Written by: Sonic Labs Compiled by: Yangz, Techub News

Translator's note: The L2 track is bustling, but the L1 is deserted. It has been a year since the Fantom Foundation announced the Sonic upgrade plan last October. Last week, Sonic Labs released Litepaper, which systematically presented the L1 blueprint of "DeFi King" Andre Cronje. At present, there are only about two months left before the expected launch of the Sonic mainnet. By then, can Sonic become the new generation of L1 and verify AC's previous sharp comment that "L2 as an application chain is illogical for developers"? Let's wait and see!

The following is a full translation of Sonic Litepaper.

Summary

In the ever-evolving blockchain ecosystem, what truly makes a network stand out? For Sonic, we believe the key is to provide unique products and features that enable developers to build applications more competitively than developers on any other chain. Our focus is on providing tangible value to developers, increasing their returns, giving them control over network fee pricing, and simplifying user payment methods, all in seconds.

Many existing platforms do not adequately address developer-centric needs. Ethereum focuses on scalability through optimistic and zero-knowledge Rollup, and L2 currently has more than $34 billion in TVL. This shift to L2 solutions has inadvertently emphasized value capture through centralized sorter fees rather than promoting high-quality application development. The incentive structure designed to increase valuation and fees through Rollup deployment has made L2 too commoditized and prioritized sorter revenue over security and decentralization. This trend has created an imbalance where sequencers benefit too much while developers remain undercompensated. As a result, adoption of innovative consumer applications has stagnated, limiting their potential to have a significant impact on the market.

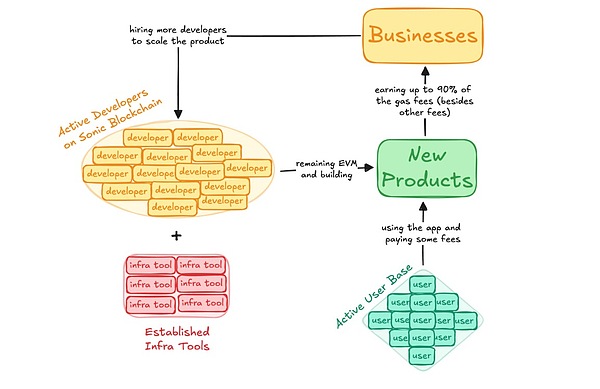

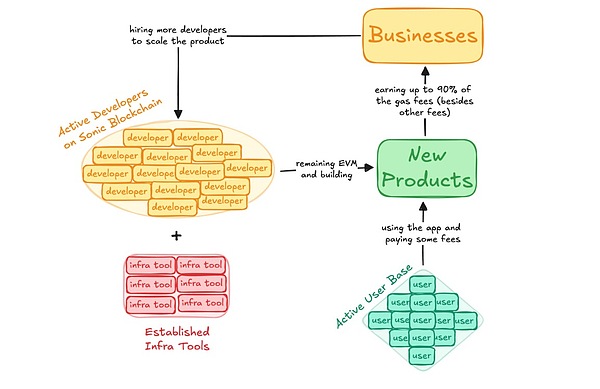

Sonic was launched in recognition of these challenges and is a L1 that aims to redefine the incentive model for developers. Sonic’s fee monetization program allows developers to earn up to 90% of the fees generated by their applications. Through features such as dynamic fees, fee subsidies, and native account abstraction, Sonic will provide flexible tools to enhance user experience and promote adoption.

Traditional L1s are currently facing a dilemma of development or obsolescence, and Sonic is leading the transformation by providing unprecedented scalability, decentralization, and near-instant speed. Sonic combines the best of L1 and L2, providing 10,000 transactions per second, sub-second finality, and native decentralized cross-chain bridges to Ethereum and other chains for enhanced liquidity and security.

By combining cutting-edge technology with a revolutionary developer-centric model, Sonic aims to redefine the blockchain industry, reinvigorating the focus on consumer-facing productive applications and empowering builders to create profitable on-chain businesses.

Business Case and Initial Goals

As a decentralized L1, Sonic primarily provides distributed computing power backed by fees. The current perverse incentive structure within the industry has led to the marginalization of essential productive applications and network revenues, and a shift towards short-term parasitic and extractive monetization, resulting in declining growth and momentum. Our measure of success is derived from a simple calculation that checks whether network revenue is higher than the total cost of incentivizing validators.

We create demand for these transactions by supporting developers and enterprises building consumer or B2B applications that need to be written to the network and collect fees. Sonic’s goal is to drive demand, utilizing the maximum volume the network can efficiently serve without causing disruption, while charging enough per transaction to cover the costs of the network.

Sonic can easily process up to 900M transactions per day with sub-second TTF. This supply capacity far exceeds current demand. Currently, all L2s combined process ~12M transactions per day, with peaks of ~17M. Additionally, Solana recently peaked at 40M transactions per day. Even adding these peaks together, the total volume is ~57M transactions per day, a fraction of our threshold.

With abundant block space and transaction capacity, our focus shifts to scaling demand. To enable more demand on one network than the industry as a whole currently handles requires bold initiatives such as:

Fee Monetization (FeeM), rewarding builders with up to 90% of application fees

Sonic Gateway, allowing users and builders to access Ethereum’s liquidity through a secure native cross-chain bridge.

Organizing one of the largest airdrops in history to kickstart the flywheel effect of the network with new users and new protocols.

Dynamic Fee Feature, allowing developers to customize the gas cost of interacting with their contracts, promoting a creator economy on-chain.

Innovator Fund, allocating up to 200 million S tokens from the Sonic Labs treasury to acquire infrastructure and strategic partners to promote the long-term development of the network.

Sonic & Sodas, driving the community to host developer-focused exchange events around the world funded by Sonic Labs.

All of this will be done while deploying AAA infrastructure partners, including Chainlink, Pyth, Dune, Alchemy, Safe, and more.

Incentive Mechanism

Peter Thiel invested heavily in user acquisition in the early stages of PayPal, paying $10 rewards to every user who signed up and referred a friend. Similarly, the Sonic Labs Treasury will provide funding of up to 200 million S Tokens for projects such as the Innovator Program to accelerate immediate adoption of Sonic ecosystem applications and support new innovative businesses. In addition, an airdrop of 190.5 million S Tokens will provide Sonic developers with the opportunity to attract more users by incentivizing the use of their applications. In addition, Sonic is also rapidly streamlining its Liquid Staking Token (LST) market to provide more flexibility for dedicated token holders.

Currently, a group of mature developers are ready to migrate from Fantom Opera to Sonic, but millions of users and thousands of developers are still needed to achieve the goal.

Sonic Labs Innovator Fund

The Sonic Labs Innovator Fund is funded directly from the Sonic Labs Treasury and consists of up to 200 million S Tokens. The funding is currently being used to secure Sonic’s integrations with top infrastructure, ensuring builders have access to the tools that work best in today’s challenging market.

Sonic is currently actively working with dozens of applications and top infrastructure providers in the industry on areas including: on-chain tooling, compliance, native assets, real-world assets, cross-chain bridge integrations, custody solutions, institutional adoption, exchange-traded products, wallets, Subgraph, strategic Web2 partnerships, and more. As of now, public security infrastructure integrations include Chainlink, Dune, Safe, Pyth, Alchemy, Redstone, Tenderly, and more.

Airdrop Program

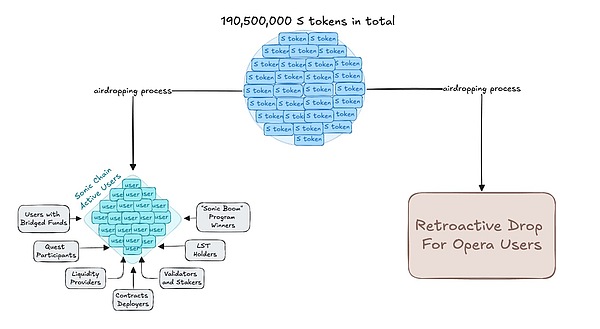

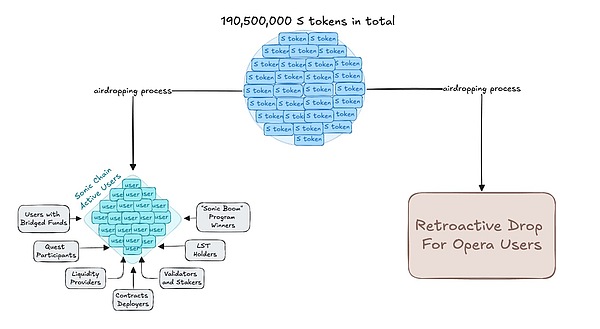

We plan to airdrop 190.5 million S tokens to incentivize user and developer activity on Opera and the new Sonic chain.

The first major component of the airdrop program is Sonic Boom, which will allocate Sonic Gems (points for the airdrop program) to up to 30 winning projects as bonuses for developing various innovative applications. The program helps create a DeFi ecosystem on Sonic and start the adoption flywheel. Projects can distribute these points to users as rewards for using their applications, helping them maintain user activity by incentivizing usage.

Sonic's goal is to discover promising teams and provide them with the tools they need to create successful applications in DeFi, gaming, artificial intelligence, and more. The focus of the airdrop is to achieve a critical mass of the developer community so that we can continue to support their growth as they scale their businesses.

Airdrop Design

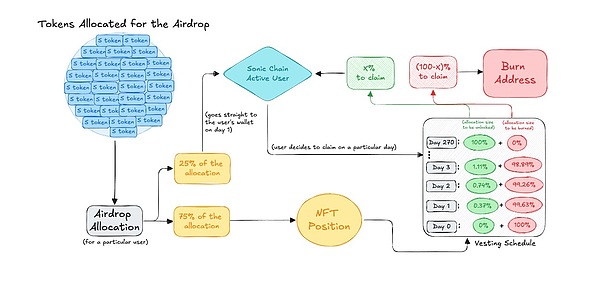

Sonic uses a deflationary airdrop system, and introduces game theory to solve the challenging problem of active on-chain airdrop incentive mechanism through a unique linear decay mechanism. Specifically, this type of airdrop needs to minimize the sudden dislocation of circulating supply in a short period of time, and linear decay and destruction can solve this problem.

Specifically, the destruction mechanism encourages airdrop recipients to increase on-chain activity while waiting for the preferred exit destruction. Recipients can either wait for the full unlocking of the airdrop position or redeem it in advance (but there will be a certain loss). As for those who do not choose the above two options, their airdrops will be allocated to speculative buyers.

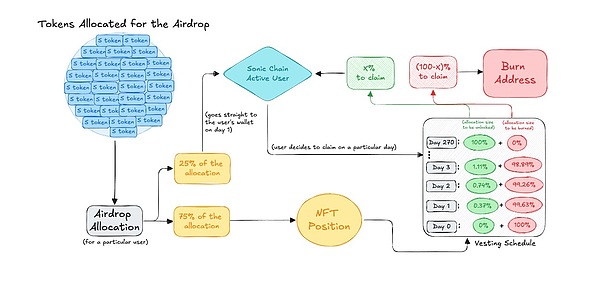

On the first day of the airdrop, 25% of the airdrop received by users will be liquid, while the remaining 75% will vest as ERC-1155 NFT positions over 9 months (270 days). Sonic users can claim this 25% allocation immediately and have the flexibility to decide when to claim the final allocation at the corresponding burn rate.

Users who choose to hold NFTs but wish to trade them on the secondary market are free to do so, which will create a speculative market for individual users' airdrop allocations while also creating deflationary pressure on airdrops. The following figure illustrates the number of S tokens that will be confiscated by the destruction mechanism if a user claims before the 270-day unlock period.

Fee monetization

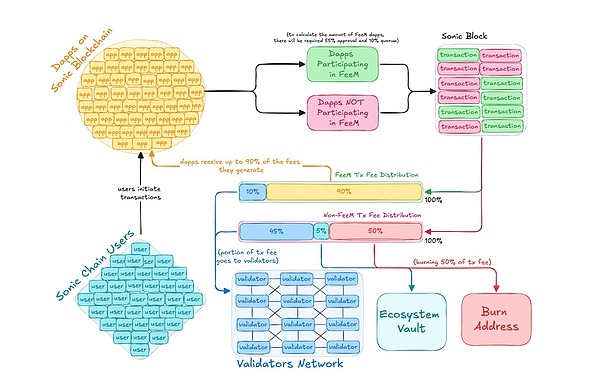

Sonic's fee monetization program (formerly known as Gas monetization) will provide developers with up to 90% of the fees generated by their applications, providing them with sustainable income to retain excellent creators and support network infrastructure.

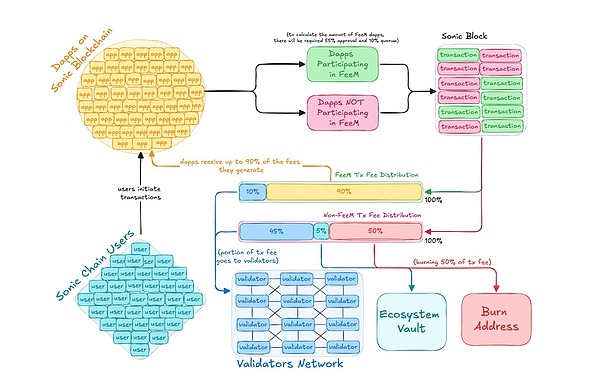

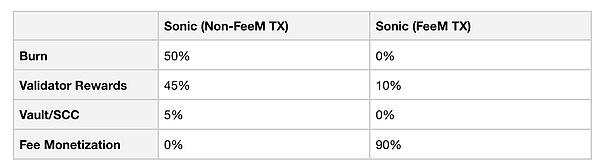

Through fee monetization, Sonic hopes to build a prosperous ecosystem for developers similar to the advertising revenue model on traditional network platforms. The transaction fee breakdown is as follows, including an innovative destruction mechanism:

If a user submits a transaction on an application that does not participate in FeeM, 50% of the transaction fee will be destroyed, and the remaining amount will be given to the validator and the ecological treasury.

If a user submits a transaction on an application that participates in FeeM, 90% of the transaction fee will be given to the developer of the application, and the rest will be given to the validator.

Fee Structure

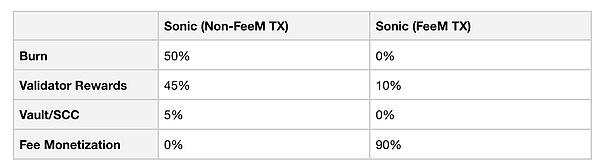

Sonic's recommended 3.5% target block reward rate ensures that the network can continue to support its applications. The following table outlines the difference in transaction fee allocation between applications that do not participate in FeeM and those that participate in FeeM.

If the transaction fees earned by applications participating in FeeM are below the 90% cap, the remaining transaction fees will be sent to the validators.

Destruction and FeeM Mechanism Example

Scenario: 50% of transactions come from applications participating in FeeM, and the remaining 50% are non-FeeM transactions

Average target cost: $0.01 per transaction

Network capacity: Sonic can handle up to 900 million transactions per day

Forecast: Achieving 10 million transactions per day will bring:

Approximately $100,000 in capital inflow per day

Approximately $3,650 per year $9.125 million in capital inflow per year

$9.125 million destroyed per year

$10.0375 million paid to validators per year

$16.425 million paid to Sonic developers per year

Sonic Liquid Staking Tokens

During Fantom's operation, there were more than 40% of staking nodes, higher than Ethereum's approximately 30%. However, the complex staking mechanism has hindered the prosperity of the LST market and limited the injection of millions of funds into the DeFi ecosystem.

Sonic’s new staking mechanism will set a 14-day lock-up period and a 7-day withdrawal period, creating an ideal structure to tap into the estimated $500 million+ LST market.

Technical Architecture

Sonic will provide developers with exceptional scalability and storage capabilities while delivering a fast, seamless user experience. Sonic can perform up to 10,000 ERC-20 transfers per second with sub-second finality, enabling instant, irreversible transactions, and utilizing cutting-edge storage systems for efficient data management.

Unlike L2 and Ethereum, truly final transactions are achieved in as little as 1 block (no longest chain rule), and there is no need to package data and write it back to Ethereum.

Sonic Gateway

In the evolving blockchain ecosystem, a native, decentralized cross-chain bridge is essential to a healthy ecosystem, enabling strong interoperability and preventing network silos. However, current L1 and L2 solutions often force users to compromise on security, speed, and decentralization. Cross-chain bridge hacks have so far cost over $2.5 billion.

Recognizing these systemic threats, Sonic’s cross-chain bridge has the following simple goals:

Safety: Ensure security with built-in fail-safe mechanisms.

Speed: Provide a smooth user experience and easily move assets across chains.

Decentralization: Eliminate single points of control and ensure only users have access to their funds.

Sonic Gateway is a trustless cross-chain bridge that facilitates ERC-20 token transfers between Ethereum and Sonic while achieving all three of the above. By leveraging Sonic's own network of validators (who have operational nodes on both chains), Sonic Gateway establishes a secure, decentralized channel between the two platforms.

With built-in fail-safe mechanisms, Sonic Gateway provides asset security to protect user funds under any circumstances. Most importantly, only users can access funds transferred through Sonic Gateway; it is impossible for any centralized institution to override user control or access funds through master keys.

In addition, Sonic Gateway is also designed for efficiency. Transfers from Ethereum to Sonic will take up to 10 minutes, while transfers from Sonic to Ethereum will take up to 1 hour (these intervals are called "heartbeats"). While Sonic is not L2, it will still be an active participant in the Ethereum ecosystem as Sonic will spend ETH to write transactions to the chain through the Sonic Gateway.

Fast-Lane TX

Users can choose to use "Fast-Lane TX" to execute transactions immediately. By paying for transactions that bypass standard "heartbeats" (which usually delay the availability of funds on the target chain), users can get their funds immediately.

Fast-Lane transactions transfer the entire state to the target chain, just like normal "heartbeats" transactions, benefiting all users, not just the user who submitted the transaction. In essence, it is equivalent to a "heartbeat" transaction, but the submission time is earlier. Importantly, fast-lane transactions are added as an enhancement and do not change the standard "heartbeats" time.

For example, if the standard “heartbeats” from Ethereum to Sonic are every 10 minutes, then submitting a fast-track transaction 5 minutes before the next scheduled “heartbeat” will allow all users crossing from Ethereum to Sonic to immediately access their funds, while the next standard “heartbeats” are still every 5 minutes.

Gateway Fail-Safe Mechanism

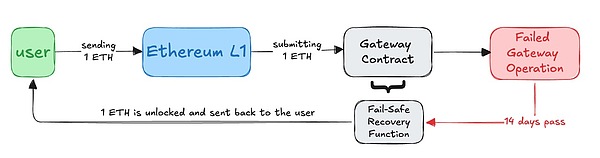

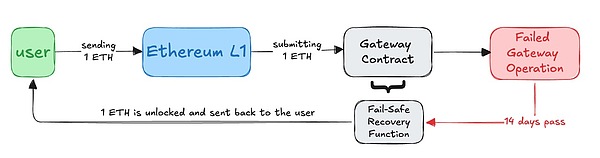

Sonic Gateway has a built-in fail-safe mechanism that allows users to retrieve their cross-chain assets on the original chain in the event that Sonic or its gateway fails.

The fail-safe mechanism is activated after the gateway fails for 14 consecutive days, providing protection for users to transfer assets from Ethereum to Sonic. As a form of insurance, the 14-day fail-safe period is immutable, meaning that once the Sonic Gateway is deployed, it cannot be changed by Sonic Labs or any other third-party entity.

Importantly, this period is not a competition period, but rather a fundamental function to ensure that users retain custody of their cross-chain funds on the original chain.

How the fail-safe mechanism works

The Sonic Gateway transmits "heartbeats" between chains, which include the Merkle root and block height of each blockchain. If the "heartbeats" stop for 14 days, it signals the failure of the Gateway, allowing users' funds to be unlocked on Ethereum.

Of course, only assets transferred through the Sonic Gateway can be restored. The 14-day duration serves as a buffer period to allow any issues to be resolved before the Gateway is deemed unavailable.

Sonic vs. L2

Most L2s are optimistic Rollups, which operate under the assumption that all withdrawals are valid unless challenged (hence the term "optimistic"). To ensure security, these L2s have a 7-day challenge period that allows anyone to verify and challenge withdrawal claims on Ethereum. For example, if you want to withdraw 2 ETH from Optimism to any other platform, those assets will not actually be released on Ethereum until the 7-day challenge period is over. So why does it only take a few minutes to withdraw from platforms like Arbitrum and Optimism to exchanges like Binance?

In fact, when depositing from optimistic Rollup to exchanges like Binance, the transfer may seem fast, but the exchange bears the risks associated with the challenge period; this is because Binance trusts most L2s. However, the funds deposited into your account by the exchange are technically not safe until the 7-day challenge window closes, which means that the exchange bears the risk during this period.

In contrast, Sonic, as an L1, has its own secure validator and can provide instant (single block) transfers to exchanges without the associated risk, because these transactions are not subject to any challenge period, and the same is true if USDC (and other ERC-20 tokens) become native tokens on Sonic. In addition, cross-chain assets from Ethereum through Sonic Gateway are completed within an hour, which is a faster and more secure alternative to the 7-day challenge period required by most L2 solutions.

Sonic Database

Sonic uses a database to store its world state, including account information, virtual machine bytecode, smart contract storage, etc. The database has a feature called "live pruning" that automatically deletes historical data, thereby reducing storage requirements for validators.

Previously, pruning required validator nodes to go offline, which posed financial and operational risks. Now, validators can use live pruning, which saves disk space and costs by discarding historical data in real time while ensuring continuous operation.

Live pruning works by splitting the database into two types, including LiveDB and ArchiveDB. LiveDB only contains the world state of the current block, while ArchiveDB contains the world state of all historical blocks. Validators only use LiveDB, while archive nodes have both LiveDB and ArchiveDB to handle historical data requests through an RPC interface.

Sonic's database storage uses an efficient tree or hierarchical structure, which simplifies data retrieval. Importantly, it still provides cryptographic signatures for the world state and uses an incremental version of the prefix algorithm to provide archiving capabilities. In addition, it uses a local disk format instead of indirectly storing the world state through a key-value store such as LevelDB or PebbleDB.

Sonic Virtual Machine

The Sonic Virtual Machine (VM) will replace the EVM and increase the execution speed of Sonic. The Sonic Virtual Machine will be fully compatible with Solidity and Vyper, so ecosystem developers can continue to use the same development tools. In addition, Sonic will support Geth 1.4.

The Sonic Virtual Machine uses dynamic translation, which translates the code into a more efficient instruction format within the client, allowing smart contracts to be executed more efficiently. This is achieved through more efficient execution technology and "super-instructions" (efficient representation of patterns that often appear in the code).

Token Economics

Sonic’s native token is S, which has multiple roles:

Pay transaction fees

Secure the chain by staking (minimum 1 S)

Run a validator to secure the chain (minimum 50,000 S)

Participate in governance

When the Sonic mainnet is launched, the total supply of S will be 3.175 billion, corresponding to the total supply of FTM, and the circulating supply of S will correspond to the circulating supply of FTM at that time. Users holding FTM can exchange for S at a 1:1 ratio. The following additions will be gradually implemented into the token economics of the S token, as decided by multiple governance proposals.

Airdrop Program

Six months after Sonic launches, 6% of the newly minted 3.175 billion S tokens will be used for an airdrop program to reward users and builders of Fantom Opera and Sonic. The airdrop program uses an innovative burn mechanism to reward active users and gradually reduce the total supply of S tokens.

Ongoing Grants

Six months after Sonic launches, more S tokens will be minted to increase S’s adoption and global impact; grow the team and scale operations to increase adoption; implement strong marketing initiatives and DeFi activities; and launch Sonic Spark and Sonic University programs to drive Sonic’s future development.

To fund this initiative, an additional 1.5% of the total initial S token supply (equivalent to 47,625,000) will be minted each year for six years, starting six months after mainnet launch. However, to prevent inflation, Sonic will destroy any newly minted tokens that are not spent that year, ensuring that 100% of all newly minted tokens generated by this initiative are used for network growth rather than being held in a treasury for later use. For example, if Sonic Labs only used 5 million tokens in the first year, the remaining 42,625,000 tokens would be destroyed.

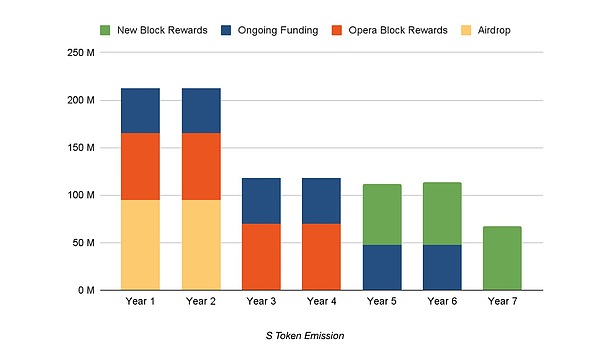

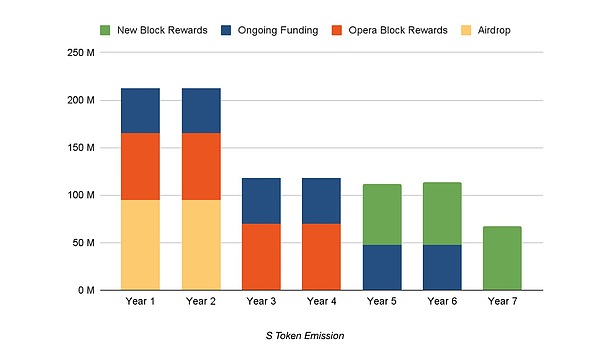

Block Rewards

We are migrating validator rewards from Fantom Opera to Sonic. Opera validators will continue to receive rewards for the first few years. However, as validators and stakers transition to Sonic, we will reduce their block rewards. The funds saved from the reduction in rewards will be reallocated to reward Sonic validators. Meanwhile, the Sonic Foundation will continue to maintain the Opera validator for the foreseeable future.

Sonic’s target annual percentage rate (APR) is 3.5%. In order to maintain this rate of return without causing inflation during the first four years, we will redistribute the remaining FTM block rewards in Opera to Sonic as rewards for validators and stakers. These rewards have been included in the initial supply of 3.175 billion S tokens.

While technically the total initial supply of S tokens is 3.175 billion, which matches the total supply of FTM, at launch the circulating supply will be approximately 2,883,358,939 tokens. The difference (70,067,224 per year) will be distributed as rewards to validators during Sonic’s first four years. During this period, we can avoid minting new S tokens for block rewards.

As a result of these changes, Opera’s annual interest rate will drop to zero after the launch of Sonic. Additionally, in order to preserve value for all FTM and S token holders and eliminate the need for new inflationary rewards at the start of Sonic’s launch, we will not mint new tokens for validator security during the first four years of Sonic’s deployment. After four years, S block rewards will continue to mint new tokens at a rate of 1.75% per year to reward validators.

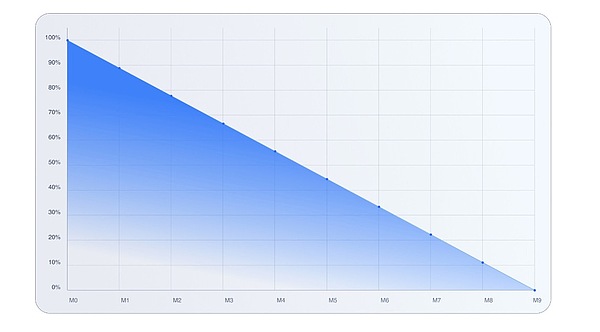

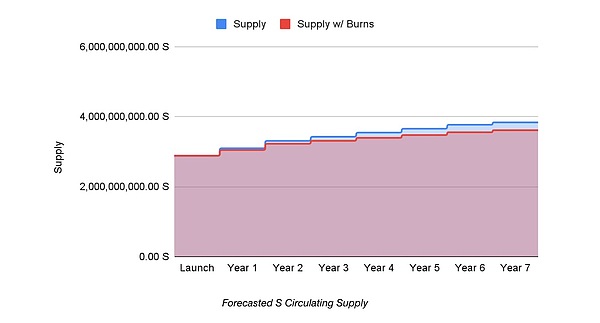

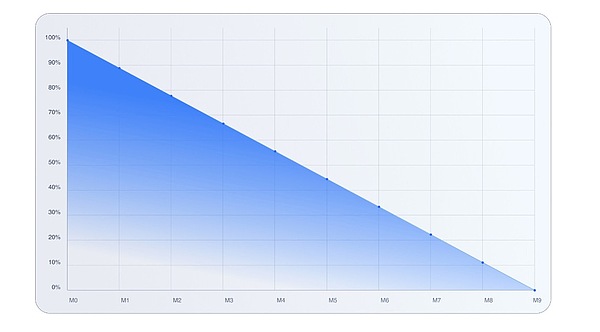

The chart below shows the total issuance of S tokens over the first 7 years.

Token Burning Mechanism

Sonic has three burning mechanisms that can reduce the release of new S tokens:

Fee Monetization Burning Mechanism: If a user submits a transaction on an application that does not participate in FeeM, 50% of the transaction fee will be burned.

Airdrop Burning Mechanism: If a user does not choose to wait for 75% of the airdrop to unlock within the 270-day unlock period, a portion of the S tokens will be lost and destroyed.

Destruction mechanism in the ongoing grant: During the first six years of Sonic, 47,625,000 S tokens will be minted each year to fund growth, and unused tokens in that year will be destroyed.

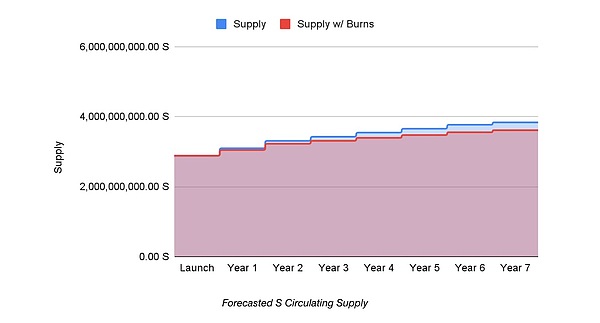

The following chart predicts the circulating supply of S from launch to year 7. The blue line shows the circulating supply without any destruction, and the red line shows the supply with destruction.

To show the potential destruction in the above chart, we assume that 50% of the S tokens from the ongoing grant will be destroyed. We also assume 10 million transactions per day on Sonic, with a fee of approximately $0.01 per transaction, and assume that half of these transactions occur on non-FeeM applications, on which 50% of the fees will be burned. Finally, we assume that users will consume an average of 20% of the airdrop, as some will choose to claim it early.

Please note that the token economics calculations provided assume that Sonic launches in December 2024. If the launch date changes, the token economics will also be adjusted.

From Fantom to Sonic

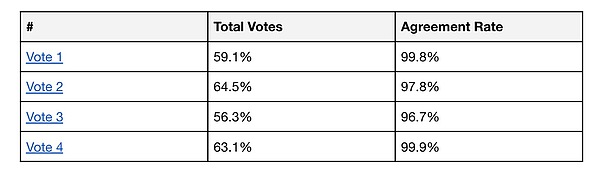

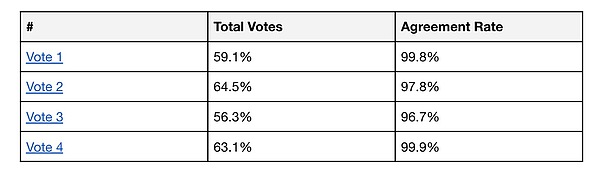

After extensive discussion in the Fantom community and through four governance votes (the results of which are shown below), Sonic will be the new chain that represents Fantom moving forward.

FTM holders can redeem S in one of two ways:

Centralized exchanges: Sonic is working with most exchanges that currently list FTM to coordinate automatic redemptions for users.

Self-custody/DeFi users: Sonic Labs will launch a simple bridge to enable 1:1 redemption from FTM to S. Two-way redemption will be supported for the first 90 days after the Sonic mainnet goes live. After 90 days, starting at 4pm GMT on the 91st day, only one-way redemption from FTM to S will be allowed.

Conclusion

Sonic aims to revolutionize the blockchain industry by providing a next-generation L1 that combines speed, scalability, and security. By introducing innovative features such as fee monetization, a secure cross-chain bridge to Ethereum, and a simplified staking mechanism, Sonic positions itself as a developer-friendly platform that prioritizes builders and users.

Catherine

Catherine