Author: Alex O’Donnell, CoinTelegraph; Compiled by: Baishui, Golden Finance

As voters flock to the polls on November 5, bettors are going all out for the U.S. presidential election, with trading volume approaching $4 billion on major prediction markets.

Web3 native Polymarket has become the dominant political betting platform. Despite being banned in the United States, more than $3.3 billion has been traded in the presidential race, according to the Polymarket website.

Emerging U.S. betting platforms — including Kalshi, Robinhood, and Interactive Brokers — have quickly gained traction since their launch in October.

Together, they have attracted more than $500 million in trading volume for the presidential election betting market, according to the app website.

Republican candidate Donald Trump leads Harris on top prediction platforms.

As of press time on November 5, Polymarket gave Trump a nearly 62% chance of winning. Kalshi and Interactive Brokers put it at about 58%, according to the apps’ websites.

Source: Polymarket

The election betting market allows users to buy contracts with binary payout structures tied to the outcome of political events.

They discuss everything from the U.S. presidential race to Senate races, Cabinet appointments and even the possible resignation of New York City Mayor Eric Adams.

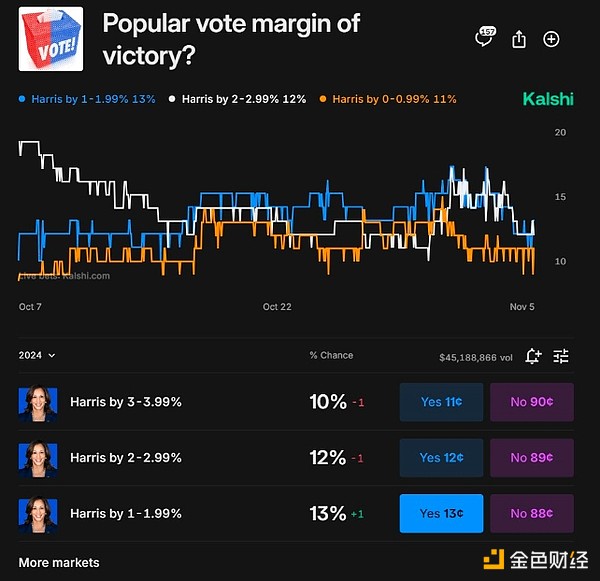

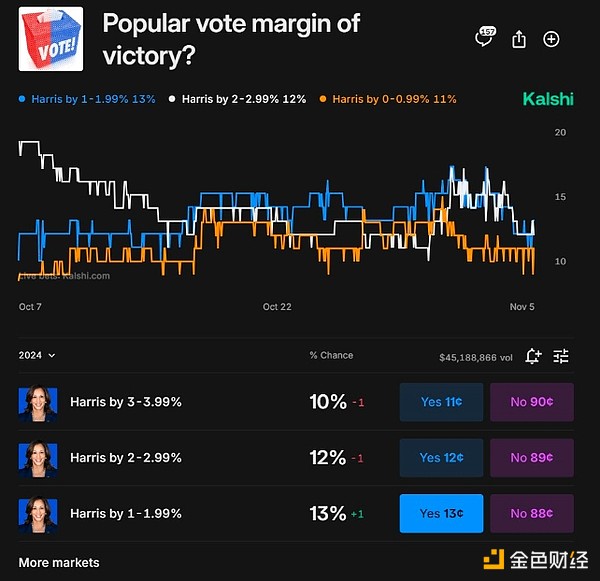

The most popular contracts involve betting on the popular vote and the winning candidate’s margin of victory.

Together, the contracts have brought in nearly $1 billion in cross-platform trading activity, according to an analysis of public data.

Source: Kalshi

Intense competition

On October 7, Kalshi listed betting contracts on the outcome of the U.S. election after winning a landmark court battle last September.

This marked the first time an election prediction market was allowed to operate in the U.S. and paved the way for other markets to enter the fray.

Since then, competition has become fierce.

On Oct. 28, cryptocurrency and stock trading platform Robinhood launched contracts for certain users to bet on the outcome of the presidential election.

According to a Nov. 5 post on the X platform, it has traded about 200 million contracts on the presidential race.

Interactive Brokers also launched election betting markets in October. Its presidential election market has attracted about $50 million in trading volume.

On Oct. 28, Kalshi began accepting deposits of the USD Coin stablecoin. Kalshi said on X that on Nov. 5 it added USDC deposits from blockchain network Polygon.

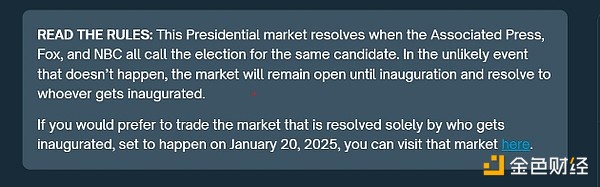

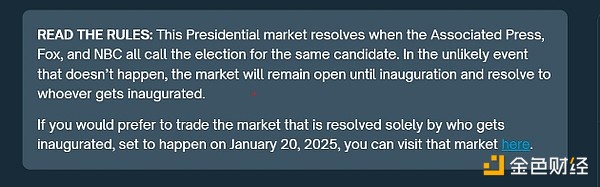

Polymarket rules governing payouts in the 2024 U.S. presidential election prediction market. Source: Polymarket

Manipulation Fear

In October, Polymarket was criticized after multiple investigations claimed that about 30% of its U.S. presidential election bets came from fake trades, a market manipulation method designed to artificially increase trading volume.

Meanwhile, according to anonymous political gambler Dormer, five large Polymarket investors allegedly bought more than half of the bets on Trump to win.

If the Associated Press, Fox and NBC are unsure about the winner, winning presidential bettors on Polymarket could see their payouts delayed until Jan. 20, 2025.

In September, Kalshi won a lawsuit against the U.S. Commodity Futures Trading Commission (CFTC) that challenged the regulator’s decision to ban Kalshi from listing political event contracts.

The CFTC has said election prediction markets like Kalshi threaten the integrity of elections, but industry analysts say they often capture public sentiment more accurately than polls.

“The market for event contracts is a valuable public good, and there is no evidence of significant manipulation or widespread use for any nefarious purpose as alleged by the Commission,” said Harry Crane, a statistics professor at Rutgers University, in a comment letter to the CFTC in August.

In August, financial data and news service Bloomberg LP added Polymarket’s election odds data to its terminal.

Joy

Joy