One day before the news of the approval of the Bitcoin spot ETF application, SEC Chairman Gary Gensler tweeted on X to warn of the risks of virtual assets. It is precisely this The statement made the market believe that the probability of approval of the Bitcoin spot ETF application has increased, and the price of Bitcoin exceeded the high of US$47,000 this morning.

Source: Bloomberg

Not only is market sentiment so high, applicants are also Be well prepared. ARK Invest (ARK), an asset management company founded by Catherine Wood, will become the first Bitcoin spot ETF applicant to receive a final response from the SEC. Late last year, ARK sold all of its remaining GBTC positions and used approximately $100 million in Half of the funds purchased BITO "possibly as a liquidity transition vehicle to maintain beta against Bitcoin" and included it in ARKW (ARK Next Generation Internet ETF) or ARKB (Ark 21Shares Bitcoin ETF, which ARK is applying for) spot ETF). All parties in the market are ready to go forward. If the U.S. SEC approves a Bitcoin spot ETF, this also means that the 10-year protracted war in which institutions have been applying to the SEC for a Bitcoin spot ETF since 2013 but has been rejected is expected to end!

The United States will not take the bargaining power from Wall Street lightly, and the adoption of ETF will bring about the superposition effect of bargaining power

If the threshold for spot ETFs is relaxed, public funds, private equity funds and individual investors will be able to participate in the virtual asset market as easily as buying stocks on traditional stock exchanges and hold them directly. With Bitcoin, the restrictions on compliance channels are lifted. The market effect brought about by the amount of funds in the short term is only one aspect. More importantly, the United States will enhance its bargaining power in the crypto market through ETFs and become the industry rule maker.

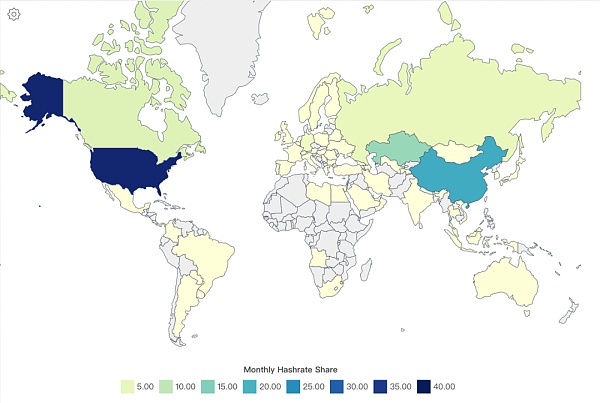

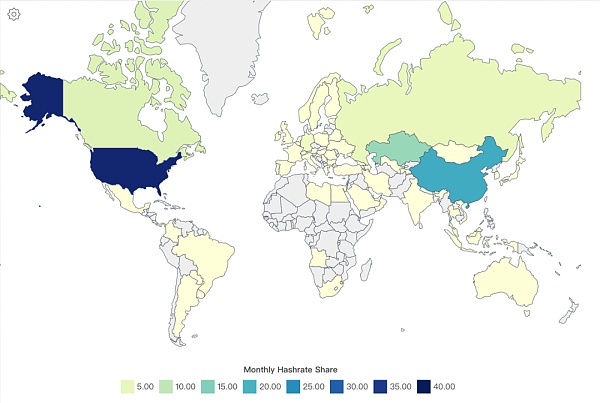

With the transfer of Bitcoin mining computing power from China to the United States,The United States’ Bitcoin computing power accounts for 40% of the world’s share, ranking first in the world. This means that on the supply side, the United States already has its bargaining power.

Figure: Global Bitcoin computing power chart

Source: worldpopulationreview.com

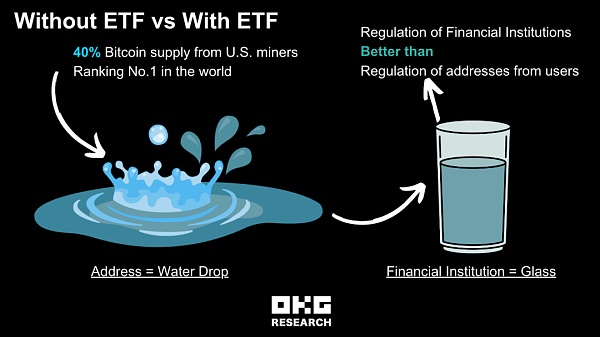

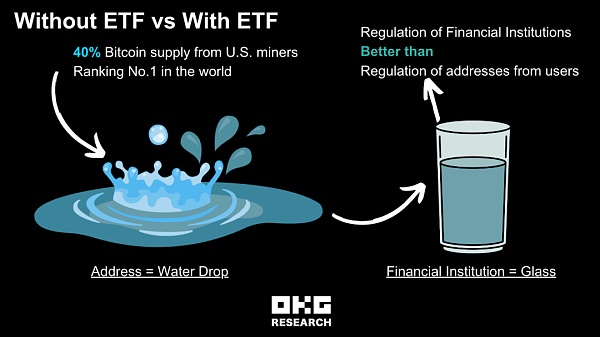

If the spot ETF passes, it means that on an institutional basis, position and transaction data will be disclosed, which will provide more market transparency for regulators and market participants. With this information, regulators can better monitor market activity and reduce the risk of market manipulation and fraud. As shown in the figure below, let us make an analogy. Although we know that "every drop of water" can be easily traced, tracked and verified on the chain, it is more difficult for regulatory agencies to supervise "every drop of water". If we collect these water droplets, put them in glass containers, and delegate such regulatory requirements to every "glass", then the regulatory agencies will be able to formulate rules and manage them better.

For the United States, if the ETF is passed, it will establish the United States’ position as a rule-setter and market leader in the encryption market. Regardless of whether the Bitcoin spot ETF is passed or not, the United States will not give up this huge advantage easily.

Picture: OKG Research - With ETF compliance channel VS without ETF compliance channel

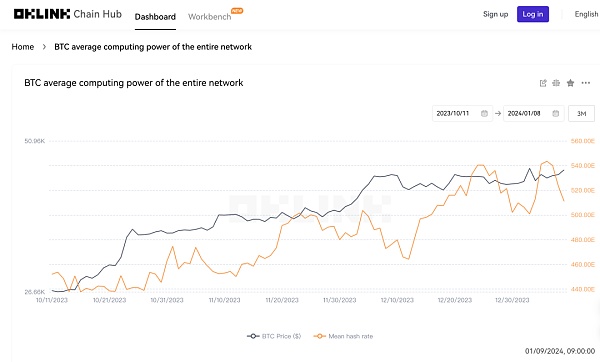

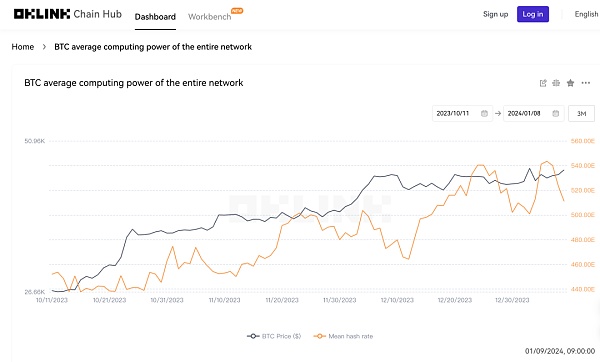

In addition, the expected adoption of Bitcoin spot ETF is also very obvious on the supply side: competition among miners on the supply side is also very fierce and in full swing. According to OKLink data analysis, the hash rate (Hash Rate) has increased at an average growth rate of 5.17% in the past three months. Compared with the average monthly growth rate of 1.76% in the same period last year, it can be seen that miners ( Competition on the supply side is more intense.

Picture: Bitcoin computing power

Source: OKLink

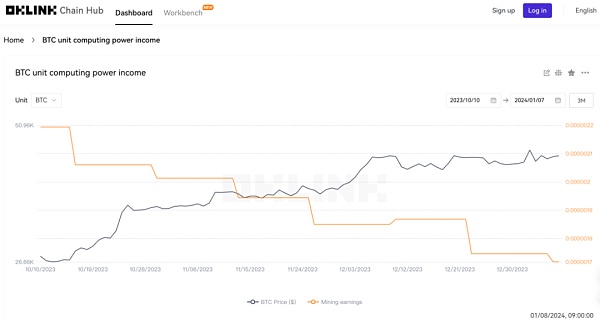

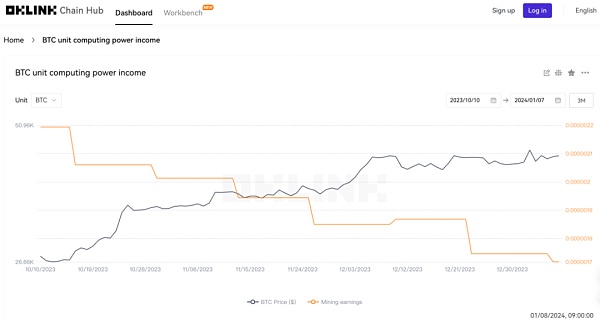

From the perspective of operating costs, OKLink data shows that miners’ unit computing power income has continued to decline at a rate of 8% in the past three months (Figure 2), and the monthly average during the same period was Growth, a growth rate of approximately 1.55%. The supply side is still selling to maintain operating costs even as unit revenue declines.

Figure: Bitcoin miner’s unit computing power income

Source: OKLink

The new market is ready to develop, and the original market is more determined

Although The news of ETF has been anticipated in the market for a long time. According to data on the OKLink chain, due to different time and risk preferences, new investors are more willing to endure the opportunity cost of waiting for the convenience of compliance channels and give up early ambush. Potential earnings from on-chain holdings. The original market participants - long-term investors, Bitcoin supporters and institutional investors who have long been optimistic about Bitcoin are more concerned about the long-term value of Bitcoin.

Because some institutions that were early bullish on Bitcoin have participated in other ways, such as ARK, which has sold its entire remaining GBTC position and injected BITO (Bitcoin Strategy ETF, BITO invests in Bitcoin futures and does not invest in Bitcoin). Grayscale is also seeking to convert GBTC into an ETF. They may be more focused on Bitcoin's fundamentals, technical development and market demand, and are relatively unaffected by short-term market fluctuations and ETF approval news.

According to the observation of data on the OKLink chain, it can be seen that these news did not bring much excitement to the ecology of the chain. In the past three months (October 10 to January 7), the total number of addresses on the Bitcoin (BTC) chain has shown a linear upward trend, with an average monthly growth rate of 1.16%. Compared with the same period last year, the growth rate was flat.

Picture: Total number of addresses in the Bitcoin ecosystem

Source: OKLink

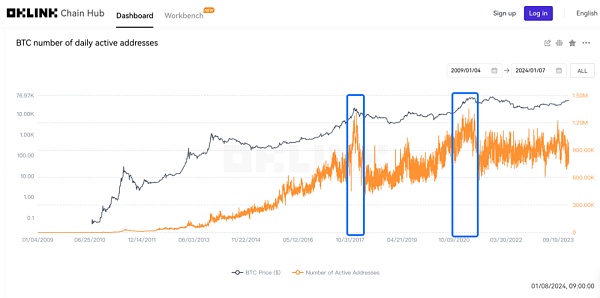

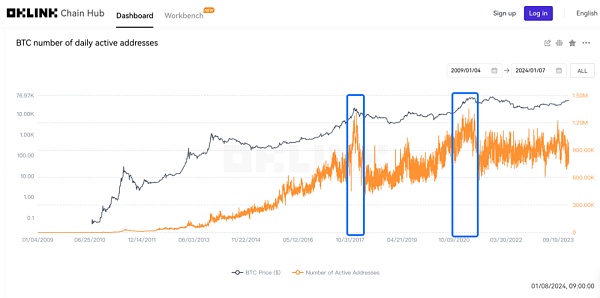

In addition, through the observation of the number of active addresses, we found that it was not that the number of active addresses reached a high point when news about Bitcoin ETF broke, but that it was relatively high in the two time periods of December 2017 and March 2021.

Figure: Number of daily active Bitcoin addresses

Source: OKLink

The era of wild growth no longer exists

"Are you going to start over?"

Even if the United States BTC If the spot ETF fails, the market will not return to the "era of barbaric growth". According to CoinGecko, eight markets around the world currently allow the operation of spot cryptocurrency ETFs, including Canada, Germany, Switzerland, and tax havens such as the Cayman Islands and Jersey. However, it did not arouse the same enthusiasm in the market as waiting for the approval of US spot ETFs.This also proves once again that the superimposed effect of the United States opening up the supply side and channels has a great impact on the market.

Just as the ETF plot in the United States is "confusing", Hong Kong, which has attracted much attention in 2023, has already taken that step. On December 22, 2023, the SFC issued multiple circulars, stating that it was “ready to accept applications for recognition of virtual asset spot ETFs.” Take Hong Kong as an example. According to KPMG’s 2023 Private Wealth Management Report, as of the end of 2022, the total asset management value of Hong Kong’s private banking and private wealth management was HK$8.965 billion. If 1% of the funds pass through the Bitcoin spot ETF, approximately US$11.6 billion in funds will flow into the market.

According to Ouke Cloud Chain Research Institute, several financial institutions are currently planning to issue Bitcoin spot ETFs in the first half of the year. Such tens of billions of competitiveness will also force the U.S. SEC not to easily reject the ready-to-go spot ETFs.

Comparing the differences between Hong Kong and the United States regarding Bitcoin spot ETFs, the following two points deserve market attention:

In the circular on December 22, Hong Kong SFC stated that it would support both cash and in-kind modes strong>, providing investors with more choices; the U.S. SEC adopts a mandatory cash redemption strategy. The use of cash redemption is also to reduce the risk of market manipulation. Cash redemption is also a disguised form of control over AP, which will also Squeeze its profit margins to earn risk-free arbitrages. Because if AP attempts to manipulate market prices through operations in the primary and secondary markets, it may cause market instability. In addition, with physical redemption, market makers can receive Bitcoin in exchange for ETF shares, improving tax efficiency. Financial institutions on the other side of the Pacific also hope to reach multiple channels. According to CBNC reports, Fidelity and BlackRock have sought approval for cash and in-kind redemptions to take care of investors who already hold Bitcoin but seek convenience in market transactions and taxes.

Currently, the United States has submitted 8 Bitcoins The ETF application plans to trade on one of three exchanges: Nasdaq (Nasdaq), Cboe BZX (Chicago Board Options Exchange BZX) and NYSE Arca (New York Stock Exchange Arca). Among them, the exchange with the largest proportion is Cboe BZX, accounting for 5/8 of the total number of applications. Unlike the trading venues applied by U.S. applicants, which are all trading platforms that already have experience in trading other financial instruments, Hong Kong’s circular on December 22 only stated that the Securities and Futures Commission and the Monetary Authority listed intermediaries in the distribution The regulations and ethics that need to be met when using ETFs.

If the US BTC spot ETF is approved and traded on one of the three trading platforms according to the application materials, with such a case reference, HKEX will be more motivated to consider Hong Kong companies The issued Bitcoin spot ETF provides a trading platform.

Picture: On December 22, SFC issued multiple circulars

Source: SFC

No matter whether the US ETF is passed tomorrow, as time goes by, the "Western World"-like encryption market will never return. In 2024, the encryption market will definitely be "blooming".

Cheng Yuan

Cheng Yuan