Written by Paul Veradittakit, Partner at Pantera Capital Compiled by Luffy, Foresight News

One week after the US election, cryptocurrency market sentiment remains strong. Polymarket, Bitcoin, and potentially more efficient and crypto-friendly governments are all worth looking forward to.

Polymarket

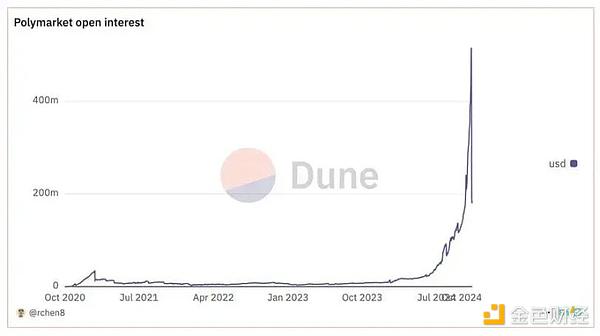

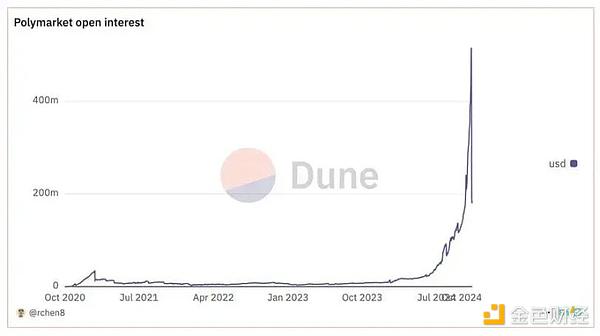

Polymarket is a prediction market based on the Polygon blockchain that saw a surge in adoption during the election, with $3.2 billion in election bets, orders of magnitude higher than before the election. Compared to other prediction markets, Polymarket charges no fees, supports seamless transactions, and is decentralized, meaning that anyone can trade directly with the underlying contracts on the chain through an API (allowing anyone to create a trading bot), and anyone from a non-blacklisted region can access the website frontend.

Amount of bets on Polymarket

Although the amount of bets dropped significantly after the election, mainstream users have tried and prefer using Polymarket over other centralized applications. A noticeable phenomenon after the election was the discussion of Polymarket's accuracy in the mainstream media. The Economist, the Wall Street Journal, Forbes, etc. have all called Polymarket the largest prediction market and used it to judge the difference between polls and voting sentiment before and after the election.

Hopefully, the enthusiasm for Polymarket will permeate the broader crypto ecosystem and inspire more crypto applications to learn from Polymarket's practices and pursue better usability, abstraction, and marketing.

Bitcoin and Altcoins

The price of Bitcoin hit a new all-time high, soaring to $77,000 immediately after the election and has been on a tear since then, approaching $100,000. Altcoins indirectly related to the election have also risen sharply, such as those on Solana. Trump's election as president did not directly lead to an increase in Bitcoin's purchasing power, but his public support was enough to cause the coin to rise.

Expectations

The positive forces brought to the cryptocurrency industry by the election itself may not last forever. However, the impact of a unified Republican majority in the House and Senate could mean a more efficient government and more legislation related to cryptocurrencies.

The number of pro-crypto representatives in both parties significantly outnumbers the number of anti-crypto representatives (266 to 120 in the House of Representatives and 18 to 12 in the Senate). A pro-crypto Trump could either ease up on cryptocurrency regulation or push for pro-crypto regulation. World Liberty Financial is a cryptocurrency project that Trump is promoting and says will run as an Aave instance, one of the largest DeFi protocols.

What does this mean for the future of cryptocurrencies? First, it could mean that lobbying efforts, such as those from Ripple and Coinbase, could increase to push cryptocurrency regulation in a friendly direction.

It is believed that regulation in the United States has been unclear, and clear regulation will completely change the way crypto companies think about operating in the United States. Most of the largest cryptocurrency venture capital firms are still based in the United States, so allowing funded crypto companies to operate in the United States can enhance the crypto industry.

Top DeFi protocols such as Compound and Uniswap have also shown new interest in previously "forbidden" protocol features such as staking, fee conversion, etc. Increased regulatory clarity on these features may prompt a new round of innovation in the DeFi space.

Overall, I am very optimistic about the direction of the crypto industry after the election. A unified House and Senate may bring unexpected good news to the ever-changing crypto industry.

Anais

Anais