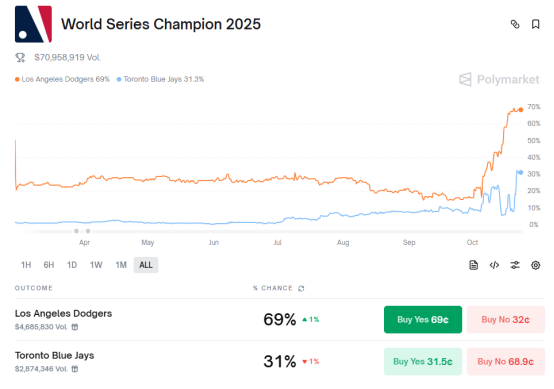

Prediction markets are becoming the new darling of Wall Street. This month, Intercontinental Exchange (ICE), the parent company of the New York Stock Exchange, invested $2 billion in the decentralized prediction market Polymarket. This marked one of the largest private financing rounds in crypto history and boosted Polymarket's valuation to $9 billion. Recently, news emerged that Polymarket is in early-stage discussions with investors and seeking funding at a valuation of $12 billion to $15 billion. Interestingly, just four months ago, Polymarket's valuation was less than one-tenth of its current value. Back in 2022, Polymarket was even under regulatory scrutiny. Polymarket's surge in valuation is astonishing, and prediction markets have once again shone in the market spotlight. When you mention Polymarket, the first thing that comes to mind is prediction markets. What are prediction markets? Despite the fancy terminology, prediction markets are essentially probabilistic betting, or more bluntly, a variation of gambling. Of course, this approach differs from pure speculation. The betting itself relies on information and the ability to predict probabilities, more accurately described as "information warfare." Using price to determine probabilities is clearly the most objective way to reflect the direction of information. The earliest prediction markets can be traced back to the 16th century, when various casinos were established in Rome, Italy, around the papal election. By the 18th century, the scope of betting expanded, evolving from a single issue to a "betting on everything." After the 19th century, the global political hotspot of the US presidential election ignited enthusiasm for prediction markets, leading to their gradual prosperity. However, as statistically-focused forecasting methodologies matured, the irrational nature of prediction markets relegated them to the background. Despite this, the spark of prediction markets has not died down. The Iowa Electronic Market, a nonprofit experimental project run by the University of Iowa, successfully demonstrated the potential of prediction markets during the 1988 presidential election, becoming one of the earliest and most famous prediction markets. Subsequently, the Hollywood Stock Exchange, Policy Analysis Market, Intrade, and PredictIt emerged, and prediction markets evolved from centralized to decentralized, ultimately shaping the current landscape of prediction markets. Polymarket is a representative example of decentralized prediction markets. It's worth noting that Polymarket wasn't the first decentralized prediction market application. As early as 2018, the decentralized prediction product Augur launched on Ethereum. However, its development fell into the trap of traditional cryptocurrency circles, using platform coins for staking and focusing on the completion of smart contracts rather than the user experience, ultimately leading to its failure. Polymarket, learning from the lessons of its predecessors, places particular emphasis on user experience, both in its mechanisms and interface. Polymarket was originally built on Ethereum smart contracts and later migrated to the more scalable sidechain Polygon. Users can participate using only their wallet, without identity verification. The only supported currency for betting is USDC, ensuring stable stakes. Architecturally, Polymarket utilizes the Conditional Token Framework (CTF) developed by Gnosis. Users stake tokens to purchase conditional tokens representing specific outcomes, and the concept of bundles facilitates bundled purchases. The market relies on central limit order books, a common practice in traditional financial markets, for market making. A hybrid architecture of off-chain matching and on-chain settlement ensures a seamless user experience. While it may sound complex, from a user's perspective, it's incredibly simple. Bet with stablecoins, and questions are matched to market questions, with only binary options of "yes" or "no." Correct predictions earn $1, while incorrect predictions earn nothing. In the CTF framework, prices represent the probability of an event occurring. For example, if the bet is $0.69, the probability of the bet event occurring is 69%.

From infrastructure development to smart contract operation, Polymarket is a purely decentralized application. In this prediction market, the platform is not the counterparty, there's no need to worry about casino rakes, and there's no large-scale public opinion manipulation or information bombardment. No one even knows who you are; you simply place your bet based on your own will.

Thanks to these advantages, Polymarket, launched in 2020, quickly experienced explosive growth, with trading volume exceeding $1 billion in 2023. In 2024, it became a hit thanks to its successful prediction of the US election, with total trading volume soaring to $8.6 billion that year, making it a leading prediction market application. In the first half of this year alone, Polymarket's trading volume reached $6 billion, and its cumulative total to date has exceeded $20 billion. While its seemingly smooth development path has been marked by its share of setbacks, Polymarket's mechanisms are difficult to define from a regulatory perspective. It can be considered gambling, but it can also be considered a binary options swap. Unlike traditional gambling, contracts on Polymarket can be traded before an event has concluded. For example, if a user purchased the "Trump wins the election" event for $0.10, and the contract price subsequently rose to $0.40, the user could sell the contract to realize a profit, even if the event has not yet concluded. This mechanism has clear advantages and disadvantages. Its advantage is that it truly transforms the prediction market from a pursuit of results into a trading process. Bets can change dynamically in real time based on the real-world context, allowing for volatility arbitrage and greater betting flexibility. However, it inevitably transforms betting contracts into investable financial derivatives. Against this backdrop, in 2022, Polymarket was accused by the US CFTC of operating an unregistered exchange offering illegal trading. Polymarket ultimately settled with regulators, paying a $1.4 million fine and withdrawing from the US market. In 2024, after Trump's election predictions completely dominated the betting market, Polymarket even faced a severe crackdown from the US. In November, the FBI raided CEO Shayne Coplan's home and seized his electronic devices. Investigations by the US Department of Justice and the CFTC followed suit, giving the market a whiff of a political purge. Of course, the environment rapidly shifted after Trump took office, and almost all of Biden's former enemies were treated with courtesy by Trump. In July of this year, the US Department of Justice and the CFTC dropped their investigations into Polymarket. Shortly thereafter, Polymarket announced a $112 million acquisition of QCX LLC and its affiliated clearinghouse, QC Clearing LLC, a small derivatives exchange licensed by the CFTC. Polymarket's strategy was clear: to re-enter the US market through acquisition. In September of this year, QCX received a letter of no action from the CFTC, officially clearing a major hurdle for Polymarket's return to the US market. With the regulatory jigsaw complete, investors flocked to the company. In January, Polymarket completed a $150 million funding round led by Founders Fund and Dragonfly, valuing the company at $1.2 billion. In October, Polymarket secured $2 billion in funding from ICE, a subsidiary of the New York Stock Exchange, valuing the company at $9 billion. More recently, market rumors circulated that Polymarket was about to raise its next round of funding at a valuation of $12 billion. Interestingly, 1789 Capital, the venture capital fund owned by Donald Trump Jr., is also among its shareholders, indirectly confirming Polymarket's legitimacy. Today, Polymarket has become a major player in the crypto market, with weekly trading volume reaching a staggering $1 billion. When discussing prediction markets, Polymarket is an unavoidable topic. For users, the platform's performance is unimportant; personal profit is paramount. Notably, Polymarket's CEO previously hinted at a coin offering, sparking market anticipation. However, judging by the investment it has attracted so far, an IPO may be more in line with its market positioning. On the other hand, while the future looks promising, Polymarket also has its hidden challenges. First, there are vulnerabilities in the technical mechanism. Polymarket uses the UMA protocol as a decentralized oracle solution, responsible for reliably recording the results of real-world events onto the blockchain. The results are determined by the UMA oracle, but decentralized oracles do not always accurately identify the correct answer. The typical oracle decision process is that after an event occurs, if there are no objections, the result is published directly. If there are objections, a dispute voting period begins, during which users holding UMA tokens can vote on the dispute, and the final result is final. This seemingly fair solution has a fatal flaw. In this scenario, large holders of UMA tokens have considerable influence and can even "fabricate the truth." In March of this year, the oracle reported "yes" despite the actual result being "no" on whether Ukraine would reach a rare earth trade agreement with Trump by April. This was because a large holder hijacked the oracle to change the result. Furthermore, even if oracle issues are eliminated, the subjective nature of decentralized voting can affect actual judgment. When faced with ambiguous answers, there is a lack of fairness, which can lead to disputes. Second, regulatory uncertainty remains. While the current US government has significantly liberalized crypto market regulations, gambling regulations remain in place. Polymarket itself faces unresolved issues of market manipulation and insider trading, creating a regulatory ambiguity. Following these issues, market challenges have also emerged. In the prediction market, Polymarket and Kalshi are competing head-to-head. In terms of differentiation, the former offers a more crypto-native approach, emphasizes decentralization, and covers a wider range of predictions, encompassing politics, economics, sports, and entertainment. The latter, on the other hand, prioritizes compliance as a key competitive advantage. As a compliant exchange approved by the US CFTC, it is more attractive to institutional users and outsiders. While Polymarket currently holds a commanding lead in terms of trading volume and brand recognition, the latter is clearly overtaking. Kalshi's market share, calculated through weekly nominal trading volume on its Dune platform, rose from 8% in January 2025 to 66% in September 2025. Although it has now fallen back to 46.6%, its growth momentum remains strong. Kalshi is also not far behind in recent funding rounds, with reports suggesting it is receiving funding offers from venture capital firms with valuations ranging from $10 billion to $12 billion. Competition is increasingly fierce, but the heavy investment also shows that the prediction market is rapidly rising with a sweeping momentum. Both Polymarket and Kalshi are just one of the investment targets within this broader context. As for why the prediction market is so important, the key lies in the information pricing behind it. Probability is a reflection of information, and information is manifested through price. This pricing method truly shifts decision-making from "immediate reaction" to "information prediction." An analogy here can be drawn with traditional media. The media is highly valued in the financial sector due to its information transmission capabilities and potential market backlash. However, as the media has become more aligned with financial and political groups, it has increasingly lost its original impartiality and independence, beginning to convey a certain bias and even coming under the control of a small elite. The emergence of prediction markets has become a valuable complement. Price betting reflects internal sentiment and signals more accurately and distinctly, and provides more immediate feedback on price fluctuations. In other words, prediction markets are becoming a new type of information medium. This medium releases information pricing power, once reserved for elitists, to the public, enabling timely feedback of event-driven data amidst volatility. This represents more than just simple betting and prediction; it represents a profound paradigm shift in the price discovery system, the inherent value of which is self-evident. For example, events that some media outlets may deem unimportant or overlook may receive significant attention in prediction markets. This attention is the very source of price, and for listed companies, it is more valuable than year-round financial reports and marketing campaigns. This may be one of the reasons the New York Stock Exchange invested in Polymarket. Adding pricing based on expectations and attention to traditional asset pricing systems is precisely a reflection of adapting to objective trends. ICE reportedly acquired global distribution rights for Polymarket's event-driven data through this investment and plans to apply it to next-generation tokenized projects. While promising, ethical issues remain. Betting on everything also means the financialization of everything, and even, in a sense, entertainment. However, there are always events that cannot be entertained. When these two factors collide, what future will prediction markets face? Of course, it's too early to discuss this; prediction markets still have a long way to go.

Anais

Anais