By Dan Morehead, Founder and Managing Partner of Pantera Capital, and Cosmo Jiang, General Partner of Pantera Capital; Translated by Golden Finance. HSDT – A Data Access Provider Dedicated to Building the Preeminent Solana Treasury. By Dan Morehead, Founder of Pantera. We are pleased to announce that Pantera has led a funding round exceeding $500 million in Helius (NASDAQ: HSDT), the Solana DAT. This investment, made through a private equity (PIPE) round, raises Helius up to $1.25 billion in total potential proceeds. Helius, in partnership with Pantera and Summer Capital, is committed to building the preeminent Solana treasury. By leveraging capital market opportunities and on-chain activity, Helius aims to maximize the number of Sol units held per share and provide public market investors with optimal access to Solana's long-term growth through familiar equity instruments. Why now? Why Helius? Providing investors with access to a full range of blockchain assets has always been Pantera's core goal, and Helius is an extension of that goal. Pantera's vision is to significantly increase access to the Solana ecosystem for both institutional and retail investors and drive its global adoption. Pantera has been at the forefront of the emerging DAT industry, having led the initial public offerings of the first digital asset treasury companies in the United States, including DeFi Development Corp. (ticker: DFDV) and Cantor Equity Partners (ticker: CEP). Pantera was also the lead investor in BitMine (ticker: BMNR), where Tom Lee of Fundstrat serves as Chairman. Currently, Pantera manages over $1 billion in digital asset treasury exposure and has completed over 15 investments, making it one of the largest investors in the DAT space. Today, we are applying all of our experience to build the most efficient Solana treasury on the market. This year, public equity markets have clearly embraced digital assets. We believe Helius will provide a new generation of investors with access to this leading monolithic blockchain. Helius is the intersection of global capital and Solana's growth flywheel. We will combine our long-term confidence in Solana, the credibility of Wall Street, and our expertise in digital asset treasuries to drive Solana into the next phase of adoption.

Solana DAT Investment Logic

Author: Cosmo Jiang, General Partner of Pantera

DAT's investment logic is based on a simple premise (see Jinse Finance's previous report "Why we are bullish on DAT"): DAT can increase net asset value per share (NAV) by generating income, and in the long run, its underlying token holdings will exceed the level of simply holding spot.

Therefore, the potential returns of holding DAT may be higher than holding tokens directly or through ETFs (exchange-traded funds). The success of a DAT hinges critically on the long-term value stability of its underlying token—which is why we chose Solana as the DAT's core reserve asset. Solana: The Most Commercially Viable Blockchain We believe Solana has the potential to become the platform of choice for consumer applications and decentralized finance (DeFi) thanks to its highly scalable infrastructure, extremely low transaction fees, and high accessibility for all connected users. Solana's market share in on-chain economic activity continues to grow, and we believe this trend will continue for years to come. Blue-chip financial institutions such as BlackRock, PayPal, and Stripe have recognized its practical value and have begun developing based on its user- and developer-friendly architecture. Solana's strengths lie in technology, user adoption, economic outcomes, and real-world integration: Solana's core advantages can be summarized in three key points: speed, low cost, and accessibility. I often think back to Jeff Bezos's "trinity of customer needs"—the cornerstone of Amazon's philosophy and the core of the company's remarkable growth. I see the same clarity of vision and this same trinity in Solana, which strengthens my confidence.

Solana adopts a "monolithic" design philosophy, focusing on creating a unified user experience and maximizing the performance of its core chain - similar to Apple's design philosophy. Solana aims for high performance and low cost from the ground up, with the base layer capable of processing tens of thousands of transactions per second.

This difference is crucial, especially for mainstream consumer adoption: users need the speed and cost advantages of Web2. For this reason, the vast majority of innovative blockchain applications (covering areas such as payments, games, social applications, and DePIN) have chosen to launch on Solana over the past year.

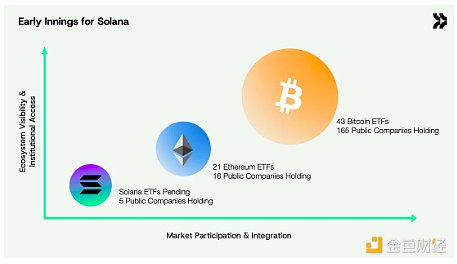

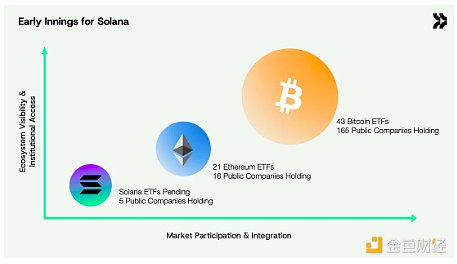

We believe that blockchain applications are still in their early stages and that on-chain activity is expected to grow by more than 100 times in the future. For these mass-market applications, Solana has a significant advantage in user experience. Relevant data is gradually confirming this trend. The launch of the Bitcoin ETF in January 2024 marked a significant turning point in Bitcoin's institutional adoption. While the Ethereum ETF did not immediately have a similar impact, the Trump administration has removed many of the regulatory barriers that previously hindered Ethereum's development, and Ethereum is now entering a critical period of institutional adoption. We believe Solana will be the next blockchain project to embrace this opportunity.

In terms of market capitalization, Solana is still only a fraction of Ethereum and Bitcoin, but its number of daily active wallets is higher. The Solana ecosystem has also attracted the most new developers - more than 7,500 new developers in 2024 alone. Currently, institutions are severely under-allocated to Solana: they hold less than 1% of the total SOL supply, compared to 7% for Ethereum (ETH) and 16% for Bitcoin (BTC). With the Solana ETF expected to be approved as early as Q3/Q4 2025, we believe Solana's adoption is just beginning, with asymmetric upside potential. Helius aims to provide investors with optimal access to Solana's growth, with the core goal of maximizing Solana per share (SPS). The project is chaired by Joseph Chee, founder of Summer Capital and former Head of Asia Investment Banking at UBS, and Pantera, the asset manager, is responsible for executing the treasury strategy. Solana is designed to generate income, while BTC does not. Helius plans to leverage this inherent characteristic of the Solana architecture. The following framework outlines Helius' core operating mechanism—three expected sources of return—designed to create long-term value for investors. Helius connects the open markets to Solana, bringing liquidity to staking and on-chain activity, driving a growth flywheel that strengthens the Solana network while compounding value for shareholders. We believe Helius is more than just an asset holding tool; it's an active asset treasury platform—designed to accelerate Solana's central role in driving the next generation of global financial and consumer applications. A Channel for Mass Investors to Participate in Solana By Dan Morehead, Founder of Pantera For 12 years, Pantera has been at the forefront of innovation in blockchain investment access: launching the first Bitcoin fund, the first blockchain venture capital fund, and the first fund focused solely on private tokens. Previously, most of our funds required a minimum investment of $1 million and required investors to meet the extremely high wealth standards set by the U.S. Securities and Exchange Commission (SEC) as "Qualified Purchasers." Today, we are launching HSDT, our first access tool for mass investors. On September 14th, the Wall Street Journal published a fascinating article about Mark Casey and his relationship with DAT. This article provides excellent perspective on why we support DAT. Mark is my friend and neighbor. A few years ago, I wasn't paying much attention to MicroStrategy because I was busy with other blockchain-related matters. When I learned that he owned over 10% of the company, I couldn't help but ask him, "Why?" His answer remains memorable: "I manage a mutual fund under the Investment Company Act of 1940, and investing in MicroStrategy is my only way to gain exposure to Bitcoin." This decision paid off handsomely for his investors: Capital Group's investment in MicroStrategy grew from less than $1 billion to over $6 billion. Solana is Pantera's largest holding, with $1.1 billion under management. Before the approval of the Solana ETF, investors had difficulty easily accessing Solana—HSDT changes that. Now, anyone with a brokerage account can invest in Pantera's largest holding. Finally, let's discuss why Solana is so important in a portfolio: The Pantera Bitcoin Fund has returned over 1,500x. Bitcoin is the best-performing asset I've ever seen in my career, generating $2.3 trillion in returns for hundreds of millions of people. Pantera itself has distributed over $10 billion in Bitcoin to investors, now valued at over $10 billion, and has also directly generated $5 billion in profits for investors. Solana is still in its early stages of development, with a market capitalization of only 5% of Bitcoin. The two serve completely different purposes, so I wouldn't assert that Solana will replace Bitcoin. My core point is that, at this stage, Solana's future upside potential may be greater than BTC's.

Weatherly

Weatherly