Author: Spirit

Abstract

PumpFun has rapidly emerged as the leading Meme coin issuance platform on the Solana blockchain, and its newly launched decentralized exchange (DEX) PumpSwap marks an important milestone in its development. PumpSwap aims to consolidate PumpFun's position in the Meme coin field by providing a seamless trading experience and innovative incentive mechanisms, and has a profound impact on the Solana ecosystem, the Meme coin market, and the broader DEX industry. The following article analyzes PumpSwap's technical design, potential impact, future prospects, revenue model, and history of cooperation with major DEXs, and evaluates it in the development trend of Web3 crypto applications. Overall, PumpSwap has the potential to become a leading dApp in the Web3 space, but its success will depend on its execution, market competition, and its ability to attract a wider range of users outside the Meme coin space.

I.The rise of PumpFun and the birth of PumpSwap

Since its inception in January 2024, PumpFun has quickly become the center of Meme coin issuance on the Solana blockchain. The platform captures the market's demand for sentiment-based token issuance by allowing users to create tokens instantly and for free.As of January 2025, more than 5.5 million Meme coins have been created on PumpFun, demonstrating the platform's dominance in the Solana ecosystem and users' huge interest in Meme coins. PumpFun’s rapid growth highlights the strong demand for Meme Coin creation and trading within the Solana ecosystem. The launch of millions of Meme Coins and the platform being described by some metrics as one of the fastest growing crypto applications ever, both indicate the huge market potential for such platforms on Solana.

To further solidify its position and enhance the functionality of its ecosystem, PumpFun has launched its native DEX, PumpSwap. Behind this move is PumpFun’s strategic consideration to retain trading volume and revenue within its ecosystem, especially in the face of the recent decline in platform fees. Multiple reports have pointed to a decline in PumpFun’s revenue, indicating that the platform needs to seek to diversify or strengthen its revenue sources. The launch of a native DEX allows PumpFun to capture trading fees that previously went to other platforms such as Raydium.

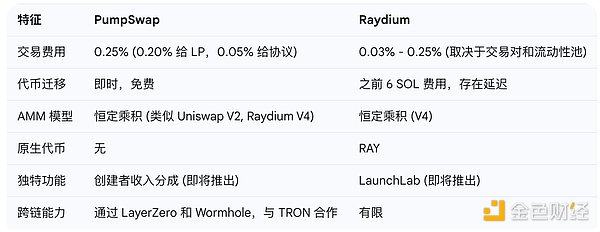

Prior to the launch of PumpSwap, the tokens on PumpFun that completed their bonding curves relied primarily on Raydium for trading and liquidity. However, this migration process has some friction, such as the requirement to pay a 6 SOL migration fee, and will slow token trading momentum and introduce unnecessary complexity for new users. Removing the 6 SOL migration fee and introducing an instant migration feature solves a significant pain point for users and has the potential to improve user experience. Multiple sources have highlighted the previous 6 SOL fee for migrating to Raydium and the delays caused by the migration process as factors that hinder the user experience. PumpSwap's instant and free migration directly addresses these issues, potentially increasing user satisfaction and platform stickiness.

At its core, PumpSwap is a constant product automated market maker (AMM) that operates in a similar way to Uniswap V2 and Raydium V4. This design allows users to trade tokens and provide liquidity in a decentralized manner.

II.PumpSwap: Technical Design and Functional Analysis

PumpSwap's architecture is based on the classic constant product AMM model. In this model, the product of the quantity of two assets in the liquidity pool (for example, SOL and a Meme coin) remains constant (x*y=k). This means that when one asset is traded, the price of the other asset is adjusted accordingly, thereby achieving decentralized price discovery. Users are free to create liquidity pools and add liquidity to existing pools, thereby facilitating decentralized trading of all listed tokens on the platform.

PumpSwap's transaction fee structure charges a fee of 0.25% per transaction, of which 0.20% is allocated to liquidity providers and 0.05% belongs to the protocol. This fee structure is competitive with other DEXs on Solana and has the potential to attract existing PumpFun users as well as new traders. 0.25% trading fees are typical in the DEX space. Allocating a large portion of the fees (0.20%) to liquidity providers incentivizes them to provide liquidity on PumpSwap, which is critical to the success of DEXs.

A key feature of PumpSwap is to provide instant and free migration for tokens that complete their bonding curve on PumpFun. This eliminates the previous 6 SOL migration fee, significantly lowers the listing threshold for new projects, and simplifies the trading process for users. In addition, PumpSwap plans to launch an innovative creator revenue sharing model. Under this model, a portion of the protocol revenue will be allocated to token creators. This mechanism is designed to incentivize higher quality token issuance and strengthen the connection between creators and their communities. By rewarding creators based on the trading activity of their tokens, PumpFun ties creator incentives to the long-term success of the project, potentially promoting a more sustainable and active community.

PumpFun attaches great importance to security in the development of PumpSwap and has conducted nine independent security audits. In addition, the platform plans to open source the PumpSwap program in the long term to further improve transparency and security. In the risky environment of Meme coin trading, demonstrating a commitment to security through multiple audits can enhance user confidence and attract more cautious participants. Open source code further improves transparency and allows the community to review and contribute to the security of the platform.

III. Impact on Solana Ecosystem: Reshaping the Meme Landscape

The launch of PumpSwap is expected to significantly increase transaction volume on the Solana blockchain. By conducting token transactions within its ecosystem, PumpSwap is expected to concentrate a large amount of Meme coin trading volume on Solana. Previously, tokens issued on PumpFun would migrate to other DEXs (primarily Raydium) for secondary market trading. With PumpSwap, this part of the trading volume will now remain in the PumpFun ecosystem. PumpSwap's simplified trading process and potential creator revenue sharing mechanism may attract more users to participate in Meme coin trading on Solana, thereby increasing Solana's user activity. The convenient migration process and the incentive mechanism of creator revenue sharing may lower the threshold for new users to participate in Meme coin trading, thereby increasing the total number of active users on the Solana network. However, the launch of PumpSwap also poses a challenge to existing DEXs, especially Raydium. Since PumpFun has previously been an important source of Raydium's trading volume, the emergence of PumpSwap as a competitor may cause Raydium's trading volume to drop significantly, resulting in a redistribution of DEX market share on Solana. Raydium appears to have recognized this threat and announced the launch of its own meme coin issuance platform, LaunchLab, as a direct response to PumpFun.

The growing competition between PumpFun and Raydium could drive further innovation and development in the Solana meme coin ecosystem, ultimately benefiting all users. Direct competition between two major players could prompt both platforms to launch new features and improvements to attract and retain users, resulting in a more vibrant and competitive market.

With the launch of PumpSwap, Solana is expected to further solidify its position as one of the leading hubs for meme coin trading.PumpFun already accounts for 70% of Solana’s token issuance and 56% of DEX trading volume. The launch of PumpSwap could further strengthen this position by creating a more self-sufficient ecosystem for meme coin creation and trading on Solana.

Fourth,Driving the Meme Market: Efficiency Improvement or Increased Volatility?

PumpSwap has the potential to improve the transaction efficiency of Meme coins through instant migration and reduced fees. The streamlined process on PumpSwap can speed up price discovery and trading of newly issued Meme coins. The elimination of migration delays and fees reduces friction in the transaction process, allowing users to react to market trends more quickly and may lead to more effective price adjustments. PumpSwap's ease of use, as well as the potential creator reward mechanism, may attract more users to the Meme coin market. The user-friendly interface and the prospect of directly supporting creators may attract a wider audience to participate in Meme coin transactions on PumpSwap.

Creator revenue sharing may incentivize creators to build more sustainable projects and cultivate more active communities, which may reduce the occurrence of "pump and dump" scams. By providing creators with a continuous income stream based on their token trading activity, PumpFun incentivizes them to focus on long-term community building and project development, rather than just short-term gains. However, even with a more efficient platform, the inherent risks and volatility associated with Meme coin trading remain. It is worth noting that the failure rate of tokens issued on PumpFun is high. Although efficiency may be improved, the Meme coin market is likely to remain highly speculative and volatile. Meme coins are often hype and sentiment driven by nature, which means that even with a more efficient trading platform, large price fluctuations and project failures may continue to occur.

V.PumpSwap's Impact on the DEX Industry

PumpSwap has the potential to disrupt the existing DEX landscape by providing a unique integration with a popular issuance platform. Compared with independent DEXs, PumpSwap's direct integration with PumpFun has significant advantages in initial liquidity and user base. By automatically listing tokens that graduate from its issuing platform, PumpSwap benefits from built-in channels for new assets and users, giving it a competitive advantage in DEXs that need to attract projects and liquidity independently.

PumpSwap has demonstrated its cross-chain ambitions through collaborations with partners such as TRON. The collaboration with TRON aims to bridge SOL/TRX and enhance liquidity. In addition, PumpSwap also leverages LayerZero and Wormhole for cross-chain liquidity. The focus on cross-chain interoperability makes it possible for PumpSwap to attract users and liquidity from other blockchain ecosystems, thereby expanding its influence beyond Solana. By integrating with cross-chain technologies such as LayerZero and Wormhole, and collaborating with other blockchains such as TRON, PumpSwap aims to break down barriers between different blockchain networks and provide users with a more seamless cross-chain asset trading experience.

The launch of PumpSwap is likely to spark competitive responses from other DEXs, such as Raydium's LaunchLab. The launch of PumpSwap is likely to intensify competition within the DEX industry, which could trigger a wave of innovation and new features from existing players. The success of PumpSwap may inspire other token issuance platforms to integrate native DEX functions, leading to a trend of more vertically integrated platforms in the Web3 space. If PumpSwap proves successful in capturing trading volume and generating revenue, other issuance platforms may see the benefits of providing users with similar integrated solutions, which may lead to a broader shift in the way new crypto projects are issued and traded.

Six,Beyond Trading: The Vision of Web3 Super Applications

PumpFun has integrated a chat function and may reintroduce the live broadcast function. Previously, the live broadcast function had been suspended due to audit challenges. Integrating social features such as chat and live streaming is in line with the trend of social finance and could enhance community engagement around Meme coins issued on the platform. By incorporating social elements, PumpFun aims to build a stronger sense of community between users and creators, potentially increasing user engagement and loyalty to the platform and its issued tokens. These features are in line with the broader trend of community-driven Web3 applications. PumpSwap has the potential to combine DEX with social features, thereby tapping into the growing demand for platforms that integrate financial activities and community interaction. The Web3 space is increasingly seeing a convergence of DeFi and social features as users seek platforms where they can not only trade and invest, but also connect with like-minded people and participate in community-driven activities. There are multiple factors to consider when evaluating whether PumpSwap has the potential to become a leading Web3 dApp. It has a strong initial user base from the PumpFun issuance platform. However, competition in the Web3 dApp space is extremely fierce, and it is also challenging to maintain growth momentum and attract a diverse user base beyond Meme coin traders. While PumpSwap has a strong foundation and innovative features, to become a leading Web3 dApp, it needs to successfully execute its roadmap, continue to innovate, and be able to attract a wider user base outside the Meme coin space. PumpSwap's initial success is likely driven by its existing user base and its focus on Meme coins. To become a leading Web3 dApp, it needs to expand its products, attract users with different interests, and overcome the challenges of scalability, security, and user experience common in the Web3 space.

Seven,Financial Pillar: PumpFun's Revenue Sources and DEX-derived Revenue Analysis

PumpFun's historical revenue data shows that its revenue is highly correlated with the overall sentiment and activity of the Meme coin market. At the peak of Meme coin activity, PumpFun once achieved a peak revenue of more than $15 million per day. However, revenue has declined recently. The significant peaks and troughs in PumpFun's revenue directly reflect the boom-and-bust cycles common in the Meme coin market, demonstrating its high reliance on market sentiment and speculative trading. The following table summarizes PumpFun's recent revenue data, highlighting its volatility:

The 0.25% transaction fee has a significant impact on PumpSwap's potential revenue generation ability. If PumpSwap can successfully attract a majority of the trading volume of its issued tokens, it has the potential to become a significant source of revenue for PumpFun, offsetting the recent decline in issuance fees. Even with relatively low transaction fees, PumpSwap could still generate significant revenue if it successfully captures the massive Meme Coin trading volume that was previously conducted on other DEXes.

The launch of PumpSwap could result in a reduction in derivative revenue for partner DEXes such as Raydium that previously relied on PumpFun’s issued tokens for a large amount of trading volume. Raydium in particular benefits from trading activity on tokens issued on PumpFun. With the launch of PumpSwap, this portion of revenue is likely to be significantly reduced as trading activity will shift to PumpFun’s native DEX.

VIII.Past Collaboration: From Partner to Competition

Historically, PumpFun relied primarily on Raydium as the primary trading platform for its tokens after completing the bonding curve. Raydium has played a vital role in the development of the Solana Meme Coin ecosystem, in part due to its symbiotic relationship with PumpFun. The fact that PumpFun tokens have historically migrated to Raydium for secondary market trading highlights the importance of this partnership in establishing both platforms in the Solana DeFi space.

Directly competing with Raydium now could put a strain on the relationship and could lead to further competitive actions on both sides. Raydium’s announcement of LaunchLab shortly after the launch of PumpSwap indicated a direct competitive response, foreshadowing the potential for intense competition in the Solana Meme Coin market.

Summary

The launch of PumpSwap is a bold move in PumpFun’s journey, with the potential to reshape the Solana Meme Coin ecosystem and have a significant impact on the broader Web3 space. PumpSwap’s strengths lie in its direct integration with PumpFun’s existing user base, its innovative creator revenue share model, and its focus on cross-chain interoperability. However, it also faces stiff competition from existing DEXs, notably Raydium, and its success depends largely on the continued vitality of the Meme Coin market and its ability to attract a wider range of users.

While PumpSwap has the potential to become a major DEX in the Solana ecosystem, and perhaps even expand to other blockchains, to become a leading Web3 dApp it will need to overcome the inherent volatility of the Meme Coin market, successfully attract and retain a wider user base, and continue to innovate to meet growing competition. PumpFun will need to effectively execute on its product roadmap, particularly regarding the integration of social features, and demonstrate its ability to go beyond meme coins to provide value to a wider range of Web3 users.

The launch of PumpSwap marks a new era of competition in the Solana Meme Coin ecosystem. While it poses a direct challenge to existing DEXs such as Raydium, it also opens up new opportunities for users and creators. Whether PumpSwap can realize its full potential and become a leading dApp in the Web3 space will largely depend on its ability to adapt and innovate in the rapidly evolving cryptocurrency market.

Alex

Alex

Alex

Alex Brian

Brian Alex

Alex Miyuki

Miyuki Weiliang

Weiliang Catherine

Catherine Alex

Alex Weatherly

Weatherly Miyuki

Miyuki Weiliang

Weiliang