Author: Liu Jiaolian

Tips:

BTC slightly recovered to around 84k on Saturday. After sending out the meeting notice email for the first quarter private board meeting on Sunday 3.23 in the evening, I took a casual look and found that the market sentiment was very cold, with only a slight ripple in the dead water.

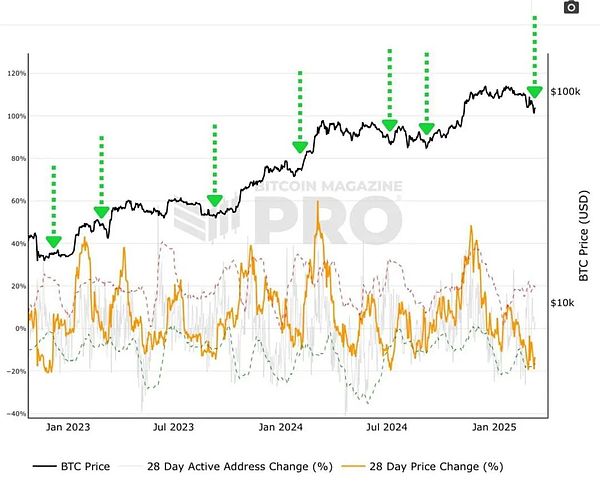

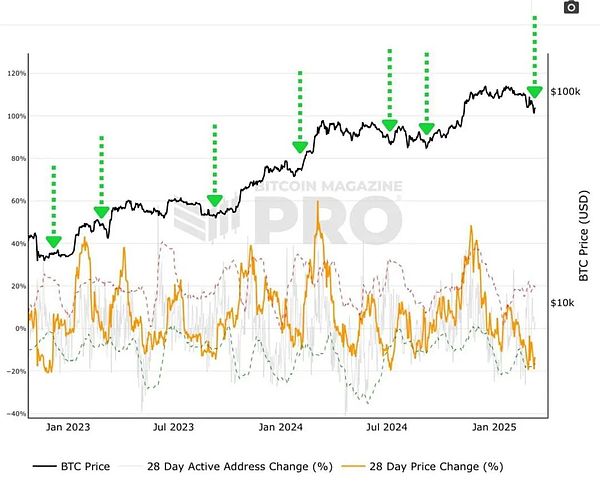

It is said that BTC is now in an oversold state. It is currently the oversold time in the market.

Oversold literally means selling too much. This is a feeling about the phenomenon. The phenomenon is that the price drops rapidly or sharply.

Although there are some technical indicators such as RSI to judge the oversold state. However, the teaching chain said that all technical indicators are lagging indicators of price.

So, it's all the same.

After you study hard and study N technical analysis books, you may realize that, returning to the basics, all technical indicators actually mainly need to understand and grasp two indicators, one is price, and the other is trading volume.

In addition, no matter how much general knowledge that is not related to specific targets is learned, it may not have much effect on the success or failure of investment.

In other words, among the knowledge you need to master to hold BTC, 20% is general financial investment knowledge, and 80% is the special knowledge of BTC itself.

Don't get it wrong.

No matter how many financial investment books you read, if you still treat BTC as a stock, you probably won't get a big result.

But almost 99% of people's cognition is stuck at this level and can never break through.

There are even some big Vs in the stock circle.

In their eyes, BTC is a position configuration. If it can outperform the US stock market, they will allocate a little, and if it can't outperform the US stock market, they will discard it. This is even considered "professional". That is to say, they look at all the holdings ruthlessly and evaluate the value purely by the rate of return.

Investment must pay attention to the rate of return, but investment cannot only focus on the rate of return. Just as doing business certainly pays attention to income and profit, but it cannot ignore national concerns and social calls.

During the oversold period, many people began to shout that the cycle no longer exists.

How can the cycle not exist? The cycle just does not appear in the way people expect.

As long as there are spring, summer, autumn and winter in a year, day and night in a day, and a person's emotions are still up and down, the cycle will definitely exist.

Of course, they are talking about the four-year halving cycle of BTC.

The four-year halving actually drives the price cycle, which is itself a fascinating thing.

The double logarithmic correlation of price and time revealed by the power law is also a fascinating thing.

The delayed correlation between macroeconomic liquidity fluctuations and BTC is also fascinating.

There are so many fascinating and worthy studies about BTC.

Just don’t get caught up in the quicksand of “life is limited, but learning is unlimited” and forget the more important thing:

Hold BTC.

Jixu

Jixu