Author: Hotcoin Research, Source: Luke, MarsBit

Recently, crypto concept stocks have set off an unprecedented frenzy in the global capital market. From the stablecoin giant Circle's stock price soaring nearly four times a week after its listing, to TRON's rapid ignition of the market through backdoor listing in the US stock market, the crypto industry is entering the mainstream capital vision at an unprecedented speed and strength. Almost all companies related to blockchain and with a clear compliance path can gain amazing valuations in a short period of time, and even become a hot spot pursued by the capital market. As more and more crypto companies announce or launch IPO plans, 2025 may usher in an unprecedented "crypto IPO year", which will have a far-reaching impact on the entire capital market and crypto ecology.

This article will deeply analyze the key reasons behind the recent surge in crypto concept stocks, carefully sort out the main crypto-related listed companies on the market, and take stock of those heavyweight crypto companies that are preparing for IPOs. At the same time, the article will also look forward to the long-term impact of the crypto IPO wave on the market ecology, providing valuable reference and inspiration for investors and industry observers.

1.Crypto stocks are hot

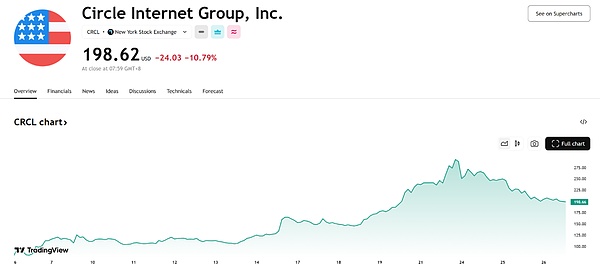

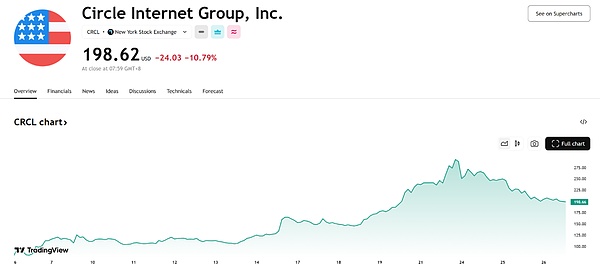

On June 5, the stablecoin company Circle was listed on the New York Stock Exchange at an issue price of $31. After that, the stock price continued to soar, and the closing price in the first week was about $115. On June 23, Circle's stock price reached a high of $292.77 during the trading session, an increase of more than 844% from the IPO price. It then fell slightly, but the heat did not diminish.

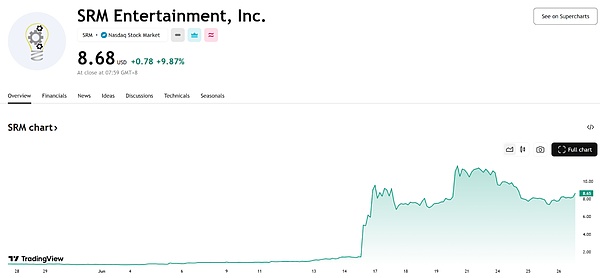

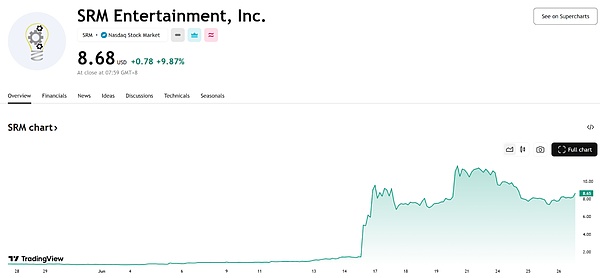

SRM Entertainment (SRM) had a stock price of less than $1.5 at the beginning of June. Under the influence of the news that Sun Yuchen, the founder of the Tron Foundation, decided to go public through a backdoor listing and inject capital through the company, the stock price soared more than 5 times in a single day on June 16, and the market value surged from tens of millions of dollars to about $158 million. The company announced that it has received $100 million in investment and will implement the TRX token treasury strategy, becoming the TRON version of MicroStrategy.

In addition to Circle and Tron related concept stocks, some rising companies are also scrambling to implement the "crypto asset treasury" strategy to attract attention:

MicroStrategy (MSTR) is the listed company with the most Bitcoin in the world. Its "digital gold reserve" strategy has made its stock price one of the vanes of Bitcoin prices.

SharpLink Gaming (SBET) announced that it spent about $463 million to purchase Ethereum (a total of 176,271 pieces) and implemented a crypto asset treasury strategy.

DeFi Development (DFDV) repositioned itself as the "Solana Treasury", holding more than 600,000 SOL tokens as of May, and announced that it had obtained a $5 billion equity financing quota to increase its hoarding of Solana.

Nano Labs announced a $500 million convertible bond plan to fund large-scale BNB purchases, and plans to establish a $1 billion BNB treasury with the goal of accumulating 10% of its circulating supply.

This unprecedented investor pursuit shows the recent popularity of crypto concept stocks. The detonation point of the crypto bull market does not seem to be in the currency circle, but on Wall Street. Traditional secondary market investors are pouring funds into "compliant crypto asset mapping companies" at an unprecedented rate. Any company that is related to blockchain assets and has compliant disclosure and real business often obtains a valuation premium in a short period of time.

II.Background and form of the listing of crypto companies

The policy tailwind, market bull market, financing needs and flexible listing tools have jointly spawned the boom of crypto companies listing this year. From the "outside circle" with limited supervision to the mainstream market stage, crypto companies are embracing Wall Street with an unprecedented attitude.

1. Analysis of the reasons for the listing of crypto companies

Since the beginning of this year, more and more crypto companies have announced or are planning to go public, and the U.S. stock market has become the preferred stage for crypto concept stocks. The emergence of this phenomenon is driven by both internal motivation and external environment.

The policy and regulatory environment has warmed up and become clearer: Trump is regarded as a representative of "pro-cryptocurrency". After returning to office, he quickly adjusted the regulatory personnel, and the US political circles have become more open to crypto assets. On June 17, the US Senate passed the Stablecoin Innovation and Unified Regulation Act (GENIUS Act) by an overwhelming 63 votes to 30, establishing a unified regulatory framework for crypto assets such as stablecoins, allowing the market to see the institutionalized prospects of crypto companies' compliance operations.

The macro market environment provides a window for crypto companies to go public: As the price of Bitcoin breaks through and stabilizes at $100,000, the "currency circle" has re-entered the bull market cycle, which means that related companies will receive higher valuations and financing in the capital market. This is the perfect window for crypto companies to enter the capital market, and investors' enthusiasm can be converted into real money financing and valuation. Many crypto companies that were originally on the sidelines have accelerated their pace of listing to seize this wave of dividends.

The inherent needs of the company's own development: Choosing IPO in a bull market atmosphere can not only raise funds and enrich capital at a relatively ideal valuation, but also enhance brand awareness and credibility. After the industry reshuffle, some leading companies (such as exchanges, custodians, etc.) hope to consolidate their market position and obtain compliance qualifications through listing, so as to win regulatory recognition and customer trust in global expansion. In addition, for venture capital-backed unicorns, listing can provide an exit channel for early shareholders and attract new institutional investors to join. These practical considerations have jointly contributed to the trend of crypto companies going public.

2. Diversity of listing forms for crypto companies

The listing forms of crypto companies show diverse characteristics. In order to seize opportunities and accelerate the process, various crypto companies have taken different paths to enter the capital market:

Traditional IPO: This is the most mainstream listing method. For example, Circle chose to issue new shares in a regular IPO on the New York Stock Exchange, which turned out to be very successful; Israeli social trading platform eToro and the reorganized Galaxy Digital also went public through IPOs in early June. These IPOs are usually accompanied by impressive gains on the first day, indicating strong market buying.

Direct listing: Unlike IPOs, direct listings do not raise funds but directly list existing shares for circulation. Coinbase used direct listing to land on the Nasdaq in 2021, setting a precedent for the listing of crypto unicorns. Direct listings are usually used for companies that are not short of money and have high visibility. Today, more companies choose IPOs, but direct listings as one of the options reflect flexibility.

SPAC merger and listing: The special purpose acquisition company path that has been popular in recent years has also been adopted by some crypto companies. A typical example is that the mining company Bitdeer successfully landed on the Nasdaq in 2023 through a SPAC merger with Blue Lake Capital; the stablecoin company Tether and Twenty One Capital, supported by the exchange Bitfinex, merged with Cantor's SPAC and went public on the Nasdaq in April 2025. As soon as it debuted, it became the third largest "Bitcoin holding" company in the US stock market with a reserve of $3.6 billion in Bitcoin. The SPAC path is relatively fast and flexible, suitable for crypto companies with clear business models and institutional endorsements. However, as the traditional IPO market picks up, the popularity of SPACs has declined, and some companies that originally planned SPACs have switched to the IPO track.

Reverse merger through backdoor listing: This is a new highlight this year, represented by the case of Tron backdoor listing through SRM. The Tron project itself has issued the crypto token TRX. With the help of SRM Entertainment, a small-cap company in the U.S. stock market, Sun Yuchen first injected $100 million into SRM and obtained a large number of new shares. Then the company was renamed "Tron Inc", allowing the Tron ecosystem to achieve a backdoor listing through the SRM shell. After the news was confirmed, SRM's stock price instantly soared more than 5 times, which shows that the market is very excited about this model of "currency projects landing on the U.S. stock market backdoor listing". Backdoor listing provides an alternative way for some crypto projects that cannot directly IPO, but the corresponding compliance challenges and operational complexities also need to be considered (such as information disclosure, shareholder structure reorganization, etc.).

"Dual listing" or cross-border listing: Some large crypto companies seek to list in multiple markets to attract capital from different regions. For example, OKX is reportedly considering an IPO in the United States while exploring a "spin-off listing" plan, which may mean listing in Hong Kong and other places at the same time. Galaxy Digital has previously been listed in Canada, and then directly listed on the Nasdaq in the United States through reorganization. Dual listing helps to increase global visibility and liquidity, and is also a strategy for some companies to deal with regional regulatory risks.

III. Inventory of popular crypto concept stocks

Currently, crypto concept stocks have spread across capital markets in many parts of the world, with the US market as the main battlefield, and there are also important crypto-related stocks in Hong Kong, Singapore and other places. Below we will take stock of the main listed crypto companies according to different segments and analyze their performance and influence.

1. Crypto financial services and investment

MicroStrategy (NASDAQ: MSTR, renamed Strategy): A traditional business intelligence software company, it has transformed into a "bitcoin reserve company" due to its large-scale purchase of Bitcoin as the main asset of its balance sheet. As of June 26, 2025, MicroStrategy has accumulated approximately 592,345 Bitcoins, accounting for 2.82% of the total global Bitcoin. With the company's strategic transformation, its market value once exceeded US$10 billion. At the end of 2024, MicroStrategy was included in the Nasdaq 100 Index, marking the beginning of mainstream indexes including Bitcoin exposure. MicroStrategy's stock performance is highly correlated with Bitcoin and is seen by investors as an alternative way to invest in Bitcoin. Circle Internet (NYSE: CRCL): USDC stablecoin issuer, successfully IPO on June 5, 2025, raising $1.1 billion. As the world's first listed stablecoin company, Circle has attracted much attention. The company's revenue in 2024 was as high as $1.7 billion, and 99% of it came from interest income generated by USDC reserves. This "lying and earning" model has a stable cash flow and extremely low volatility, making it a very popular investment target for investors. Circle's stock price rose nearly twice from the issue price on the first day, and has continued to soar several times since then. Circle's successful listing not only brought itself a high valuation, but also ignited the enthusiasm of the entire crypto IPO market.

Galaxy Digital (NASDAQ/TSX: GLXY): A digital asset financial service provider founded by Wall Street celebrity Mike Novogratz, Galaxy represents crypto investment banks and asset management entering the public market. Galaxy was listed on the Toronto Stock Exchange as early as 2018, and after reorganization, it was directly listed on Nasdaq on May 16, 2025. Galaxy's business includes crypto trading, asset management and investment banking services, and it is the representative of the crypto version of "Goldman Sachs".

Amber Group (NASDAQ: AMBR): Founded in 2017, Asia's top crypto financial service platform provides comprehensive services such as trading, market making, and lending, and has received investment from many well-known institutions. After twists and turns, Amber was listed on Nasdaq on March 13, 2025. Amber is a global leader in technology-driven high-frequency trading and quantitative strategies, and is a representative of the internationalization of Singapore's crypto companies.

Twenty One Capital (NASDAQ: XXI): A company initiated by stablecoin giant Tether and exchange Bitfinex, and listed in April 2025 through a SPAC merger. As soon as it went public, it became a veritable "big player" with a Bitcoin reserve worth US$3.6 billion. It is said that its Bitcoin holdings are second only to MicroStrategy and Tesla, ranking among the top three in the world. The company is more like a Bitcoin ETF alternative or investment company. Its emergence reflects the demand of some investors to invest in Bitcoin through stocks. XXI's stock price has performed steadily since its listing in the United States, and has also risen due to the favorable legislation of stablecoins.

2. Exchanges and platforms

Coinbase (NASDAQ: COIN): A world-renowned leading cryptocurrency exchange. Founded in the United States in 2012, it serves more than 120 million users. Coinbase went public directly in April 2021 and is one of the first crypto unicorns to land on the US stock market. In May 2025, the stock was officially included in the S&P 500 index, becoming the first crypto concept stock to enter the S&P index in history. This milestone event pushed Coinbase's stock price up 10% after the market, and is also seen as a sign that crypto stocks have entered the mainstream. Coinbase's current market value is about more than 60 billion US dollars. As an industry benchmark, its steady performance (recent slow growth and low volatility) reflects investors' confidence in compliant trading platforms.

eToro (NASDAQ: ETOR): A social trading platform founded in Israel, it has special features such as "copy trading" and more than 30 million users worldwide. After experiencing a failed SPAC, eToro successfully landed on the Nasdaq through an IPO on May 15, 2025. The stock price rose by more than 40% on the first day of listing. As a platform covering crypto and traditional asset transactions, eToro's listing shows that investors are optimistic about the prospects of cross-market integrated trading platforms, and its listing also sets an example for crypto companies in Europe and the Middle East.

Robinhood (NASDAQ: HOOD): A well-known zero-commission broker in the United States, it has provided crypto trading services since 2018. Although the company is not entirely a crypto company, it is also regarded as one of the crypto concept stocks because it supports transactions such as Bitcoin and Ethereum. Robinhood went public in 2021, and currently about 20% of its revenue comes from crypto transactions. As a representative of the integration of traditional finance and crypto business, Robinhood reflects the trend of FinTech giants embracing crypto.

Block (NYSE: SQ): Formerly known as Square, it is a US payment technology giant that went public in 2015. Because its Cash App provides Bitcoin buying and selling functions, the company changed its name to "Block" in 2021 to highlight its emphasis on blockchain technology. Block has also invested in Bitcoin mining and hardware wallet research and development, and is one of the pioneers among traditional technology companies that actively engage in the field of encryption. Although its main payment business accounts for the majority, the market has positioned it as a "partial encryption company", and its stock price has a certain linkage with the price of Bitcoin.

OSL (HKEX: 0863): Asia's representative encryption trading platform stock. OSL is affiliated to BC Technology Group and was established in Hong Kong in 2018. It holds a virtual asset trading license issued by the Hong Kong Securities Regulatory Commission and is one of the first legal and compliant digital asset trading platforms in Hong Kong. OSL was listed on the Hong Kong Stock Exchange through a backdoor listing in 2019 (BC Group was formerly engaged in media business). At present, OSL mainly serves institutions and high-net-worth customers, providing brokerage, custody and other services, and managing assets of more than US$5 billion. In recent years, Hong Kong has actively embraced encryption, introduced new regulations on virtual assets and allowed retail transactions. As a licensed leader, OSL has benefited greatly, and its stock price has risen due to favorable policies. The existence of OSL shows that the Hong Kong market is also cultivating its own encryption concept stock ecology.

3. Mining and mining hardware

Marathon Digital (NASDAQ: MARA): One of the largest Bitcoin mining companies in the United States, it went public in 2012 and operates several large mining farms in North America. As of June 26, 2025, the company holds a total of 49,179 Bitcoins. The rebound in Bitcoin prices from 2023 to 2025 has driven its stock price to rebound sharply and attracted institutions to maintain positive ratings. Marathon's stock price has become a "magnifying glass" for Bitcoin's market, making it one of Wall Street's main tools for betting on the price of the currency.

Riot Platforms (NASDAQ: RIOT): Another long-established Bitcoin mining company, it went public in 2003 and focuses on North American mining operations. Similar to Marathon, as the price of Bitcoin has recovered in recent years, Riot's stock price has risen by 20-30% since the beginning of 2024. During the same period, industry funds have flowed back into the sector, pushing Riot to become a core asset in the mining industry.

Bitdeer (NASDAQ: BTDR): Bitdeer was founded by Wu Jihan, the former chairman of Bitmain, and focuses on mining operations and computing power leasing. It was listed on the Nasdaq in April 2023 through a merger with Blue Safari SPAC, and attracted attention due to its computing power resources and market scarcity. The company operates multiple mining farms in the United States and Norway, with steady revenue growth in 2024-2025, and plans to expand its data center facilities to AI cloud services. As a derivative company of a Chinese mining machine giant overseas, Bitdeer's listing means that Chinese mining capital has landed on the US stock market.

Canaan Technology (NASDAQ: CAN): Canaan is one of the first listed Bitcoin mining machine manufacturers in China. It was IPOed on Nasdaq in 2019 and mainly produces the Avalon series of mining machines. Bitcoin performed well during the bull market in 2021, but its stock price was sluggish afterwards due to market correction and fierce competition. With the recovery of the mining industry from 2023, Canaan's performance improved, and its revenue and orders recovered. As of now, Canaan is a key representative of the capital market covering the blockchain hardware field, and its recovery means that the industry cycle has started.

4. Other ecosystem-related companies

Tron Inc (to be listed): The Tron project is in progress through the SRM backdoor listing. Once completed, Tron will become the first case of a crypto public chain project successfully landing on the US stock market. Tron's listing process may create a new model for the capitalization of cryptocurrency projects, which may lead to other projects to follow suit or explore. However, the Tron case has also attracted discussions on its compliance, especially in the context of tokens still being traded and having previously been sued by the SEC. If Tron is successfully listed, it will inevitably further push up market expectations for the securitization of "crypto-native projects."

DeFi Development (NASDAQ: DFDV): The company has transformed from real estate technology to a company holding Solana assets, which is an exploration of the securitization of DeFi ecosystem companies. Its stock price has risen by as much as 28 times due to the switch. This shows that as long as small companies are linked to the popular public chain ecology and boldly announce the holding strategy, they can also get amazing hype in the capital market.

Other targets in the Hong Kong and Singapore markets: In addition to the aforementioned OSL, Hong Kong also has companies such as Xinhuo Technology (formerly known as Tongcheng Holdings, HKEX: 1611) involved in crypto asset management and brokerage business. In Singapore, in addition to Amber, which has already been listed, Osmosis (a mining machine distributor) and others are also seeking to be listed locally. Although the scale and number of crypto concept stocks in these regions are not as large as those in the United States, they are also gradually developing under their respective regulatory frameworks. For example, the Hong Kong government has actively promoted becoming a crypto center in recent years. It is expected that more Asian crypto companies will choose to list in Hong Kong in the future, giving birth to iconic companies such as the "Hong Kong version of Coinbase".

In general, the global crypto listed company map has covered the upstream and downstream of the industry. There are mining companies and mining machine manufacturers in the upstream, exchanges and wallets in the midstream, and payment and investment services and even public chain ecological companies in the downstream. The expansion of this map is a microcosm of the blockchain industry moving from the margins to the mainstream. The stock market provides a new stage for crypto companies to demonstrate their own value, and also allows traditional investors to share the dividends of the blockchain revolution.

Fourth,Inventory of Crypto Companies in Preparation for IPO

Many blockchain-related companies are actively preparing to enter the capital market. It is expected that in the next 1-2 years, a number of heavyweight companies in the crypto industry will enter the secondary market, including exchanges, mining companies, infrastructure and Web3 content platforms.

Bitmain / Antalpha (Bitmain and its subsidiaries)

Bitmain tried to go public in Hong Kong in 2018 but failed, and has no direct IPO plans in the short term. However, its mining and financial subsidiary Antalpha has submitted a US stock IPO prospectus (Form F-1) in April 2025, planning to go public on the Nasdaq, and is expected to issue about 3.85M shares, raise about US$50 million, and use the funds raised for asset management such as Bitcoin and digital gold. Antalpha is mainly engaged in mining machine supply chain finance, and has signed an MOU with Bitmain as its main financing partner, which is regarded by the industry as a "curve listing" operation of Bitmain.

BitGo (crypto asset custodian)

The old custody platform BitGo is actively preparing for an IPO. According to Bloomberg and other financial media, the company is working with investment banks and is expected to be listed in the United States (NASDAQ/NYSE) in the second half of 2025, and its asset custody scale has exceeded US$100 billion in the first half of 2025. BitGo has also added OTC trading business to expand revenue channels.

Kraken (old American crypto exchange)

Kraken has repeatedly stated its IPO plan at the end of 2024 and the beginning of 2025, and launched preparatory measures including US$100 million in debt financing in 2025. According to market news, the company is preparing for a listing in Q1 2026, preparing for compliance and capital structure optimization. Although the co-CEO emphasized that the listing needs to be "beneficial to customers and build trust", if the supervision is favorable, the IPO will proceed steadily.

Gemini (founded by Winklevoss, a US compliant exchange)

Gemini has submitted a confidential S-1 form to the SEC on June 6, 2025, officially launching the IPO process. Affected by the previous industry downturn and the Genesis incident of its partner, Gemini's listing process has slowed down. The company resolved the investigations of the CFTC and the SEC earlier this year, which cleared the way for its listing plan.

OKX (old offshore exchange)

OKX is preparing for a US IPO and plans to list on Nasdaq through its US subsidiary. The company has reached a settlement with the US Department of Justice and the Treasury Department and resumed US business. At the same time, it must pass the SEC review and the adjustment of the Asian license system. It is reported that OKX is expected to go public under the background of the "warming up" of supervision.

Bithumb (South Korea's leading crypto exchange)

Bithumb is planning to split its business, focus on the core exchange, and prepare for listing on KOSDAQ in South Korea in the second half of 2025. Samsung Securities has been hired as the lead underwriter, and the trading and investment departments have been split. They will be listed first in South Korea, with the goal of raising US$1 billion, and then go public in the United States when the time is right.

Bitkub (Thailand's largest crypto exchange)

Bitkub Capital Group is preparing for an IPO on the Stock Exchange of Thailand (SET) in 2025. The CEO revealed that the valuation will reach 6 billion baht (about US$165 million). The company is expanding its team and hiring financial advisors to speed up the listing process. It still regards listing as a strategic node for accelerating expansion.

FalconX (crypto brokerage platform for institutions)

FalconX is actively preparing for an IPO, which could be listed on the NYSE as early as 2025. The company provides OTC and derivatives trading services to institutions, and is currently relying on the market recovery and investment banks to promote the final landing.

Ripple (RippleNet network operator)

After the lawsuit with the SEC gradually ended, Ripple's management has repeatedly reiterated that it is not in a hurry to go public. CEO Brad Garlinghouse said that Ripple is well-funded and is currently focusing more on mergers and acquisitions rather than raising funds for listing. IPO is clearly listed as "not a priority at the moment." Although it is "definitely possible" in the future, Ripple prefers to wait until the regulation is completely clear before considering it.

V.The impact of the crypto IPO boom on the market and the outlook for subsequent trends

With a large number of crypto companies rushing to IPO, 2025 has become the "big year for crypto IPOs". Such an intensive wave of listings has had a profound impact on both the cryptocurrency market and the traditional financial market, and has also brought new variables to future trends.

1. The impact of the crypto IPO boom

First, the listing of a large number of crypto companies means that traditional capital is further embracing the crypto industry. When stocks such as Circle, Coinbase, and MicroStrategy entered authoritative indexes such as the S&P 500 and Nasdaq 100, global passive investment funds and traditional institutional investors passively or actively allocated crypto exposure. This will deepen the linkage between the crypto market and the overall financial market. On the one hand, crypto assets are no longer limited to the form of tokens, but are integrated into mainstream investment portfolios through stocks; on the other hand, the volatility of traditional stock markets and the flow of funds may also affect the performance of these crypto concept stocks, and thus indirectly affect the sentiment of the cryptocurrency market.

Secondly, the listing boom may also have an indirect impact on the price of cryptocurrencies themselves. On the one hand, some listed companies directly hold a large number of crypto assets. The fundraising and stock appreciation of these companies have enhanced their ability to increase their holdings of crypto assets. For example, Semler Scientific announced that it will raise funds to purchase as many as 100,000 bitcoins in the next few years, which will actually further introduce funds from the stock market into the crypto asset market. Similarly, companies that implement the "treasury strategy" may have more motivation and resources to buy related tokens after their stock prices rise, thereby supporting the price of the currency. On the other hand, when the performance of crypto company stocks is outstanding, it will also increase investors' interest in the underlying crypto assets.

2. Potential risks and challenges

It is worth noting that not every listed crypto company can replicate the myth of Circle. Investors' enthusiasm is inevitably overheated, and there may be differentiation in the future: only companies with real performance support and mature models can maintain high valuations, while theme stocks that lack fundamentals will eventually return to rationality. For example, SharpLink Gaming (SBET) soared and then quickly halved. This reminds us that when the craze subsides, the market will pay more attention to fundamentals. Therefore, in the short term, this wave of IPO fever has brought funds and attention to the industry, but in the medium and long term, whether the company can realize growth and whether the regulatory environment can continue to be friendly will determine whether the stock price and market value can be stable.

In terms of supervision, although the current US regulatory attitude tends to be positive, policy uncertainty is still a long-term variable. Future political changes and changes in regulators may affect the regulatory scale of crypto companies. For example, if the stablecoin bill is blocked in the House of Representatives or other aspects of supervision are tightened, it will hit market sentiment. However, there are reasons for optimism: the two major US securities indices have included many crypto stocks, and the interests of millions of traditional stockholders are tied to the crypto market, which will force regulators to be more prudent and balanced when formulating policies, and dare not easily suppress them in a one-size-fits-all manner. Therefore, the entry of crypto companies into the public market has to some extent enhanced the industry's "political weight" and helped to strive for a more rational regulatory environment.

3. Outlook for the future trend

Looking forward to the future trend, we can foresee that the integration of crypto and traditional finance will be further deepened. In the next 18 months, the industry predicts that many more companies will join the ranks of listing: for example, Kraken, a veteran US exchange, is reportedly preparing to go public before 2026; custody giant BitGo may IPO as early as this year; Ethereum ecosystem development company Consensys, hardware wallet manufacturer Ledger, institutional custody company Fireblocks, on-chain data analysis company Chainalysis and other unicorns with a valuation of billions of dollars are also considered to have the potential to go public. In addition, Chinese-backed companies and projects are also making frequent moves: OKX Exchange has established its headquarters in the United States and is considering an IPO; Tron is actively entering the US stock market through a backdoor listing. If the crypto market remains strong, these reserve projects are likely to be implemented one after another, setting off the largest wave of crypto IPOs in history. It is conceivable that by then, crypto concept stocks will further enter the public eye, and the market value and influence of the sector will continue to rise.

Six,Summary

The recent strong performance of crypto concept stocks in the global capital market is a concentrated victory for the crypto industry to move towards the mainstream. The "two-way rush" of the stock market and the chain circle shows us that crypto companies are no longer limited to self-entertainment within the circle, but have truly knocked on the door of the capital market. From the shift in macro policies and the hot pursuit of capital to the doubling of specific company stock prices and the surge in financing, the crypto industry is gaining recognition from more and more traditional investors. For investors, it is necessary to recognize the opportunities and risks: on the one hand, high-quality crypto company stocks are expected to share the dividends of the industry's rapid growth; on the other hand, the high volatility characteristics of the crypto field have not disappeared, but have only been reflected in the stock market in a different carrier. Looking to the future, the listing tide of crypto companies may continue to rise, and the integration of the crypto world and traditional finance will be further deepened, jointly writing a wonderful chapter for the next stage.

Miyuki

Miyuki