Author: Paul Veradittkit, Managing Partner of Pantera Capital, Coindesk; Translated by: Tao Zhu, Golden Finance

The Ondo Summit held in New York City on February 6, 2025 marked an important milestone in the integration of traditional finance and blockchain technology. The event has a star-studded guest lineup, including but not limited to:

Asset Managers:

Goldman Sachs

Franklin Templeton

BlackRock

Fidelity Investments

Bank of New York Mellon

Blockchain and DeFi Leaders:

David Schwartz (CTO of Ripple)

left;">Sergey Nazarov (Chainlink co-founder)

Mary-Catherine Lader (Uniswap COO)

Konstantin Richter (Blockdaemon CEO)

Regulators:

Caroline D. Pham (Acting Chairman of the Commodity Futures Trading Commission)

Summer K. Mersinger (Commissioner of the Commodity Futures Trading Commission)

J. Christopher Giancarlo (Former Chairman of the Commodity Futures Trading Commission)

Industry Experts:

list-paddingleft-2" style="list-style-type: disc;">

Dan Morehead (Founder, Pantera Capital)

Mike Novogratz (CEO, Galaxy Digital)

Patrick McHenry (Former Chairman, House Financial Services Committee)

This was perhaps the first time that blockchain leaders, regulators and traditional asset managers came together to discuss the steps needed to integrate blockchain technology with traditional finance (rather than meta-planning).

This has been a long time coming.

What excites me most is the pragmatism in the conversation. Some of the comments from Franklin Templeton’s Sandy Kaul exemplify this thoughtfulness:

“Don’t underestimate how hard it is to move from an account-based system to a wallet-based system… There are no real portfolios; portfolios are virtual constructs of different accounts, and so the idea that I can mix assets and have interoperable assets is completely foreign to anyone coming from a traditional background.”

“The system that [regulators] came up with in the [1970s] started with having central counterparties [and] central depositories. We started having clearing houses that were the buyer to every seller and the seller to every buyer, we started netting portfolio positions, we started doing order entry and ownership. We had to unravel the whole system to make this new system work.”

Pantera Capital Founder Dan Morehead also referenced the changing political zeitgeist:

“There used to be a large group of people in Congress who were against crypto… out of 58 disputed elections in favor of crypto, 54 people who were against crypto left Congress. No one says a bad word about crypto in Congress anymore.”

Ondo’s Highlights

While I may be biased as Pantera led Ondo’s Seed round and co-led the Series A, I believe Ondo is the only company laser-focused on solving the convergence of blockchain and traditional finance.

Ondo also announced Ondo Chain, a full-chain network for RWAs. This chain solves two problems: making on-chain yields more attractive/accessible to off-chain investors, and connecting on-chain users to off-chain products/yields.

The problem is simple.

The financial plumbing in today’s world is built on the assumption of trustlessness and is often subject to checks and balances. If I want to buy a stock, my money goes through my bank or payment processor, brokerage firm, possible market maker, stock exchange, clearing firm, custodian bank, and possibly transfer agent. That’s 7 intermediaries to buy a stock.

And if I’m not happy with the interest rate I’m getting on my savings at my current bank, I have to sign up for an account at another bank, which takes days, and may require redoing AML and identity checks, and creating new, repetitive documents.

On-chain, a single wallet can interact trustlessly with any market directly, without any middlemen, and without creating new accounts for every transaction.

Ondo’s vision is to make the boundaries between traditional finance and blockchain disappear, powered by Ondo Chain and the broader Ondo infrastructure. Investors will be able to instruct their bank to send a SWIFT bank wire to a user on the chain, which can be done in one go through Ondo Chain. Similarly, global investors will be able to purchase securities on Ondo Chain, which will translate into a buy order on the TradFi exchange. Similarly, institutional investors will be able to pledge their treasuries as collateral in the traditional repo market, but convert the resulting cash into a yield coin asset that they can use in DeFi. Powered by Ondo Chain and the infrastructure Ondo is building, the boundaries between the financial silos that currently exist will continue to blur.

Ondo Chain will allow for 24/7 trading, global assets, easier compliance, better interest rates, and new investment opportunities.

Being a shovel seller during the gold rush

On-chain real-world assets are growing at an accelerated rate ($8.5 billion at the beginning of 2024, compared to $17 billion at the beginning of 2025) because it benefits both token creators and buyers.

On-chain users can earn yield from off-chain sources, while RWA creators can hold a large amount of assets, collect a small fee, and invest it elsewhere for additional yield. RWA provides strong support for DeFi because it brings some trust guarantees of on-chain RWA earnings, which can be overcollateralized, margin traded, and wrapped to create unlimited derivative tokens. In fact, one dollar of RWA can increase the GDP of the on-chain economy several times.

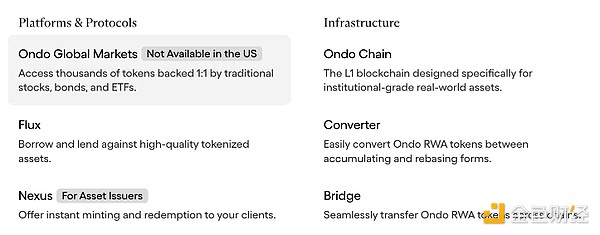

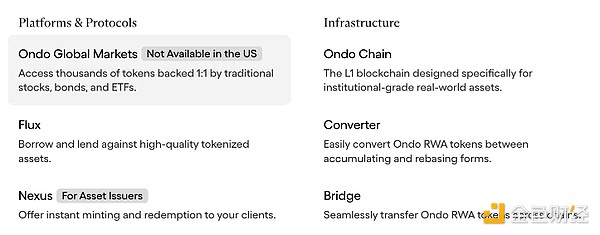

Ondo Global Markets allows access to tokens backed 1:1 by traditional assets, Bridge transfers RWA tokens across chains, and Nexus provides instant minting and redemption for customers. Instead of having to have their own proprietary channels, each bank can use Ondo Chain to eliminate the administrative bloat of traditional finance while making it easy for users to earn on-chain returns and providing developers with a single platform to build on, rather than having to work with each bank to create products.

DeFi promised the dream of financial accessibility, interoperability, and transparency. More than a decade later, we may finally have the infrastructure to connect the web2 world and web3. - Paul Veradittakit

Joy

Joy