Author: Revc, Golden Finance

I. Introduction

Fractal, a popular Bitcoin expansion solution, broke through the $6 billion full circulation market value on the day of its listing, while Bitcoin took nearly 5 years to achieve this achievement, which gave us a new perspective to think about the project launch mechanism. The market value of POW projects fluctuates violently with the recognition of the projects, while the market value of POW+pre-mining mixed projects is expected at the time of listing, which triggered a series of thoughts. Does pre-mining lead to insufficient decentralization when the protocol is launched, and further affect the development of its ecology and mining return expectations? How to balance ecological community incentives and decentralization?

Within a week of listing, Fractal supported a full circulation market value of $6 billion with an average daily trading volume of $10 million. In today's sluggish market environment, what technical innovations did Fractal rely on to make the market pay, or was it crazy market maker behavior? Let's take a look at Fractal, a Bitcoin expansion solution, with some thoughts.

2.CATProtocol

The outbreak of CAT20 has made Fractal the focus of market attention again. CAT20 is the token launched by the Fractal network project CAT protocol. It has created 4.7 million transactions in two days and has nearly 35,000 total holder addresses. As a tokenization protocol, the Bitcoin scripting language can be used to define the characteristics and behaviors of tokens, thereby realizing the creation, transfer, and destruction of tokens.

CAT Protocol Main Features:

CAT Protocol Main Features:

Based on Bitcoin: The CAT protocol uses Bitcoin's UTXO model and scripting language to implement tokenization functions, ensuring security, decentralization and scalability.

Custom Tokens: Users can create different types of tokens according to their needs, including transferable, non-transferable, with specific attributes, etc.

Security Mechanism: CAT protocol uses a recursive contract mechanism to ensure the security of tokens and prevent malicious behavior and forgery.

Scalability: CAT protocol can support a large number of tokens and transactions and has good scalability.

The implementation process of the CAT protocol can be divided into the following steps:

Creating a token:A user can create a new token by submitting a specific transaction, which contains the properties and initial state of the token.

Transferring a token:A user can transfer a token to another person by specifying the new owner address in the transaction.

Merging tokens:Multiple tokens of the same type can be merged into one token.

Destroy tokens: Users can destroy tokens so that they no longer exist.

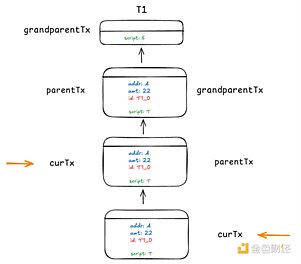

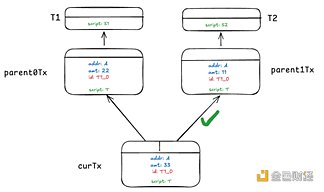

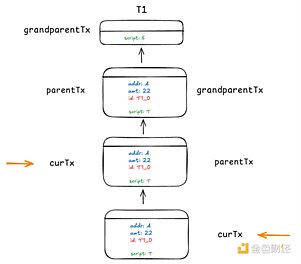

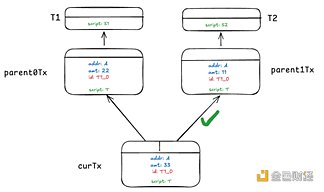

The CAT protocol uses a recursive contract mechanism to ensure the security of tokens. This mechanism verifies whether the status of the token is legal by embedding conditional statements in each transaction. If the conditional statement is not satisfied, the transaction will be rejected.

The expansion idea of the CAT protocol comes from the Bitcoin operation code OP_CAT, which is a proposed operation code in Bitcoin script, which aims to enhance the functionality of Bitcoin script by allowing scripts to splice two elements in the stack.The current execution mode of Bitcoin script is linear, lacking loops and basic arithmetic operations, which limits its expressive power. Bitcoin script cannot directly access certain data in transactions, which limits the complexity of smart contracts.OP_CATcan enhance the expressive power of Bitcoin scripts by splicing data and implementing simple arithmetic operations, so that Bitcoin can support more complex smart contracts.For example, safe contracts, Merkle tree verification, tree signatures, etc. Through OP_CAT, scripts can access more transaction data, allowing for more refined control. Recursive restriction clauses can also be implemented so that constraints can be passed across multiple transactions.

Three,Fractal

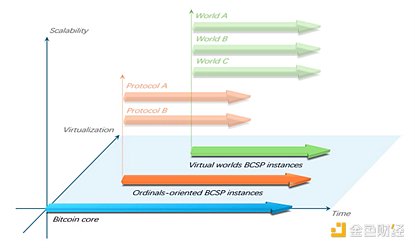

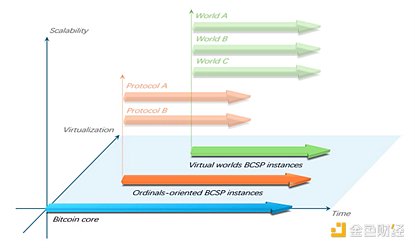

Fractal (Fractal Bitcoin) is a Bitcoin network extension protocol. Fractal encapsulates the Bitcoin core into a deployable software package (BCSP) to run multiple instances on the Bitcoin mainnet. Infinite expansion is achieved through nested recursion while maintaining consistency with the Bitcoin core. Similar to operating system virtualization, it provides isolation and flexibility.

Fractal reuses Bitcoin's consensus mechanism to ensure that all virtualized instances remain consistent with the main chain. It avoids consensus divergence caused by forks and enhances the stability of the system. By instantiating BCSP multiple times, it achieves unlimited expansion in both horizontal and vertical directions. At the same time, it can maintain structural balance and avoid excessive congestion at any specific layer. New instances may require protection mechanisms when they are launched, such as security settings for specific block heights. The system's anti-attack capabilities are enhanced through merged mining and other methods. Fractal's distributed on-chain computing can establish a network of multiple BCSP instances, which is better than the computing efficiency of a single instance. Unlike on-chain sharding, BCSP instances can be deployed and monitored independently.

Fractal shortens the block confirmation time to 60 seconds or less, improving the response speed. It increases storage space and reduces transaction costs, and is suitable for applications such as ordinal inscriptions. The cross-layer elevator (Elevator) can realize the direct transfer of assets between different layers without additional relays. Fractal Bitcoin theoretically enhances the processing power of Bitcoin through virtualization and self-replication, and also provides new application scenarios for future development, such as the optimization of ordinal inscriptions and the construction of virtual worlds, integrating the inscription community, and making the value of ordinal inscriptions spill over to the L1 network.

Fourth, Thinking

First of all, the virtualization instance is easier to understand, but the application of recursion in the Bitcoin network is obviously much more complicated. While reusing consensus reduces the complexity of the blockchain system, it also introduces new entropy. The following is my thinking after reading the Fractal Lite paper.

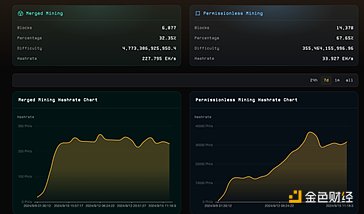

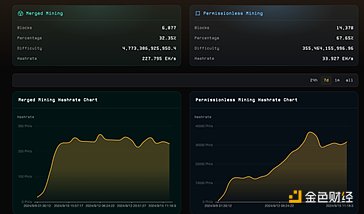

Fractal uses the same PoW consensus mechanism as Bitcoin. BTC miners can seamlessly switch to Fractal block mining with current ASICs, GPUs, and other existing hardware, with a cycle of 3 blocks, 2 of which are produced through "permissionless mining" and 1 block through "merged mining". Permissionless mining allows anyone with the right tools and hardware to mine Fractal blocks, similar to how BTC is mined. Merged mining is specifically for BTC miners, allowing miners to mine BTC blocks and Fractal blocks at the same time without taking up additional computing power.

In order to control the transaction confirmation time to about 30 seconds, Fractal may adjust the difficulty more frequently than the Bitcoin network. Due to the existence of the two mechanisms of permissionless and merged mining, the network computing power level is not stable enough, and the complexity of the difficulty adjustment mechanism may affect network security.

The merged mining mechanism also increases the initial reward burden of the network, which requires Fractal to maintain the coin price at least at $25 to achieve 50% of the income of each 1EH computing power of the Bitcoin network. If it blindly attracts computing power for the so-called network security, it may cause the token price to continue to perform poorly.

Assume that the packaging reward for each block is 0.3 bitcoins, the coin price is 60,000 US dollars, and the total network computing power is 660EH.

(3.15+0.3)*60000/660 ≈ 313USD

Assume that the packaging reward for each block is 5 FB, the coin price is 25 USD, the combined computing power is 220E, and the unlicensed computing power is 30E

(25+5)*25*(600/30)/(220*1/3+30*2/3)≈ 160USD

Note: The actual permissionless computing power income may be higher, and the formula here is only a simplified expression.

The instantiated BCSP reaches consensus through recursion to ensure security, and the elevator ensures the cross-layer flow of assets, which is similar to the plug-in ledger, increasing the computing power and storage capacity of the network. However, recursive calls will generate a large number of function call stacks, which may cause stack overflow. Debugging recursive code is relatively difficult, and the function call process needs to be carefully tracked. As the network expands, new problems will arise and need to be paid attention to. The early start of the instance requires the specification of the block height. Is there a centralized operation and the risks that come with this process?

Can the instance have independent security, that is, an independent difficulty adjustment mechanism and network rewards to attract computing power and expand new usage scenarios beyond ordinal inscriptions? But from the current point of view, the risk is relatively high.

V. Comparison of Bitcoin Expansion Solutions

The following compares the characteristics and challenges of several major expansion solutions. Projects such as Fractal aim to enhance the expressiveness of Bitcoin scripts, enabling Bitcoin to support more complex smart contracts.

VI.Summary

Fractal's innovative design deserves recognition. While expanding the Bitcoin network, it utilizes Bitcoin's existing code and ecology. Through recursion, an expansion layer that is highly compatible with the Bitcoin main chain is created, which greatly improves the network's transaction processing capabilities and speed, and Bitcoin miners and users can make a seamless transition. In the future, more expansion plans will emerge, which is also a manifestation of Bitcoin's greater decentralization than other ecosystems.

However, as the CAT protocol itself states, the current mainstream solution is still in the experimental stage. We must pay attention to network security, especially changes involving the core mechanism of the Bitcoin network, such as the difficulty adjustment mechanism, the computing power impact that the Bitcoin shadow chain may face, and the sustainability of the token economic model.

In addition, there is a consensus in the market that high-market-value, low-circulation VC tokens should not be brought into the Bitcoin ecosystem. Although the POW consensus mechanism is adopted, Fractal has 50% tokens pre-mined and allocated to ecological partners, BRC20 communities, large mining pools, wallet infrastructure and other game makers. The high cost of resource integration may also be a foreshadowing that restricts its development and reduces its decentralized attributes. Crypto projects should avoid the formation of crypto-elites or crony capitalism and carefully design token distribution mechanisms.

JinseFinance

JinseFinance

CAT Protocol Main Features:

CAT Protocol Main Features: