Author: NingNing, Crypto Observer Source: X, @0xNing0x

In the post-Cancun upgrade era, Ethereum equivalence is no longer inherently correct.

The core of Ethereum equivalence is EVM compatibility. EVM compatibility is important not only because of EVM's simplicity and reliability and the completeness of development tools, but also because EVM's developer community and the scale of deposited assets are far ahead. EVM compatibility, obtaining developers, users, capital and other resources from the Ethereum ecosystem, is a shortcut to quickly start and reach the PMF point for any chain/Rollup.

But EVM is far from perfect. Compared with the VM characteristics of the high-performance public chain, its state data account mechanism and serial state data processing have a sense of comparison between a 19th-century ironclad ship and a 21st-century destroyer.

The Transmutation of Digital Forms of Crypto Assets

After the Cancun upgrade, although the gas fee of the mainstream Rollup L2 dropped by two orders of magnitude, the expected explosion of the Ethereum L2 ecosystem did not come as expected. Instead, we welcomed the strong growth of high-performance public chain ecosystems such as Solana and Sui. This has caused some keen minds in the crypto industry to begin to reflect on whether the general Rollup L2 expansion solution, which aims to pursue the complete equivalence of Ethereum as the ultimate goal, has gone in the wrong direction.

At present, the parallel expansion solution has three main shortcomings: EVM compatibility and consistency of underlying mechanisms make the Ethereum mainnet and the Dapps in the Ethereum general L2 ecosystem highly homogeneous; the L1-L2-L3 hub-and-spoke network structure also deprives the sovereignty of Dapp developers to a considerable extent; the 1+1+1+1+1+*+n linear scalability enhancement implemented by many L2s has a clumsy feeling of mechanical Lego stacking.

Therefore, both parallel expansion solutions and vertical expansion solutions are necessary. Perhaps it is time to try to introduce the transaction parallel processing capabilities of high-performance public chain VMs into the Ethereum ecosystem to create some chaos and uncertainty. Recently, parallel EVM projects Monad, Movement, and Lumio (Pontem) have officially announced a new round of financing led and participated by top crypto VCs.

Monad and Movement are well-known, needless to say. Let's focus on the relatively low-key Lumio.

Lumio is a parallel EVM project developed by the Pontem team. It is positioned as the altVM layer of Ethereum and is a VM abstraction protocol that supports multiple VMs such as Move, SVM and WASM. This altVM layer supports out-of-the-box use, and only requires minimal modification, allowing teams in non-EVM ecosystems to "copy and paste" their code on Ethereum, and only need to maintain a code base to minimize technical debt.

The Pontem team is a team with strong engineering capabilities. It has been deeply cultivating the high-performance public chain ecosystem of the Move system since the Diem period. The team has now developed two mature products in the Aptos ecosystem: Liquidswap AMM and Pontem Wallet. These two products have an average of ~10,000 active addresses per day. Among them, Liquidswap has a cumulative Tx number of 8 million, 700,000 unique addresses and a daily transaction volume of ~2 million US dollars.

To simply summarize the history of Pontem, it is a process of wallet optimization and DEX, and DEX optimization and parallel EVM.

The Pontem team has rich experience in application development, so when designing the architecture of Lumio, they pay great attention to protecting the sovereignty of developers and providing developers with the highest possible degree of freedom.

Lumio is designed to support any chain and any VM to help developers get rid of the shackles of product supply chain. The modularity at the VM level allows developers to choose their favorite VM (SVM, EVM, MoveVM) to deploy their favorite L2 and L1 on Lumio, such as Optimism and Solana, without affecting performance and interoperability.

Lumio integrates basic components such as OP Stack, Arbitrum Orbits' shared sorter and cross-chain bridge to achieve shared status and unified liquidity between Dapp on Lumio and mainstream L2.

The shared state and unified liquidity between Lumio and L1 ecosystems such as Solana are achieved through cross-VM calls. In the next step, the Pontem team plans to support the shared state and unified liquidity of Lumio and other L1 ecosystems such as Bitcoin and Ton.

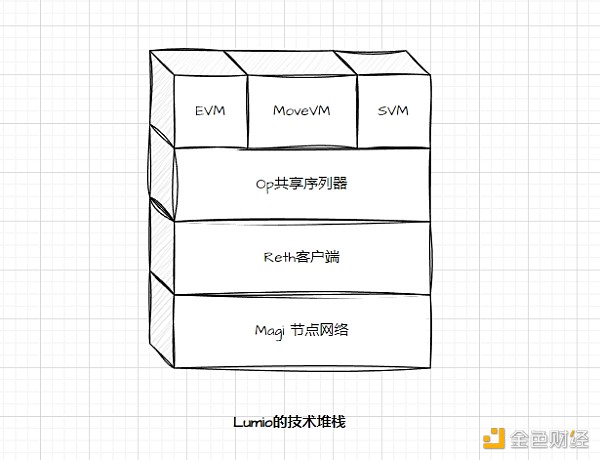

In order to achieve the above Lumio protocol design goals, Pontem reused a large number of OP Stack components, especially its RUST instance. Lumio's technology stack consists of the Magi node network developed by A16Z + Rust language Ethereum client Reth + OP Stack shared sequencer + altVM layer.

Such a technology stack design can not only make full use of the high performance and security features of parallel EVMs such as SVM and MoveVM, but also maximize the compatibility with EVM and the consistency of UX (user interaction). The first mainnet iteration of Lumio, SuperLumio, can also be regarded as an OP superchain.

This makes Lumio naturally have a strong connection with other OP superchain projects, such as OP mainnet, Base, Aevo, Worldcoin, Redstone, Mode and other Rollups, and together form a robust, prosperous and diverse L2 ecosystem.

To be honest, compared with Monad and Movement, Lumio's parallel EVM implementation is a "glue-like" engineering thinking solution, with the advantages of fast availability, friendly developer learning curve, and stable and reliable. Although it does not have as high a concentration of new technology primitives as the first two solutions, it is still an excellent and novel Ethereum scalability L2 solution.

Finally, let me add some details about Pontem's latest round of financing: In January 24, Pontem announced a round of $6 million in financing, co-led by Lightspeed Faction ("Faction") and Lightspeed Venture Partners. The financing also attracted participation from companies such as Pantera Capital, Aptos Foundation, Wintermute, Altonomy, Shima Capital and Kraken Ventures.

JinseFinance

JinseFinance

JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance Alex

Alex Huang Bo

Huang Bo Alex

Alex JinseFinance

JinseFinance Hui Xin

Hui Xin Bitcoinist

Bitcoinist