation. That's the case. We just need to see the data. Ultimately, it comes down to 12-month inflation because it takes out the seasonality that may have been there -- takes out the seasonality that may have been there, and we need to see that. We think the path to that is probably going to emerge.

A key example is that you do see right now that owner's equivalent rent and housing services, how it's calculated in personal consumption expenditures, are now steadily declining, whereas non-market services tend not to send out much of a signal. You can look at this and say, well, we appear to be positioned for further progress, but it's one thing to be perceived as positioned for it and another to achieve it, so we want to see further progress in inflation.

Remember, we're below 2%, but our target is 2%, and we do intend to get back to 2% sustainably.

In terms of the labor market, it's broadly -- you said a broad range of indicators suggest it's in a pretty solid position. Is there broad consensus on that? There are some underlying indicators that suggest there may be some softness. Hiring is low, workers are reporting that it's getting harder to find jobs.

Is the committee concerned about that?

Chairman Jerome Powell: You're right. We certainly look at a very broad range. It starts with the unemployment rate, employment, participation rate, wages, the quits rate, whether people are leaving their jobs, things like that. The ratio of job openings to the number of unemployed people, we look at all of those factors. You pointed out, this is a low hiring environment. So if you have a job, everything is fine. But if you have to find a job, the job search rate, the hiring rate, has come down. It's more like -- let's say unemployment -- the labor market is at a sustainable level, it's not overheating anymore. We don't think we need it to cool down any more. We do watch it very carefully. It's one of our two target variables. But I would say, we watch these things very carefully. But, having said that, overall, looking at the overall data on the labor market, it seems -- the labor market seems to be fairly stable and roughly balanced, when the unemployment rate has been fairly stable for a full six months. Thank you. Fox Business. On employment, you said there's a wide range of possibilities, but in September you said that border flows were quite large, which is one of the reasons why the unemployment rate could have risen. Now that flows at the border have slowed and we're seeing deportations, how do you expect unemployment to change?

Chairman Jerome Powell: Flows at the border have decreased significantly, and there's good reason to expect that to continue. So, but job creation has also declined slightly.

So, you know, if those two things are going down together, that could be one reason why the unemployment rate has stabilized. In other words, the breakeven rate, as population growth slows, the need to create jobs for workers also goes down. So that seems to be happening.

You do see unemployment very flat, and you've seen significant declines.

I wanted to ask you about employment at the Fed. I know mission funding is not used here, but Elon Musk has claimed that the Fed is overstaffed and that the branches are pushing the federal workforce. I want to get your response.

Chairman Jerome Powell: We run a very careful budget process. We are fully aware of our responsibilities to the public, and we believe we do that.

I have no further comment on that. Thank you.

AP: President Trump has said he would reduce inflation by lowering gas and energy costs. Do you see such costs as a specific driver of inflation? Would lowering them have a significant impact?

Chairman Jerome Powell: Chris, I don't react to or discuss what any elected politician says, so I'll give you a do-over.

Thank you. Nearly two weeks ago, the Federal Reserve said it would withdraw from the Network on Climate-Related Financial Risks (NGFS), a group established to discuss how the financial system can respond to climate change, even as major wildfires in Los Angeles caused billions of dollars in damage. Many of the commentators that I've spoken to have viewed climate as a political issue. Why did you leave that organization?

Chair Jerome Powell: We thought about this carefully and we decided to leave the NGFS. And actually, the work that the NGFS does has expanded significantly. Think about nature-related risks and biodiversity and so on. And also, the work of the NGFS is very much aimed at — and this is quote — "mobilizing mainstream finance to support the transition to a sustainable economy." So, we joined to see what other central banks are doing and to look at the research and so on.

I think that goes well beyond any reasonable mandate that you could attribute to the Federal Reserve. So, as I've said many times, our role is very limited.

I think that the activities of the NGFS are not appropriate for the Federal Reserve given our current mandate and our current powers.

So, I think it's time to acknowledge that. This process goes back a few years, and I decided a few months ago to bring this matter to the Board. It's just — it took some time for the process to get to this point, and that's when we got it and voted on it.

I know what it's going to look like. It's really not politically motivated, but it's a disconnect between what the NGFS does and our mandate. Other central banks have different mandates. There's nothing critical about the NGFS, but it's not for the Fed.

The Washington Post: I wonder if you could talk a little bit more about what further progress would look like for consumers?

Chairman Jerome Powell: Well, 2% inflation, down to 2% sustainably, is what we are trying to achieve. As you know, we're slightly above that. We want to see a range of data that shows that we're making further progress on inflation. That's what we want to see. And of course, consumers will feel that in the goods that they buy in the grocery stores, in the stores.

The other thing I wanted to ask is, how far away do you think you are from the neutral rate? CHAIRMAN JEROME POWELL: Yes. Of course, as I like to say, you can't know for sure. You get a sense of the neutral rate by what it does. So, I think at 4.3 percent, we are above almost everyone on the committee's estimate of what the longer-run neutral rate is. I think our observations tell us that our policy is having an effect on the economy. That's really the question we have to ask. You can look at the models, but you really have to look out the window and see how your policy rate is affecting the economy. I think we're seeing that it's having a meaningful effect in terms of controlling inflation. It's also helping to bring the labor market back into balance. So, that's what we think. I would say we are meaningfully above it, but I'm under no illusion that anyone knows exactly what it is.

But knowing that and cutting rates by 100 basis points means that it's appropriate that we're not in a rush to make further adjustments.

POLITICO: Generally speaking, do executive orders and OMB memoranda always apply to the Fed? Sometimes, never, or do you often voluntarily comply? What's the legal basis there?

Chairman Jerome Powell: As I mentioned, our practice is to try to keep our policy consistent with what's mentioned in the executive orders. I'll stop there. I won't go any further into that today, or into this line of question.

FT: I have two questions on tariffs, if I may. First, it seems like we've been through trade wars before. In 2019, the last time, but we were in very different positions then, both in terms of inflation and growth. If we see tariffs of the same magnitude as we did then, which I know is a big "if," what do you think would be different this time around, and secondly, having said that there's no doubt that the threat of tariffs was a major driver of the Bank of Canada's actions today. What would the Fed need to see about tariffs before it would be willing to take this kind of preemptive action? Thank you.

Chair Jerome Powell: Excuse me?

What would you need to see about tariffs? Do you need to see a strategy? Actual execution? Actual changes in inflation expectations before you'd really be willing to change the path of monetary policy based on that.

Chair Jerome Powell: First of all, the situation is a little different. We just came out of a period of high inflation. You could make the argument on two fronts, businesses have realized that they do like higher prices, but we're also hearing from a lot of businesses right now that consumers are really fed up with higher prices, so I don't know how that's going to play out.

Nevertheless, we're getting back to a situation where we're not quite back to 2%. Also, trade, the footprint of trade has changed a lot because trade is now dispersed to -- you know, it's not as concentrated in China as it once was. There's a lot more manufacturing moving to Mexico and other places.

So, there are differences. I think the odds are very, very good. We just don't know. I don't want to start speculating, as tempting as it is, because we really don't know. And we didn't know, by the way, in 2000, I think, 18 years, we really didn't know. Again, the odds are very, very good.

We don't know what the tariffs are. We don't know how long they'll last, how much, which countries, and we don't know the retaliation, or how it's going to be passed through the economy to consumers.

That really remains to be seen, you know? There are a lot of possible places where the price increases from tariffs could appear, between manufacturers and consumers. There are a lot of variables, so we'll have to wait and see.

The best we can do is what we've done, which is to study this, look at the historical experience, read the literature, think about the factors that might be important, and then we'll have to see how this plays out.

Thank you. Axios: Two unrelated questions. The first is, was there any discussion of quantitative tightening (QT) at this meeting and the timeline for ending QT. & ...

We prefer to reduce the size of the balance sheet to the level that is effective under an ample reserve system. We are monitoring a range of indicators to assess the possibility of slightly above ample levels.

I don't have anything to say about specific dates. That's the process, and what we see -- the ratios do look ample.

As always, we stand ready to act as appropriate to support a smooth transition of monetary policy, including details on how we would adjust the size of our balance sheet in light of economic and financial developments.

Regarding AI, this is a big event for the stock market, and in particular for certain parts of the stock market. What really matters to us are macro developments that imply material changes in financial conditions and persist over a period of time.

So I wouldn't label these events as such, although, of course, we are all watching it with interest. The Economist: You mentioned in your speech that activity in the housing sector appears to have stabilized. At the same time, long-term rates have risen back a full percentage point, back to 7%, since the first rate cut in September. Looking ahead, do you think -- given that mortgage rates are so high, do you believe activity will remain stable, and how does that fit in with your broader thinking about the economy? Chairman Jerome Powell: As you know, when we cut our policy rate by 100 basis points, long-term rates rose. That was not primarily because of expectations about our policy or inflation, but more to do with the term premium, the interest rate associated with housing. I think that if higher rates persist, that could dampen housing activity to some extent. We'll have to see how long they persist. What we control is the overnight rate. Normally, that feeds through to the entire range of asset prices, including interest rates. In this particular case, it occurred at a time when longer-term interest rates were rising for reasons unrelated to our policy.

Yahoo Finance: You said you'd like to see further progress on inflation. Given that households seem unhappy with prices remaining high, do you think the committee should wait until inflation falls back to its target before cutting rates?

Chairman Jerome Powell: No, I wouldn't say that. We've never said that we have to be exactly at our target before we can cut rates. At all times, what we do is look at the economy and ask whether our policy stance is the right stance to achieve maximum employment and price stability. So, I think we'd like to see further progress, but we think our -- as I mentioned, we think our policy stance is restrictive. Meaningfully restrictive. Not highly restrictive, but meaningfully restrictive.So, I think we need to see further progress.

I wouldn't say go all the way back to a sustainable level of 2%, although we would love to see that and we will.

Another question on tariffs, oddly enough, the threat of tariffs and the uncertainty of whether they're going to persist has created uncertainty in the U.S. and could ultimately cause the economy to pull back and drag on growth, does the threat of tariffs make you think about your growth forecasts?

Chairman Jerome Powell: I want to refrain from commenting directly or indirectly on tariff actions. It's not our job, it's not our job to comment on what people are doing, so I don't want to criticize anything that's going on or really comment on it in any way, or praise it. It's not our job.

I do think that we found in 2018 that we did a lot of work on trade policy uncertainty, and if it's large and persistent, it can start to affect businesses making investment decisions and so on. That's not what I'm observing today. It's still early, but I think it's really going to be important in 2018 and 2019. It's one of many things that we're going to be watching. CNN: How do relatively high market valuations affect considerations of potentially lowering interest rates further? Is that something that's on your mind? Chairman Jerome Powell: We look at asset prices from a financial stability perspective, as well as leverage in the household sector, leverage in the banking system, funding risk at banks, and so on. That's one of the four factors that go into asset prices. Yes, I would say they're all elevated by a lot of measures right now. And a lot of that, of course, is around things like tech and artificial intelligence. We look at this primarily from a financial and stability perspective. There's a lot of resilience. Banks are highly capitalized. Households are in pretty good financial shape overall today, so that's what we're thinking about. We also look at overall financial conditions. You can't just think about -- you can't just think about stock prices. You have to think about interest rates as well. That represents a tightening environment, with higher interest rates.

So, overall, financial conditions are probably still somewhat accommodative, but it's a mixed bag.

CBS News: The unemployment rate is stable at a low level, and you explained some of the drivers, but I'm wondering what risks you might see that might challenge your assessment?

Chairman Jerome Powell: Well, the things that we're concerned about, we've talked about it before. One is the low hiring rate. If there was a spike in layoffs, if businesses started to lay off employees, you would see unemployment rise rapidly because the hiring rate is low. That's one thing that we're concerned about.

I think it's also worth pointing out that for low-income households, they're under tremendous pressure.

Overall, the numbers are good, but we know that people at the lower end of the income spectrum are struggling with costs. It's really high inflation for necessities. It's not so much inflation now as it is the price level because inflation raises prices. Inflation is closer to target now, but people are definitely feeling it.

Overall, it's a good labor market. The unemployment rate is 4.1%. That's really a good level, and you've been holding it solidly for six or seven months. Job creation is also pretty close to being able to keep the unemployment rate at this level, given that population growth is going to be much lower.

One more question. Some of the uncertainty around immigration policy. In your assessment, is that making it more difficult for businesses and the Federal Reserve to plan for the future?

Chairman Jerome Powell: You know, we've heard reports, but I haven't seen anything about that in the data yet. But you hear these kinds of things about the construction industry, for example, where businesses that rely on immigrant labor say it's suddenly harder to find people. But again, you don't see that in the aggregate data yet, but you hear it anecdotally.

Investment Bank Daily Chart

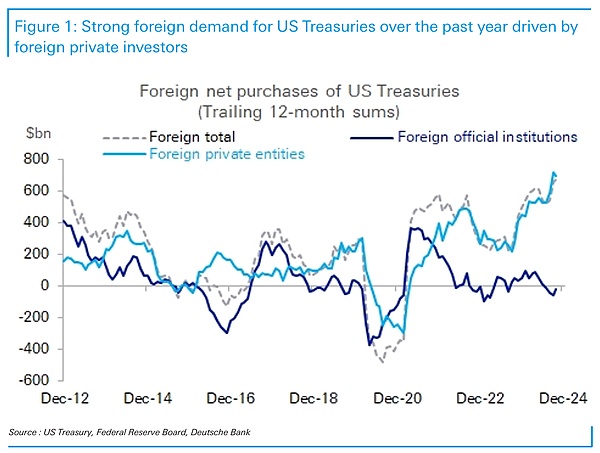

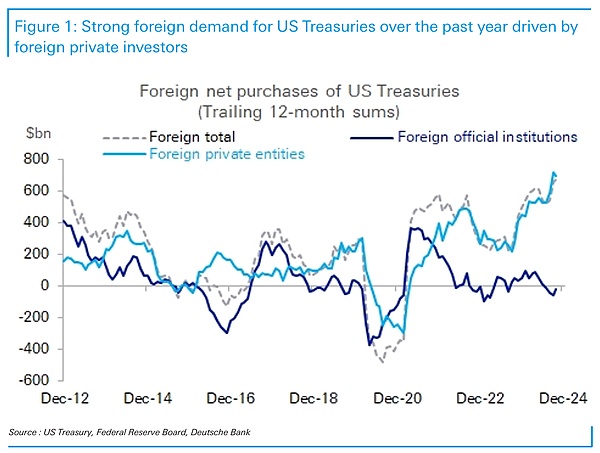

DB: Overseas demand for U.S. debt: private sector takes over from official institutions

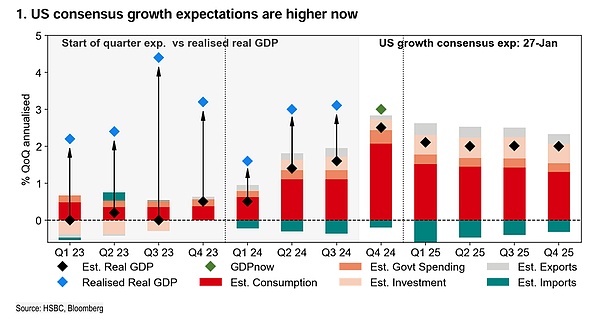

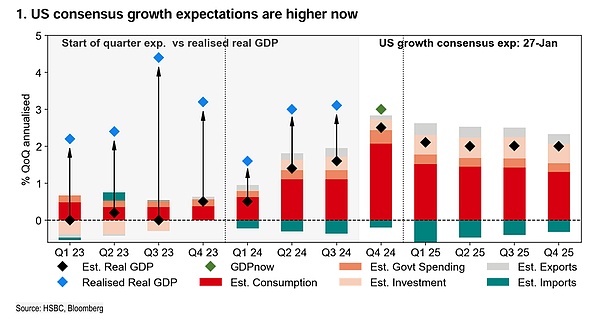

HSBC: The continued improvement of the economy has led to higher growth expectations, and the threshold for exceeding expectations has also become higher

JPM: Thinking about exchange rate risks from the scale of U.S. stock holdings

![]()

Anais

Anais