Why is stock tokenization so difficult

To understand the dilemma of stock tokenization, we must first see the key to the success of RWA/offline assets on the chain. Whether it is the chain of national debt, funds, stocks, private credit or even intellectual property, the essence only requires the entity to hold physical assets offline, and then issue a set of tokens on the chain, just like issuing memecoin, there is no technical threshold.

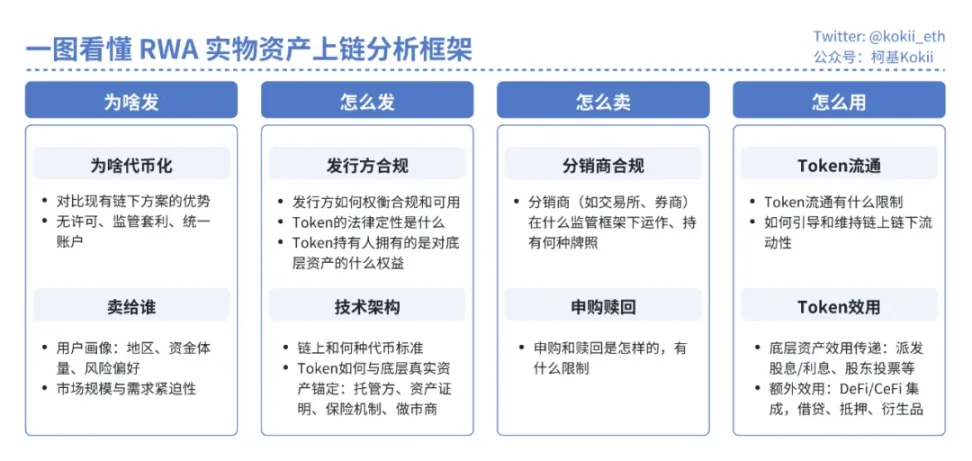

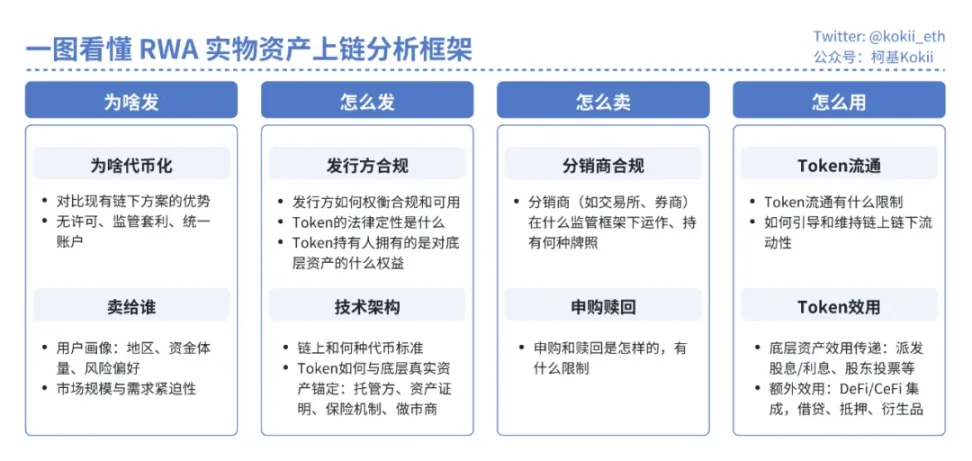

But all project parties must return to the four core issues: Why issue? How to issue? How to sell? How to use? Without solving the above problems, RWA can only be like most memecoins, without actual demand and liquidity.

Taking the most successful RWA product category, tokenized U.S. Treasury bonds/money market funds, as an example, as a standardized debt instrument with simple rights and predictable cash flow, the core of its tokenization has gone through three steps: identifying real needs, establishing a compliant issuance framework, and building token utility:

Why issue: Institutional investors [Crypto VC/Fund] have a lot of idle stablecoins on the chain and need risk-free interest-bearing scenarios

How to issue: Fund - Fund manager structure, tokens legally represent fund shares. The fund is responsible for issuing tokens and holding assets, and the fund manager is responsible for making investment decisions. Both the fund and the fund manager must be licensed and compliant, and require institutional-level service support such as custodians, audits, and transparency reports.

How to sell: Only qualified investors after KYC/AML can buy, 24/7

How to use: Tokens have derivative utilities, which are supported by mainstream DeFi. They can be used as collateral to borrow stablecoins. Some centralized exchanges are supporting them as collateral.

As a certificate of ownership with complex rights (including governance rights) and uncertain cash flow, the tokenization of stocks must overcome a series of huge operational and compliance obstacles.

Why issue

Early RWA attempts were often ambiguous about why they were issued. They focused on alternative assets such as private loans, private equity funds, real estate, etc., hoping that the efficient settlement of blockchain would improve liquidity. However, the limited liquidity of these assets themselves is not a technical problem, but is limited by deeper problems, such as information asymmetry, lack of substitutability, pricing challenges and issuers’ resistance to the secondary market for liquidity. These problems are off-chain and cannot be solved by simply putting them on-chain.

The benefits of putting physical assets on the chain are already clichés, to be briefly summarized:

Permissionless access: including [capital] lowering the investment threshold, [product] eliminating geographical and financial barriers such as bank accounts, compliance, foreign exchange controls, and [time] 7*24*365 trading, instant clearing and settlement; as well as regulatory arbitrage brought about by permissionlessness, crypto-native platforms including wallets and exchanges can expand to traditional businesses without a license

DeFi composability: DeFi protocols such as trading, lending and derivatives are used to apply DeFi's transparency and composability to traditional assets to obtain additional income opportunities

DeFi composability: DeFi protocols such as trading, lending and derivatives are used to apply DeFi's transparency and composability to traditional assets to obtain additional income opportunities

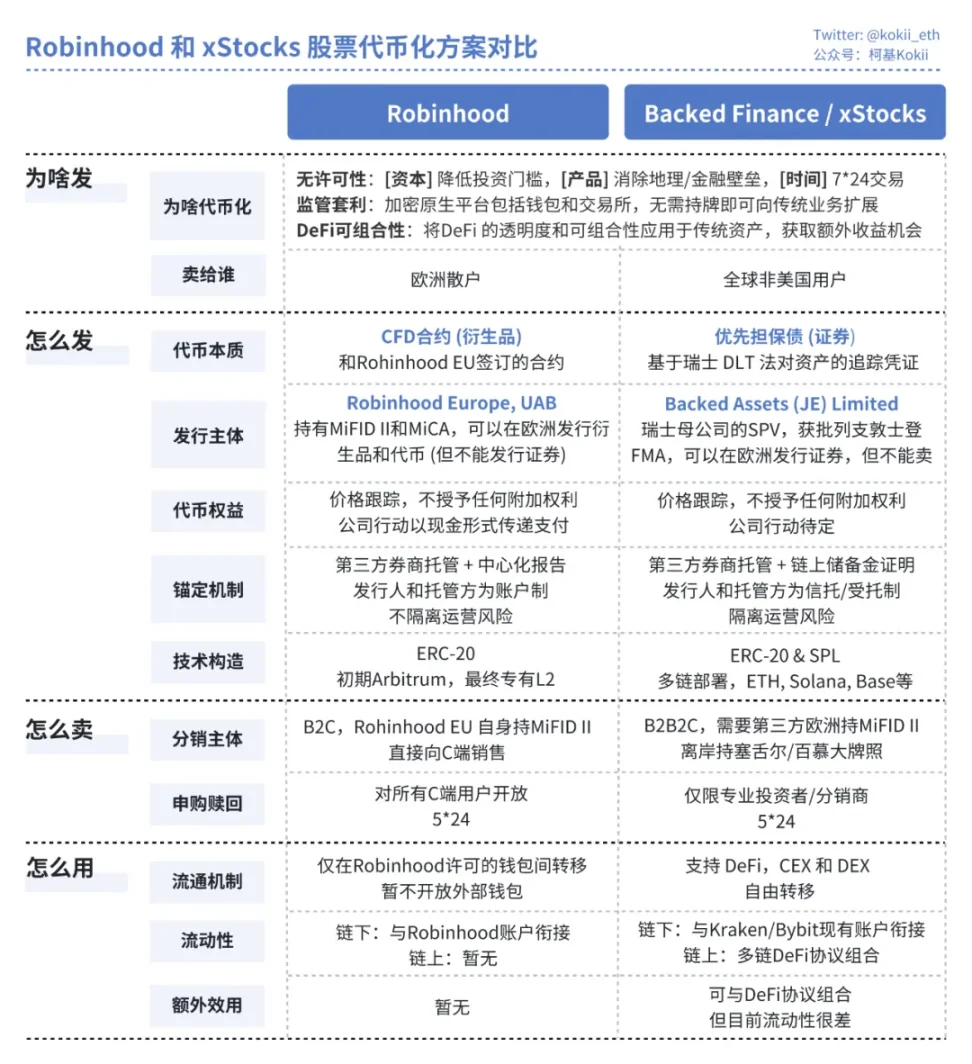

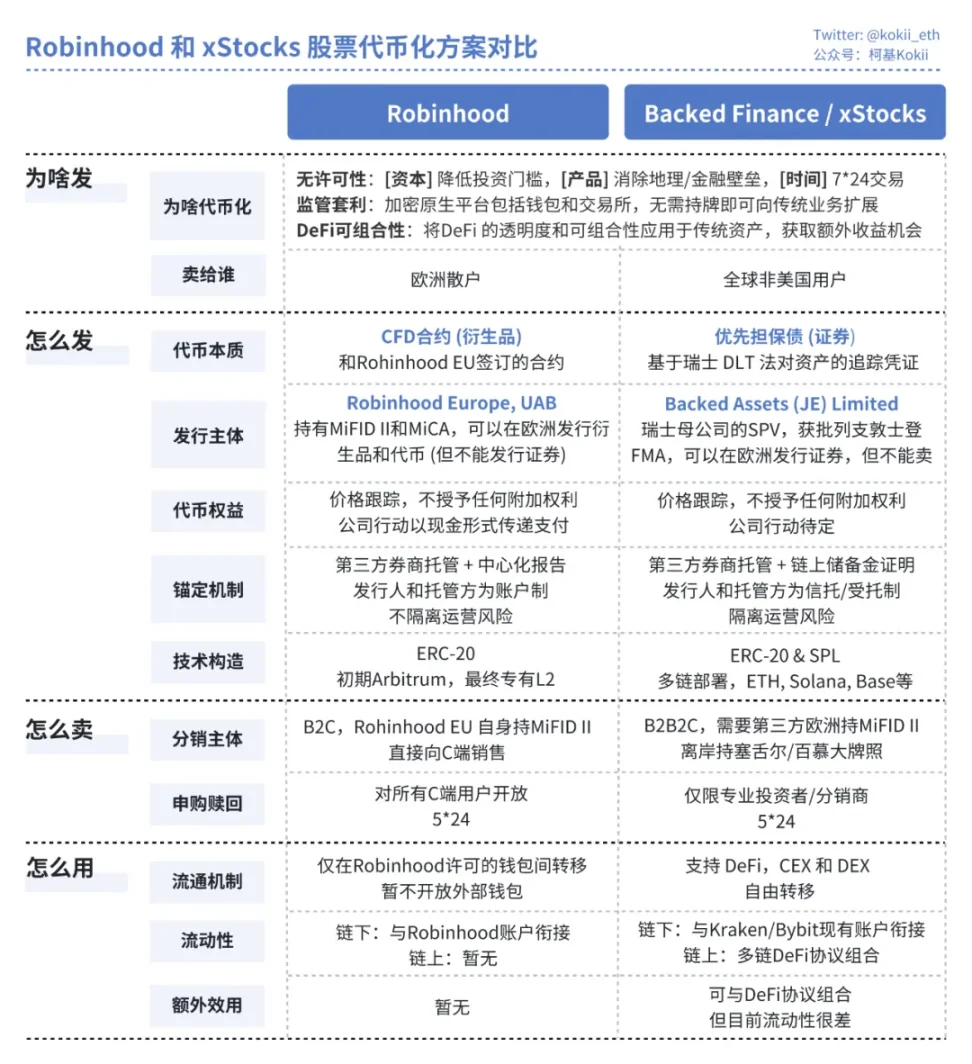

Recently, Robinhood and xStocks have designed tokens with full 1:1 mapping, centralized securities registration, and full compliance and legality under the existing relatively friendly laws.

Current plan

a.Robinhood

How to issue: The legal core is to issue a financial derivative contract under the EU MiFID II framework by its licensed entity Robinhood Europe UAB in Lithuania. The tokens held by users are only digital certificates of this contract, and its counterparty is Robinhood itself. Real stocks are held by Robinhood's US affiliated brokerages as a hedge position

How to sell: Using the B2C model, Robinhood Europe is the only issuer and seller, directly facing European retail users in its app. Liquidity is provided entirely within the platform, which is a closed loop

How to use: The smart contract of the token has a strict whitelist mechanism embedded in it, which makes it unable to circulate freely and does not have any external DeFi composability

b.xStocks

How to issue: The legal core is to hold real stocks through a bankruptcy remote SPV established in Liechtenstein under the framework of the Swiss DLT Act. The tokens held by users are legally a 1:1 asset-backed senior secured debt (tracking certificate) whose trust mechanism is built on independent third-party custody and Chainlink Proof of Reserves (PoR) that can be verified by anyone in real time.

How to sell: Adopting the B2B2C model, the issuer Backed Finance serves the institutional-level primary market subscription and redemption, and licensed exchanges such as Kraken and Bybit act as distributors to serve secondary market users. Liquidity is provided by professional market makers on centralized exchanges and liquidity pools in decentralized protocols (such as Jupiter and Kamino on Solana)

How to use: freely transferable and fully DeFi composable, can be used as collateral for lending

Legally, tokens only track prices, not directly on-chain equity. As for other rights of stocks (voting rights, dividend rights), and the handling of corporate actions (such as splits, mergers, delisting, liquidations) are also pending. At the same time, the additional utility brought by tokenization has not yet been generated: Robinhood's Token can only circulate within the ecosystem, and although xStocks can be combined with DeFi protocols, its liquidity is currently very poor and can basically be regarded as non-existent.

These two solutions are more like regulatory arbitrage of crypto-native platforms under the current more relaxed regulatory conditions, used to attract market attention to demand better pricing in the capital market. Regardless of the paradigm, the current stock tokenization faces several structural obstacles that are difficult to resolve in the short term:

Ambiguous demand: For its main non-US users, there are already a large number of mature, low-cost, and highly liquid US stock trading channels in the market (such as online brokers such as IBKR, CFD, etc.), and stock tokenization has no obvious advantages in user experience and fees

Liquidity dilemma: The off-chain is the price discovery center. On-chain liquidity is too small and severely fragmented compared to traditional markets, resulting in high slippage for large transactions

Market-making risk: During periods when the underlying stock market is closed (such as weekends), market makers cannot hedge risks and must widen spreads or withdraw liquidity, resulting in low reliability and cost-effectiveness of 24/7 trading

Incomplete rights: Both current models have made significant compromises on core shareholder rights. Holders only receive the economic benefits of the stock, while corporate governance rights such as voting are intercepted and handled by the issuer (SPV or Robinhood), which is limited in functionality compared to mature tools such as ADR

The road ahead

Although the reality is bleak, the real significance of this "pilot" is to explore future possibilities. The future of tokenized stocks depends on their ultimate positioning in the entire financial ecosystem.

Path A: Mainstream and infrastructure. If the global mainstream regulatory framework matures and becomes clear, stablecoins will flow into thousands of households, major financial institutions will put a certain amount of assets on the chain, and the issuing custodians will gradually evolve into traditional financial giants such as JPMorgan Chase and Bank of New York Mellon. By then, stock tokens will become a more powerful "composable super ADR". Blockchain will become the unified settlement layer for various equity markets around the world, integrated into various DeFi protocols, and companies will go public directly through STO issuance on the chain

Path B: Offshore and emerging asset platforms. If mainstream regulation continues to tighten, the crypto world may evolve into an efficient offshore innovation center. By then, tokenization will no longer seek to compete with the NYSE for Apple stock trading, but will turn to becoming a "launch platform" for new or illiquid assets, such as private equity of Pre-IPO companies, share transfers of VC funds, and even securitization of future income streams such as intellectual property.

The current immaturity of tokenized stocks is not a sign of its failure, but an early and necessary stage in its construction as an infrastructure. The measure of its success should not be whether it can provide a better Apple stock trading experience today, but what kind of new market and financial behavior it creates for tomorrow. For all market participants, understanding this is the key to seizing the initiative in this coming financial revolution.

Weiliang

Weiliang