Author: Song Xuetao of Tianfeng Macroeconomics/Contact Person: Zhong Tian; Source: Xuetao Macroeconomic Notes

Powell’s most important correctness is “political correctness”.

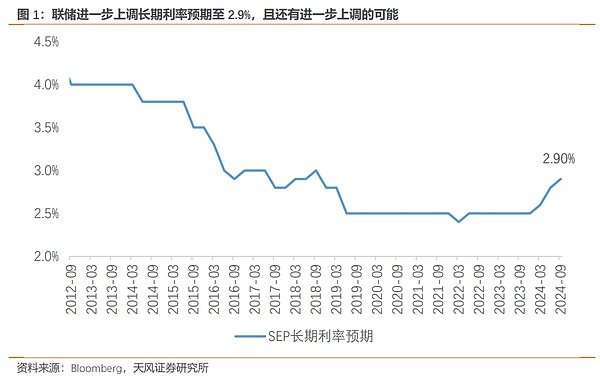

In the September FOMC meeting, the Fed cut interest rates by 50bp beyond expectations, revised up the unemployment rate forecast at the end of the year to 4.4% (4.0% in June), revised down the core PCE at the end of the year to 2.6% (2.8% in June), and further revised up the long-term interest rate to 2.9%.

Following the Jackson Hole meeting, the Fed declared victory in the fight against inflation by substantially cutting interest rates by 50bp, thus starting a new cycle of interest rate cuts.

Throughout the press conference, Powell did not give a strong argument for a 50bp rate cut, but repeatedly emphasized "doing the right thing". However, judging from recent economic indicators, a 50bp rate cut "is not necessarily correct".

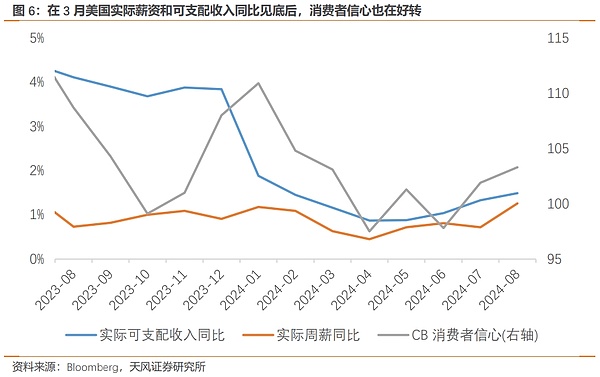

Since August, core inflation has rebounded, wage growth has rebounded, employment conditions have improved, retail sales have exceeded expectations, the entire real estate chain has rebounded, the service industry PMI has maintained a substantial expansion level, and industrial production has recovered beyond expectations, all of which deny the urgency of a substantial rate cut.

As we mentioned in "Understanding the Logic of Fed Actions", Powell's dovish change is not economic logic, but political logic. From the perspective of economic logic, a 25BP rate cut or no rate cut is reasonable; from the perspective of political logic, a 50BP or even 75BP rate cut is not wrong. Recently, Democratic Senator Elizabeth Warren called on the Federal Reserve to cut interest rates by 75BP before the election.

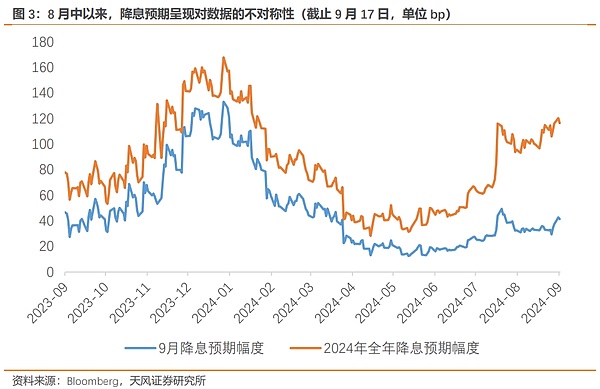

This led to the continuous rise in expectations of a 50BP rate cut during the silent period of Fed officials and the consistent improvement of economic data, relying on the former New York Fed Chairman and the media, and Powell chose to move closer to market expectations and conform to financial market pricing, rather than the active "expectation management" that he often did before.

This is not a compensatory rate cut. If the Fed really believes that the July non-farm data points to the necessity of a rate cut, it should publicly guide clearer expectations of a rate cut (25bp+25bp) after the data is released, rather than letting the market gamble on the possibility of 25bp and 50bp after the silent period.

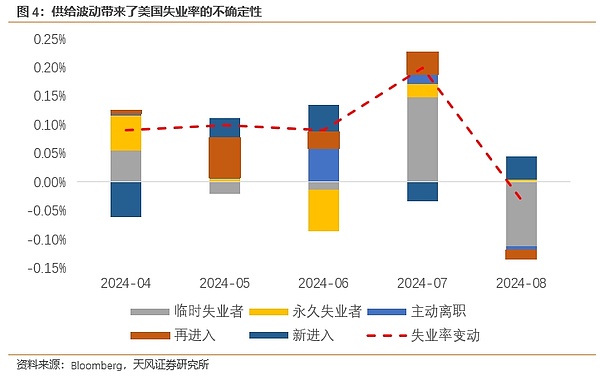

The September SEP gives that the unemployment rate will remain stable at 4.4% in 2024 and 2025, which is also difficult to be self-consistent: because historically, the unemployment rate is difficult to stay at one position, but such a large labor supply shock has never appeared in history, and the unemployment rate is full of too many unknowns. (For details, see "Recession Fears and the Non-landing of Easing")

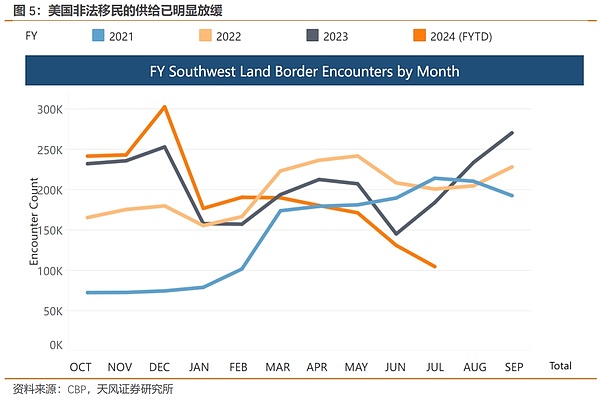

The entire US labor market is engulfed by the unpredictable influx rate of illegal immigrants (including the time it takes for illegal immigrants to transform into the labor force, and the level of participation rate). The number of illegal immigrants currently recorded by the US Border Service has significantly weakened.

Such a bold monetary policy adjustment and a relatively active interest rate cut path have not taken into account the marginal weakening of the labor supply. Coupled with the demand recovery brought about by the interest rate cut, there is a possibility that the US unemployment rate will turn downward.

Looking back now, the correctness that Powell mentioned is not based on the "correctness" of economic factors, but more on the "preference" of political factors.

When Biden's approval rating lagged behind Trump, Powell tried his best to maintain a vaguely neutral position. After Harris took over Biden and his approval rating exceeded Trump, his attitude quickly turned dovish, and he started a rate cut cycle with his Jackson Hole speech of "doing everything possible." (See "Powell's Dovish Change" for details) Interestingly, Powell talked about his experience in four presidential elections as Fed Chairman at the press conference, "each time it was a collective decision based on maximizing the interests of the American people." However, in 2016, the Fed tried its best to avoid interfering in the election and continued to raise interest rates after the election; and for the current US economy, it is more than enough to wait until the election is over before taking action. Trump previously threatened to replace Powell and shouted to Powell "not to cut interest rates before the election", which may have "counterproductively" contributed to the 50BP rate cut to some extent.

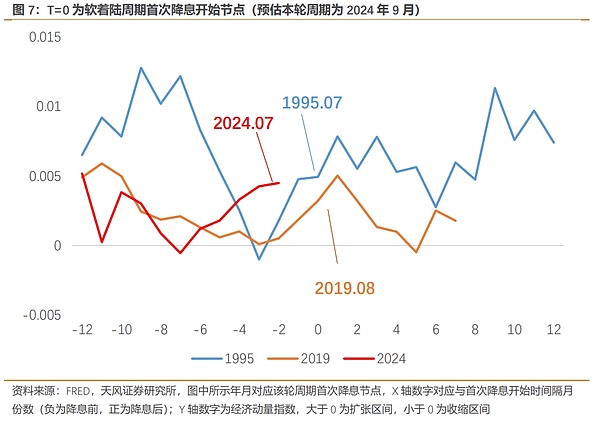

In general, this is a substantial rate cut driven by non-economic factors, which may also increase the risk of secondary inflation. The US economy is stimulated by the rate cut at a relatively high level (Figure 7: The economic momentum index is at the highest level of the soft landing cycle), and the rebound in demand will drive the rebound in inflation. The Fed may consider raising interest rates again next year. (See "One Rate Cut Away from Second Inflation" for details)

The volatility of the large rate cuts and increases also brings Powell one step closer to his idol (Paul Volcker) predecessor, Arthur Burns, the Fed Chairman in the 1970s. (For details, see "Powell is destined to be the Burns of the 21st century")

Risk Warning

The US unemployment rate data has a large deviation, US corporate profits have slowed down beyond expectations, unexpected events in the US election have reappeared, and the uncertainty of US wage growth has increased

Hui Xin

Hui Xin

Hui Xin

Hui Xin YouQuan

YouQuan Davin

Davin Joy

Joy Clement

Clement Catherine

Catherine Hui Xin

Hui Xin Alex

Alex Jasper

Jasper YouQuan

YouQuan