As we all know, the Injective public chain is a high-performance public chain built on the Cosmos SDK, specially designed for high-frequency trading, Defi, RWA and other scenarios. Its unique shared order book model provides a new liquidity supply method for Defi applications, and specialized technologies such as the iAssets module provide RWA with an efficient on-chain channel.

In addition, due to its unique economic model and inflation adjustment mechanism, INJ is widely favored by investment institutions and the community. Its latest releaseINJ 3.0 is even called by the community as a heavyweight update comparable to Ethereum EIP-1559. In this article, we will explain INJ's economic model, inflation adjustment mechanism and INJ 3.0 in detail, so that everyone can have a more detailed understanding of INJ's economic model

INJ basic functions and token uses

As the native token of the Injective public chain, INJ has three basic functions.

First, INJ can serve as an on-chain transaction medium and fee token, which is basically the same as the functions of ETH and SOL on their respective chains, so I will not go into details here.

Second, INJ is used for POS network staking, and participants in staking (including validators and delegators) can obtain income distributed in the form of INJ. text="">and pledgeratebetweenmaintenanceBalance, INJlaunched

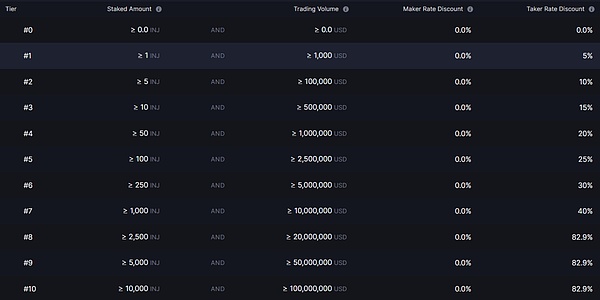

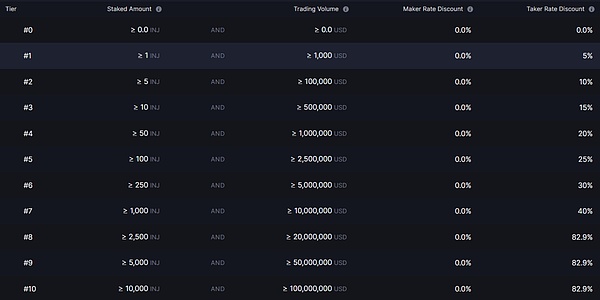

In addition to staking, INJ holders can also participate in on-chain governance and vote on on-chain parameter adjustments, protocol upgrades, new feature proposals, etc. In order to encourage more people to participate in staking, Injective has launched a VIP plan, and staking more INJ can have more incentives.

Third, the INJ public chain has a unique Burn Auctionmechanism, in which the only auction currency is INJ. In short, the INJ public chain will allocate part of the handling fee/network income every week and pool it into a prize pool. Users can bid with INJ. The highest bidder will get the assets in the prize pool, and the INJ paid will be destroyed. Burn Auction and "dynamic supply rate adjustment" work together to constitute INJ'soverallinflation adjustmentmechanism.

INJ's economic model and inflation adjustment mechanism

In the previous article, we briefly mentioned that INJ'sdynamic supply rate adjustment + Burn Auctionconstitutes an inflation adjustment mechanism. As long as the deflation rate is greater than the issuance rate of block rewards, INJ as a whole can achieve deflation.

Increase in issuance mechanism: dynamic pledge incentive adjustment

INJ's Tokensupply mechanismborrows from and improves the Cosmos inflation model, adopting “dynamic supply rate adjustment”, the core of which is based on the INJTokensupply mechanism The pledge rate is used to dynamically adjust the pledge income/token issuance to achieve the established target pledge rate. Injective currently sets the target pledge rate to be 60%. Each new block will adjust the subsequent token issuance rate (pledge incentive) based on the deviation between the current actual pledge rate and the target pledge rate.

For example, if the current actual staking rate is lower than 60%, then INJ will continue to increase the staking incentives until the upper limit, allowing more holders to participate in staking. This approach will increase the inflation rate, but will increase staking returns and attract more people to stake INJ.

Whenthe actual pledge rate reaches 60%, the supply rate remains unchanged and the network is in a balanced state.

If the actual pledge rate is higher than 60%, the principle is similar. It should be noted here that the higher the pledge rate, the better. Because the pledge rate must be maintained very high, high pledge income must be provided, which will increase the inflation rate of INJ and bring selling pressure, so an excessively high pledge rate is equivalent to indirectly diluting the asset value of INJ holders. In essence, the pledger imposes a seigniorage on non-stakers.

Currently, the supply rate of INJ is adjusted block by block and takes effect in real time. It is achieved through automated control.The mathematical formula is a piecewise function, which increases or decreases the current Token issuance rate in proportion to the pledge rate deviation, but is always limited to an upper and lower bound.

The current INJ Token supply Parameters are as follows:

Supply rate upper and lower limits : Initial setting 5%~10% In other words, no matter how the pledge rate fluctuates, the annualized inflation rate is always within the above range. In the INJ 3.0 economic model, the above range is further tightened.

Target pledge rate:60%.

Number of blocks per year: About 350410,000blocks(Injective block interval <1 second)

Supply rate change parameters :In the past, it was 10% per year. After the INJ3.0 upgrade, it became 50%. That is, if the pledge rate deviates greatly from the target, the token issuance rate will be adjusted by a maximum of 50% each year.

Throughsequential adjustment,the INJ issuance rate will stabilize in a given range around the target pledge rate, and the actual total amount of INJ will eventually change with the issuance/deflation rate, that is, it will be regulated by the two major mechanisms of pledge incentive issuance and destruction auction. In November 2022, Injective officials destroyed the 5 million Tokens initially reserved by the team, which largely offset the inflation-induced increase.

Deflation mechanism: Burn Auction

Burn Auction is the core of INJ's deflation model.

Injective has a core module called Exchange Module (on-chain matching transaction module). DApps in the ecosystem can obtain liquidity and capture handling fees through the shared order book pool. After the INJ 2.0 upgrade, INJ on-chain applications can contribute any proportion of income to participate in the Burn Auction, and users can also donate assets to enter the auction pool on their own. Therefore, the weekly auction pool will accumulate a basket of multiple token assets from different dApps.

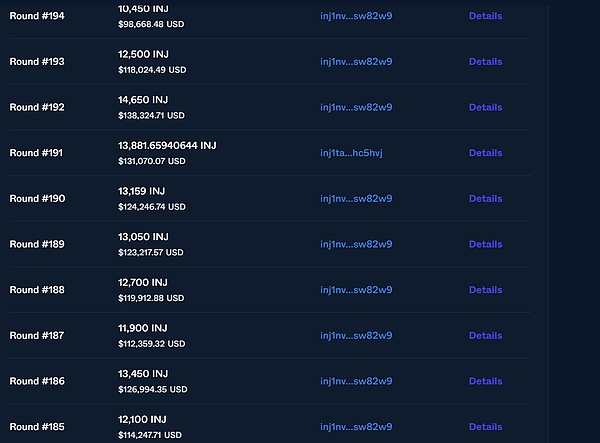

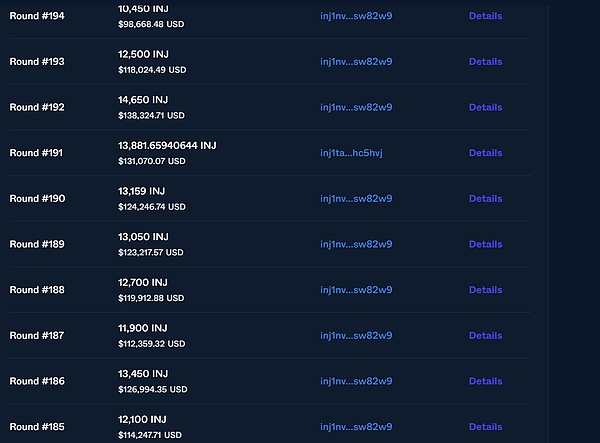

INJ will then be auctioned once a week, users will bid with INJ, and the highest bidder can obtain a basket of assets in the pool.

The INJ paid by the winner will be permanently destroyed. This operation is hosted and executed by Auction Moudle, and the results can be queried on the block browser.

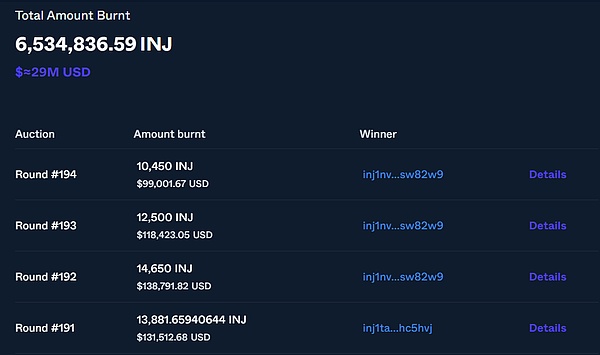

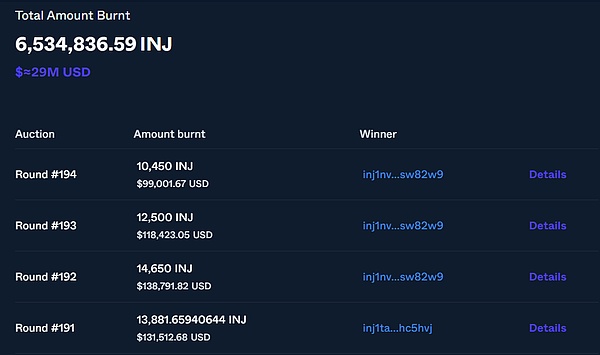

The current INJ destruction amount displayed on the Injective Hub

This"weekly auction + destruction"model brings a clear deflation scenario for INJ. The protocol "burns" part of the Tokens every week to give back to the holders. As of January 2025, INJ has destroyed more than 6.54 million pieces.

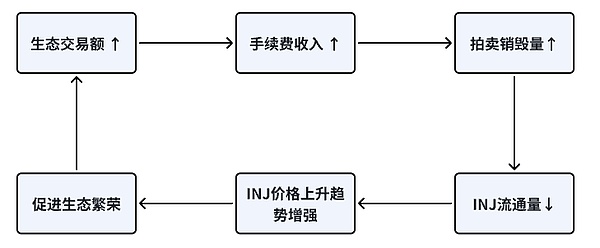

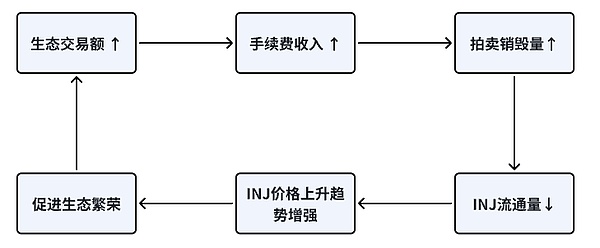

Through Burn Auction, Injective directly links network activities with Token value, forming the following deflation closed loop:

Schematic diagram of INJ deflation closed loop

When the amount of destruction in a period of time exceeds the amount of increase brought by staking incentives, the total supply of INJ will. leaf="">Net reduction(Deflation). Since 2023, Injective has experienced multiple net deflation cycles. For example, in early 2023, about 10,000 to 20,000 INJ were destroyed each week, which exceeded the inflation increase of that week.

AndIn the first half of 2024, with the INJ 2.0 upgrade opening up the revenue of all dApps to form the auction fund pool, the weekly destruction rate of INJ surged, and the cumulative destruction volume increased by by 274% in just half a year. Specific amounts and charts can be found in the following text.

In summary, dynamic staking incentive adjustment + Burn Auction together give INJthe ability to adjust the total amount. Injective officials and the community often compare INJ with Ethereum after EIP-1559 and Bitcoin with a fixed total amount.

INJ 3.0 Upgrade: Making the Deflationary Effect Stronger

In April 2024, the INJ community passed theINJ 3.0 TokenEconomic UpgradeProposal (IIP-392),which is regarded as the largest economic model improvement of Injective to date, greatly enhancing the deflationary effect of INJ.

We mentioned before that the dynamically adjusted pledge incentive determines the issuance rate, and the Burn Auction determines the destruction rate. When the destruction amount is basically stable, a reduction in the issuance rate will strengthen net deflation. Based on this, the idea of INJ3.0 is to not change the Burn Auction, but to adjust the parameters of the supply side.

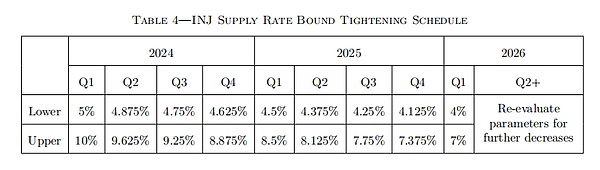

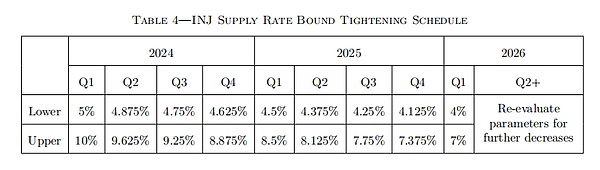

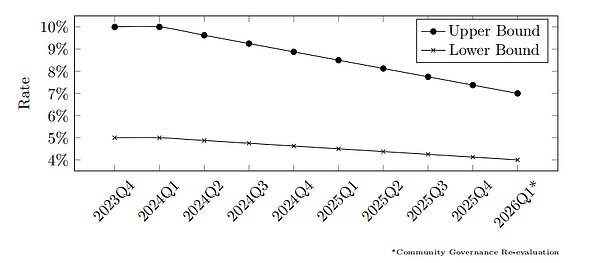

On the one hand, INJ3.0tightened the supply rate range,graduallyloweringthe upper and lower limits ofthe annualincrease in issuance rateover two years. According to the proposal, the issuance rate of INJ will drop from 5% to 10% to 4% to 7%, decreasing by a certain amount at the end of each quarter until the target range is reached in the first quarter of 2026. See the specific table in the figure below

INJ supply rate change table

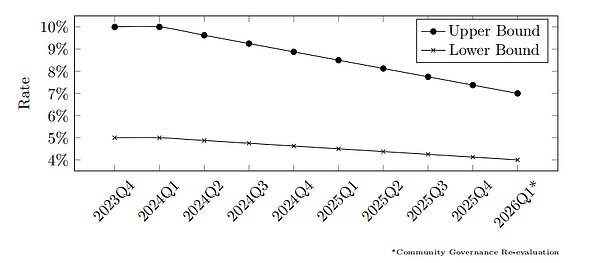

The figure below vividly shows thissupply rate curve:It can be seen that after the implementation of INJ 3.0, the upper and lower limits of inflation have dropped significantly, laying the foundation for long-term deflation.

On the other hand, INJ 3.0increased the adjustment speed of the pledge yield, and increased the adjustment range of the pledge yield from 10% per year to 50%. The system will Faster increase or decrease of inflation rate, ensuring that the pledge rate is pulled back to the target of 60% in a shorter time. Through the above two changes, INJ 3.0 strengthens the deflationary effect. According to the calculation of the Injective Foundation, the overall deflationary effect of INJ will be enhanced by 4 times after the upgrade. The community vote also showed overwhelming support (99.99% voted in favor), reflecting the high hopes of INJ holders for INJ 3.0.

Since Q2 2024, the Injective network has been running according to this new parameter, and there have beenlongernet deflation cycles. At the same time, as the ecosystem expands, the size of the weekly auction pool is also growing synchronously. Under the two-phase effect, INJ is moving towards the goal of "accelerated deflation".

INJ market circulation and inflation data (as of Q1 2025)

As of Q1 2025, the Injective network has destroyed more than 6.54 million INJ (including 5 million INJ official one-time destruction and cumulative weekly auction destruction of about 1.54 million). Among them, the average weekly auction destruction is about 10,000.

According to the data in mid-2024, the ratio of INJ's weekly destruction volume to the staking incentive issuance volume of that week once reached more than 100%, achieving net deflation.

The following is the destruction data of some key time nodes:

November 2022: INJ official one-time destruction 5 million pieces

August 2023: INJ 2.0 After the upgrade, the cumulative destruction exceeded 5.7 million INJ. December 2024: The cumulative destruction reached 6.38 million INJ. January 2025: The 195th round of weekly auction was completed, and the total destruction in history was about 6.54 million INJ

It can be seen that in addition to the 5 million tokens destroyed by the INJ official team in a single transaction, more than 1.5 million INJ were destroyed in weekly auctions. After the INJ 3.0 upgrade, the reduction in inflation has made the net deflation cycle more frequent. Take the beginning of 2025 as an example, the amount of INJ destroyed in that month was about 40,000, and about 30,000 were issued during the same period, and the net supply decreased by nearly 10,000, which verified the expected effect of the upgrade.

INJ has been destroying more than 10,000 tokens per week recently.In addition,

As of the end of 2024, the Injective network has a total of23 6,000 principal addresses participating in staking Tokens, accounting for 42% of all active addresses, the total circulation of tokens is 97.72 million, the total pledged amount is 51.5 million INJ, an increase of about 4.8 million from the beginning of the year, the pledge rate is about 52%, the pledge income APY is about 15.52%, and the overall annual inflation rate is stable at around 8%~9%. It can be seen that the inflation adjustment ability of the INJ economic model is still relatively stable.

In the future, as the INJ ecosystem continues to grow, the DApps that inject assets into the destruction auction fund pool will steadily increase, and it is expected that they will bring a strong deflation scenario to INJ for a long time. The ecological expansion will also attract more verification nodes and pledgers to join. In the near future, long-term net deflation of INJ may become a reality.

Weatherly

Weatherly