By Anthony Pompliano, Founder and CEO of Professional Capital Management.

There’s no better feeling than a bull market.

Your portfolio rises day after day. The media is dancing with excitement. Social media is abuzz with people taking screenshots and sharing their net worth. Bear market cries are rising, and a crash is imminent. Your barber, taxi driver, and neighbor are all trying to sell you their latest stock picks.

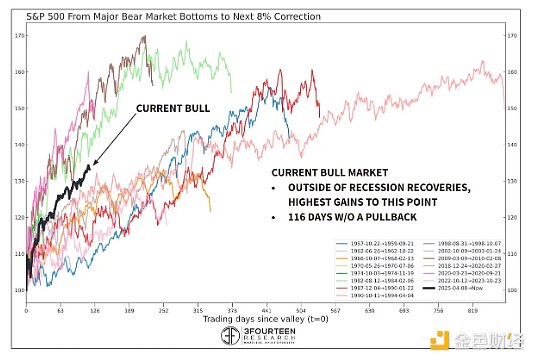

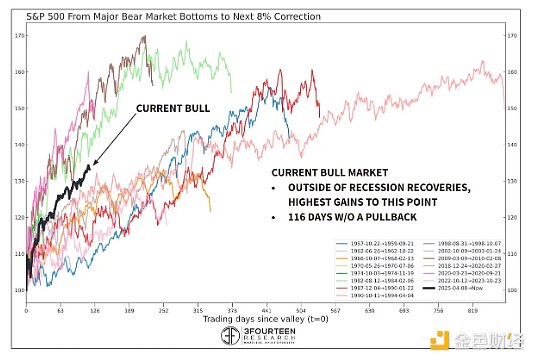

It's chaos. Bull markets are fun. That's exactly where we are now. Stocks, Bitcoin, gold, and just about every other asset will continue to soar to new all-time highs in 2025. But just how good is this bull run? How does it compare to previous markets? 3Fourteen's Warren Pies writes: How does this rally compare to previous bull markets? Compared to all other bull markets, this one is the fourth strongest. Only 1982, 2009, and 2020 were stronger. Excluding recessions, this rally is the strongest. It's gone 116 days without a 6% correction, outperforming all but two of the earlier bull markets (1966 and 1957).

This data confirms what we all feel...the current bull market is exceptionally rare. Tariff concerns earlier this year artificially suppressed the stock market, setting the stage for the historic market recovery we are now witnessing.

Many believe the recent run-up in stock prices is unsustainable. They will point to a wealth of data showing that the stock market is overvalued. You'll hear them say that reversion to the mean is virtually inevitable.

But what if they are wrong? What if the opposite is true?

I challenge each of you to ask yourself: If this bull market has just begun, what will the future hold? What will investors expect if all goes well?

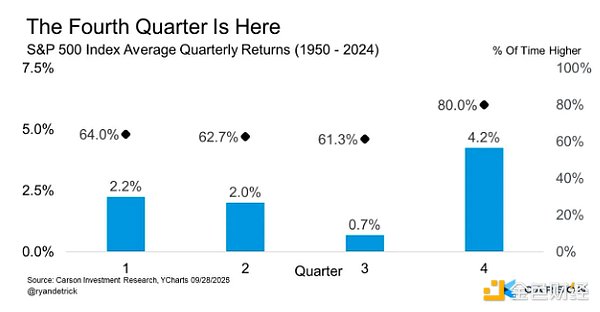

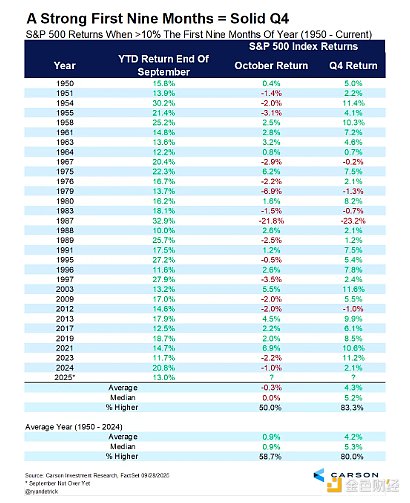

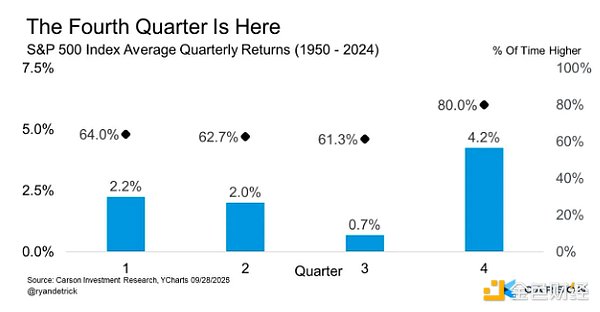

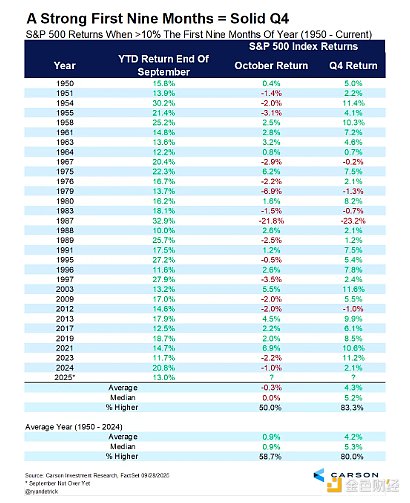

However, these questions are not based on fantasy. Ryan Detrick of the Carson Group noted: "The fourth quarter was the best quarter in history, no one can match it."

Still not convinced? Well, we can see that the trajectory in 2025 is similar to that of 1999. Connor Bates of Revere Asset Management shows this perfectly in this chart, which compares the 1996 to 2001 timeframe with the 2023 to date: I doubt my eyesight, but to me, the two markets look very similar. Given current trends, this comparison suggests that in a 1999 market repeat scenario, this bull market still has significant room for appreciation.

Keep in mind that all of this analysis and stock market performance is taking place against the backdrop of the Federal Reserve's recent rate cuts.

The Federal Reserve is lowering the cost of capital, while at the same time, the stock market is hitting record highs. This development is not bearish, but rather suggests that the stock market will continue to hit new highs before the end of the year.

This is undoubtedly good news for stock investors, but another asset class is also sounding the alarm bells that cannot be ignored. That is gold.

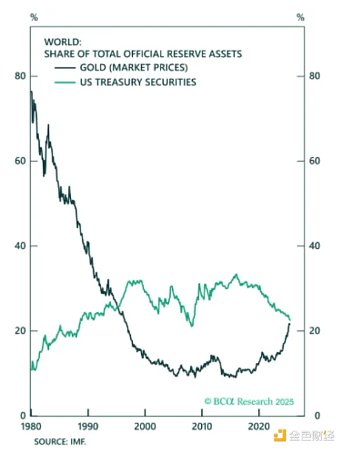

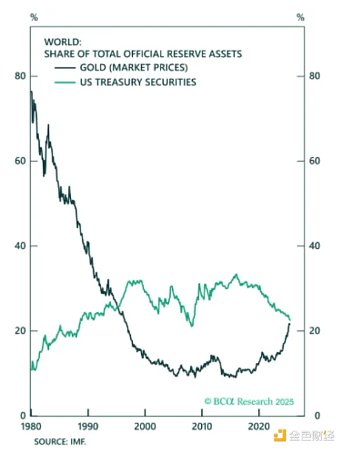

Mike Zaccardi said that central banks around the world are buying gold in large quantities:

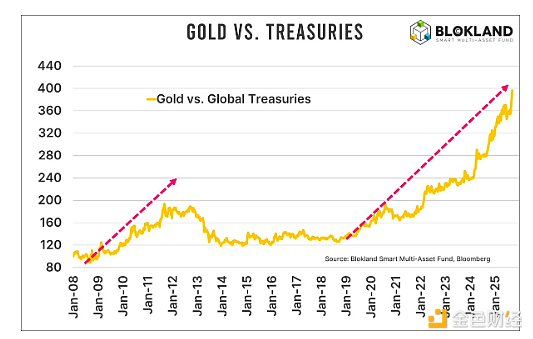

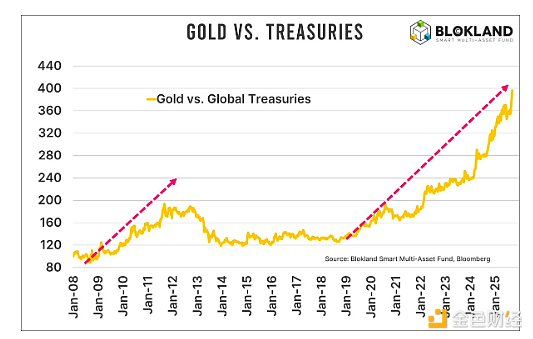

The Blokland team demonstrated the dominance of gold priced against US Treasuries. The trend is clear and the logic is obvious.

Stocks, gold, and Bitcoin. These three assets will allow you to profit from the ridiculous and undisciplined behavior of central banks. Buy them and then calm down.

They're all going up. The bull market isn't over yet because cheap money is pouring in and the world needs new technologies to lead the next twenty years. I urge each of you to ignore the bears. Don't be fooled by their nonsense. They're wrong. They don't understand the markets or the economics. These people are stuck in the past.

Optimists will prevail. I'm literally betting my entire portfolio on this.

Anais

Anais