Kennedy Sr., who made his fortune bootlegging during Prohibition, became the first chairman of the Securities and Exchange Commission (SEC) after the end of Prohibition. President Roosevelt is said to have said of the appointment, “Let thieves catch thieves.” Kennedy subsequently cleaned up Wall Street with a reformed zeal, establishing rules that still govern securities markets today.

A similar example in the modern cryptocurrency space is OKX’s transformation from regulatory pariah to potential IPO candidate.

According to a report on Sunday, Seychelles-based cryptocurrency exchange OKX is considering a public listing in the United States, just four months after it agreed to pay a $505 million fine to the U.S. government for operating without a license.

In February 2025, the world's second-largest centralized exchange (CEX) admitted to processing more than $1 trillion in transactions from unauthorized U.S. users while willfully violating anti-money laundering laws and agreed to pay a massive fine of more than $500 million. Now, it wants to invite American investors to buy shares in its company.

Nothing says "we have moved on" more than voluntarily accepting the quarterly earnings calls, disclosures, and filings required by the U.S. Securities and Exchange Commission.

Can a crypto company succeed on Wall Street?Circle recently proved that it is possible. Over the past few weeks, the USDC stablecoin issuer has shown that investors will enthusiastically throw money at crypto companies as long as they follow the compliance route.

Circle's stock price soared from $31 to nearly $249 in a few weeks, creating instant billionaires and creating a new template for crypto IPOs. Even Coinbase, the largest crypto exchange in the United States, has risen 40% in the past 10 days, close to a four-year high, after four years of listing.

Can OKX achieve similar success in the stock market?

Well, Circle went public with an impeccable regulatory record. They have worn suits, attended congressional hearings, and released transparency reports for years. And OKX recently admitted to facilitating $5 billion in suspicious transactions and criminal proceeds, and had to solemnly promise not to repeat the same mistakes.

Different CEXs, different stories

To understand OKX's IPO prospects, let's look at Coinbase, the only crypto exchange that has successfully entered the public market. OKX and Coinbase make money in the same way: charging fees every time someone trades cryptocurrency.

When the crypto market is crazy, such as the bull market, they make a lot of money. Both platforms provide crypto basic services: spot trading, staking and custody services. However, their business construction methods are very different. Coinbase chose the compliance-first route. They hired former regulators, built institutional-grade systems, and spent years preparing to go public on Wall Street. The strategy worked, and they went public in April 2021, despite the ups and downs of the crypto market, and are now worth over $90 billion. In 2024, Coinbase averaged $92 billion in monthly spot trading volume, mostly from U.S. customers who paid a premium for regulatory certainty. This is the tortoise strategy: slow, steady, and focus on one market well. OKX chose the rabbit strategy: move fast, grab global market share, and worry about regulation later. From a business perspective, this approach has been very successful.

In 2024, OKX averaged $98.19 billion in monthly spot trading volume, 6.7% higher than Coinbase, serving 50 million users in more than 160 countries. Coupled with their dominance in derivatives trading (19.4% global market share), OKX processes far more crypto trading volume than Coinbase.

OKX processes about $2 billion in spot trading volume and more than $25 billion in derivatives trading volume every day,while Coinbase does $1.86 billion and $3.85 billion, respectively.

But speed comes at a cost. Coinbase builds relationships with U.S. regulators, while OKX actively courts U.S. customers despite being banned from operating in the U.S. Their attitude seems to be "forgiveness first, not permission," which works until they need to ask the Department of Justice for leniency.

There's a problem: crypto exchanges' revenues are completely dependent on people continuing to enthusiastically trade cryptocurrencies. When the market is hot, exchanges make a lot of money. When the market cools, revenues can drop sharply overnight.

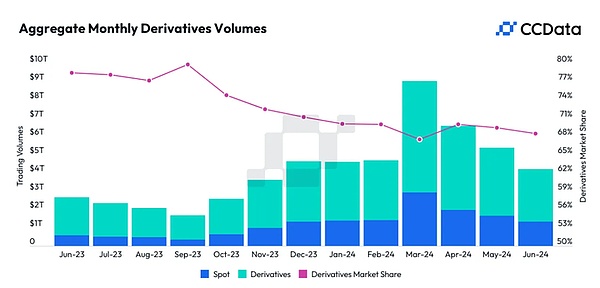

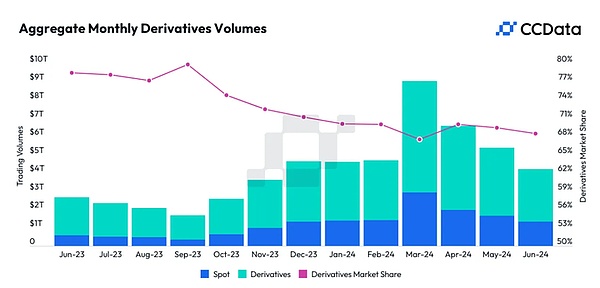

For example, in June 2024, exchanges' spot and derivatives trading volumes collectively fell by more than 50% from a peak of about $9 trillion in March.

@CCData Exchange Comment

OKX's $500 million settlement became a mandatory lesson in how U.S. financial markets operate. They appear to have learned from their expensive mistakes. They hired former Barclays executive Roshan Robert as U.S. CEO, opened compliance offices in San Jose, New York, and San Francisco with 500 employees, and began talking about building a "category-defining super app," corporate language that suggests a serious reform effort.

It will be interesting to see whether investors buy into this redemption story.

Valuation Game

Based on trading volume, OKX's valuation should theoretically be comparable to or even higher than Coinbase.

Coinbase has a market cap of over $90 billion and a monthly average of $92 billion in trading volume, equivalent to a single multiple of monthly volume. OKX's monthly volume is $98.19 billion, 6.7% higher than Coinbase. Based on the same multiple, OKX's market cap should be $85.4 billion.

But valuation is not just about math, it's also about perception and risk.

OKX's regulatory baggage may need to be discounted. Their international presence means profits depend on a rapidly changing regulatory environment, as they learned in Thailand, where regulators just banned them and several other exchanges.

Applying a 20% “regulatory risk discount,” OKX could be valued at $68.7 billion. But given their global reach, derivatives dominance, and higher trading volumes, they may be justified in getting a premium valuation.

Realistic range: $70 billion to $90 billion, depending on how much investors value growth vs. governance.

Advantages

OKX’s investment appeal is based on several competitive advantages that Coinbase lacks.

Global Scale:Coinbase is primarily focused on the U.S., while OKX serves markets where crypto adoption is surging: Asia, Latin America, and parts of Europe where traditional banking systems are less developed.

Derivatives Dominance:OKX controls 19.4% of the global crypto derivatives market, while Coinbase’s derivatives offerings are negligible. Derivatives trading incurs higher fees and attracts more sophisticated traders. Coinbase’s recent announcement of perpetual futures means OKX will face more competition from established and regulated players.

Volume Lead: Despite being a private company with recent regulatory troubles, OKX’s spot trading volume exceeds that of publicly traded Coinbase.

Coinbase also has advantages—a clean regulatory record and relationships with institutional investors who prefer predictable compliance costs to a global growth story fraught with regulatory complexity.

What Could Go Wrong

The risks for OKX are significant and different from typical IPO concerns.

Regulatory uncertainty:OKX operates in dozens of jurisdictions, and rules change quickly. The Thailand ban is just the latest example. Any major market could see a significant amount of revenue cut overnight.

Market cyclicality:Crypto exchanges’ revenues rise and fall with trading activity. When crypto markets cool, exchange revenues can collapse.

Reputational Risk: Despite the settlement, OKX could still suffer significant reputational damage from a regulatory scandal. Crypto exchanges are inherently risky businesses, and a technical glitch or security breach could destroy customer confidence overnight.

Summary

OKX’s potential IPO could be an interesting test of whether public markets will ignore the exchange’s problematic background.

Stripping away the regulatory drama, OKX actually has advantages over Coinbase, the only crypto exchange to have successfully gone public. They dominate derivatives trading and have a global customer base.

Whether OKX learns from its mistakes (expensive lessons often stick) may not matter. What matters is whether public market investors are willing to pay growth multiples for a company operating in dozens of unpredictable regulatory environments. Coinbase built a moat of U.S. compliance credentials; OKX built a global trading empire and is now reinventing it around compliance.

Both strategies may work, but they appeal to very different investors. Coinbase is a safe bet for institutions seeking regulated crypto exposure. OKX may appeal to investors who believe the future of crypto lies in global adoption and sophisticated trading products.

Circle proved that investors will throw money at clean crypto stories. OKX is betting that investors will do the same to them, even if they have a checkered past.

Whether OKX's reformist image resonates with public markets will tell us a lot about how investors weigh growth versus governance in the crypto space.

Catherine

Catherine