Author: Dankrad Feist, former Ethereum Foundation researcher and current Tempo researcher; Translated by: Jinse Finance

I am not a trader. This article represents only my personal views and does not constitute investment advice.

Currently, some interesting phenomena are occurring in the valuation of L1 tokens: although on-chain activity continues to grow, many tokens are struggling to maintain their previous price levels. This disconnect suggests that the underlying value proposition of these tokens may have shifted. Here are my thoughts on the current situation.

ETH Was Once Money

There has been much debate about whether ETH is money, but if we examine the facts, the reality is that ETH was once money..

In 2017, the first major Product-Market Fit (PMF) for the Ethereum public blockchain was the ICO. It was a crazy year, filled with optimism, but most importantly, the investments raised through ICOs were in the form of ETH. Since ETH seemed poised for only appreciation at the time, individuals and institutions held the majority of their investments in ETH, even using it as a primary measure of their asset reserve value. 2020/2021 brought another wave of adoption centered on DeFi and NFTs. ETH once again became central—remember when Christie’s and Sotheby’s started pricing in ETH? Looking back, that was the peak of ETH’s adoption as a currency. In some respects, it has already achieved the "three elements of money": Unit of account (primarily for NFTs), Store of value, Medium of exchange. According to the velocity of money equation (MV = PQ, where M is the money supply, V is the velocity of circulation, P is the price level, and Q is the total quantity of goods/services), we can see that when ETH is used as currency, its market capitalization (proportional to M) should be proportional to the on-chain... GDP (PQ) is directly proportional (assuming the velocity of circulation V remains relatively constant). In other words, as Ethereum's economic activity grows, its valuation should also increase if ETH continues to serve as the primary medium of exchange.

ETH Replaced by Stablecoins

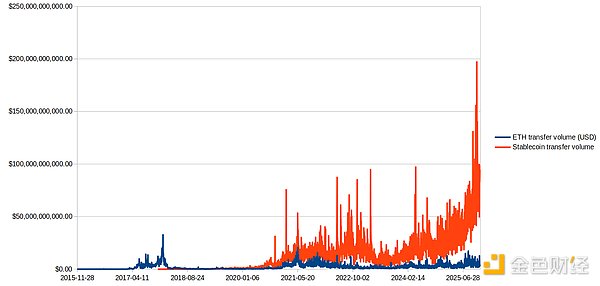

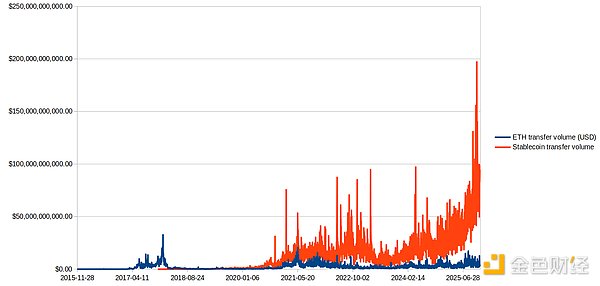

Since 2021, time has not been kind to ETH: NFTs have lost significant value, and their status as a medium of exchange has largely been replaced by stablecoins.

Compared to the period of 2017-2021, Ethereum is now rarely used as a medium of exchange or unit of account. This may explain why, despite continued growth in adoption, the appreciation of ETH seems to have stagnated.

The Way Forward

ETH can find a way out of this predicament by:

Transforming into a "meme-like store of value" that mimics gold (and now Bitcoin).

Transforming into a "meme-like store of value" that imitates gold (and now Bitcoin).

However, this largely decouples it from the success of the Ethereum chain itself, and it remains unclear whether it will be considered superior to Bitcoin; the value of meme-style stores of value is primarily driven by brand rather than technological attributes. Driving large-scale activities to re-establish ETH's monetary function in its lost territory. Focusing on revenue generation and burn fees, with a target of at least tens of billions of dollars in revenue. This will require transforming the Ethereum Foundation (EF) into an efficient R&D and business development (BD) organization and finding ways to sustainably fund these efforts. Many L1 tokens will also face the same problem. While their tokens lack a history as currency, their valuations largely stem from being seen as potential alternatives to Ethereum, implicitly assuming that their tokens will also be used as a medium of exchange. Solana experienced brief success during the meme coin boom of early 2025, but this success was much shorter-lived than Ethereum's past drivers. Conclusion The challenge facing L1 tokens lies in the fact that their historically high valuations have largely depended on their use as money (especially as a medium of exchange). The velocity of money equation suggests that when a token fulfills this function, its valuation will follow on-chain economic activity. However, the shift to stablecoins has broken this connection for most L1 tokens. This raises a valuation question: If tokens are no longer used as money, what drives their value? There are only three options: either reclaim the monetary function, shift to a store-of-value narrative (competing with Bitcoin), or fundamentally change the value proposition by generating substantial revenue through transaction fees and burning tokens. The latter requires a different type of organization: one focused on business development and sustainable revenue generation, not just protocol development.

Aaron

Aaron