Written by: Kedar @Foresight Ventures, Alice @Foresight Ventures

Contributor: Max Hamilton @Foresight Ventures

PayFi: The Transformative Force for Financial Transactions

In today’s world, cross-border payments can take days and cost businesses billions of dollars in transaction fees. PayFi is an innovative solution that combines the benefits of decentralized finance (DeFi) with the immediacy of modern payment systems to reshape the future of transactions.

As the global financial landscape continues to evolve, PayFi is emerging at the intersection of blockchain technology and payment systems, committed to combining the efficiency of DeFi with the immediacy and convenience of modern payment solutions to transform the way transactions are conducted. This article will delve into the reasons for the rise of PayFi, outline the current status of its industry, list key cases, and explore its potential application scenarios.

1. Background and advantages of PayFi

(I) Filling the gap between DeFi and payment

The traditional financial system has long suffered from inefficient settlement, such as long settlement time, high transaction costs, and limited accessibility, which were exposed during the 2008 financial crisis. Although DeFi has introduced innovative financial services through decentralized platforms, it lacks the ability to process daily transactions in real time.

PayFi uses blockchain technology to achieve real-time settlement of transactions. Based on the theory of time value of money (TVM), that is, the current disposable currency is more valuable than the same amount of currency in the future due to its potential earning power, PayFi maximizes financial efficiency through instant, secure and low-cost transactions.

(II) PayFi’s unique advantages

Real-time settlement: transactions are completed instantly, eliminating the delay problem of traditional banking systems.

Safety and reliability: The immutable ledger feature of blockchain ensures that transactions are safe and transparent, providing protection for users.

Cost reduction: removing intermediaries, significantly reducing transaction fees and saving users’ expenses.

Global accessibility: its decentralized platform reaches markets that are not fully covered by traditional financial services, including the unbanked population, achieving inclusive financial services.

Innovative products: giving rise to novel financial service models such as “buy now, pay never”, as well as innovative applications such as providing creators with advanced monetization channels.

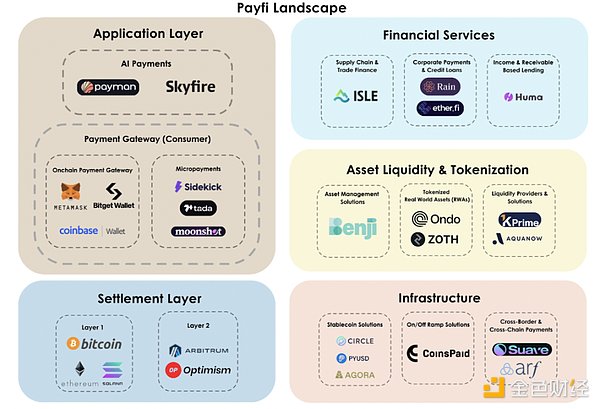

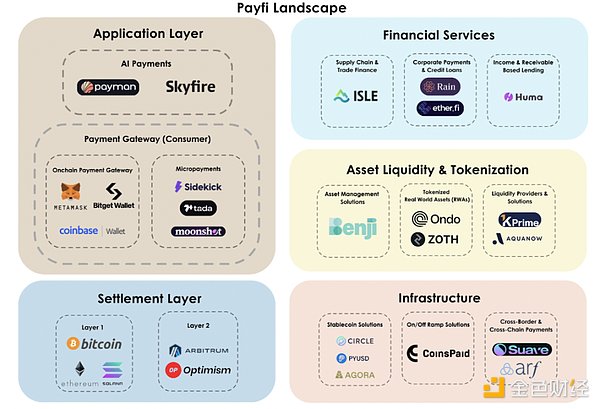

II. PayFi industry overview and insights into sub-sectors

The PayFi ecosystem is booming, and various industries are actively innovating to meet financial challenges. The following is an analysis of its key sub-sectors and examples of innovative companies in each sector.

(I) Cross-chain and cross-border payments

The chronic problems of traditional cross-border payments

Slow speed and high latency: Traditional payment channels are inefficient, settlement often takes several days, and the complex settlement process across time zones and bank business hours exacerbates payment delays.

Inefficient funding and constraints of pre-deposited funds: The pre-deposit requirement forces financial institutions to maintain foreign currency funds in their nostro accounts, resulting in a global liquidity gap of $4 trillion. Idle funds cannot generate income, becoming a hidden cost for financial institutions and passed on to end users, causing users to pay higher fees.

High transaction costs: Involving multiple intermediary institutions charging layers, including pre-deposit fees, currency exchange fees, etc., the average transaction cost of global cross-border remittances is as high as 6.35% (World Bank statistics).

Industry Innovation Cases

Arf: Building a regulated global settlement bank platform to provide on-chain liquidity solutions for financial institutions. With the help of stablecoins such as USDC, the immediacy and low cost of cross-border settlement are achieved. Through blockchain, real-time liquidity is provided for cross-border transactions on demand, eliminating the dependence of nostro accounts on large cash reserves; providing instant credit lines based on USDC, allowing financial institutions to temporarily borrow funds when trading and repay after payment settlement. Arf abandons the pre-deposited fund account model, and the short-term liquidity solution based on USDC effectively reduces the demand for funds and settlement time, significantly reducing the operating costs of financial institutions engaged in global transactions. Attach importance to transparency, create a complete traceable loan record, and use blockchain to easily trace all loan, repayment and receivable information. Adhering to the concept of strict compliance, as a member of the VQF Financial Services Standards Association, it follows international standards for anti-money laundering and financial supervision, setting an example for the industry. So far, it has successfully processed more than US$1.6 billion in on-chain transactions and maintained a zero default record.

suave.money: Create a cross-chain payment solution that enables enterprises to receive cryptocurrency payments from any blockchain network. Enterprises can seamlessly connect to various token payments and flexibly choose to receive the tokens they want according to their own needs, thereby improving the payment flexibility in the blockchain ecosystem. suave.money's platform simplifies cross-chain transactions. Enterprises can attract user groups from different blockchain ecosystems and broaden their customer sources without having to manage multiple wallets or rewrite decentralized applications (DApps). By promoting the convenience of payments from more than 10 blockchain networks and enhancing liquidity acquisition capabilities, it provides strong support for the expansion of DeFi and Web3 projects and expands market coverage. Simplifying the cross-chain transaction process and reducing the complexity of enterprise operations, enterprises can attract customers more widely in the blockchain ecosystem without relying on professional infrastructure construction, creating more opportunities for enterprise development. With its innovative capabilities, it helps enterprises tap into the trillion-dollar cross-chain capital potential, occupies an important position in the rapidly developing DeFi and crypto payment fields, and provides users with unparalleled flexibility and convenience.

(II) Income- and receivables-based lending

Dilemma of traditional lending model: Traditional lending business relies on collateral, excluding potential borrowers who lack a lot of assets or credit records, limiting the inclusiveness and fairness of financial services.

The emergence of innovative solutions: Platforms such as Huma Finance allow users to borrow with future income or receivables as collateral, using blockchain technology to make the lending process transparent and efficient.

Positive benefits: This innovative model significantly improves financial inclusion, provides new ways to obtain funds for underserved markets neglected by traditional financial institutions, and promotes balanced economic development and social equity and justice.

Huma Finance's practical case: Building a decentralized lending protocol to provide lending services based on future income and receivables for enterprises and individuals. Connecting borrowers with global investors through an on-chain platform, creating an income-supported lending model that is different from the traditional DeFi over-collateralization model. Cooperating with platforms such as Circle, Request Network, and Superfluid, the world's first on-chain factoring market was launched on Ethereum and Polygon. For the first time, users can use tokenized invoices or payment flows as collateral, broadening the scope and form of collateral. With the efficiency of blockchain, the on-chain processing time of the factoring process is shortened to less than one minute, providing users with a convenient experience. Huma Finance's technical architecture includes several key parts. The decentralized income portfolio layer converts income sources such as invoices, payrolls, and pledge income into tokenizable assets, providing a rich asset base for lending business. The assessment agent framework is responsible for accurate risk assessment of various lending needs to ensure reliable and stable credit quality on the chain. The smart contract suite uses configurable smart contracts to achieve a variety of lending use cases, from invoice factoring to general credit lines, to meet the personalized needs of different users. Huma Finance focuses on providing much-needed liquidity support to small and medium-sized enterprises and the unbanked population. Through innovative lending models, it helps these groups break through traditional financial restrictions and obtain financial resources that were previously inaccessible, promote their economic development and social integration, and make positive contributions to building a more equitable and inclusive financial ecosystem.

(III) Tokenization of real-world assets

Difficulties of traditional asset transactions: The transaction process of real-world assets such as real estate is cumbersome, the intermediate costs are high, and the transaction speed is slow, which brings inconvenience and economic burden to both buyers and sellers.

Tokenization innovation breakthrough: Tokenization of real estate and other real-world assets, through smart contract technology, asset ownership can be divided into multiple parts, realize partial ownership transactions, and greatly speed up the transaction speed and process, injecting new vitality into the asset trading market.

Significant advantages: This tokenization model significantly lowers the threshold for investors to enter the market, allowing more investors to participate in real-world asset investment, while greatly improving asset liquidity, accelerating the asset buying and selling process, and making market resources more efficiently allocated and circulated.

Ondo Finance's successful practice: Launching tokenized U.S. Treasury bonds and other income-generating products on the blockchain platform, opening up new investment channels for investors, enabling them to easily obtain short-term U.S. Treasury bonds and other fixed-income assets through decentralized finance (DeFi), realizing the organic integration of traditional financial markets and DeFi. Ondo Finance's innovative products provide investors with stable, profitable, liquid and secure investment options, breaking down the barriers between traditional financial markets and DeFi, enabling more investors to share the dividends of the relatively closed capital market, enriching investors' asset allocation portfolios, and improving the efficiency and vitality of the entire financial market. As of September 2024, Ondo Finance has achieved remarkable results in the field of tokenized U.S. Treasury products, and its total locked value (TVL) has exceeded the $600 million mark. Among them, the locked amount of USDY (interest-bearing stablecoin) reached $384 million, and the locked amount of OUSG (tokenized U.S. Treasury bonds) was $221 million. These data fully demonstrate the market's high recognition and wide acceptance of its innovative products, highlighting its leading position and strong influence in the field of tokenization of real-world assets.

Zoth's innovative contribution: Building a market platform dedicated to tokenized trade finance assets, providing investors with a convenient way to obtain fixed-income products denominated in U.S. dollars. By tokenizing traditional financial assets such as trade receivables and corporate bonds, a bridge is built between traditional finance and decentralized finance (DeFi), creating high-yield, low-risk investment opportunities for investors, while providing companies with new financing channels and fund management methods. Zoth's platform plays an important role in the market, not only bringing high-quality investment options to investors, helping them to increase and preserve their assets, but also providing strong support for corporate development. By tokenizing trade finance assets, companies can unlock working capital more efficiently, optimize capital structure, and enhance their competitiveness and risk resistance. At the same time, this will help promote the optimal allocation of capital in the global market, promote a more reasonable flow of financial resources to companies and projects in need, further improve the on-chain trade finance ecosystem, and make positive contributions to the stability and development of the entire financial market.

(IV) Enterprise Payment and Credit Solutions

New Consumer Demands and the Limitations of Traditional Credit: In today's consumer market, consumers have higher requirements for payment flexibility and expect to enjoy a more convenient and diversified payment experience without incurring a heavy debt burden. However, traditional credit models often fail to meet this demand, causing inconvenience and financial pressure on consumers.

PayFi's Innovative Model: In response to this market demand, PayFi innovatively introduced unique payment models such as "Buy Now, Pay Never", which cleverly used the interest income obtained from the DeFi lending platform to offset the purchase cost, providing consumers with a new, more flexible and debt-free payment solution, greatly enhancing consumer purchasing power and shopping experience.

Industry Innovation Cases

Rain: Launched a corporate card supported by USDC, designed for the daily business payment needs of Web3 teams (such as decentralized autonomous organizations DAO and various protocol projects). With this corporate card, Web3 teams can easily use their on-chain assets (such as USDC) to pay for daily business expenses such as travel expenses and office supplies procurement expenses, without the tedious conversion of cryptocurrencies and legal currencies, greatly simplifying the corporate payment process and improving financial management efficiency. As an important part of its expenditure management platform, Rain's corporate card fully utilizes the advantages of blockchain technology to achieve seamless connection between digital assets and traditional payment systems. Through this innovative payment method, companies can manage finances more efficiently, reduce the cost and time consumption of intermediate links, and provide more convenient and secure payment solutions for blockchain and encryption companies, which will effectively promote the development and popularization of Web3 industry.

Ether.fi: The "Ether.fi Cash" product launched by Ether.fi has attracted widespread attention in the market. This is a credit card in cooperation with Visa with unique and innovative features. After holding this card, users can easily obtain a loan amount by using their crypto assets (including various assets based on Ethereum) as collateral, so that they can make legal currency consumption without selling crypto assets, providing users with a more flexible fund management method and consumption experience. In addition, the "Ether.fi Cash" credit card is deeply integrated with Ethereum's Layer 2 network Scroll. This technical advantage significantly reduces transaction costs and further improves the user's cost-effectiveness. At the same time, the card supports peer-to-peer USDC transfer functions, allowing users to transfer and manage funds more conveniently, meet payment needs in different scenarios, and bypass the traditional bank intermediary links to save users extra expenses. In addition, in order to improve user enthusiasm and satisfaction, the "Ether.fi Cash" credit card also provides an attractive cashback reward mechanism, which brings tangible economic benefits to users during the consumption process, further enhancing the product's market competitiveness and user stickiness.

Bitget Card: The Visa card launched as an important bridge between cryptocurrency and traditional payment systems provides users with convenient and efficient payment solutions. The card is closely connected with a multi-currency wallet, and enterprises or individual users can easily hold, convert and use various mainstream cryptocurrencies in the wallet, such as USDT, BTC, ETH, USDC, BGB, etc. (currently, the fund account is mainly recharged with USDT, and more cryptocurrencies are planned to be gradually introduced in the future). In the actual payment process, Bitget Card can automatically convert cryptocurrency into legal tender according to the real-time exchange rate, ensuring that users can successfully complete the payment when consuming at any merchant accepting Visa cards around the world, without worrying about the cumbersome procedures of currency exchange and the risk of exchange rate fluctuations, truly realizing the seamless connection between cryptocurrency and legal tender payment, and providing great convenience for users. The emergence of Bitget Card has an important impact on the field of corporate payment. It not only simplifies the corporate payment process, but also enables enterprises to use traditional currency for consumption in real time without manually performing complex cryptocurrency and legal tender conversion operations, greatly improving payment efficiency and capital utilization efficiency. At the same time, its powerful cross-border payment capabilities make it easier for enterprises to expand and operate international businesses, without having to worry about opening and managing foreign currency accounts, effectively reducing corporate operating costs and financial risks. At present, Bitget Card has been widely accepted and recognized in more than 180 countries and regions around the world, providing strong support for the global development of enterprises. In addition, Bitget Card also has a wealth of potential DeFi use cases. For example, in terms of supplier payments, enterprises can directly use the card to pay suppliers in legal currency, avoiding the cumbersome process of manually converting cryptocurrencies, and improving the efficiency and stability of supply chain payments; in terms of travel expense reimbursement, employees can use the card to easily make business-related consumer payments during cross-border travel, such as air ticket bookings, hotel accommodation, etc., without worrying about payment restrictions and handling fees, providing a more convenient payment solution for corporate cross-border business activities; in terms of corporate reward mechanisms, companies can also use the cryptocurrency payment function provided by Bitget Card to issue cryptocurrency-based rewards to employees, and employees can convert cryptocurrencies into legal currency for consumption according to their own needs, or use them directly in scenarios that support cryptocurrency payments, bringing more innovation and flexibility to corporate employee incentives and welfare systems, and further enhancing corporate competitiveness and attractiveness.

(V) Supply Chain and Trade Finance

The dilemma of traditional supply chain finance: In the traditional supply chain finance system, suppliers often face long and complex payment cycles, and a large amount of funds are locked for a long time, which seriously restricts their operational efficiency and capital turnover ability, making it difficult to maintain normal production and operation activities and business expansion. According to statistics, due to the limitations of traditional financial institutions, global companies have up to 2.5 trillion US dollars in trade financing needs that cannot be effectively met each year. This has become a bottleneck in the development of global trade, hindering the coordinated development of the industrial chain and the stable growth of the economy.

PayFi's solution: PayFi provides innovative solutions to the invoice financing problem in supply chain finance by introducing a decentralized platform. Under this model, suppliers can use the advantages of blockchain technology to tokenize the invoices they hold, and quickly realize financing on the decentralized platform, obtain immediate financial support, and greatly improve the liquidity of funds. At the same time, buyers can continue to settle according to the original payment plan without changing traditional payment habits and financial processes, so as to achieve a balance of interests and coordinated development between buyers and sellers, and provide strong guarantees for the efficient operation of supply chain finance.

Industry Innovation Cases

Isle Finance: Deeply cultivating the on-chain credit market in the field of supply chain finance, the platform it has built can accurately connect high-credit buyers with liquidity providers, thereby helping companies obtain financing at a faster rate. It cleverly uses blockchain technology to rigorously verify real-world assets (RWAs) and implement early payment strategies for buyers (especially those with low credit ratings), greatly enhancing the liquidity and security of the entire supply chain and laying a solid foundation for the stable development of supply chain finance. With the help of its own platform, Isle Finance vigorously promotes the development of reverse factoring business, which not only significantly speeds up the payment speed of enterprises, but also greatly optimizes cash flow. This innovative blockchain-based solution enables companies to flexibly offer early payment discounts, creating extremely stable and substantial returns in the field of supply chain finance, while also broadening the channels for companies to obtain liquidity, injecting strong impetus into their sustainable development.

(VI) Stablecoin Payment Platform

Example: Agora

Business Content: Carefully crafted the U.S. digital dollar (AUSD), which is backed by full support of cash, U.S. Treasury bonds, and overnight repurchase agreements. The platform is committed to using blockchain technology to enable the U.S. dollar to circulate more widely and conveniently around the world, especially focusing on those areas where traditional financial systems are not well covered, and fully practicing the concept of financial inclusion, opening up a new path for the public to more easily obtain stable and globally recognized currencies.

Impact: It has strongly promoted the democratization of access to the US dollar, which is highly consistent with PayFi's grand vision of expanding financial inclusion. It fully utilizes the technical advantages of blockchain to build a decentralized and accessible financial system, allowing individuals and businesses to benefit from financial instruments backed by the US dollar. The results are particularly significant in Argentina, Southeast Asia and other regions, providing strong support for local economic development and financial stability.

Achievements: Successfully launched the stablecoin AUSD to the market, initially issued on Ethereum and then expanded to the Avalanche network. Remarkably, within just a few weeks of its release, its minting volume exceeded US$20 million in one fell swoop. Today, the platform is steadily advancing its global layout of the digital dollar and continuing to expand its international market. At the same time, it always adheres to the development strategy of financial inclusion and regulatory compliance, and gradually establishes a good reputation and influence in the field of stablecoins.

Example: PayPal

Business content: PayPal USD (PYUSD) was officially launched in August 2024, first on the Ethereum blockchain, and then successfully expanded to Solana in May 2024. The original intention of this stablecoin is to fully integrate the advantages of both blockchains and strive to achieve a fast and low-cost digital payment experience. Especially after expanding to Solana, with its excellent transaction speed and low fee advantages, PYUSD's usability in various commercial and DeFi application scenarios has been greatly improved, providing users with a more efficient and convenient payment option.

Impact: It is expected to become a powerful alternative to traditional payment systems with its fast and cost-effective characteristics, thereby significantly improving global payment efficiency. It has successfully achieved seamless transfers across different platforms (including PayPal and Venmo), allowing users to easily hold and transfer stablecoins, and making full use of the technical advantages of blockchain, bringing more convenience and innovative experience to users' digital asset management and payment transactions.

Achievements: After expanding to Solana, PYUSD's market adoption rate has shown a rapid growth trend, and its market value has rapidly climbed and successfully exceeded the $500 million mark. This remarkable achievement fully demonstrates its deep integration and wide recognition in centralized and decentralized platforms, and also marks that PayPal's exploration in the field of stablecoins has achieved a major stage victory, laying a solid foundation for its further development in the field of digital payments in the future.

Example: Bridge (acquired by Stripe)

Business content: As a platform focusing on stablecoin payments, Bridge has always taken simplifying cross-border digital payments as its core goal. Through convenient API interfaces, it can easily implement stablecoin-based payment integration and provide low-cost and efficient cross-border transaction solutions for global users. Before being acquired by Stripe, Bridge had achieved remarkable results in e-commerce platform integration, successfully helping merchants to seamlessly connect and efficiently process stablecoin payment businesses in any corner of the world, greatly expanding the scope of application of stablecoins in the commercial field.

Impact: The recent acquisition by the US payment giant Stripe is undoubtedly a key milestone in the integration of stablecoins into mainstream financial services. With Stripe's powerful infrastructure and extensive market network, Bridge is able to further expand its business coverage and comprehensively enhance its capabilities, and is committed to providing more convenient and efficient stablecoin payment and settlement services to global companies. This move is highly consistent with PayFi's grand vision of promoting the global popularization of digital currencies by promoting financial inclusion and seamless cross-border transactions. It is expected to leverage Stripe's existing advantages and Bridge's stablecoin technical expertise to accelerate the widespread application and deep integration of blockchain-supported payment methods in mainstream financial channels, and inject new vitality into the innovative development of the global financial payment field.

Achievements: In August 2024, Bridge's annualized payment volume successfully exceeded US$5 billion, with remarkable achievements. During its development history, Bridge has established close cooperative relationships with many industry-leading companies, such as Coinbase and SpaceX, and is still providing high-quality payment services to these companies. It has accumulated rich practical experience and a good market reputation in the field of stablecoin payments, and has become one of the important forces driving the development of the industry.

Conclusion

Overall, PayFi is not a completely new concept. The problems it aims to solve already exist in the traditional financial system and have corresponding solutions. But this does not mean that PayFi is worthless, because traditional solutions are still not perfect. By solving the core inefficiencies of the global payment system and leveraging the transformative potential of blockchain, PayFi is expected to unleash unprecedented liquidity and promote financial inclusion. As more and more companies innovate in this field, the vision of creating a fully decentralized financial ecosystem where payments are instant, secure and borderless is getting closer to reality. Now is the time to embrace the PayFi revolution and shape the future of global finance.

Weatherly

Weatherly