Source: AiYing Compliance

For the supervision of virtual assets, we mainly refer to the "A Guide to Digital Token Offerings" issued by MAS in May 2020, which represents Singapore The main regulatory idea for Web3 clarifies that security tokens and digital payment tokens are supervised by two special regulations, but it does not clarify the regulatory requirements for functional tokens. Among them, digital payment tokens are regulated by the aforementioned "Payment Services Act" (PSA), which came into effect after being revised in January 2020, and is responsible for supervising and regulating the payment service business in Singapore; ifVirtual AssetsConstitute securities (including equity, debt, business trust interests, etc.), derivatives contracts (including derivatives of securities), or collective investment plans (collective) specified in the Securities and Futures Act ("SFA") investment scheme, "CIS") 9, etc., are collectively referred to as capital markets products (capital markets products). Unless exempt, activities related to such virtual assets will be subject to the supervision of the SFA.

Singapore Capital Market Supervision Policies (Virtual Assets)

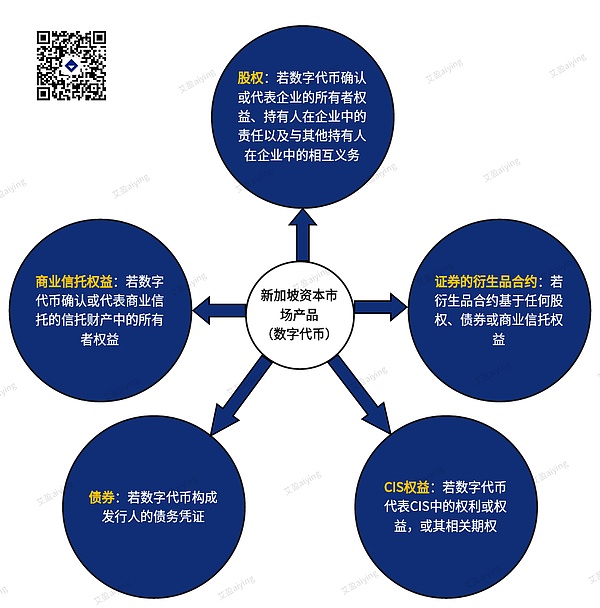

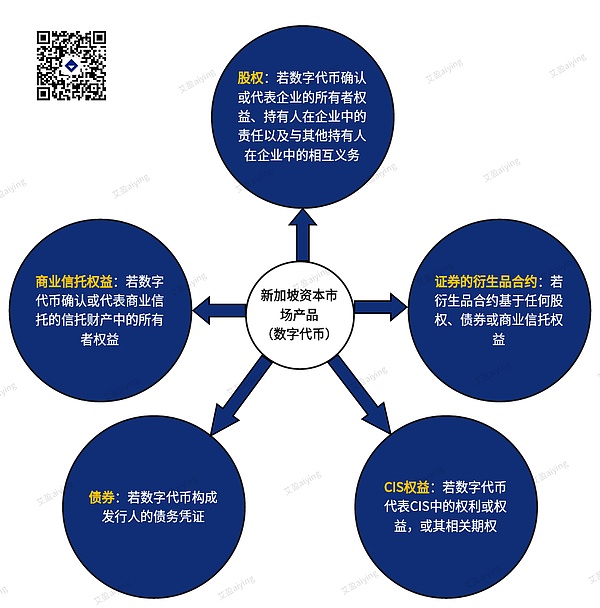

(1) Determine whether virtual assets are capital market products

According to the "A Guide to Digital Token Offerings" issued by MAS, MAS will comprehensively review the structure and characteristics of digital tokens, including the rights attached to them, To determine whether it is a capital market product. Specifically, digital tokens may be classified as the following capital market products:

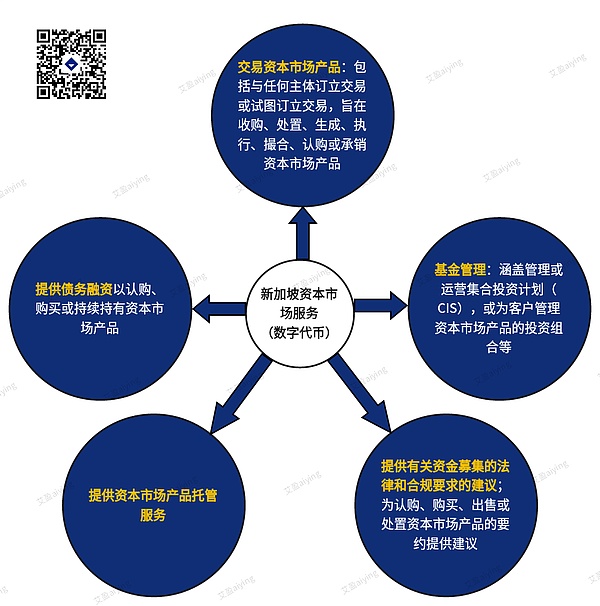

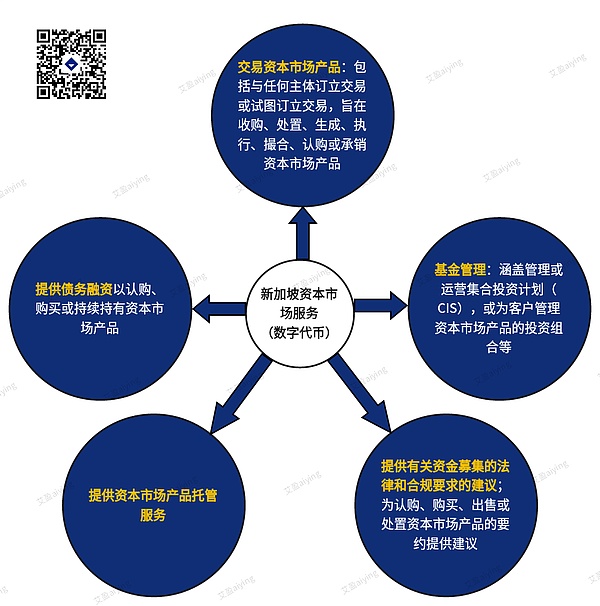

(2)What arecapital market products and services?

In addition, exchanges that establish or operate capital market products also need to obtain approval or confirmation from MAS. Only exchanges or confirmed entities approved by MAS are eligible to establish or operate exchanges.

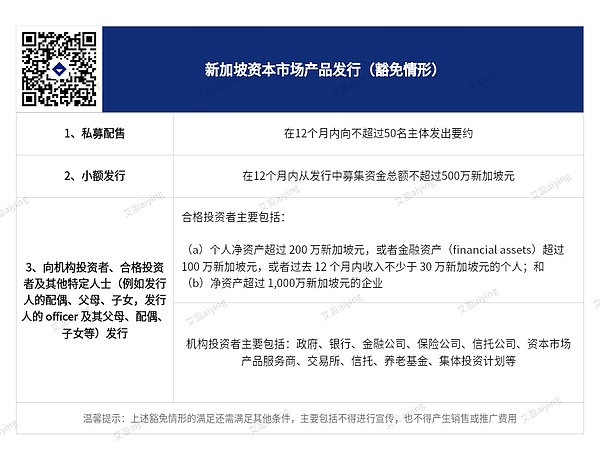

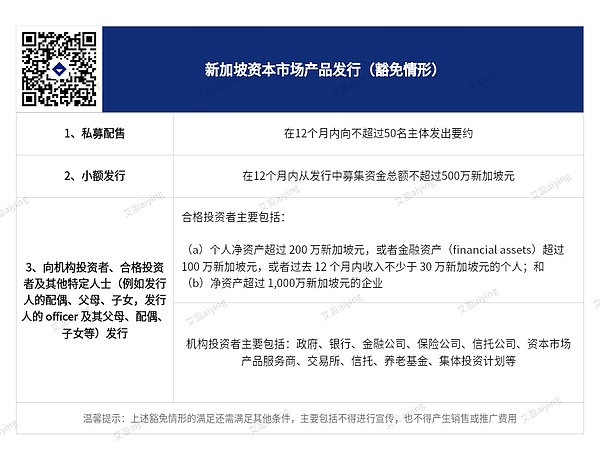

(3) Issuance of Capital Market Products(Exemptions)

If virtual assets are classified as capital market products, their issuance must comply with a series of regulations, among which This includes compliance with the requirements for a prospectus to be registered with the Monetary Authority of Singapore (MAS), unless one of the specified exemptions is met. These exemptions include:

It should be noted that the above exemptions Other conditions must be met, which mainly include no publicity and no sales or promotion expensesto be incurred. There was an ICO (initial coin offering) of security tokens that was banned by MAS because the issuer intended to meet the exemption requirements by issuing to qualified investors, but its legal counsel posted information related to the issuance on social media, Violates the no-publicity requirement.

If the virtual assets issued belong to collective investment scheme (CIS) interests, the relevant CIS also needs to be authorized or confirmed by MAS and must meet relevant compliance requirements.

Warm reminder: If virtual assets are classified as capital market products, they will be subject to capital market regulations. Specific licenses may be required to engage in service activities related to these virtual assets. In addition, the issuance of these virtual assets also needs to comply with the registered prospectus requirements prescribed by the Monetary Authority of Singapore (MAS), unless exemptions are met.

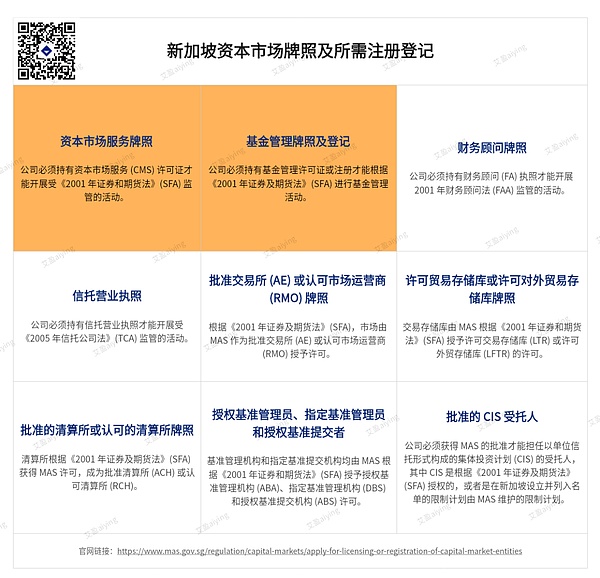

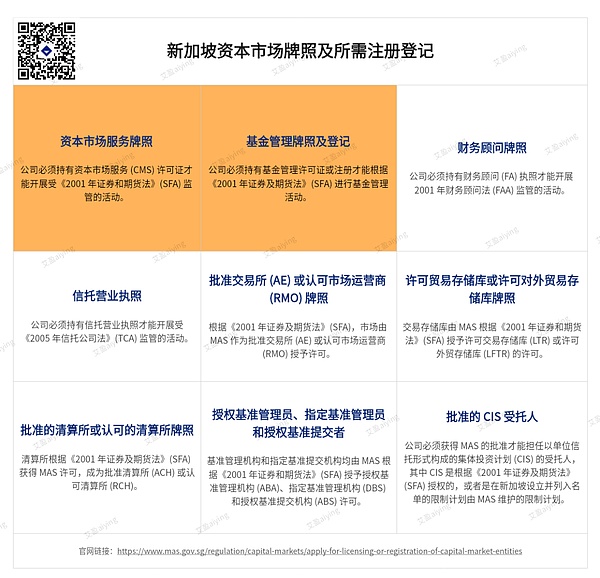

Singapore’s capital market license types

Singapore’s financial industry implements mixed industry Operating and unified license management, the Monetary Authority of Singapore (MAS) is the core of the financial regulatory system. Founded in 1971, it has the dual responsibilities of central bank regulation and supervision of banking, securities, insurance and other financial industries. It is also a comprehensive The entity responsible for access to the financial industry and registration of financial institutions. There are many types of licenses issued by Singapore MSA, among which the capital market license types mainly include the following 9 types:

< /p>

< /p>

Singapore Capital Market Services License (CMS)

Among them Fund Management License, Also called Capital Market Service License (CMS License). To engage in fund management activities in Singapore, you must either be an LFMC that already holds a CMS fund management license, or apply to the Monetary Authority of Singapore to register as an RFMC. However, on October 24, 2023, the Monetary Authority of Singapore (MAS) issued a public consultation , to solicit public opinions on the transition arrangements for the existing RFMC. MAS plans to abolish the existing "Registered Fund Management Company (RFMC)" system, and operating RFMCs will become "Licensed Fund Management Companies (LFMC)" after submitting applications and being approved, and will comply with the regulatory requirements of the LFMC.

The Capital Markets Services License (CMS) is a financial regulatory license granted by the Monetary Authority of Singapore (MAS), and its full name is "Capital Markets Services Licensee". There are 7 types of businesses that can be carried out after the CMS license is approved, which are:

Application People can choose one or more of these operations on their own, but they must meet the corresponding regulatory requirements. After obtaining a CMS license, you can engage in fund management including fund management regulated by the Monetary Authority of Singapore. At the same time, it has been actively recognized by local regulators in terms of qualifications and risk management, and can further provide investors with richer wealth management services.

Licensed Fund Management Company LFMC

Licensed Fund Management Company LFMC (Licensed FMC) refers to a company that has obtained a CMS license Fund management companies

LFMC can be further divided into:

(a) Retail licensed fund management company (RETAIL LFMC);

(b) Qualified investors /Institutional licensed fund management company (A/I LFMC); and

(c) Venture capital licensed fund management company (VC LFMC) three categories.

Currently, companies such as HashKey Capital, DigiFT, FOMO Pay, and Japanese financial services giants in the industry SBI Holdings subsidiary SBI Digital Markets, crypto custodian Hex Trust, Swiss digital asset bank Sygnum Singapore branch Sygnum Singapore have all obtained CMS licenses issued by the Monetary Authority of Singapore to provide institutional and qualified investors with securities, futures and securities in Singapore. Security token trading service.

Xu Lin

Xu Lin

< /p>

< /p>