Author: Brayden Lindrea, CoinTelegraph; Compiler: Baishui, Golden Finance

Apollo Crypto's investment director said that the recent large number of celebrity, political and animal-themed memecoins, as well as the sluggish cryptocurrency market, may have led to a 44% drop in sales of non-fungible tokens (NFTs) in the second quarter.

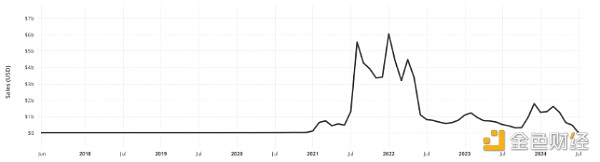

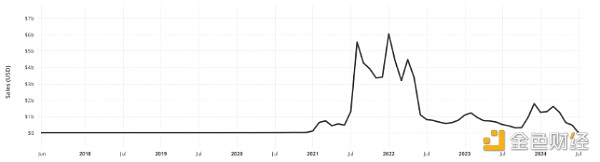

NFT sales fell from $4.14 billion in the first quarter to $2.32 billion in the second quarter due to the overall market decline, according to CryptoSlam.

“The second quarter was a tough market, with Bitcoin down 15% and many altcoins performing significantly worse,” noted Henrik Andersson, chief investment officer at Apollo Crypto.

NFT monthly trading volume since June 2017. Source: CryptoSlam

“[But] memecoins could also take away some of the attention from NFTs,” Andersson added.

Mindshare is a marketing term that refers to the level of consumer awareness or popularity of a particular product or idea.

Despite the slowdown in NFT sales, Memecoin trading volume remains huge, with $3.4 billion in trading in the past 24 hours alone, according to CoinGecko data.

This was largely sparked by the growth of the PolitiFi memecoin associated with the US presidential election, while a number of new celebrity tokens emerged on Ethereum and Solana.

MAGA (Trump) and Pepe were the memecoins that saw price increases in the second quarter.

Ordinals Take More Market Share

Andersson noted that the development of Bitcoin-based Ordinals could also shift attention away from traditional NFTs in the coming months.

“In the long term, we believe Bitcoin Ordinals will continue to take market share in the NFT space, especially given the many Bitcoin L2s that are about to enter the market.”

However, network activity for Ordinals and Runes has also declined in recent weeks.

Runes transaction volume is down 88% from its peak in June, while Ordinals and Runes contributed less than 2 Bitcoin (BTC) per day in mining fees last week.

NFTs have rebounded before

NFTs made a small comeback in the last quarter of 2023, with sales exceeding $3 billion, which may bring hope for an NFT recovery in the second half of 2024.

Monthly sales in December 2023 were $1.77 billion, the largest month since the NFT summer began to decline in June 2022.

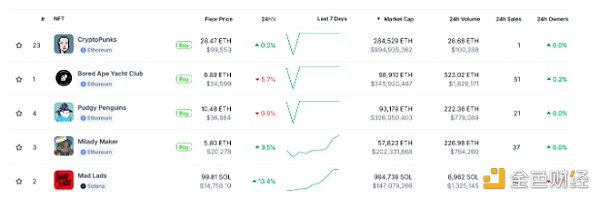

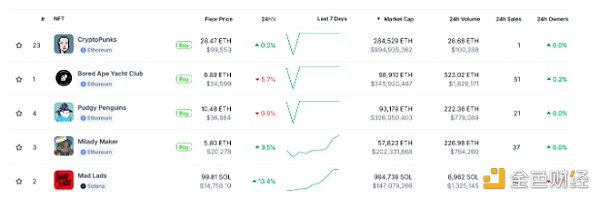

Top NFT collectibles such as CryptoPunks and Bored Ape Yacht Clubs still have market capitalizations of $994.9 million and $345.9 million, respectively, according to CoinGecko data.

The largest NFT projects by market cap. Source: Coingecko

In comparison, the two largest Ordinals projects, NodeMonkes and Bitcoin Puppets, have market caps of $121.1 million and $94.2 million, respectively.

JinseFinance

JinseFinance