Author: thedefinvestor Translation: Shan Ouba, Golden Finance

It’s been another historic week for the crypto industry.

Trading platform giant Robinhood announced the launch of a tokenized version of US stocks on Arbitrum One. But that wasn’t even the biggest news of the week. On the same day, xStocks also went live through the Jupiter Exchange on Solana.

In the initial stage, Robinhood’s on-chain stocks will have some limitations:

Only supports 24/5 trading (it’s still closed on weekends).

Researchers have decompiled Robinhood’s tokenized stock contracts and believe that these stock tokens are probably not compatible with DeFi.

Purchasing these on-chain stocks seems to require KYC.

However, Robinhood’s on-chain stocks have an interesting highlight:

They also support investing in private companies like OpenAI and SpaceX—which was almost impossible for retail investors to do before.

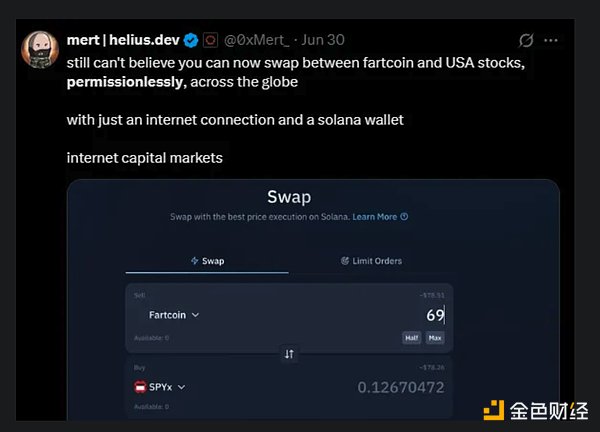

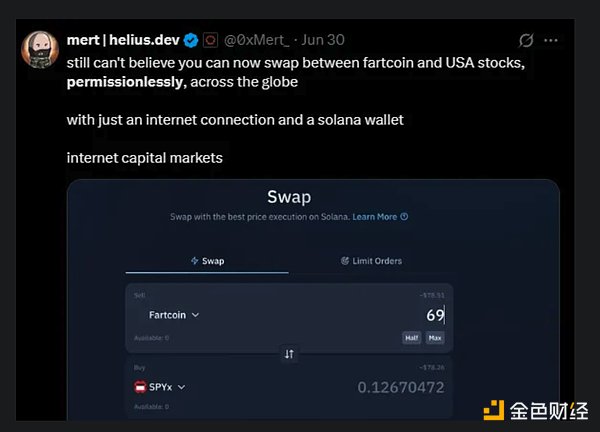

Of course, don’t get me wrong: this news from Robinhood is exciting, but the real breakthrough is making tokenized assets permissionless in DeFi.

That’s where xStocks shines.

Earlier this week, Backed Finance launched xStocks on Solana. These are tokenized versions of real US stocks and ETFs and are truly “DeFi-ready” products.

“DeFi-ready” means: it has been integrated into multiple DeFi protocols, and anyone with a Solana wallet can trade freely on the chain without permission

Currently, you can use these xStocks to do the following:

Exchange xStocks with any Solana token on Jupiter Exchange

On Provide liquidity for xStocks on Raydium and earn trading fees. Borrow stablecoins on Loopscale using xStocks as collateral (Circle, Tesla, Nvidia stocks are currently accepted as collateral). Soon, they can also be used as collateral on Kamino Lend. I’ve personally been waiting for this “DeFi-ready” version of stocks for a long time. While Ethereum is still ahead in terms of institutional adoption, it’s interesting that Backed chose to launch xStocks only on Solana. I wouldn’t be surprised to see them expand this product to other chains in the future.

Of course, you can also buy xStocks directly through centralized exchanges (such as Bybit, Kraken, and Gate), although this is not the usage I am most interested in.

The Future of Tokenized Assets

Imagine these scenarios:

Speculating on future dividends from a US company on a yield trading protocol like Pendle

Borrowing on AAVE using on-chain stocks as collateral

Trading stocks on-chain on weekends (when traditional stock markets are closed)

In my opinion, tokenized assets (such as on-chain stocks) have huge potential as they can enable many new and interesting use cases.

This is exactly why DeFi has the opportunity to bring the next billion users on-chain: by providing the same products as traditional finance, but with lower fees, better experience, and support for new capital-efficient use cases.

RWA is still a very early field. The total value of tokenized stocks worldwide is only US$392.8 million, while the total market value of global stock markets exceeds US$100 trillion.

I would not be surprised if by 2030, the RWA track can develop into a trillion-dollar market.

Anais

Anais