Author: Franklin Bi, Partner at Pantera Capital; Translated by: 0xjs@黄金财经

What does the path to mainstream crypto look like?

When you get past the noise and speculation, that’s the question that matters most. As investors, our job is to find the path to adoption because that’s where we find the next 100x opportunity.

But the best venture capitalists don’t predict the future. They look at the present with great clarity.

One thing is clear about the coming year: 2025 will be a turning point for the crypto industry.

Imagine what the internet would look like if Jeff Bezos went to jail for selling books online. What would the internet look like if Steve Jobs was sanctioned for launching the App Store? Or what would the internet look like if Jensen Huang was forced to create Nvidia outside the United States because a stranglehold operation shut down his bank account? This is the period of confusion our industry is emerging from.

2025 is the first time in blockchain history that entrepreneurs, regulators, and policymakers can finally unlock the path to adoption.

With the road now open to the future, we return to the original question: What lies ahead on the road to adoption? Where will the biggest opportunity - the next 100x or even 1000x investment - appear?

Just as “SoLoMo” (Social/Local/Mobile) unlocked the potential of the Internet in the 2010s, the convergence of three major trends will unlock the adoption of cryptocurrencies from 2025 onwards:

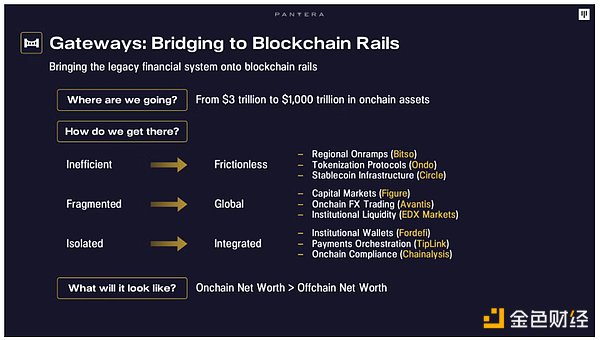

Gateways – Bringing traditional financial systems onto blockchain rails;

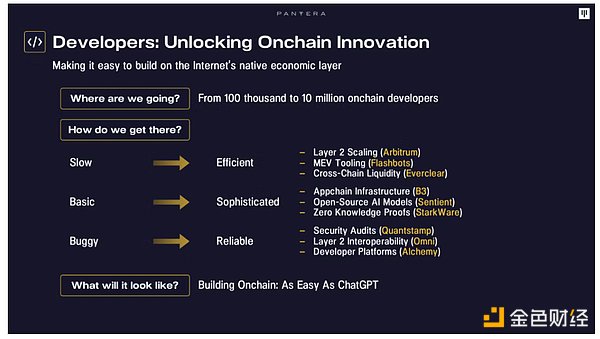

Developers – Easily building on the Internet’s native economic layer;

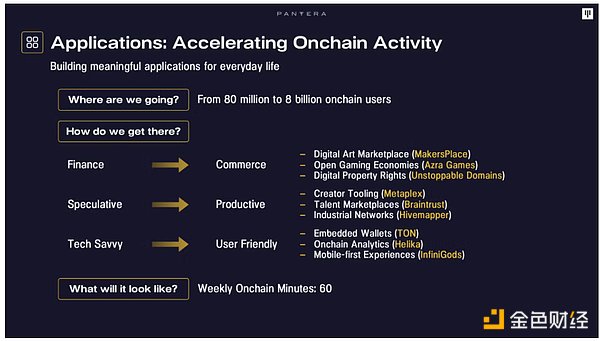

Applications – Building meaningful applications for everyday life.

Gateways

From the introduction of electronic trading in the 1970s to the digitization of payments today, Wall Street has experienced 50 years of software upgrades. The steady, inevitable march of software eating finance has taught us one thing: all financial assets eventually migrate to where they flow most freely, trade most efficiently, and are worth the most.

Today, blockchain networks secure $3 trillion in crypto assets (Bitcoin, Ethereum, etc.) and a small but mighty asset-backed token (tokenized dollars and U.S. Treasuries). Total financial assets held by households, governments, and corporations around the world are over $1,000 trillion (1 quadrillion!). That means we still have 300x more potential to grow.

Where are we in the game? The players haven’t even gotten off the bus yet. The world’s balance sheet is now starting to migrate to blockchain rails. To succeed, we need gateways to connect us to the legacy financial system.

We must scale platforms that can effectively onboard new users and existing assets. Regional remittance platforms like Bitso in Latin America are using blockchain to process over 10% of US-Mexico remittances. Tokenization platforms like Ondo are going head-to-head with Franklin Templeton and BlackRock to put over $20 trillion of US Treasuries on-chain.

Cryptocurrencies are giving rise to the first truly global capital markets, enabled by real-time settlement and borderless liquidity. But global markets require global trading venues. Exchanges like Figure and Avantis are integrating global supply and demand, transforming FX, credit, and securities markets simultaneously.

Finally, we need products that work with existing systems, not just a parallel crypto universe. They might look like advanced wallets for institutions from Fordefi. Or simple, grandma-friendly solutions like TipLink for sending payments.

What will it look like when we get there? We believe there will be a day when the value of your net worth on-chain exceeds the value off-chain. Once migrated on-chain, your wealth can flow instantly around the world. It can be traded at low cost, without intermediary fees, and has access to global demand to achieve its highest value. This is the point of no return.

Developers

There are currently about 100,000 developers building applications on the blockchain. That’s equivalent to half of a Silicon Valley tech giant. To achieve mainstream adoption, we need to increase this number 100 times and onboard 10 million developers.

Unleashing the creative potential of blockchain technology is critical. Just as providing better tools for mobile developers unlocked the potential of Apple’s App Store, we need tools that make it easier to build applications on the chain and create useful new products.

In 2025, the blockchain development stack will take a major leap forward. A critical step depends on making blockchains themselves more developer-friendly. Scaling solutions like Arbitrum’s optimistic rollup technology created crypto’s first “broadband moment.” But upgrades like the Arbitrum Stylus could have an even greater impact. Stylus enables developers to write smart contracts in a variety of major programming languages like C, C++, and Rust, opening the door to more than 10 million developers worldwide. Zero-knowledge technology was once considered too intimidating to enable practical development. But new tools like the StarkWare Development Kit make zero-knowledge implementation easier than ever. Today, zero-knowledge proofs are powering products like the Freedom Tool, Rarimo’s blockchain voting tool that has been deployed in Russia, Georgia, and Iran to increase democratic participation. Tools and infrastructure to support blockchain development will play a vital role in driving progress. Platforms like Alchemy are helping developers build and deploy on-chain applications at scale. By streamlining the development process, Alchemy has already helped many projects succeed, from decentralized finance (DeFi) protocols to gaming applications. As the blockchain ecosystem continues to grow, these developer platforms must keep pace and enable developers to push the boundaries of what is possible on-chain.

In 2025, the multi-chain world will continue to grow, and likely at an even faster pace. As developers face increasingly complex challenges, new chains continue to emerge to meet them, each with their own strengths and weaknesses in terms of computation, execution, or decentralization. To meet specific use cases like gaming or trading, application-specific infrastructure like B3 is taking shape. This explosion of chains, L2s, and app chains requires seamless connectivity, which is where cross-chain liquidity solutions like Everclear and interoperability protocols like Omni come into play - allowing developers to focus on building novel applications.

Web development has evolved from raw coding to intuitive no-code solutions, now controlled by AI. We expect a similar evolution in blockchain development. Each wave of technological advancement and developer-centric tooling will usher in a new wave of talent. Eventually, building on-chain applications may become as easy as having a conversation with ChatGPT.

Applications

How many people are on-chain users today?

According to most estimates, the number of on-chain users is around 80 million. Much of this growth stems from the appeal of cryptocurrency as "Wall Street 2.0" - a new place to raise funds, speculate, and remit money. But expanding the number of users 100 times to 8 billion will depend on cryptocurrency's transition from Wall Street to Main Street.

2025 may well be the turning point for mainstream adoption of cryptocurrency. It will be blockchain technology’s “FarmVille moment”. FarmVille was Facebook’s first social gaming hit. It drove the network’s first exponential growth, transforming it from a photo-sharing app into a global platform.

Crypto is accelerating toward its own “FarmVille moment”. Onchain features are being integrated into new games and social apps. Game studios like InfiniGods are creating first-time onchain users. Their mobile casual game King of Destiny has had over 2 million app downloads in the past year, attracting people who spend more time on Candy Crush than on Coinbase.

Onchain gaming, social, and collectibles activity account for about 50% of today’s unique active wallets. As we have a diverse user base engaging in on-chain commerce, it’s clear that blockchain will disrupt more than just Wall Street.

A new class of “productive” applications is leading a new industrial revolution. The rise of the enterprise gives way to the rise of the Industrial Network. Also known as DePIN, these applications focus on underserved markets in areas such as wireless connectivity, hyperlocal data, and human capital. They do this through on-chain coordination and market-driven mechanisms. Hivemapper is a decentralized mapping network that has mapped over 30% of the world’s roads, thanks to over 150,000 contributors, providing more timely and accurate data than Google Maps.

Importantly, these “productive” applications are tapping into real revenue streams. By 2025, we believe the DePIN industry will generate more than $500 million in annual revenue by 2024. These industrial-grade cash flows provide a path to profitability based on real-world utility, building a powerful commercial engine for new capital to flow into the on-chain economy.

But how do we get these applications into the hands of 8 billion people? New distribution models capable of reaching hundreds of millions of consumers at scale will emerge in 2025. Cryptocurrency exchanges such as Coinbase, Kraken, and Binance are creating their own chains to bring customers on-chain. Telegram and Sony are incorporating Web3 capabilities into their massively influential platforms. Gaming companies are relaunching popular games like MapleStory with on-chain capabilities, potentially attracting millions of players. Institutions such as PayPal and BlackRock are launching on-chain financial and payment solutions. The convergence of these trends in 2025 will lead to a critical turning point. When the average person has a reason to spend 60 minutes a week on-chain, "on-chain" will become the new "online." Forget "killer apps." Just like we switch between apps on the internet, people will have many reasons to spend time on-chain. They may do so for entertainment, connections, or to make money. At that point, the on-chain economy will quickly become part of our daily lives.

Future Outlook

Next year will usher in a new era in which blockchain technology will begin to integrate into our daily lives, just like the internet did. The shift from Wall Street to Main Street is not accidental - it is accelerating, driven by entertainment, business, and utility applications.

To achieve this, we need to invest in more accessible gateways, improved technology and developer tools, and applications that solve real problems.

The road ahead of us in 2025 remains filled with 100x opportunity as mainstream adoption of cryptocurrency becomes a reality.

As a wise man once said, "The best way to predict the future is to create it."

Davin

Davin

Davin

Davin Weiliang

Weiliang Joy

Joy Miyuki

Miyuki Brian

Brian Brian

Brian Weiliang

Weiliang Miyuki

Miyuki Alex

Alex Alex

Alex