Gold, which has been dormant for thousands of years, is mankind's eternal belief——When war, unrest or inflation occurs, gold is the last refuge of value.

In one civilization iteration after another, it has always maintained its unique value status.

But this time, things seem to have changed. The World Gold Council has formally put forward a proposal to launch a digital token backed by physical gold in London, aiming to revolutionize the way gold is traded, settled and mortgaged. This move will inject new vitality into the world's largest physical gold trading center with a scale of up to US$93 billion. We can regard it as RWA (Real-world Assets) - the largest experiment in the tokenization of physical assets to date. This has, of course, triggered a fierce discussion in the market about the collision between tradition and innovation – when physical assets move towards tokenization, how do we open this door? I had the honor of attending a discussion on token economy at the Bund Conference in Shanghai, where I witnessed different perspectives and value orientations from multiple dimensions, including third parties, industry participants, regulators, economists, and financial institutions. To sum up everyone's views in one sentence, the token economy is very worthy of discussion. But to put it another way, for tokenization to reach its peak, it will require the coordinated efforts of regulators, financial institutions, and technology companies to jointly explore and support the real economy.

Before Dawn: Exploration and Boundaries of Token Economy

2025may be a small but important turning point for the entire token economy. This year, the US government proposed

“ Project Crypto ”, openly supporting tokenization innovation and promoting SEC , Regulatory agencies such as the CFTC have successively expressed their views, gradually building the United States' leadership in the token economy. At the same time, the Hong Kong Special Administrative Region Government of China issued the "Policy Statement on Digital Asset Development 2.0", which clearly proposed to encourage the development of RWA and try to provide a clearer regulatory framework for tokenized assets, with the goal of building Hong Kong into a digital asset hub. Why does the Policy Statement 2.0 encourage “RWAs”? It is because the Hong Kong Government believes that The tokenization technology represented by RWAs can improve the efficiency, accessibility, and potential liquidity of the Hong Kong market, ultimately bringing new vitality to the economy. Currently, several licensed institutions in Hong Kong are exploring the issuance of tokenized products such as gold, funds, bonds, and new energy, and have achieved real-world implementation. For example, Longxin Group's charging pile project has become the first such asset to be launched in the new energy industry. Through RWAs, it has generated new liquidity, which can help accelerate the development of the real economy. Of course, the enthusiasm for exploring the token economy still needs to define the compliance boundaries of the industry, just as in Shanghai where the temperature was 35 degrees Celsius in September, there was no shortage of calm, objective and constructive speeches at the conference. In this "confession session" of the token economy, Li Yang, chairman of the National Finance and Development Laboratory, was the first to admit that the token economy is still in its early stages of development.

"The tokenization of legal tender and financial assets is moving faster, but the tokenization of physical assets has just begun."

Ant GroupCEO

Han Xinyi, Chairman of Ant Digits, said: "Currently, the world The scale of Web3 native assets has exceeded $3.8 trillion, but the vast majority of this is still primarily used for speculative trading and value storage, lacking deep interaction with the real economy. He said that if tokens are confined to internal circulation in the virtual world, their value proposition will be very limited. The "Token Economy Report" released at the Bund Summit noted that financial assets are still the primary players in tokenization. But its true mission and value should be to provide timely assistance to the real economy, rather than simply adding icing on the cake to financial assets. Li Lihui, former president of the Bank of China, raised a deeper question: Which financial services are truly suitable for decentralization? Which assets truly need to be tokenized? On the other side of innovation, how can we prevent systemic risks through technological and institutional innovation? “

Many innovationsexist only inform,the essence is

the original functionsre-implementation of The experts were not enthusiastic, but they pointed out the most pressing questions that need to be answered on the road ahead for the token economy: we must not only pursue “can we” but also consider “should we”; we must not only pursue efficiency but also safety. This is the path of exploring the token economy, and clear boundaries must be defined. Only by clearly understanding the underlying value of the technology can the entire industry develop healthily and vigorously, breaking through the chaos and ushering in the dawn. The author noticed that Ant Digital Technology’s CTO Yan Ying announced the launch of the new “Smart Agent Contract (

)” at the Bund Conference.

Smart ContractIntroducing AIIntelligent agents drive smart contracts, allowing the contract itself to perform environmental perception, logical reasoning and dynamic decision-making based on AISmart Contract This technological evolution provides new infrastructure possibilities for the efficient, flexible and compliant processing of tokenized assets. The meaning of dawn: the value and red line of the token economy

In essence,The underlying logic of the development of RWA

is mankind's continuous pursuit of improving transaction efficiency, thereby promoting the value of human economic growth. Imagine that humans initially traded through barter. As transactions grew, this became too cumbersome and unable to meet people's needs. This led to the development of physical exchange, with grain, cattle, and sheep serving as the initial medium of exchange. This later evolved into "currency" such as shells, which were easy to carry and count. Later, metals like gold, silver, and copper, due to their value, divisibility, ease of preservation, and scarcity, became the currency of choice for thousands of years. This was followed by the credit era of fiat currencies and, in the millennium, internet payments. Every improvement in transaction and payment efficiency has a positive effect on improving the efficiency of economic activities in human society as a whole.

The development and exploration of blockchain technology has made asset tokenization and token payment possible, bringing new application prospects for improving transaction efficiency.

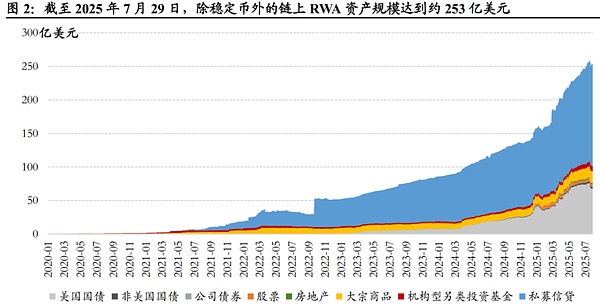

Based onrwa.xyzData,2022GlobalRWA5 billion US dollars. But as of July 2025, the global RWA market has grown to leaf="">US$25.5 billion, achieving a rapid growth of 3 times annually. Looking at the underlying asset structure, private credit, U.S. Treasuries, and commodities together account for nearly 95%. In the words of Chairman Li Yang at the Bund Conference, "the early stages of development are primarily based on safe assets." At this immature stage, the industry as a whole needs to continuously accumulate credit assets to consolidate the value of upstream and downstream industries.

Source: Cathay Pacific Haitong Securities

Ant Group

CEOA statement that broke the circle at the Bund Conference: "We will resolutely not issue virtual currency and will not participate in any form of speculation."Li Lihui said at the meeting,

“The changes and development of the global digital asset market have created new application scenarios for the internationalization of the RMB. We should stand at the height of the national economic security strategy, observe and think about the direction and strategy of the development of the digital asset market, accelerate the pace of RMB internationalization, and promote the construction of a diversified and multi-polar global monetary and financial system.”The international landscape, global trade and global payment systems are facing a node of systemic change. Globally, WIFT is trying to pilot real-time digital asset transactions with Ripple, and Visa is also trying to pilot real-time digital asset transactions with Ripple. It is crucial for this transformation that international institutions take the lead in exploring tokenized tools and application scenarios. According to an EY report, the cross-border payment market size will reach US$194.6 trillion in 2025, of which blockchain and AI Driven solutions will account for a significant share. Against the backdrop of global trade hegemony, the token economy is poised to become one of the solutions for finding new engines and driving forces for human economic growth. This is also consistent with the Bund Summit's motto of "Reshaping Innovative Growth." The ultimate purpose of technological change should always be to serve human society by finding more efficient solutions. Looking at the long-term vision of the token economy from this perspective, its future depends not only on how fast the industry can grow, but also on whether it can continue to run smoothly. Value exploration and risk prevention and control must be given equal importance - they are not in opposition, but rather complementary dual tasks. History serves as a mirror. The 1997 Southeast Asian financial crisis offers a profound lesson. When countries like Thailand, Malaysia, and Indonesia pursued financial liberalization but lacked appropriate regulatory frameworks and dynamic risk response mechanisms, international capital engaged in a series of speculation and attacks on these countries, ranging from their financial assets to their real economies. This ultimately triggered regional economic recession and social unrest. We need to establish a clear and secure regulatory framework while encouraging technological innovation; while pursuing efficiency, we must never compromise on financial stability and investor protection. Regulators and the industry should jointly seek a practical path that embraces innovation while upholding ethical principles. As the Tao Te Ching says: “Who can remain in constant motion and yet still live slowly?” Alternating between movement and stillness, following nature, and realizing that slow is fast are the only ways to ensure the industry’s continued vitality and development.

when

decades from nowpeoplelook back,

perhaps the year 2025 will truly be remembered as In the first year of “Gold on Chain”, the door to the token economy is slowly opening. But its real success should not depend on the moment the door is pushed open, but on whether there is a smooth and safe road behind the door. This is an era worthy of enthusiastic embrace, but also one that must be viewed with sobriety. Only by finding a balance between value and risk can the token economy truly mature, the roots of technology benefit all things, and the meaning of dawn lasting and stable.

Beincrypto

Beincrypto

Beincrypto

Beincrypto decrypt

decrypt dailyhodl

dailyhodl decrypt

decrypt Others

Others The Crypto Star

The Crypto Star Cointelegraph

Cointelegraph Cointelegraph

Cointelegraph Cointelegraph

Cointelegraph Cointelegraph

Cointelegraph