Author: Franklin Bi, Partner at Pantera Capital; Cosmo Jiang, Portfolio Manager at Liquid Strategies; Eric Wallach, Investment Analyst; Translation: Jinse Finance xiaozou

1, Blockchain Oligopoly

How many blockchains will there be in the world? This is a question we often hear, but a better question should be: How many blockchains must exist? In other words, how many blockchains are needed at least to fully realize the potential of blockchain technology? To answer this question, we should look to the root of the blockchain ecosystem: developers.

The "customers" of blockchain are developers. The applications and protocols built by developers drive the demand for on-chain bandwidth (i.e., block space). Developer preferences and cultural factors will greatly influence the development path of cryptocurrencies.

Developer-oriented technologies have always tended to gather around a few dominant players - usually two or three oligopolies, each of which uses different methods to meet different developer preferences. We can see this in operating systems (Windows, macOS, Linux), game consoles (Sony, Microsoft, Nintendo), and mobile platforms (Apple, Android). As the technology cycle matures, there may be 70-90% of the market converging to the largest players. Eventually, the market will approach equilibrium unless there is a new breakthrough that breaks the equilibrium and resets the pattern.

Similar patterns are also emerging in the blockchain ecosystem.

2, Solana's path to rise

Ethereum has historically dominated blockchain developer activity, with about 70-80% of blockchain developers developing and building on Ethereum or chains compatible with the Ethereum Virtual Machine (EVM). But Ethereum's dominance seems to be giving way to a multi-polar model.

Solana has gained significant share in the past year. This shift can't help but remind people of Microsoft's dominance in the early desktop computer market, but then Apple broke through with its vertically integrated approach. Solana is now a major competitor for the future development of blockchain.

Solana's monolithic architecture has a product roadmap focused on optimizing its own components, similar to Apple's approach to vertically integrating hardware and software in macOS. This approach has several benefits:

Seamless user experience: Without the need to bridge between multiple chains, Solana provides a smooth, intuitive experience for developers and end users.

Faster innovation: Solana’s streamlined architecture supports more efficient product upgrades and faster iteration cycles.

Enhanced security: By minimizing dependencies and points of failure, Solana’s single-chain design can provide better security and stability, just as Apple’s tight control over its ecosystem can lead to better security and stability.

3, Solana Use Cases

Solana’s architectural advantages support a range of use cases and user experiences that may be more challenging to achieve on modular blockchains such as Ethereum and Cosmos. These characteristics are particularly valuable for use cases such as content distribution, DePIN (decentralized physical infrastructure network), and CLOB (central limit order book).

One notable example of an application leveraging Solana’s capabilities is DRiP, a platform for earning free collectibles from creators, which can be music, art, videos, and more. To date, DRiP has sent 168.95 million collectibles to 227 wallets. Much of its success is due to its ability to send millions of NFTs to collectors around the world for free — something that is only possible on Solana. The platform’s seamless, instant user experience is made possible by Solana’s high-performance blockchain, which allows for fast, low-cost transactions, and is also supported by the compressed NFT standard built by Metaplex, which reduces the cost of minting NFTs to less than a cent.

Another application that showcases Solana’s strengths is Hivemapper, a decentralized mapping network that creates highly accurate, up-to-date, detailed maps using data collected from dashcams, drones, and other sensors. The project uses Solana’s high-speed, low-cost transactions to process the massive amounts of data generated by network contributors and rewards them with tokens for their participation. Solana’s scalability and efficiency make it possible for Hivemapper to create a decentralized alternative to traditional mapping services, with the potential to disrupt industries such as transportation, logistics, and urban planning.

Solana’s high-performance blockchain can also create capital-efficient financial markets. For example, Phoenix is a Solana-based decentralized exchange built on an on-chain CLOB (central limit order book). This approach leverages Solana’s 4,000 transactions per second processing capacity, 400 millisecond block times, and low fees to bring a trading experience similar to Nasdaq or CME. Similarly, MarginFi is a Solana-based lending protocol that manages collateral with greater speed and predictability, enabling collateralized borrowing of long-tail, volatile assets. Solana’s speed and low fees are key to MarginFi’s ultra-efficient liquidations, helping to minimize the impact of bad debts on other market participants—particularly useful during Wall Street’s last financial crisis.

These are just a few examples of how Solana’s monolithic architecture enables high-quality applications. As more developers realize the many advantages of building on Solana, we will see more and more innovative projects using Solana's high-performance blockchain.

4, Strong Fundamental Growth

The situation on Solana is changing in real time, and key fundamentals such as user growth and transaction fees are accelerating at a rapid pace. Solana has become a major destination for retail users and meme coin traders, replacing Ethereum's NFT dominance in the previous cycle.

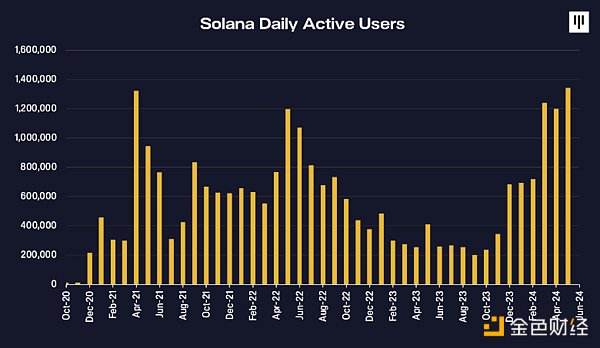

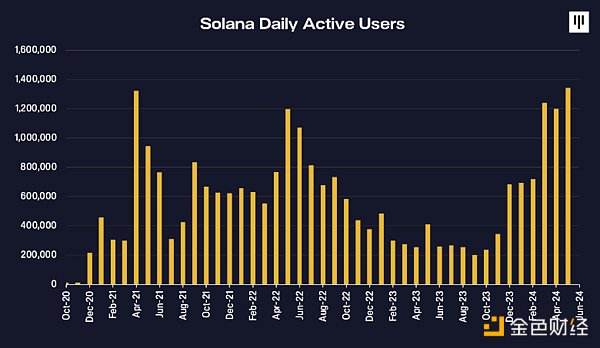

Solana's unique active addresses soared from 14,000 in October 2020 to 202,000 (local low) in October 2023, and now have reached nearly 1.34 million, showing an astonishing growth in user activity on the platform. At the same time, priority fees on the network have also exploded, soaring from less than $100,000 per month in mid-2023 to an all-time high of more than $60 million in March 2024, highlighting the strong demand for Solana block space.

One of the most obvious signs of Solana's soaring retail adoption is the explosive growth of new tokens in its ecosystem. Starting in January 2024, a large number of new tokens have poured into Solana, far exceeding the number of other chains such as BNB, Ethereum, and Polygon. Solana accounts for 85% of all new tokens on DEXs by May 2024, up from 50% a year ago. The growth of Solana-based tokens reflects the strength of Solana’s retail adoption driven by meme coin activity.

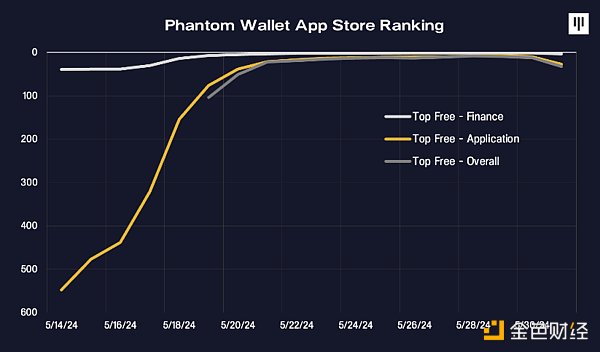

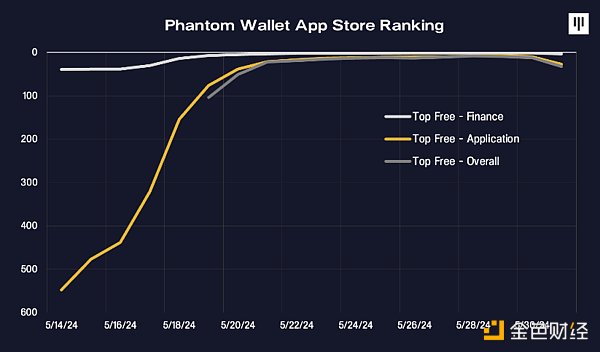

Solana’s main wallet, Phantom, dominates the iOS App Store rankings, further validating the influx of retail Solana users. From late May to early June, Phantom was ranked #1 in the Finance category. Even more astonishingly, it topped the charts in all categories of free apps, beating out the very popular social media, entertainment, and gaming apps. For a crypto wallet, becoming the most downloaded app in the entire US App Store is an amazing feat, indicating massive mainstream adoption of Solana. This influx of retail users is closely tied to the meme coin trading boom on Solana DEX.

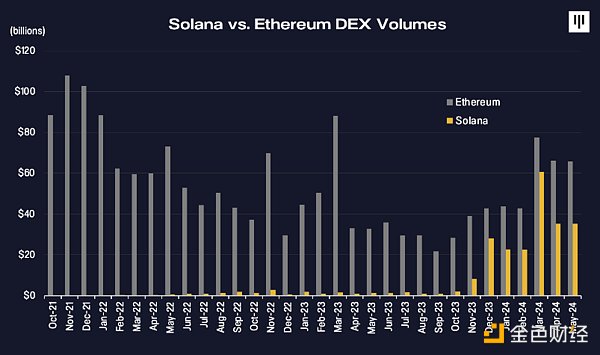

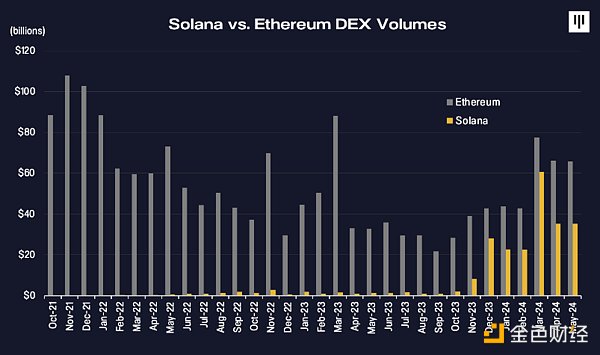

Speaking of DEXs, Solana’s share of decentralized trading has soared from almost zero at the beginning of 2021 to over 24% in May 2024. The rate of growth is astonishing, with Solana accounting for over 60% of incremental DEX trading in May 2024 alone. This shows the incredible momentum behind the Solana DEX ecosystem and highlights how its high-performance architecture is enabling it to quickly take market share from competitors.

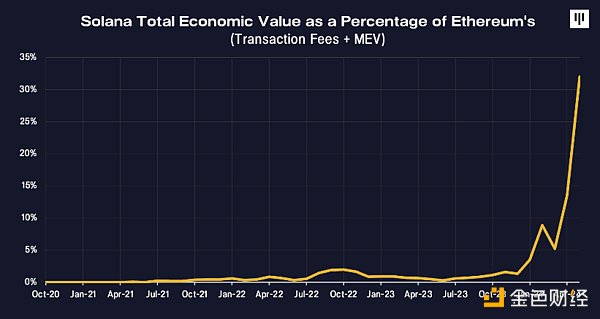

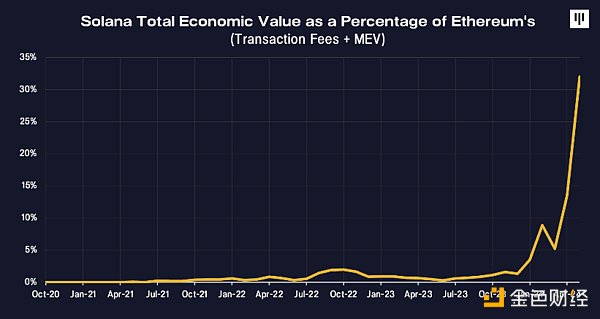

Crucially, Solana's soaring user activity and DEX trading volume are translating into real economic value for SOL token holders. Measured in transaction fees and MEV, the total value generated by Solana transactions has grown to a level comparable to Ethereum. This highlights that Solana is gaining more and more adoption, creating a powerful flywheel effect - more use drives more fees, which in turn attracts more stakers, making the network more decentralized and secure.

To sum up, Solana's expanding retail user base, record-breaking token issuance, DEX growth dominance, and surge in staking rewards constitute amazing fundamentals. Solana's architectural advantages enable it to capture a huge share of the new demand flowing into the blockchain field, accelerating its rise to become a competitor to Ethereum. With the fundamentals firing on all cylinders, Solana seems ready to continue its upward trajectory.

5 Conclusion

Solana's monolithic design and relentless focus on optimization provide unique advantages in user experience, developer agility, and security. As the blockchain industry matures, these advantages enable Solana to thrive and gain market share from fiercely competitive ecosystems.

While the road ahead is not smooth, Solana’s fundamentals are moving at full speed. Retail adoption is soaring, developers are flocking to build breakthrough applications on Solana, and value capture is accelerating. As the Solana ecosystem continues to grow and mature, Solana’s architectural advantages and vibrant community both indicate a bright future.

JinseFinance

JinseFinance