Author: Cosmo Jiang, Portfolio Manager at Liquid Strategies; Erik Lowe, Head of Content at Pantera; Translator: 0xjs@黄金财经

As we approach the middle of the year, we wanted to take a moment to share our thoughts on the market rhythm so far this year. After a rapid rise at the beginning of the year, digital asset prices retreated in the second quarter. Every period of strong performance is followed by a period of consolidation. Inevitably, during this period, some people will throw in the towel and start calling for the end of the cycle, especially in asset classes that are more volatile than most. While digital asset prices have seen some recovery in July, we wanted to provide our thoughts on what happened and why we remain bullish on the future.

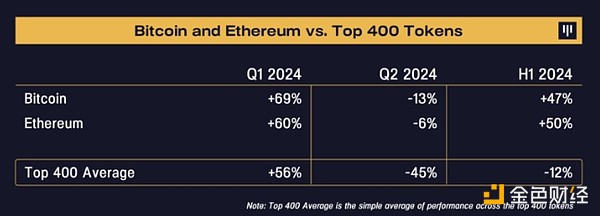

Following the broad market gains in the first quarter, the top 400 tokens fell an average of 45% in the second quarter and were down 12% year-on-year as of June 30.

Below we point out several macro-related and crypto-specific reasons for this decline.

The main macro headwind in early April was that the market began to re-price the scenario of higher long-term interest rates, as the economy remained strong and inflation was high, in stark contrast to the previous view that interest rates would be quickly lowered. In crypto, the market was dragged down mainly by concerns about excess supply. For Bitcoin, the German government began to liquidate its $3 billion position and the $9 billion Mt.Gox distribution schedule was also confirmed. Long-tail tokens face supply resistance, which comes from both the increase in new token issuance, investor distraction and limited capital, and private investors' continuous profit from newly issued tokens over the past year. Additionally, the SEC’s investigations into Consensys and Uniswap have created some uncertainty for certain protocols.

Overall, breadth has been narrow, with the crypto space as a whole significantly underperforming Bitcoin and Ethereum so far this year, similar to the dynamics of the stock market this year, with the Big Seven holdings against the rest. To help illustrate this, we’ve included below the distribution of returns for the top 400 tokens by market cap this year.

This has been a one-size-fits-all period for the long-tail tokens. We say this because the sell-off has been widespread — nearly 95% of tokens have underperformed Bitcoin and Ethereum, and nearly 75% have underperformed this year. Looking at the performance by sub-category, Q2 has been largely the same - nearly every major sub-category is down 40-50%.

We believe altcoins have underperformed for the following reasons:

1) Attention has been largely focused on Bitcoin and Ethereum due to key regulatory approvals

2) New token issuance this year has diluted available capital and attention

3) The market has been more cautious about tokens with large unlocks from private investors, which could fuel selling pressure for the remainder of the year

As often happens in underperforming markets, we are seeing commoditization of tokens, failing to adequately differentiate between protocols with stronger and weaker fundamentals. As investors, it is important that we do not fall into the same trap and generalize. As prices and sentiment begin to rebound, this phenomenon provides an excellent opportunity for token selection. We believe that tokens with strong fundamentals and good growth prospects will outperform as diversification increases. We have already seen evidence of this in early July.

Why We Are Positive

Price and Fundamentals - If you look at price action alone, especially for long-tail tokens, the market appears to be weak, with many tokens underperforming this year. However, this is in stark contrast to the improvement in fundamentals, such as on-chain users and activity, both of which have clearly accelerated from the bear market lows of the past two years.

In addition, there are many green shoots of innovation in this cycle, such as AI-related blockchain protocols, decentralized physical infrastructure networks ("DePIN"), and decentralized social.

We believe that everything is actually much cheaper now on a price-to-fundamentals basis than at any time during the recovery.

Regulatory Shift - One of the biggest impediments to the growth of the crypto industry has been the negative attitude of US regulation. We are seeing a 180-degree shift in real time right now.

Trump turned in favor of crypto in early May, followed by legislative developments like FIT21 and the approval of an Ethereum ETF.

Having prominent politicians publicly support crypto is great for our industry. We believe they realize that being supportive of crypto is the same as being supportive of innovation, and being against innovation does not win votes and can even be anti-American. Polls show an increased likelihood of pro-crypto regulators and authorities emerging after the November election.

As far as tokens are concerned, we are optimistic that the shift in political and regulatory stance towards crypto will begin to drive positive change. To date, regulatory ambiguity has led to unfortunate volatility in the cryptocurrency space. Currently, if a token clearly has no value, it is legal, but if a token creates value and attempts to return that value to token holders, it is illegal. This creates completely the wrong incentives, attracting bad actors and hindering good actors. With regulatory clarity, we believe we are headed in the right direction to correct this, and tokens with real value tied to strong fundamentals will stand out, while those without real value will not be rewarded. In fact, the FIT21 bill recently passed by the House of Representatives begins to lay the foundation for such sensible regulation.

We believe this paves the way for innovation and blockchain to flourish and continue to grow in the United States.

Position and Sentiment - The technical indicators we observe describe the current position as "very clean", i.e. "good entry point".

Looking at futures open interest, a lot of leverage has been washed out of the system. Many altcoins returned to the lows of September 2023 before this rally began. The Crypto Fear and Greed Index measured by CoinGlass just hit its lowest level since the depths of the bear market in December 2022 after the FTX crash. Sentiment is as fearful now as it was then.

Based on these indicators, we believe today's position and entry point are attractive.

Macro – Recent macroeconomic indicators show that inflation is finally starting to cool, which gives the Fed a signal to start cutting interest rates. CPI deflation was -0.1% month-on-month in June, the first since 2020. While the unemployment rate rose slightly to 4.1%, it is still at a stable level.

From the rhetoric of Powell and several more dovish Fed members, it can be seen that rate cuts may be closer than most people on Wall Street realize, and rate hikes may very well be off the table. This is a big deal.

The shift in Fed policy from restrictive rates to supportive rates is very favorable for high-growth early-stage technologies such as cryptocurrencies. There is a lot of capital on the sidelines. Money market fund assets reached $6 trillion, a record high. With interest rates expected to fall later this year and money market fund yields falling, we believe capital will return to high-growth assets.

Entering Phase 2 of the Bull Market

Our thesis is that protocol tokens with product-market fit and strong unit economics that generate real revenue and have strong unit economics will perform best in this cycle. We have previously described how these tokens outperform other tokens in the second phase of the bull cycle when market breadth broadens from major tokens.

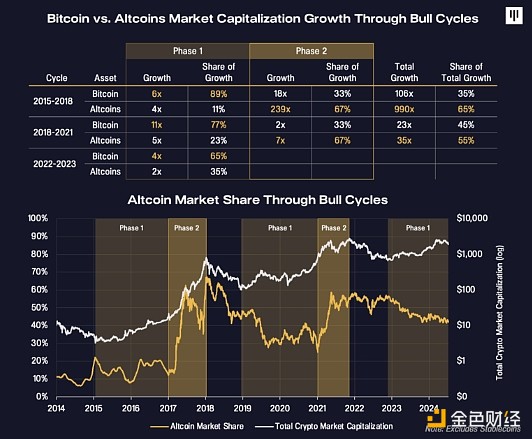

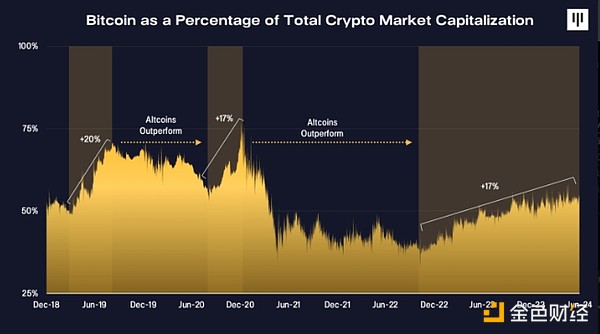

Looking back, we observe that historically there are two distinct phases in bull cycles. The first phase is the early stages of the rally, where Bitcoin tends to outperform the rest of the market. The second phase is the late stages, where altcoins tend to outperform the rest of the market. The chart below highlights these phases, showing how Bitcoin grew relative to altcoins in each phase, and how altcoins performed throughout the bull cycle, with most of the gains occurring in the second phase.

We believe we are entering the second phase. Historically, Bitcoin's dominance has increased by 15-20 percentage points in the first phase of each previous cycle, and at this stage of the cycle, it has increased by 17 percentage points. We believe we are closer to the end of Bitcoin's dominance than the beginning, and the next phase will be meaningful outperformance of fundamentally sound tokens.

JinseFinance

JinseFinance

JinseFinance

JinseFinance ZeZheng

ZeZheng Wilfred

Wilfred JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance YouQuan

YouQuan Bitcoinist

Bitcoinist