Source: Wall Street News

US President Trump is disappointed again.

Despite his repeated calls for interest rate cuts, the Fed chose to wait and see, and did not cut interest rates, and also hinted that Trump's policies risked stagflation.

Federal Reserve Chairman Powell also reiterated after the meeting that the Fed was not in a hurry to act and did not think it should preemptively cut interest rates to deal with the impact of tariffs, once again slapping Trump in the face.

Powell also said that Trump's call for interest rate cuts "will not affect our work at all", and he has never taken the initiative to ask for a meeting with any president, and will not do so in the future.

Nick Timiraos, known as the "New Fed News Agency", commented that Fed officials are considering whether the focus is on employment risks or inflation risks.

Although the Fed continues to sit on its hands, Trump has "made a move" and plans to revoke the Biden administration's new export restrictions on AI chips, which has helped the US stock market close higher, bid farewell to two consecutive declines, and the US dollar index has accelerated its rebound, and gold has further fallen.

01 Slap Trump in the face, the Fed pauses interest rate cuts again

On Wednesday, May 7, Eastern Time, the Federal Reserve announced after the FOMC meeting that the target range of the federal funds rate remained unchanged at 4.25% to 4.5%.

This is the third consecutive monetary policy meeting of the Federal Reserve to decide to suspend action. The Federal Reserve has cut interest rates for three consecutive meetings since September last year, with a total reduction of 100 basis points. Since Trump took office in January this year, the Federal Reserve has been suspending its actions.

This resolution was supported by all FOMC voting members, and no one opposed it like last time. The Federal Reserve statement said that the uncertainty of the economic outlook has "further" increased, and the new sentence "the risk of rising unemployment and rising inflation has increased"; reiterated that recent indicators show that economic activity is still expanding steadily, but pointed out that fluctuations in net exports have affected the data.

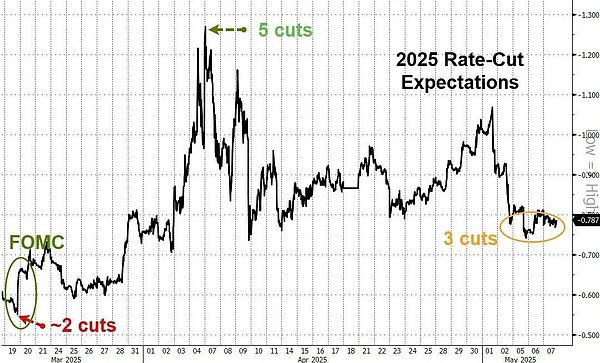

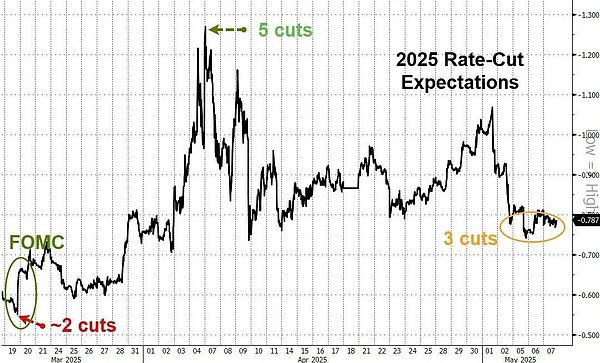

This time the Federal Reserve's suspension of interest rate cuts was completely expected by the market. By the close of Tuesday, CME tools showed that the futures market expected the Fed to keep interest rates unchanged this week with a probability of more than 95%, and more than 68% of the probability of not cutting interest rates in June, and about 77% of the probability of cutting interest rates in July. Before the Fed's decision was announced on Wednesday, derivatives market pricing showed that traders cut their bets on rate cuts, expecting about three 25 basis point rate cuts this year starting in July.

02 Powell refuses to preempt action due to tariffs

Powell commented on the US economy, saying that the economy remains solid. The labor market is roughly balanced and at or close to full employment. Inflation growth has slowed significantly. Wage growth continues to moderate.

Powell said that the current monetary policy is moderately restrictive, the underlying inflation outlook is good, and wait and see is a clear decision; he said that companies, market participants and forecasters are watching how things develop, insisting that "everyone is waiting." Can't preemptively strike because don't know how to respond until more data is seen.

Powell said that Trump's call for rate cuts "will not affect our work at all". He said: "We will always do the same thing, that is, use our tools to promote maximum employment and price stability for the benefit of the American people. We will always only consider economic data, prospects, risk balance, that's all. That's all we have to consider."

Asked why he has not yet met with Trump during his new presidency, Powell replied: "I have never asked to meet with any president and I never will."

Powell was asked which aspect of the problem needs to be solved first during his term, unemployment or inflation.

Powell said that the risks of rising unemployment and rising inflation have increased. It is not clear which risk is more worrying. "It is too early to draw a conclusion now." Powell believes that it is necessary to pay attention to both the risks of unemployment and inflation, and may have to make a choice between them.

When asked whether it will take a long time for the Fed to figure out the development of the situation, Powell emphasized: "I don't think we know." He also reiterated his previous remarks that the Fed will not rush to cut interest rates. He said:

"We don't think there is a need to rush to adjust interest rates."

"We think we can be patient and we will pay attention to the data."

At the same time, Powell emphasized that high tariffs may push up unemployment and inflation.

"If the announced significant tariff increases continue, it could lead to higher inflation, slower economic growth and higher unemployment."

When asked if the impact of tariffs has not yet arrived, he replied, "Not yet." "People are worried about inflation and the impact of tariffs, but this impact has not yet arrived."

Powell believes that if Trump maintains high tariffs, the Fed's inflation and employment goals will not make progress for at least the next year. Negotiations may or may not substantially change the trade situation.

03 The Fed did not take action, but Trump did, and US stocks rebounded

Although the Fed continued to sit on its hands, Trump "made a move".

The media said that as part of its efforts to modify semiconductor trade restrictions, the Trump administration plans to revoke the artificial intelligence (AI) chip restrictions during the Biden administration. Later, a spokesman for the U.S. Department of Commerce confirmed the news.

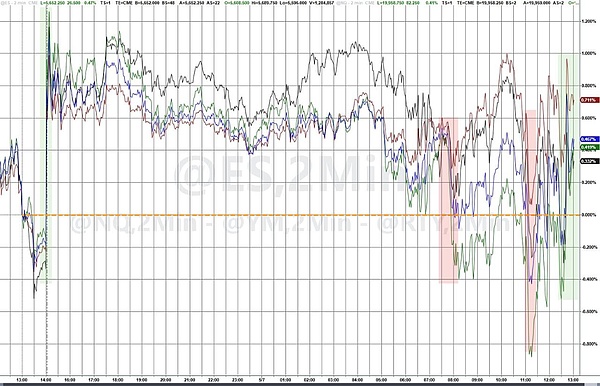

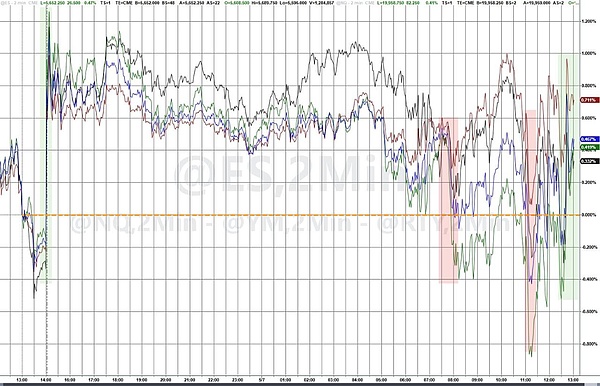

After the news came out, chip stocks rose in the late trading of U.S. stocks. The Philadelphia Semiconductor Index once rose by more than 2%. Nvidia's gains in the late trading expanded to more than 3%, and when it hit a new high, it rose 4.8% from the intraday low.

The news from the Federal Reserve and Trump dominated market sentiment, and the major U.S. stock indexes fluctuated and closed higher. The tariff news stimulated a sharp rise in chip stocks in the late trading, and Google still fell against the market:

In the early trading of the U.S. stock market, driven by the news of the upcoming economic and trade talks between China and the United States, the three major U.S. stock indexes opened higher.

In the morning, Apple executives said that they were planning a major Safari revision, aiming at AI search, and Google's search position was facing severe challenges. After that, Google fell more than 9% and Apple fell more than 2%, and the Nasdaq fell.

In the midday trading of the US stock market, the Federal Reserve announced that it would not cut interest rates, and added a sentence to the interest rate decision statement: "The risks of rising unemployment and rising inflation have increased." With the risk of stagflation at hand, the three major US stock indexes hit new daily lows.

At the end of the US stock market, Powell reassured the market that the economy is still strong and refused to take preemptive action due to Trump's tariffs. The S&P 500 turned from a decline to an increase and fluctuated upward. It was reported that Trump would revoke the new global AI chip export restrictions introduced when Biden was in power. After the news came out, chip stocks rose in the late trading, and Nvidia once rose nearly 5% from the daily low.

On Wednesday, the three major US stock indexes closed higher, bidding farewell to two consecutive days of decline. Apple closed down 1.14%, and Google closed down more than 7%. After the financial report, Disney rose nearly 11%, and AppLovin rose more than 10% after the market. Arm, which gave poor guidance, fell more than 10% after the market. The China Concept Index closed down more than 2%.

Catherine

Catherine