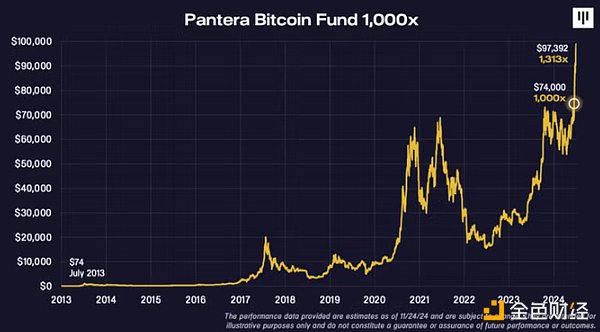

Original title: Pantera Bitcoin Fund Hits 1000x

Author: Dan Morehead, founder of Pantera Capital; Compiler: 0xjs@Golden Finance

1000x: Pantera Bitcoin Fund

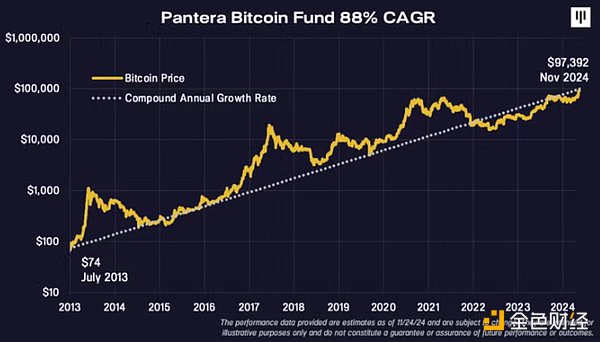

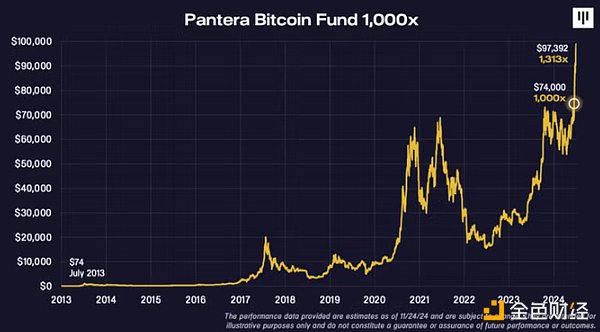

Pantera Bitcoin Fund recently achieved a crazy milestone - 1000 times return.

The surge in Bitcoin prices after the election has pushed Pantera Bitcoin Fund up a further 30%. After deducting fees and expenses, Pantera Bitcoin Fund's lifetime return is now 131,165%.

I wanted to share the original logic - because it is just as compelling to me today.

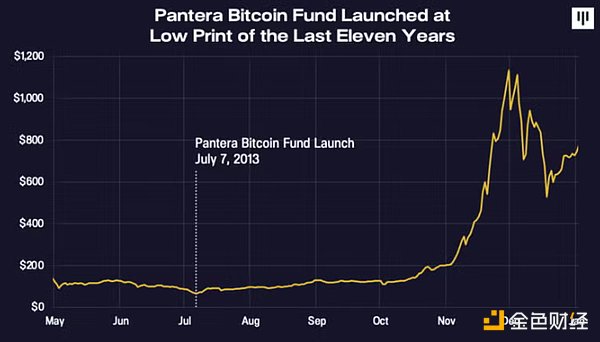

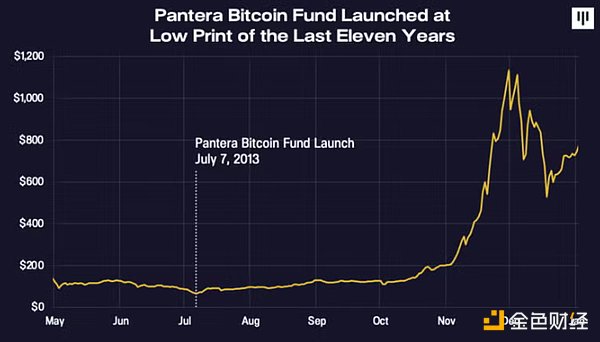

The day we chose to launch the Pantera Bitcoin Fund was actually the lowest point in the past eleven years.

The day we chose to launch the Pantera Bitcoin Fund was actually the lowest point in the past eleven years.

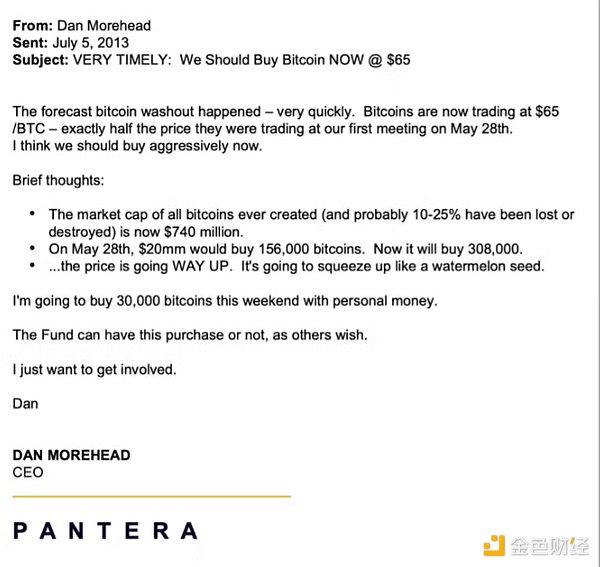

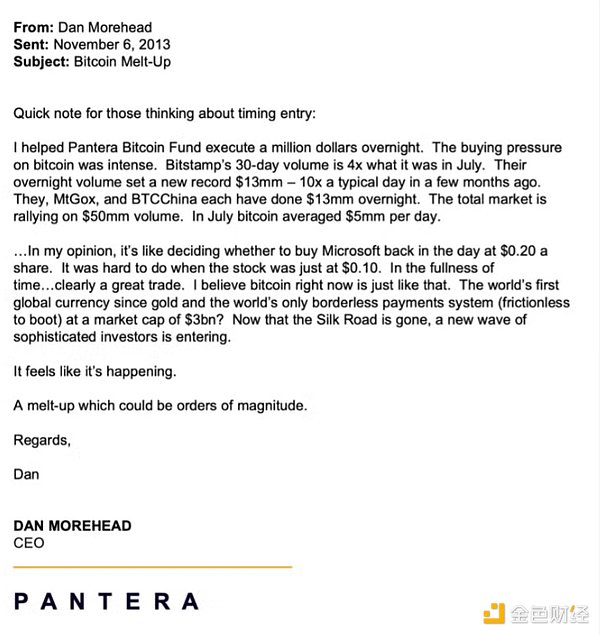

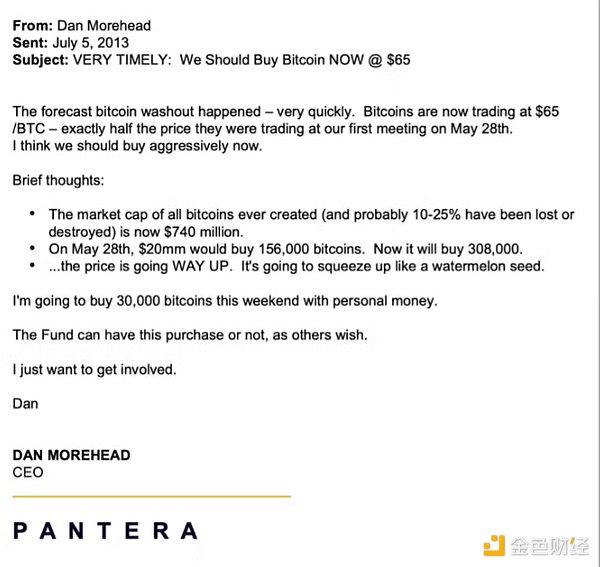

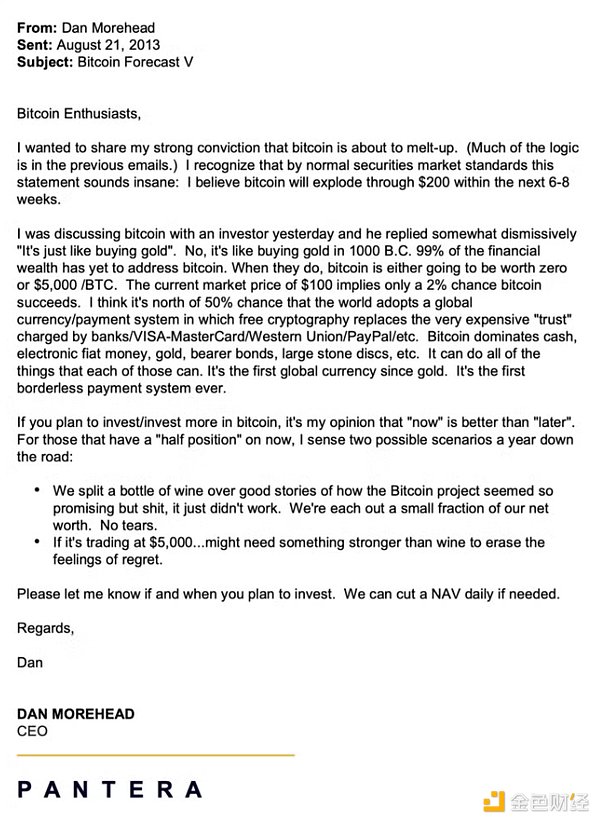

The first investment memo still reads great.

The first investment memo still reads great.

In 2013, we bought 2% of the world's bitcoins at the time.

Even after 11 years, bitcoins are still squeezing up like a watermelon seed.

Honestly, I just can't help thinking that we can get very good returns for many years to come.

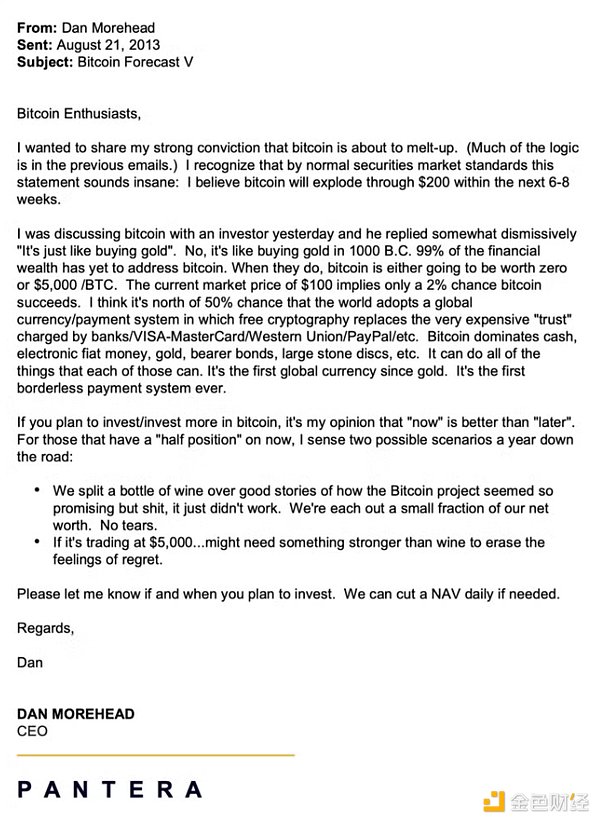

Gold in 1000 BC

My core point was written a month later:

“I was discussing Bitcoin with an investor yesterday and he responded somewhat dismissively by saying ‘it’s like buying gold’. No, it’s like buying gold in 1000 BC, 99% of financial wealth has yet to touch Bitcoin. When they do, Bitcoin’s value will either be zero or [go up by orders of magnitude].”

We’ve made some progress as an industry. There’s still probably 95% of financial wealth that has yet to deploy their positions.

The catalyst for this change – from 5% in 2024 to something much higher – has just happened: regulatory clarity in the US. Large institutional managers like BlackRock, Fidelity, and others now offer extremely cheap, efficient services to anyone with a brokerage account. This new convenient service will ultimately allow tens of millions of investors and individuals to gain exposure to this important new asset class.

We believe that the industry will benefit greatly from the first pro-blockchain president in the United States. We believe that the success of blockchain is in the best interest of the United States, and we believe everyone in the U.S. Congress will eventually take a neutral or pro-blockchain stance - which is already starting to happen. 15 years of regulatory headwinds for blockchain are now turning into tailwinds.

I still believe what I wrote eleven years ago:

"I give a greater than 50% chance that the world will adopt a global currency/payments system where free crypto replaces the very expensive 'trust' charged by banks/VISA-MasterCard/Western Union/PayPal/etc. Bitcoin will outperform cash, electronic fiat, gold, bearer bonds, large stone disks, etc. It can do all of those things. It is the first global currency since gold. It is the first borderless payments system ever."

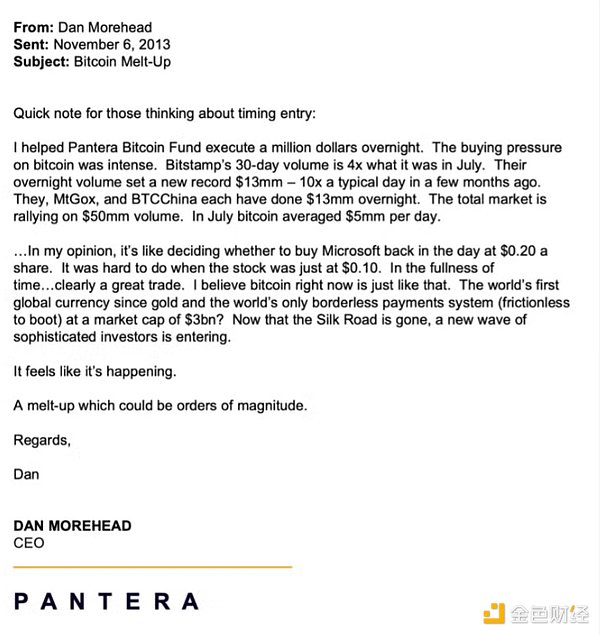

[Bitcoin at $104]

[Bitcoin at $254]

The market has really exploded. In less than a month, Bitcoin was at $1,000, and now it's up three orders of magnitude.

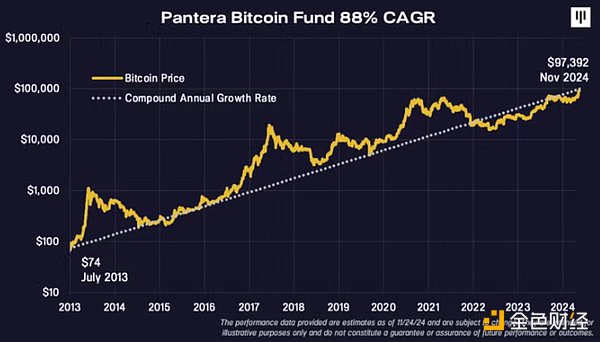

An 11-year CAGR of 88%

I can imagine an investor thinking, "Bitcoin has doubled this year. Well, I guess I missed out," and giving up.

No, that’s the wrong mindset. On average, it’s almost doubling every year. That’s a compound annual growth rate of 88% since we launched the Pantera Bitcoin Fund 11 years ago.

Orders of Magnitude

Bitcoin has already grown by three orders of magnitude. Another order of magnitude seems feasible. If Bitcoin reaches $740,000 per BTC, then the Bitcoin market cap would be $15 trillion. That’s not an inconceivable number relative to $500 trillion in financial assets.

While the past doesn’t necessarily predict the future, if this trend continues, Bitcoin will reach $740,000 by April 2028.

I think it’s still a few years away, but I do think there’s a good chance it will happen.

That’s my mentality: I wouldn’t bet my life on this, I’m not 100.00% sure that blockchain assets will go up, but when you multiply the probability of going up by the order of magnitude or more that the industry could go up, the results end up being much better than other assets that you can invest in. The expected value of Bitcoin trading is the most compelling I’ve seen in nearly four decades.

It wasn’t easy

It seems obvious now, but it was actually hard.

After an 87% plunge starting in December 2013, Bitcoin was losing its relevance. More than three years later, the market was still depressed. By 2016, almost everyone had given up on Bitcoin. Investors had no interest.

I flew all over the world that year and attended 170 investor meetings. The result of all this effort was that we only raised $1 million.

Management fees were $17,241. A hundred dollars per meeting.

We could buy the hotel!!!

I am a loyal team player by nature. I always want the Bitcoin team to win. For years, we have done everything we can to help the community. So when Expedia announced in 2014 that they would accept Bitcoin, all of our travel spending on Expedia was paid in Bitcoin. In 2015, our team spent 59 nights on the road, spending an average of 1.5 Bitcoins per night, for a total of 88 Bitcoins.

This is equivalent to $8,683,136 in today’s fiat currency!?!?!

With this money, we can buy two hotels!

With this money, we can buy two hotels!

The amazing growth of the blockchain industry

In 2013, when we were preparing to launch the Pantera Bitcoin Fund, I opened accounts on several exchanges and wired money to prepare for emergencies. When I first walked into the Wells Fargo on Market Street in San Francisco from my office to wire money to Ljubljana, Slovenia, I didn’t even know how to spell Ljubljana. Everything about it felt very fishy. So much so that the bank manager came over and interrogated me about what I was doing for a long time. (I now know that Slovenia is a lovely country located to the right of Venice and below Austria.) But at the time I wondered if I was crazy. The company I was sending money to, a small, unknown startup, sounded equally fishy. The price of Bitcoin was about $130 at the time. Over the next few days, I watched the price of Bitcoin drop from $130 to $100. It’s funny in retrospect that this is basically the same thing that skeptics call “FUD — Fear, Uncertainty, Doubt” during the Bitcoin bear market. Even with all the problems that arose when the price of Bitcoin dropped to $65, I decided to go all in — launching the Pantera Bitcoin Fund. Thirty years of trading instincts convinced me that that was the day. I sent the above email to a small group of Bitcoin enthusiasts, maybe twenty people at the time, who said, “I just want to get in on the action.” (The list now numbers in the hundreds of thousands, and the subsequent letter has been read 2.7 million times.) I logged on to a startup called Coinbase and tried to buy 30,000 Bitcoins. A pop-up window indicated that the fund had a daily limit of $50 (bucks) — a departure from Wall Street jargon, where “bucks” sometimes mean millions. One Ulysses S. Grant a day. I nearly had a heart attack.

Since this was a hip startup, they had no address or phone number. I sent an email to their support email address with the uncharacteristic all-caps subject line: “I WANT TO BUY TWO MILLION DOLLARS OF BITCOIN”. Four days later, their sole employee – a guy named Olaf – wrote back and said, “OK, your limit is now $300.” Even with my newly expanded trading limit, it would take 6,667 days to complete this transaction.

Even if I bought it today, that’s still 2,522 days!

Thankfully, I was able to buy Bitcoin on Bitstamp, and the industry grew. Today, the cryptocurrency market trades $130 billion a day. It’s amazing how fast this industry is growing.

Blockchain as an Asset Class

I sometimes feel like a gorilla in the forest who notices a shiny object on the ground… picks it up… spins it… wonders what it is…

Bitcoin!

I certainly don’t understand all the nuances of the incredible technology projects happening in this space, but I feel like I’ve seen this movie before.

I was the first Asset-Backed Securities trader at Goldman Sachs. Now everyone thinks ABS is an asset class. I was there when they did the GSCI. Now everyone thinks commodities are an asset class. I invested in Emerging Markets in the 90s. Now everyone thinks EM is an asset class.

The same is true for blockchain.

I believe that in the not too distant future every investment firm will have a blockchain team, and a sizable, permanent blockchain fund.

Asymmetric Trading

My background in global macro got me into blockchain in the first place. The asymmetry of this trading – working on the world’s largest market – makes this opportunity orders of magnitude larger than the trades we typically chase around the world. I believe this is the most asymmetric trade I’ve ever seen.

This theme is best illustrated by a comparison from the second Pantera Blockchain Summit in March 2014:

“Over dinner a few hours before a late night poker game, Morehead joked that all the bitcoins in the world were worth roughly the same as Urban Outfitters, the company that makes ripped jeans and dorm room decor – about $5 billion. ‘That’s crazy, right?’ Morehead said.

“I think that centuries from now, when they’re anatomizing our society like they did in Planet of the Apes, Bitcoin will probably have a bigger impact on the world than Urban Outfitters did.” ”

– Nathaniel Popper, Digital Gold, 2015

When I updated in November 2020, Bitcoin had the same market cap as L’Oréal. Waterproof mascara is undoubtedly a fantastic invention, but I still think there is an asymmetry.

Digging further…

“At L’Oréal, our mission is to make the most affordable and highest quality beauty products in skincare, makeup, haircare and color accessible to everyone. ”

Great. Bitcoin’s mission sounds eerily similar: democratizing financial services.

I thought the financial mission would end up being much bigger.

Bitcoin recently surpassed Meta (aka Facebook) in market cap.Photo sharing is cool, but I think financial inclusion will be even greater for everyone on the planet with a smartphone.

Five more to go…

Weatherly

Weatherly

The day we chose to launch the Pantera Bitcoin Fund was actually the lowest point in the past eleven years.

The day we chose to launch the Pantera Bitcoin Fund was actually the lowest point in the past eleven years.  The first investment memo still reads great.

The first investment memo still reads great.

With this money, we can buy two hotels!

With this money, we can buy two hotels!