Author: Sumanth, P2 Ventures; Translation: Jinse Finance xiaozou

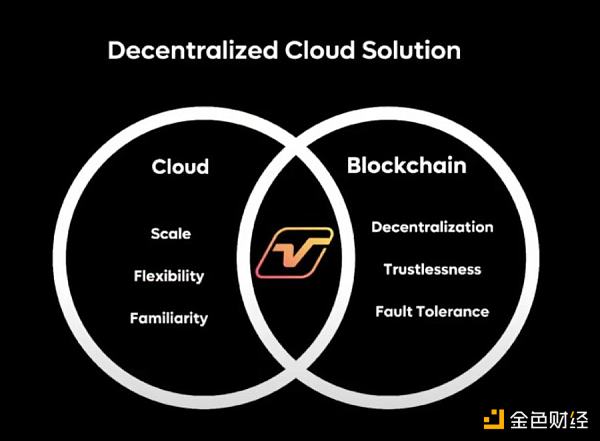

AVS (Actively Validated Services) combines the scale of web2 with the trust of web3, opening up the next iteration of the network: distributed systems and custodial assets. In this article, let's take a quick look at EigenLayer's AVS ecosystem:

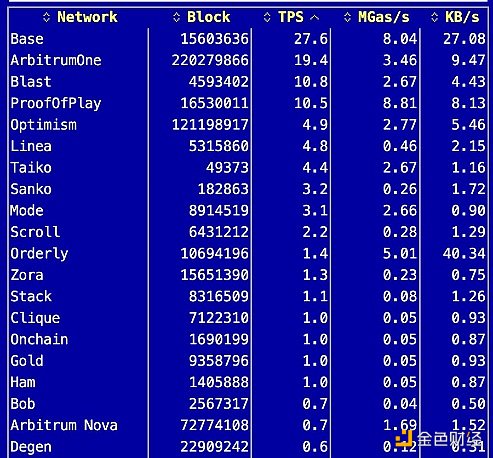

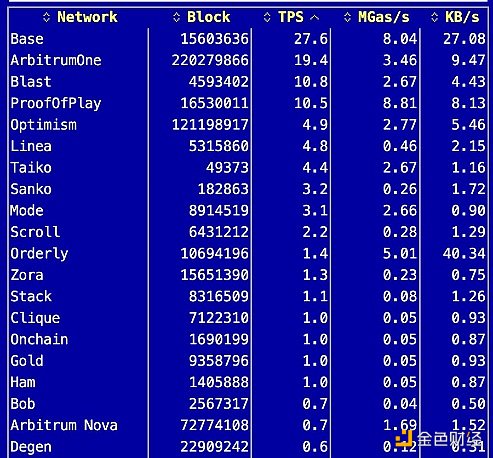

While blockchains process transactions efficiently, attempts to move all computation to smart contracts have proven to be extremely challenging due to latency and throughput limitations. Even rollup solutions cannot support the combined needs of hosting front-ends, oracles, and databases.

While blockchains process transactions efficiently, attempts to move all computation to smart contracts have proven to be extremely challenging due to latency and throughput limitations. Even rollup solutions cannot support the combined needs of hosting front-ends, oracles, and databases.

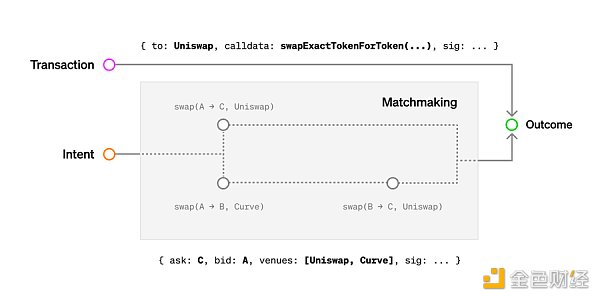

Smart contracts must be carefully designed because they interact with the account layer and paying gas fees for each transaction is of great economic importance. Take Uniswap as an example. This DEX heralds on-chain DeFi with AMM mechanisms.

Their latest v4 design combines hooks external deployment contracts, providing a high degree of customizability for market makers and users. Hooks can support different types of orders, such as limit orders, dynamic fee structures, custom oracles, and TWAMM.

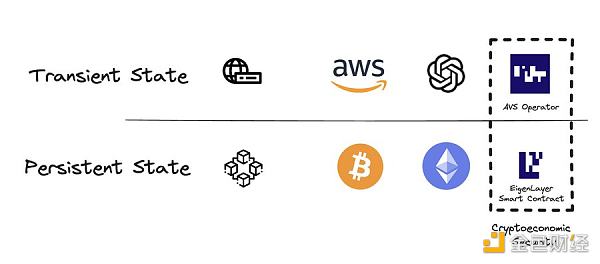

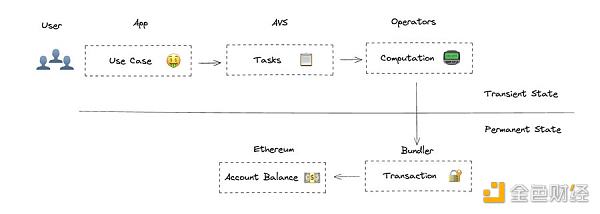

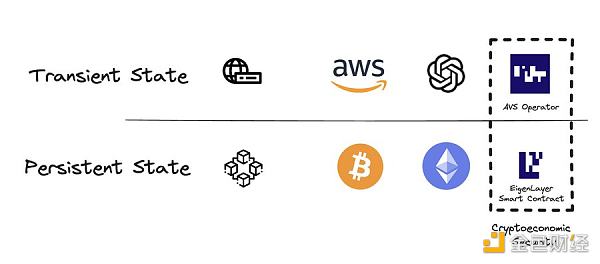

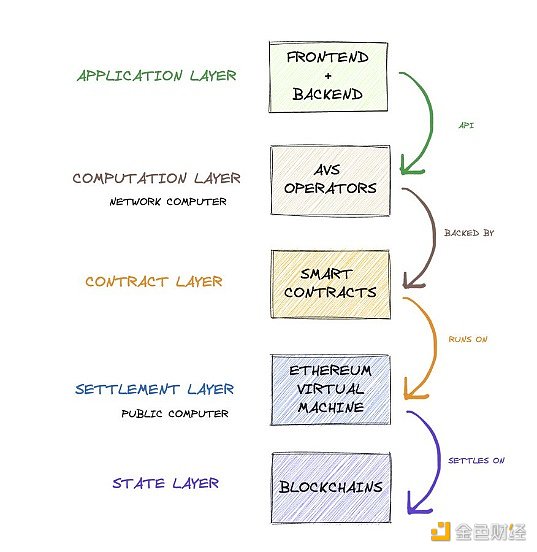

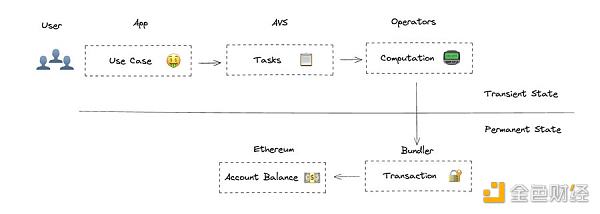

One consideration for the future of blockchain computing is a hybrid architecture that separates computing and storage into temporary and persistent layers.

Blockchain is a persistent layer with high security guarantees that maintains shared states among multiple validators. Low validator requirements ensure broad decentralization, minimize censorship, and protect the security of important data such as transaction logs and identities.

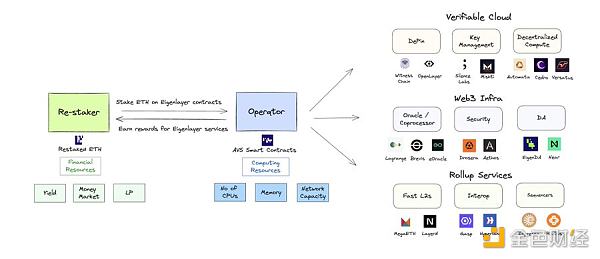

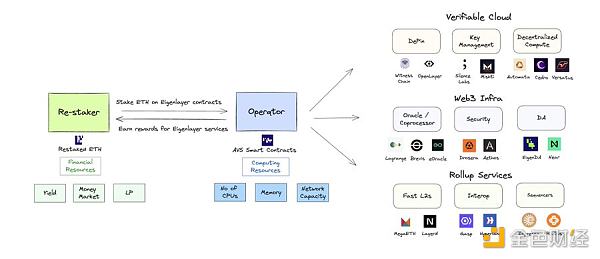

AVS introduces an ad hoc layer maintained by a decentralized network of operators who provide hardware such as GPUs, ZK provers, SSDs, etc. to power hyper-specialized services including execution engines, virtual machines, oracles, watchtowers, distributed key generation, and more.

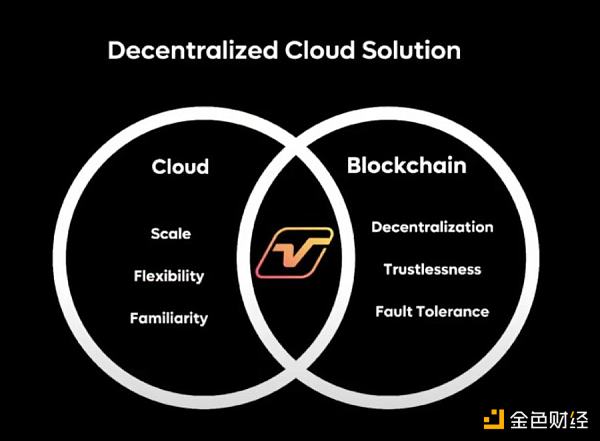

Web2 relies on centralized cloud service providers for storage and computing, which makes it less secure and vulnerable to censorship. AWS replicates data in different locations for redundancy, but sensitive information such as bank accounts requires governance custody.

Unlike centralized cloud service providers, the AVS service is supported by a group of Ethereum operators who prove their honesty and reliability through cryptoeconomic staking. Even if the temporary state is destroyed, user funds are still safe on the blockchain persistence layer.

AVS's core promise is to bring web3 trust guarantees to all computing - both on-chain and off-chain.

AVS - a network of node operators checking each other's work.

AVS Operator - a single node operator who provides specific hardware resources.

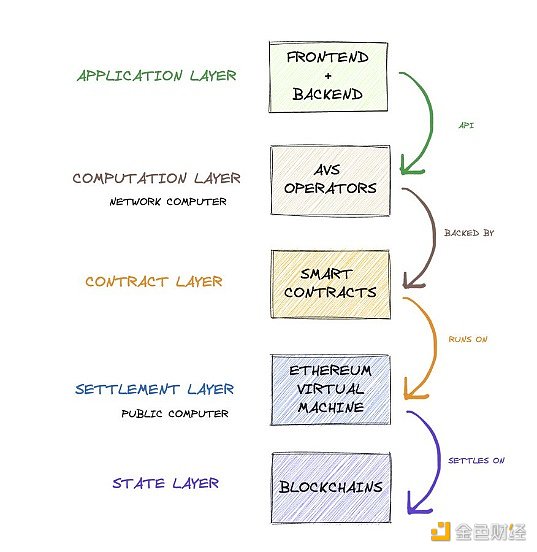

The architecture of AVS implements a new application infrastructure that provides verifiable cloud services and verifiable computing.

Let’s first look at “verifiable cloud”.

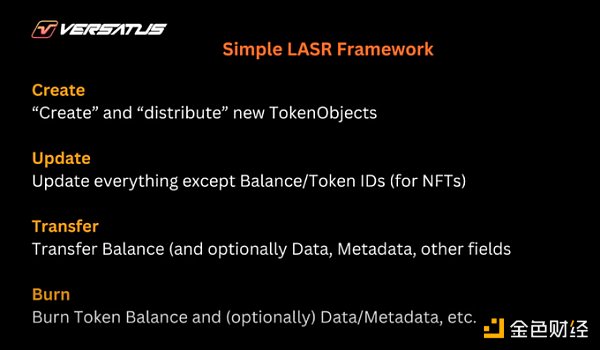

Versatus has launched Allegra, a cloud AVS that provides censorship-resistant, transparent infrastructure for dApps at 50% lower costs than traditional cloud providers. These applications are hosted on a network of AVS nodes, eliminating single points of failure.

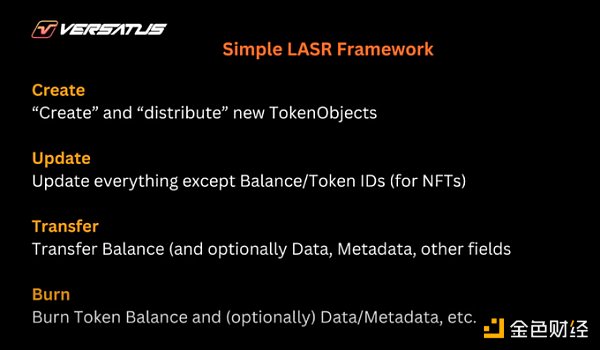

We may see the emergence of a new category of applications that are different from traditional dApps that are completely on-chain. Versatus has aptly named it "U?????????e A???" and introduced a new framework that reflects the HTTPS standard we are all familiar with.

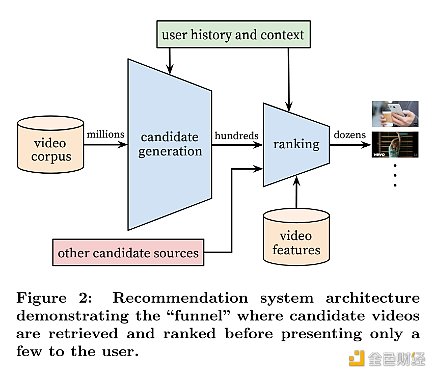

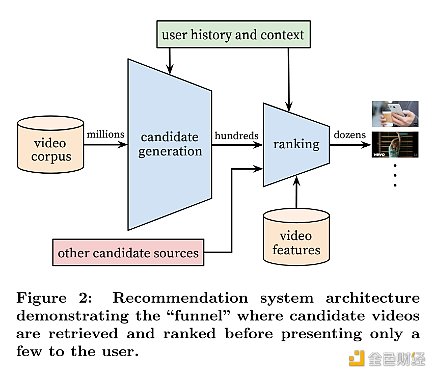

Projects like decentralized social media that require recommended information flows are now possible. AVS achieves this by supporting advanced algorithms that can continuously update user information flows based on user historical information, creating a dynamic experience while accessing on-chain media NFTs.

Do we need to "trust" these services? Just as we expect quality from physical services, we need honesty in every software calculation. Unlike tangible goods, where quality is visible, software requires trust in the invisible processes behind each function.

The algorithms that control our lives lack transparency and we know very little about them. Consider the recent leaks about Google’s SEO algorithm. It was clear that the people at Google had misled the public about how they ranked web pages.

How expensive is this “trust”?

Since we are still in the early stages, it is difficult to put a number on the additional costs of AVS operating software. EigenLayer founder Sreeram Kannan estimates that cryptoeconomic security for financial transactions will add an additional 0.1% cost.

The second key benefit is "verifiable computation".

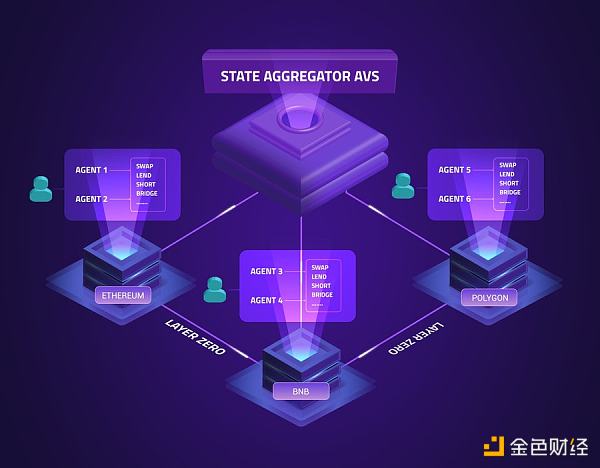

The AVS node network performs off-chain computations, powered by cryptoeconomic/ZK proofs, and can be used as input to applications. This also opens up the possibility for experimentation and interaction with AI agents.

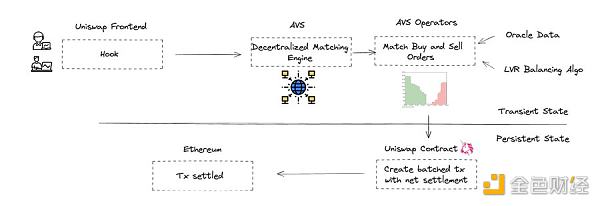

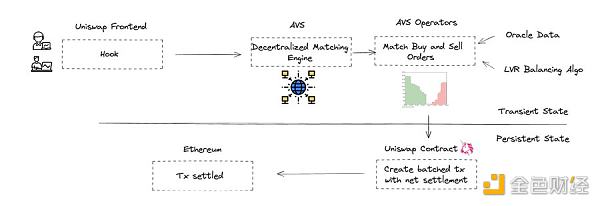

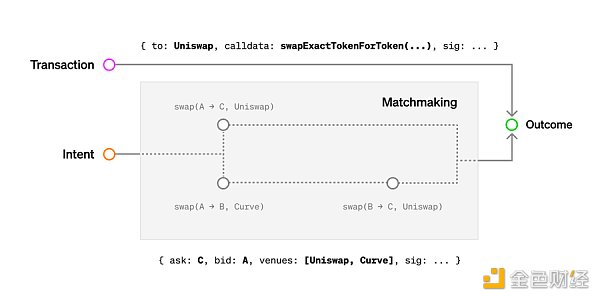

Let's look at Uniswap's v4 design, which can be combined with a decentralized matching engine hosted on a dedicated AVS node. This pool of operators can efficiently match thousands of trade requests with counterparties, creating a trade package that is settled on-chain.

AVS operators cannot steal user funds and can only match transactions based on user-defined intents. The architecture allows operators to process intents, integrate AI-driven results, manage dark pools, and develop applications with variable fees, thereby bringing enhanced functionality.

AVS provides: neutral, accessible, and unstoppable web services.

It provides developers with a reliable node network that is ready to handle any specialized calculations on demand, simplifying the development process without having to build from scratch.

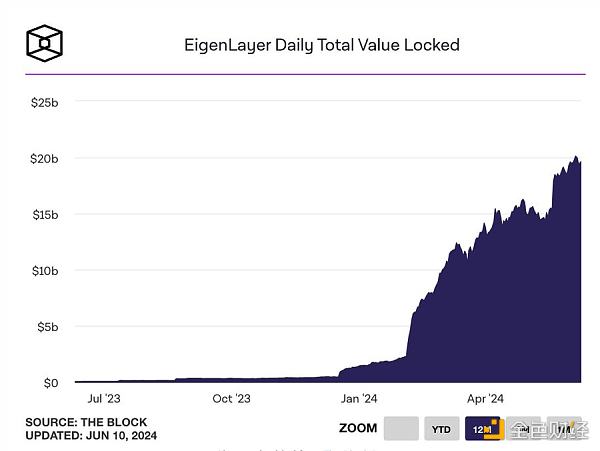

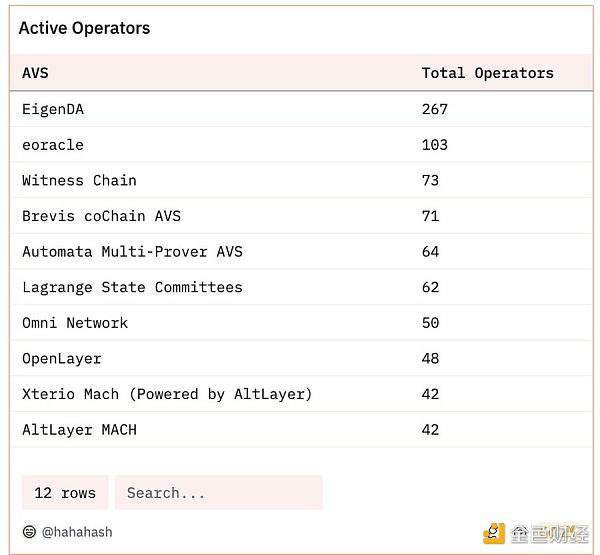

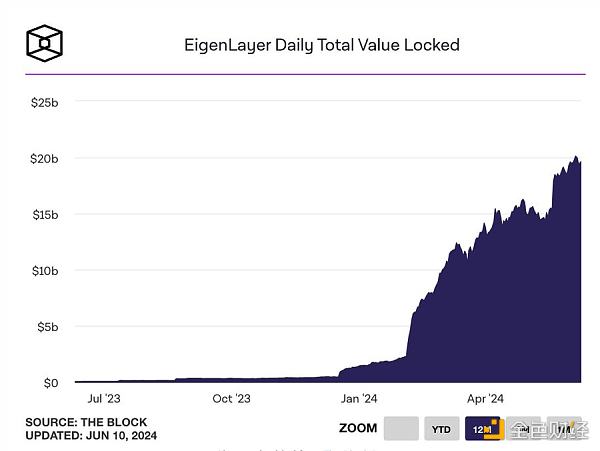

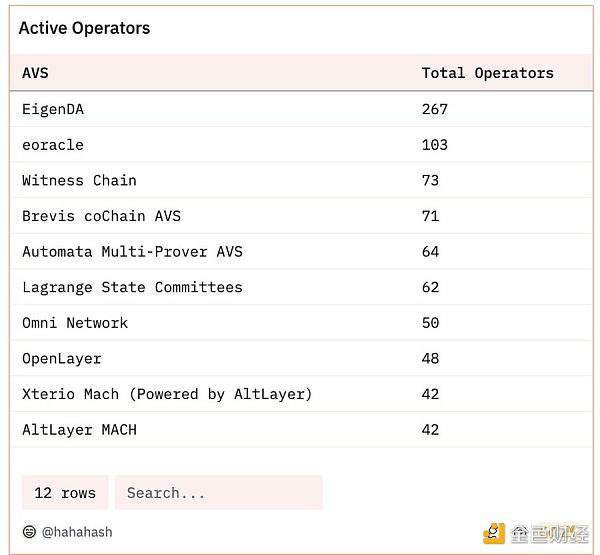

Currently, there are 1,459 AVS operators and 16 AVS services, with EigenDA leading with 264 active operators. Operators handle multiple tasks simultaneously and provide multiple AVS services to maximize returns. Some services usually have specific hardware configuration requirements.

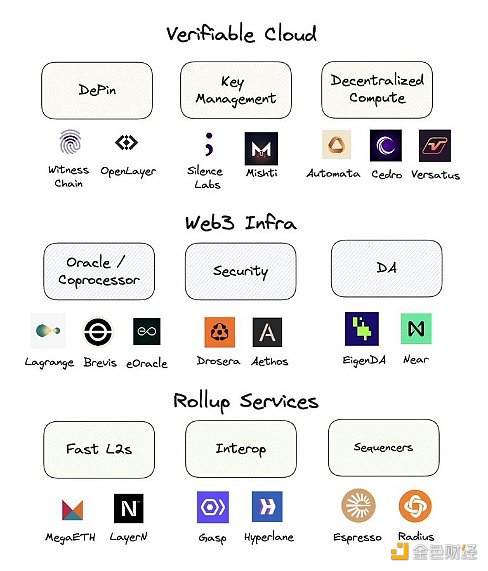

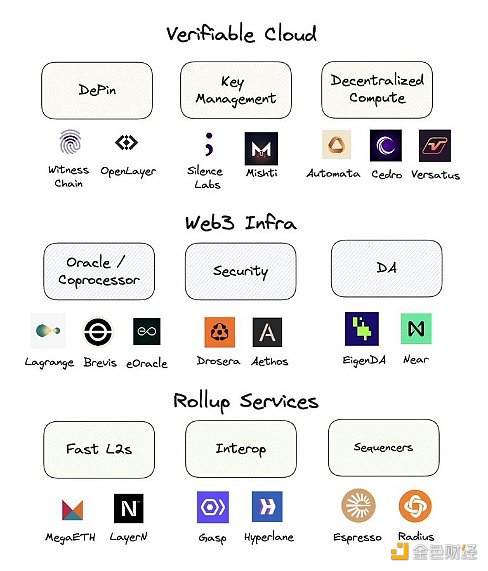

The possibilities opened by AVS are huge and span multiple fields. We can divide them into 3 categories: verifiable Web2 infrastructure, Web3 basic primitives, and rollup services.

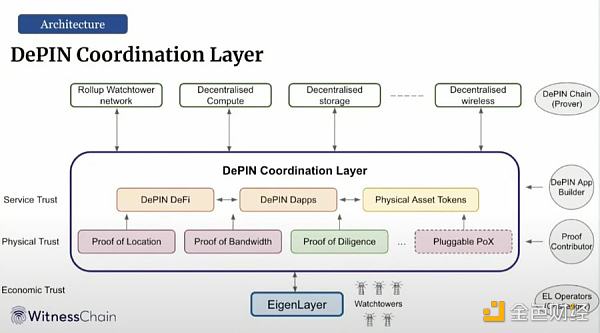

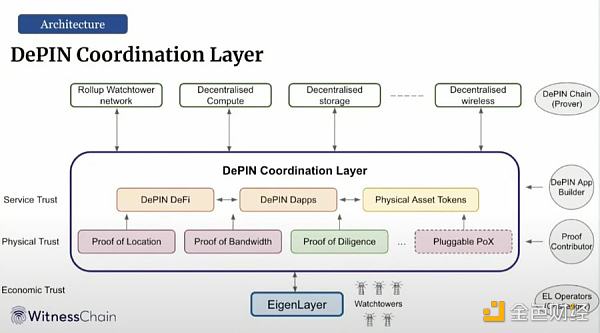

AVS operators can provide trustless web2 services such as content delivery, key management, and decentralized computing. For example, Witness Chain

uses AVS watchtowers for strategic global positioning and provides location proof by analyzing network latency.

By combining MPC and threshold signatures with AVS, applications can provide a smoother login experience and privacy protection. Mishti is an AVS network that uses a set of distributed nodes to generate private keys through biometrics, so no single node has the user's password.

AVS is changing the field of decentralized computing through innovations, such as providing traders with an off-chain matching engine. Cedro Finance is preparing to launch an AI agent layer that supports LPs to dynamically calculate prices for CEX and DEX to provide timely liquidity.

AVS also provides support for the basic primitives that blockchains and rollups rely on. It strengthens the ecosystem by securing the DA (data availability) layer, providing ZK-backed oracles, and deploying monitoring systems that can be easily integrated.

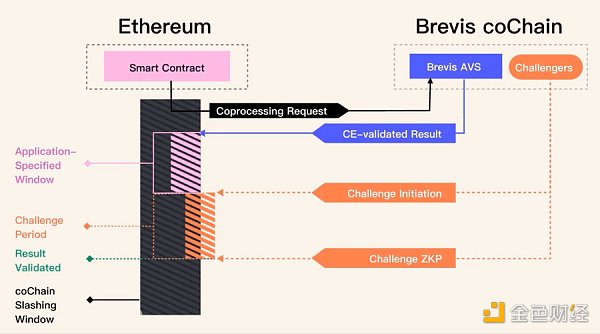

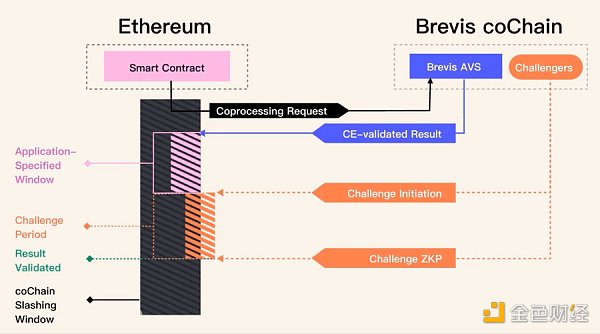

Lagrange and Brevis are decentralized provers, and queries are transferred to an AVS network off-chain, where they are executed and verified, and then reintegrated into the contract. dApps can leverage historical data to implement features such as VIP loyalty programs.

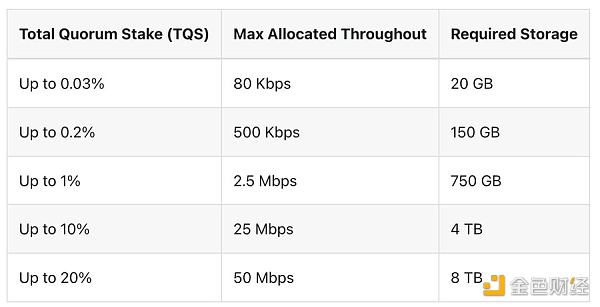

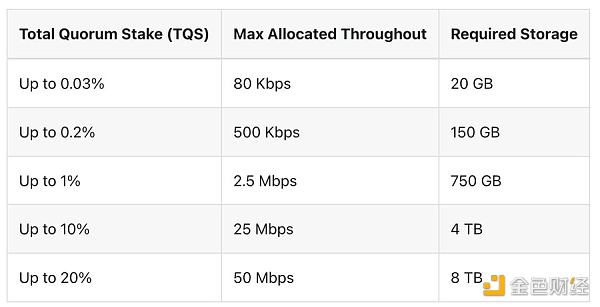

EigenDA is an innovative DA solution inspired by the Danksharding roadmap. Designed to scale horizontally, EigenDA's AVS operators provide enterprise-class SSDs to store data, supporting speeds up to 10 Mbps in testing, with the ultimate goal of 1 Gbps as more operators join.

EigenDA is an innovative DA solution inspired by the Danksharding roadmap. Designed to scale horizontally, EigenDA's AVS operators provide enterprise-class SSDs to store data, supporting speeds up to 10 Mbps in testing, with the ultimate goal of 1 Gbps as more operators join.

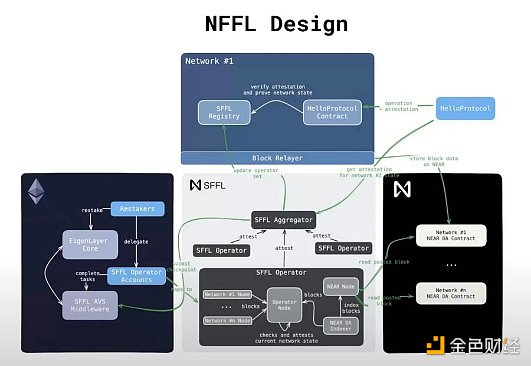

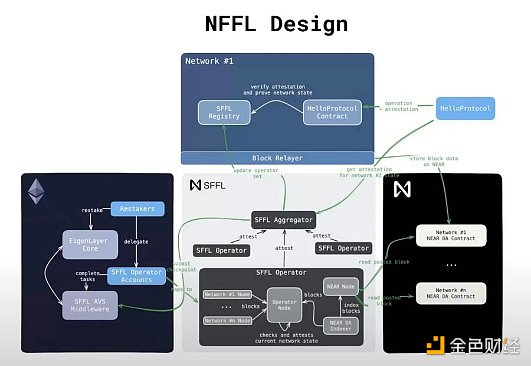

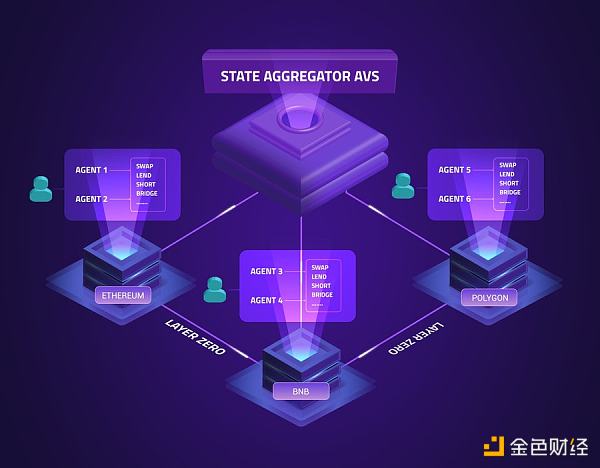

The last category of AVS focuses on rollup services - bridges, interoperability solutions, fast layers, shared sorters, re-staking rollups, etc., which are all secured by AVS. Taking NEAR Protocol as an example, NEAR is developing NFFL - a fast finalization layer that uses AVS to verify the rollup status between L2s.

In short, AVS is a revolutionary crypto-economic layer on the blockchain that enables developers to build trustless applications using any programming language.

JinseFinance

JinseFinance

While blockchains process transactions efficiently, attempts to move all computation to smart contracts have proven to be extremely challenging due to latency and throughput limitations. Even rollup solutions cannot support the combined needs of hosting front-ends, oracles, and databases.

While blockchains process transactions efficiently, attempts to move all computation to smart contracts have proven to be extremely challenging due to latency and throughput limitations. Even rollup solutions cannot support the combined needs of hosting front-ends, oracles, and databases.

EigenDA is an innovative DA solution inspired by the Danksharding roadmap. Designed to scale horizontally, EigenDA's AVS operators provide enterprise-class SSDs to store data, supporting speeds up to 10 Mbps in testing, with the ultimate goal of 1 Gbps as more operators join.

EigenDA is an innovative DA solution inspired by the Danksharding roadmap. Designed to scale horizontally, EigenDA's AVS operators provide enterprise-class SSDs to store data, supporting speeds up to 10 Mbps in testing, with the ultimate goal of 1 Gbps as more operators join.