Author: Greysen Cacciatore, Research Assistant at Outlier Ventures; Jasper De Maere, Head of Research at Outlier Ventures;

Translation: Golden Finance xiaozou

The market value of USD stablecoins has exceeded $220 billion, accounting for 1% of the US money supply. As US stablecoin legislation is about to allow new issuers such as banks, fintech companies, enterprises and governments to enter the market, the market is approaching a turning point that will completely change the competitive landscape, distribution models and industry innovation. More importantly, the underlying business model of stablecoin issuers provides the US government with innovative opportunities: expanding the base of short-term debt buyers through financial engineering and expanding the global influence of the US dollar with the help of digital currencies.

1. Key points of this article

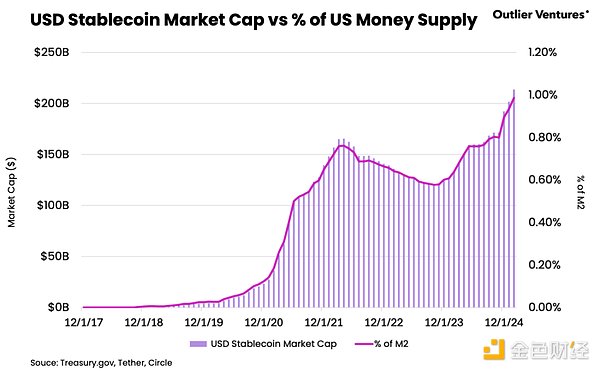

* The total market value of US dollar stablecoins exceeded US$220 billion, accounting for about 1% of the US M2 money supply, an increase of 59.7% this year, and a year-on-year increase of 40.9% in the proportion of M2.

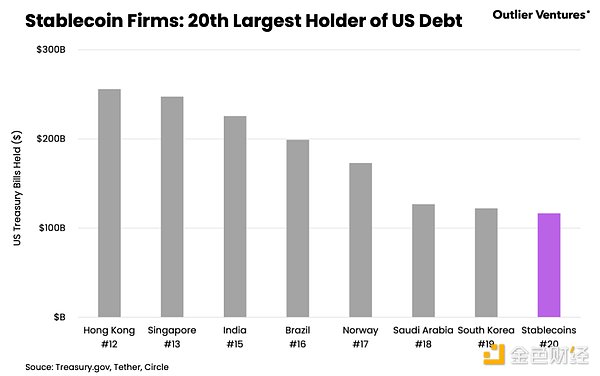

* Stablecoin issuers have become the world's 20th largest direct holder of US debt, surpassing sovereign countries such as Germany and Mexico, which not only demonstrates the market's growth potential, but also creates a strategic opportunity for the United States to coordinate stablecoin regulation with fiscal/geopolitical goals.

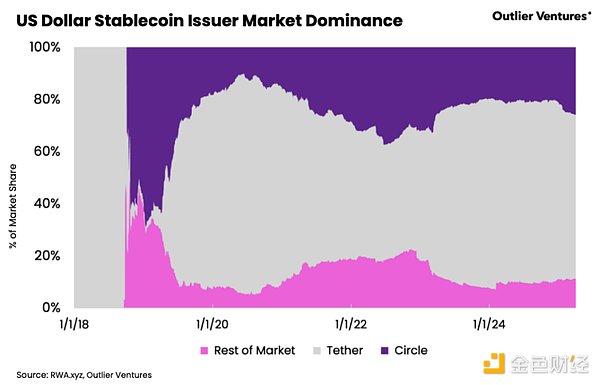

* Although Tether and Circle still dominate the stablecoin market with 89% of the market share, US legislation is opening the door for new participants such as banks and enterprises - the huge distribution channels of these institutions may reshape the market competition landscape.

2. From niche to macro: Digital dollar scale

In 2025, stablecoins have undoubtedly become the main theme in the field of cryptocurrency. As of the first quarter of 2025, the market value of USD stablecoins exceeded US$220 billion (accounting for 99.8% of the total amount of fiat-pegged stablecoins), accounting for about 1% of US M2. The total market value increased by 59.7% during the year, and the USD stablecoin/M2 ratio increased by 40.9% year-on-year (see the figure below).

This trend not only reflects the steady growth of the digital dollar, but also reflects the accelerated migration of economic activities to distributed ledger infrastructure. Last year, the settlement value of stablecoins exceeded 24 trillion US dollars. With its stability, high liquidity and programmable medium of exchange characteristics, stablecoins have proven themselves to be the infrastructure of blockchain finance and commerce.

Looking forward to 2025, stablecoins are increasingly showing their global financial influence in the sovereign debt market and geopolitical landscape. Its business model provides the U.S. government with a unique opportunity to strengthen the dollar hegemony through digital assets: by incentivizing new issuers to do business in the United States through legislation, it can not only expand the base of short-term debt buyers in a financial engineering way, stimulate the demand for U.S. debt, but also strategically expand the influence of the U.S. dollar currency. Clarifying supervision will also attract companies, institutions and even governments to consider issuing stablecoins, creating a new market competition pattern.

3. Stablecoin companies: the new main force in the U.S. debt market

The digital asset industry generally recognizes that the stablecoin business model is extremely beneficial to issuers. Most stablecoins are backed by 1:1 cash and highly liquid assets (mainly short-term U.S. debt) reserves. However, unlike banks or money funds, stablecoin issuers do not distribute the reserves of asset income to holders, but enjoy the interest rate spread income alone - creating a considerable income stream based on the interest rate environment and the demand for stablecoins.

At the global macro level, this model is creating new structural demand for US Treasuries. The two major issuers Tether and Circle hold a total of $116 billion in US Treasuries, making stablecoin companies among the top 20 direct holders of US Treasuries, surpassing sovereign countries such as Germany and Mexico (see the figure below).

This phenomenon indicates that stablecoins are not only the infrastructure of the crypto-native market, but also a new force in global finance. As its role in the U.S. Treasury market becomes more prominent, the United States has an innovative opportunity to align the adoption of stablecoins with national fiscal interests. U.S. Treasury Secretary Scott Bessent made it clear at the White House Crypto Summit last month: "We will maintain the dollar's position as the world's leading reserve currency, and stablecoins are the tool to achieve this goal", indicating that the authorities are viewing stablecoins as a strategic tool to defend the dollar's hegemony.

Looking deeper, each new issuer is a channel for the digital dollar to penetrate the global economy. In emerging markets with persistent inflation, strict capital controls, and unstable local currencies, stablecoins provide individuals and businesses with a convenient hedging tool. Through forward-looking legislation, the United States can accelerate the adoption of stablecoins around the world, both enhancing the accessibility of the dollar and expanding the influence of monetary policy. In this way, stablecoins are both a lever for domestic fiscal strength and a new tool for the globalization of the dollar.

4. Future Outlook: New Issuers and Evolution of Market Structure

With the accelerated improvement of the US stablecoin regulatory framework, the overall market structure of stablecoins is about to undergo changes. Last week, the US Securities and Exchange Commission's Corporate Finance Division made it clear that dollar-pegged stablecoins backed by low-risk liquid assets do not constitute securities. Combined with the STABLE Act and the GENIUS Act, this will pave the way for powerful new participants such as enterprises, fintech companies, banks and governments. New issuers with mature distribution channels are likely to reshape the competitive landscape and innovation direction, while strengthening the overall role of stablecoins in financial commerce.

Today, Tether and Circle dominate the stablecoin market with 89% market share (see figure below). This concentration reflects the historical influence of first-mover advantage and network effects.

While it is uncertain whether market share will be eroded, the reduced risk brought about by regulatory clarity will give new issuers with strong financial channels the opportunity to challenge existing giants. Banks and leading fintech companies are particularly advantageous - they can integrate stablecoin products into existing capital market infrastructure and customer distribution networks. In addition to financial institutions, large consumer-oriented companies also have great potential: with their massive user base and brand stickiness, they can incentivize users to use their issued stablecoins through promotional discounts.

Overall, user experience will become a key bottleneck as the number of issuers increases. When there are hundreds of stablecoins issued by institutions/enterprises/governments in the market, elegant solutions are needed to deal with blockchain infrastructure, cross-chain interoperability, instant redemption, atomic swaps, and access channels to promote scale growth and adoption.

Aaron

Aaron

Aaron

Aaron Snake

Snake Alex

Alex Kikyo

Kikyo Davin

Davin Jasper

Jasper Hui Xin

Hui Xin Catherine

Catherine Jasper

Jasper Catherine

Catherine