High-performance public chain and customizable subnet architecture bring strong ecological growth

Project name: Avalanche

Token: AVAX

Current market value: US$21 billion

Estimated market value in 6 months: US$35.5 billion

Road potential: 69%

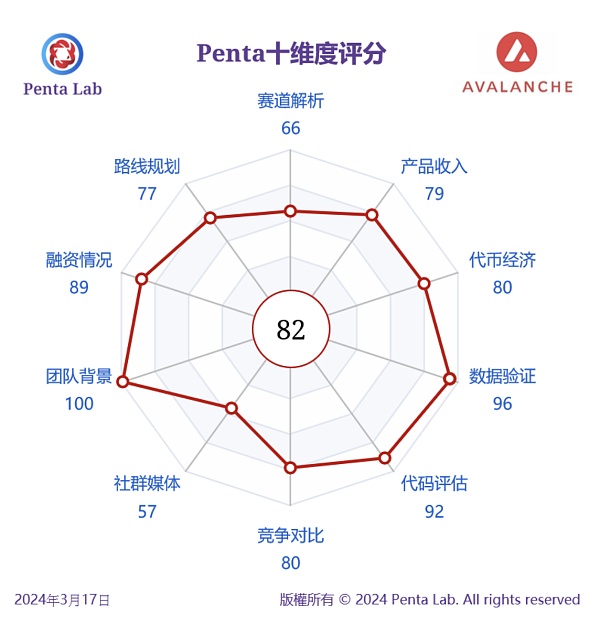

Penta ten dimensions Rating: 82

Data as of: March 17, 2024

Download the complete research report: https://t.me/pentalabio

Official website: pentalab .io

Original consensus mechanism and three parallel chains The structure creates the fastest TTF on the public chain. Avalanche uses an original consensus mechanism to reach consensus through rapid repeated sampling. It does not require the consent of all nodes, as long as more than half of the consensus defined by the network is reached. In addition, Avalanche adopts a unique three parallel chain architecture. The core platform includes three interoperable blockchains: transaction chain (X chain), contract chain (C chain) and platform chain (P chain), of which X chain is used for To create and trade assets, the C chain is used to create smart contracts, and the P chain is used to coordinate validators and subnets. Avalanche assigns different functions to each blockchain, which greatly improves speed and scalability compared to concentrating all processing operations on one blockchain. This mechanism allows Avalanche to achieve a TTF (time to final confirmation) of 0.5 to 2 seconds, which is much shorter than other platforms.

Innovative multi-purpose subnet provides strong ecological development momentum. The Avalanche subnet can be regarded as either an EVM-compatible L1 or a L0-like infrastructure. It is also an expansion solution, providing more possibilities for Avalanche expansion. Avalanche's subnets do not require beacons or relay chain designs, and assets can move freely between subnets, with good cross-chain compatibility, lower latency, higher TPS and lower processing transaction costs. Currently, Avalanche’s subnet ecology ranks among the best in terms of expansion of DeFi, GameFi and RWA.

Durango has upgraded and launched new features of Teleporter, and the interoperability of the subnet ecosystem continues to increase. On March 6, 2024, the Avalanche team released a Durango upgrade with a new feature called "Teleporter." Teleporter is built on Avalanche Warp Messaging (AWM), supports EVM-compatible subnets, specifically C-chains, and solves network fragmentation issues. It will enable the sharing of various data types, including tokens, NFTs, and oracle price feeds, and will further enhance the interoperability of the Avalanche subnet ecosystem.

Valuation: By analyzing the top seven projects on Avalanche with a total value locked (TVL) greater than US$30 million, and assuming a growth rate of 24% in the next six months To 60%, we forecast TVL will reach $1.78 billion in six months, an improvement from the current growth rate (42%). Avalanche currently trades at 16x float-to-TVL, which is 0.7 standard deviations above its historical average of 7x over the past three years. Taking into account the rising market expectations for its GameFi and RWA subnet applications, we use the historical average of the past three years to raise one standard deviation, that is, 20 times, multiplied by the estimated six-month TVL ($1.78 billion), and get six The monthly target market value is US$35.5 billion, with a 69% upside potential.

Main risks: Market competition risk, technology development falling short of expectations, and subnet ecological development falling short of expectations.

Disclaimer: The copyright of this article is held by Penta Lab. Any commercial reproduction, distribution or dissemination requires the express prior written authorization of Penta Lab. For non-commercial dissemination of information, the original source of the work and Penta Lab information must be preserved and clearly attributed. The content of this article only reflects the views of Penta Lab and does not constitute a recommendation for any investment behavior. Any subject mentioned in this article does not constitute investment advice. Investors should make investment decisions based on their own independent judgment and bear the corresponding investment risks themselves. There are risks in the market, so investment needs to be cautious.

JinseFinance

JinseFinance

JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance Brian

Brian JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance Cointelegraph

Cointelegraph Cointelegraph

Cointelegraph