In early July this year, the decentralized derivatives exchange SynFutures announced the launch of Base. In just three months, SynFutures quickly rose to the top of the Base derivatives market, occupying half of the Base derivatives market in Q3, once again attracting great attention from the market!

What is the innovation of SynFutures?

How to attract users through incentive plans, and what are the recent ways to participate?

In this article, Biteye will elaborate on the core advantages, project progress and participation methods of SynFutures.

SynFutures was launched at the end of 21 and began to exert its strength in the first half of this year. With its pioneering permissionless contract market model, it allows anyone to add liquidity through a single currency to achieve 30-second listing, supports perpetual contracts and expiration contracts, and brings users the ultimate experience.

In addition, SynFutures has a keen sense of the market, focuses on the development of the Blast and Base ecosystems, and has successfully achieved a dominant position in the two networks.

Since the launch of Blast in March and Base in July this year, the cumulative trading volume has exceeded 180 billion US dollars, and nearly 300,000 independent addresses have traded on SynFutures.

Currently, more than 45 trading pairs are supported. In addition to mainstream currencies such as BTC and ETH, there are also MEME tracks that have been in a hot state this year and the US election prediction-related market, which truly returns the decision-making power of DeFi contracts to the community.

01 Project Innovation: Oyster AMM

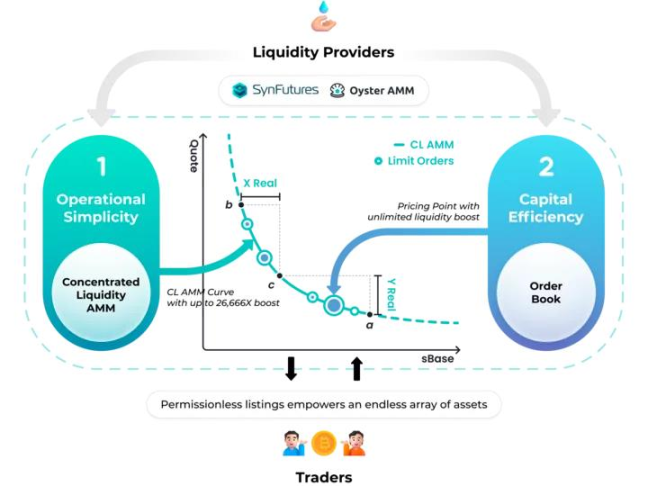

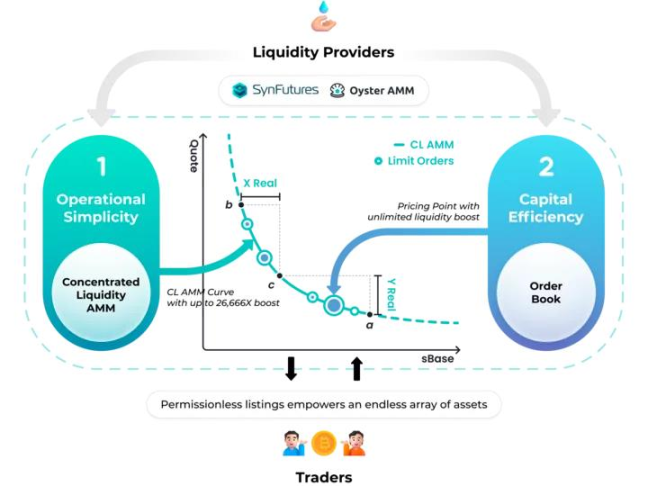

Derivatives trading platforms face a series of problems: the simplicity of traditional AMMs allows everyone to list coins and make markets, but at the expense of capital efficiency.

The order book model maximizes capital efficiency, but it cannot support arbitrary risky assets. Based on the original Oyster AMM (oAMM), SynFutures organically combines full-chain matching, full-chain order books and AMM, which is compatible with CeFi's high capital efficiency and DeFi's permissionless and decentralized characteristics, perfectly solving the above problems.

SynFutures' contracts have been audited by QuantStamp.

As the core of SynFutures, Oyster AMM (oAMM) has three characteristics: centralized liquidity, full-chain order books to enable AMM, and a stable mechanism to protect users.

1.1 Concentrated Liquidity

In oAMM, liquidity can be concentrated in a specific price range (similar to UniSwap V3), increasing the capital efficiency within that price range, allowing funds to be concentrated on supporting transactions within that range, rather than being dispersed across the entire price range.

In addition, oAMM also supports adding unilateral liquidity, that is, liquidity providers only need to provide a single type of token to participate in the market's liquidity provision, reducing the participation threshold and token risks.

oAMM achieves concentrated liquidity and allows unilateral liquidity to be added through the following mechanisms:

Concentrated liquidity range: oAMM allows liquidity providers to concentrate their funds in a specific price range. This means that LPs can choose to provide liquidity in the price range where they think transactions are most likely to occur, rather than the entire price range (similar to UniSwap V3).

Using virtual positions to simulate the trading process: In the oAMM model, when LP provides liquidity (taking the ETH-USDC trading pair as an example, when only USDC is provided), the system creates a corresponding virtual position behind the scenes. This virtual position represents exposure to another asset (ETH in this case). This approach allows unilateral provision of liquidity while maintaining market balance.

1.2 The full-chain order book empowers AMM

Combining the full-chain order book with AMM is one of the important features of the oAMM model. "Full chain" ensures the decentralization and security of transactions, and the "order book" further empowers AMM, provides extreme liquidity depth, and optimizes user experience.

The full chain order book means that all transaction orders (buy and sell instructions) are recorded and stored on the blockchain, and the matching between buying and selling is also carried out on the chain, rather than in the traditional centralized server or partially centralized system.

The clever implementation of the order book: oAMM implements the chain limit order by allowing users to provide liquidity at a specified price point, thereby simulating the trading behavior of the order book and further improving the efficiency of funds. Unlike off-chain order books such as dYdX, oAMM is a smart contract deployed on the blockchain. All data is stored on the chain and can be verified by anyone. It is completely decentralized, and users do not need to worry about the dark operation of the trading platform or false transactions.

Extreme liquidity depth: AMMs that achieve centralized liquidity are not uncommon on the market, such as Uniswap V3, etc. The concentration of liquidity improves capital efficiency, but it also puts higher requirements on the liquidity depth of the centralized point. Compared with the traditional AMM market-making method, the market makers of centralized trading platforms are more familiar with the limit order market-making method, have a higher level of awareness, and are more willing to participate in it. Therefore, oAMM that supports limit orders can better attract market makers to participate in active market making, further improve the trading efficiency and trading depth of oAMM, and achieve a trading experience comparable to that of centralized trading platforms.

In general, oAMM cleverly combines the full-chain order book with AMM, implements the most difficult liquidity problem of the exchange on the chain, and at the same time has the advantages of transparent transactions on the chain, truly combining the advantages of DEX and CEX.

1.3 Stability Mechanism to Protect Users

SynFutures has also designed a set of mechanisms to maintain market stability and protect the interests of users. These mechanisms ensure a healthy and fair trading environment by preventing extreme market fluctuations and reducing unnecessary risks.

Dynamic Penalty Fees: In order to prevent price manipulation and extreme market volatility, oAMM introduces a dynamic penalty fee mechanism. When a transaction causes the difference between the market price and the mark price to exceed a certain threshold, the transaction will be charged an additional fee. This fee increases as the price difference increases, thereby suppressing potential manipulation.

Stable Mark Price: oAMM smoothes market prices by using algorithms such as exponential moving average (EMA) to reduce the risk of liquidation caused by short-term fluctuations due to sudden news or market manipulation. A stable mark price helps prevent unnecessary liquidations triggered by extreme price changes.

Through this series of mechanisms, SynFutures imposes costs on manipulative behavior and reduces the motivation to manipulate the market; at the same time, the smoothing price mechanism reduces market overreactions caused by emergencies or large-scale transactions, protecting users from unnecessary losses; in addition, SynFutures also reduces unexpected liquidations caused by drastic price fluctuations through stable mark prices and continuous funding rates, further enhancing user protection and effectively maintaining market stability in the oAMM model.

02 Project Progress

2.1 Stand firm in the Blast ecosystem and give back to users

Soon after Blast was launched in March, SynFutres has established itself as the first derivatives trading platform in the Blast ecosystem. While providing users with the ultimate experience, it also provides users with generous incentive plans to achieve user growth and retention.

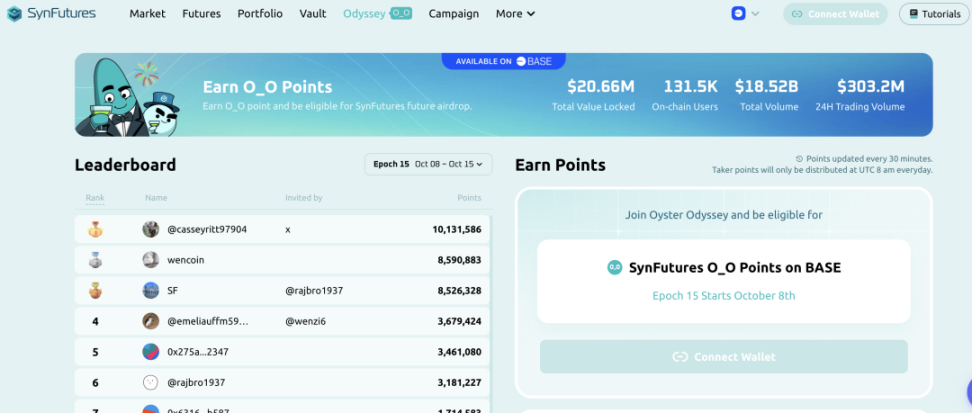

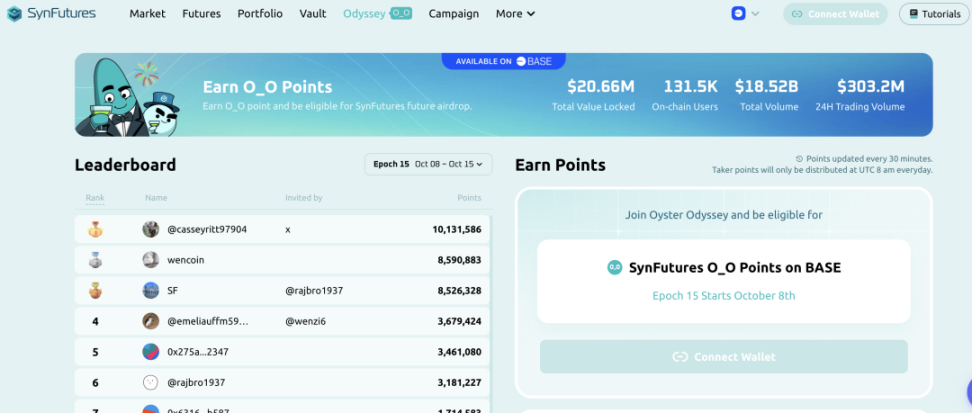

At the beginning of the launch of Blast, SynFutures announced the introduction of the O_O (Oyster Odyssey) points incentive program. SynFutures not only provides O_O points holders with future SynFutures airdrop opportunities, but also returns 100% of all Blast-related incentives (including points, yield, and additional developer token airdrops) to users.

Through a trading competition of up to $500,000 and triple airdrop opportunities, SynFutures provides strong motivation and rewards for user participation.

In Blast's activities, Blast users, dYdX/GMX users, and Pudgy Penguin NFT users can directly receive the SynFutures O_O points airdrop when registering for the O_O event on the first day of SynFutures' launch.

In addition, providing liquidity (including makers and AMM LP) and trading (Taker) can also receive Blast native token points rewards + 50% of Blast Big Bang Winner airdrop rewards + SynFutures O_O points rewards, and traders can also receive additional trading competition rewards.

Users who participated in the SynFutures Blast event said they gained a lot. Currently, the O_O incentive plan has simultaneously supported the Base network, and users can earn points rewards by trading and providing LP on the Base network.

2.2 Focus on Base Ecosystem, Growth and Innovation

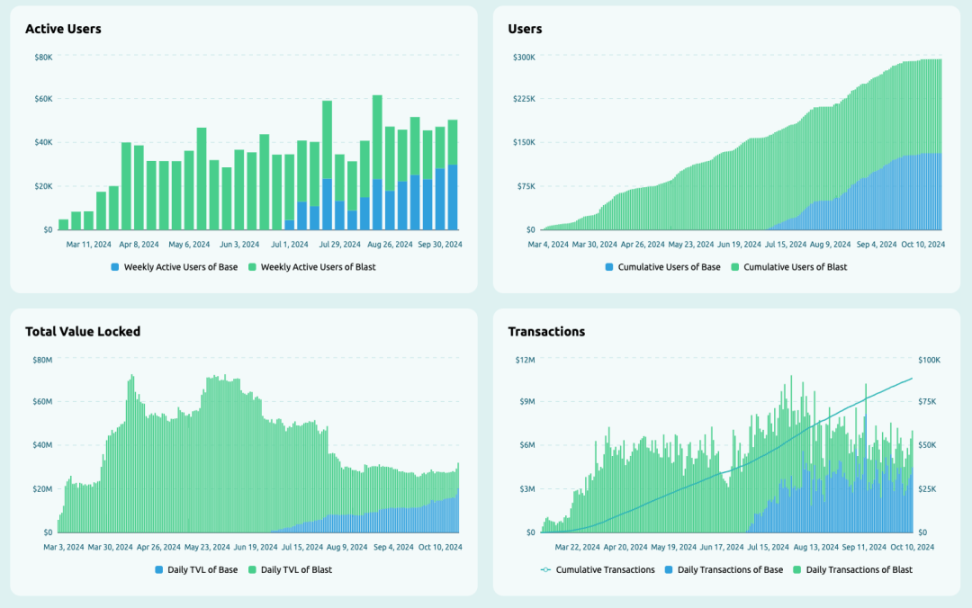

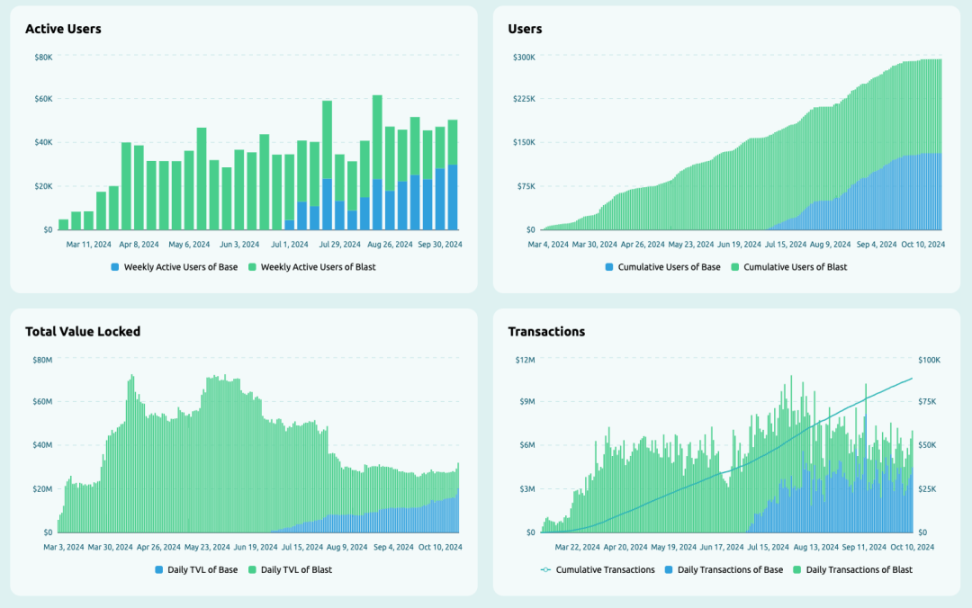

SynFutures announced the launch of the Base network in early July this year. By the end of September, SynFutures had taken an absolute leading position in the Base derivatives market, and in Q3 it had obtained about 50% of the market share of the Base derivatives market.

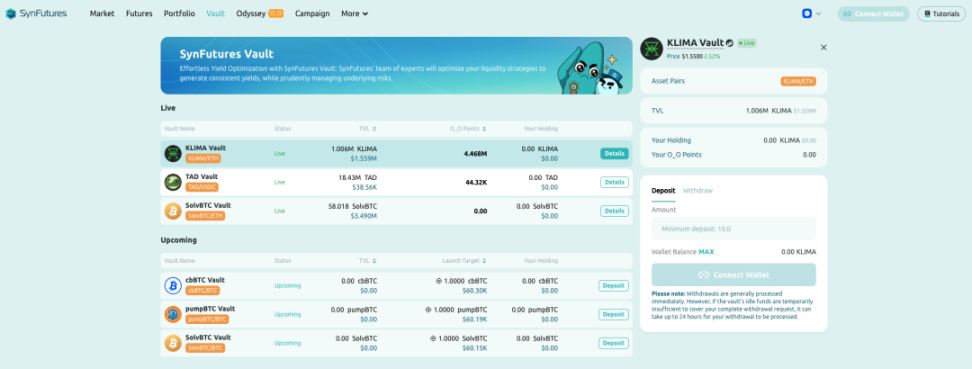

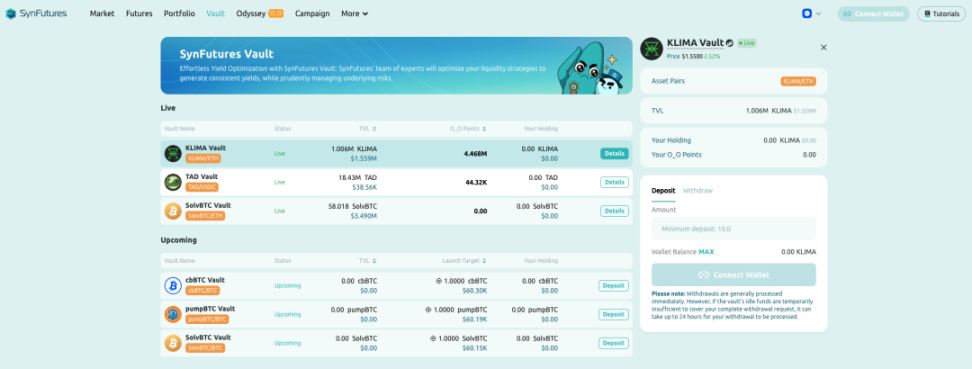

At the same time, SynFutures also announced the launch of the Vault product line on Base at the end of September. Users can provide liquidity through a single currency and earn liquidity income, platform transaction fees and O_O points rewards. The operating mechanism and features of Vault are as follows:

Fund deposit and management: Users can deposit funds into Vault, which will automatically provide liquidity and rebalancing operations in the corresponding market, and can simultaneously obtain points rewards.

Simplified market-making process: Vault automatically executes market-making strategies, and there is no need to operate frequently compared to making markets by yourself.

Risk diversification: Through different Vaults, users can allocate liquidity to different assets, thereby diversifying their portfolios and reducing concentration risks.

Source: https://oyster.synfutures.com/#/vault/base/0x152d6356da0b84eb796247b03b3a17a791d83c42

Similar to Blast's points activities, providing LP and trading can also earn O_O points rewards. At the same time, with the launch of Vault, users have an easier way to generate asset income through SynFtures and earn O_O Points rewards.

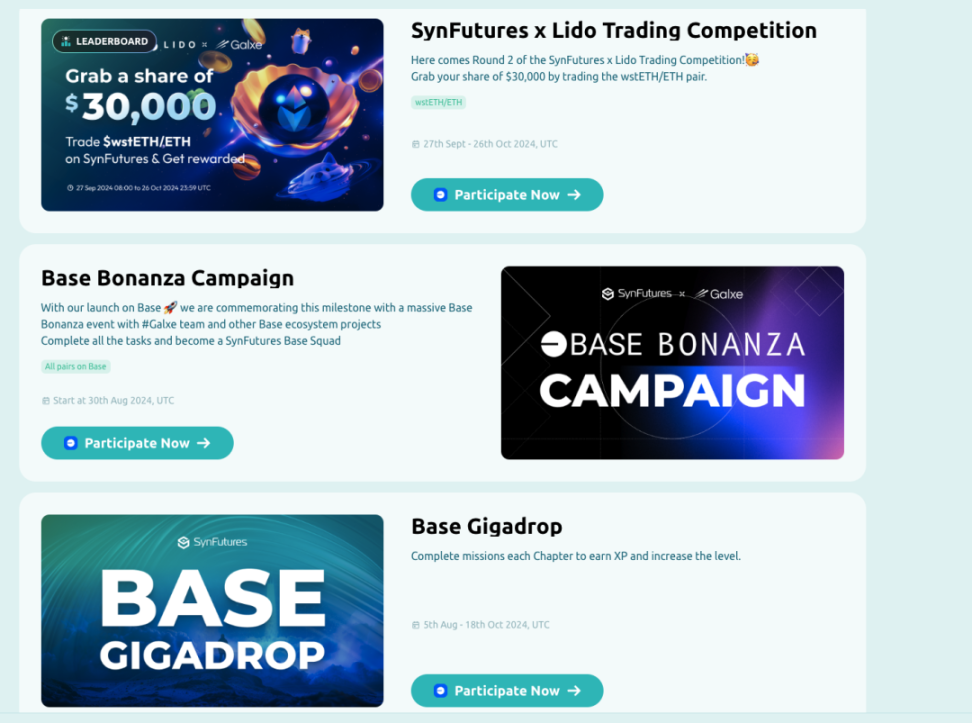

In addition, more ways to earn points can be found on the SynFutures activity interface, which shows that SynFutures is full of sincerity in giving back.

Source: https://oyster.synfutures.com/#/campaign

In the current event, SynFtures also provides a points page to encourage users to rank, which brings more fun.

Source: https://oyster.synfutures.com/#/odyssey

From the chain data, Base has gradually become the growth engine of SynFutures, demonstrating SynFutures' flexible market adaptability. At the same time, it also indirectly confirms Base users' recognition of SynFutures' product experience and incentive plan.

Source: https://info.synfutures.com/

03 Core Advantages and Comparison with Competitive Products

3.1 Market Position

At present, there are several derivatives trading platforms that have occupied a certain market position, such as dYdX, Hyperliquid, GMX, etc.

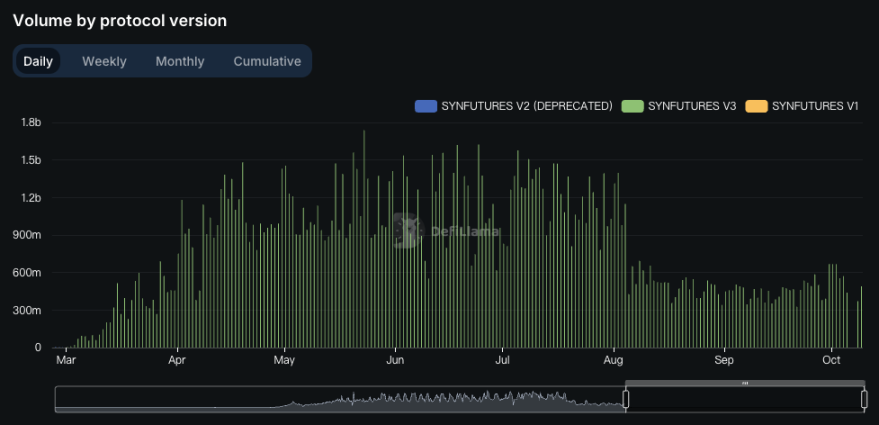

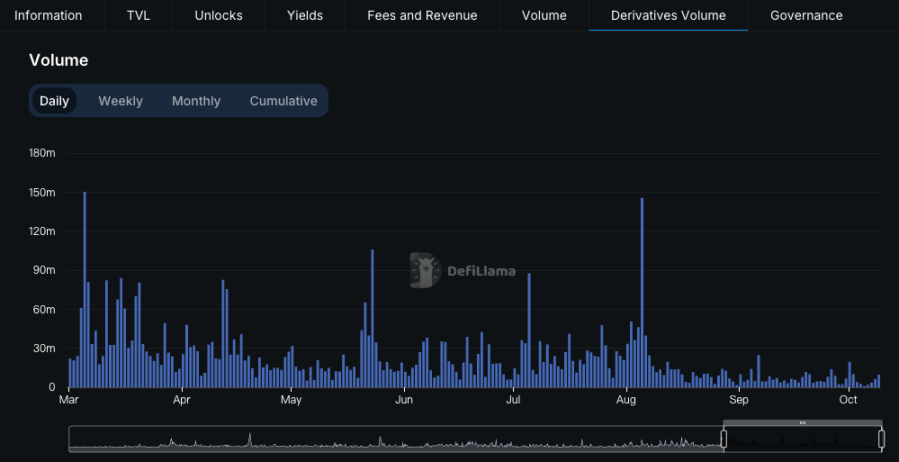

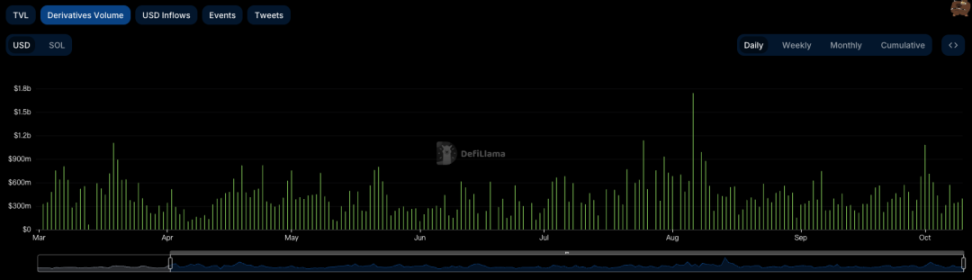

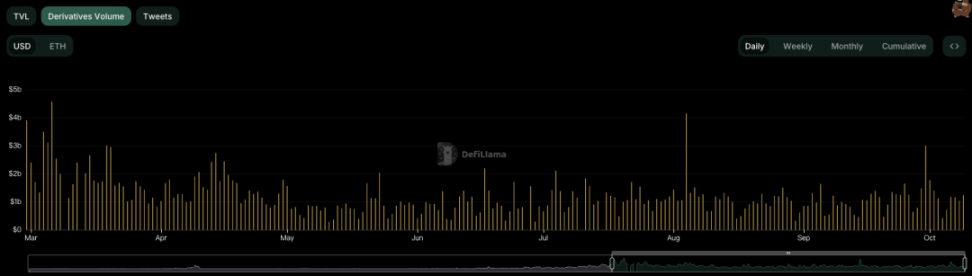

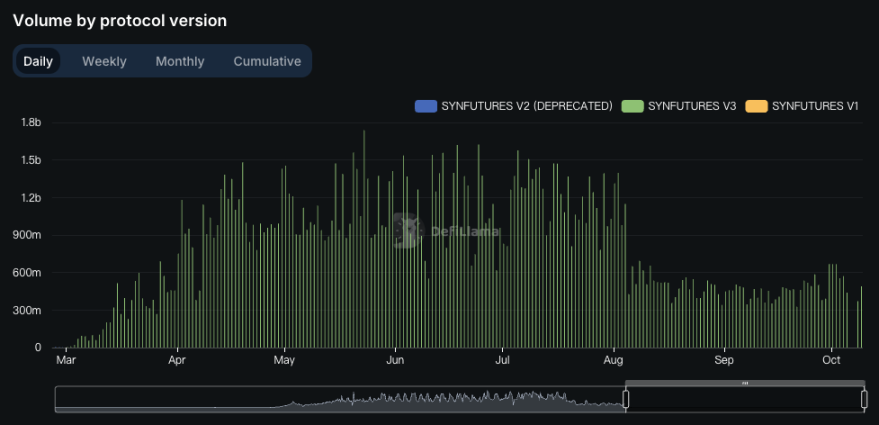

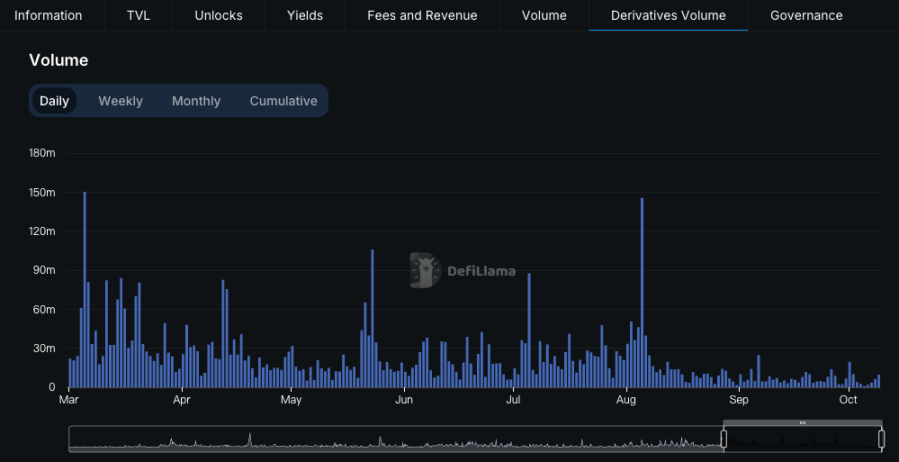

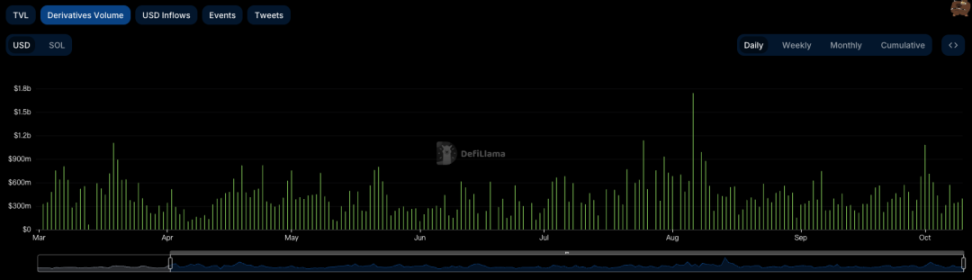

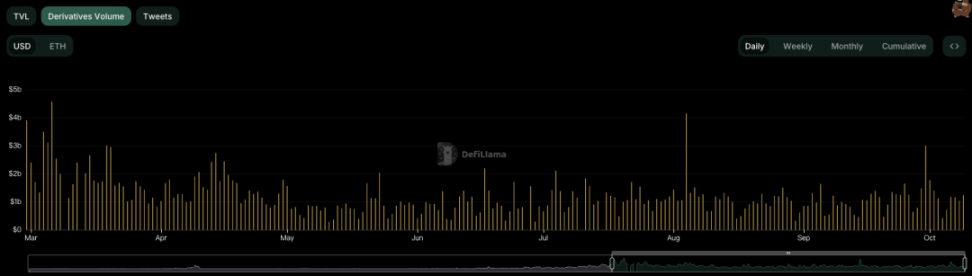

From DefiLlama's Derivatives Volume, we can see the performance of major on-chain derivatives platforms since March. From March to September, Hyperliquid and dYdX maintained their leading derivatives trading volume, basically maintaining a daily trading volume of about 1.5 billion US dollars. SynFutures was able to achieve a daily trading volume of about 1 billion US dollars, leading Jupiter, GMX and other players, and being in the first echelon of the derivatives track.

Since September, due to market reasons, the trading volume of most derivatives platforms has declined. Hyperliquid still ranks first with a trading volume of about 1.5 billion US dollars, and Synfutures has surpassed dYdX with a trading volume of about 600 million US dollars.

As the derivatives platform with the shortest launch time, it was able to quickly gain its current market position, indicating that it has gained full recognition from the market.

SynFutures V3 derivatives trading volume, source: https://defillama.com/protocol/synfutures

GMX Derivatives trading volume, source: https://defillama.com/protocol/gmx?volume=true

dYdX derivatives trading volume, source: https://defillama.com/protocol/dydx

Jupiter Perpetual Exchange derivatives trading volume: Source: https://defillama.com/protocol/jupiter-perpetual-exchange

Hyperliquid Derivatives trading volume, source: https://defillama.com/protocol/hyperliquid?derivativesVolume=true

3.2 Core advantages

SynFutures can achieve outstanding results in a short period of time, which is inseparable from its unique advantages:

On-chain order book + AMM hybrid model, combining decentralization, liquidity depth and capital efficiency:dYdX and Hyperliquid rely only on order books, with high capital efficiency, but limit the diversity of trading assets; the peer-to-pool model used by GMX is subject to the bottleneck of LP in terms of trading volume, lacks scalability, and the diversity of trading assets is also limited; SynFutures combines on-chain order books and AMM, combining DEX

The right to list coins belongs to the community: The trading assets of other derivatives trading platforms are basically centralized decisions, while SynFutures allows the community to decide on the assets to be listed, and can achieve permissionless listing in 30 seconds; in this round of MeMe craze, SynFutures quickly achieved the listing of $BOME, leading the market rhythm.

Support any ERC-20 token as margin:SynFutures supports any ERC-20 token as margin for trading, while other platforms only support limited currencies such as USDC and ETH.

Full-chain order matching:SynFutures places order matching completely on the chain, ensuring the transparency of transactions and preventing market manipulation; while competitors such as dYdX and Hyperliquid match orders off-chain, which still has potential centralization risks.

Expected open airdrops and coin issuance:SynFutures V3 currently focuses on the Blast and Base ecosystems, providing users with deposit income, point incentives, and chain-related airdrops in a variety of ways, which are not available on other platforms such as dYdX and Hyperliquid. In addition, SynFutures is one of the few leading derivatives trading platforms that has not yet issued tokens. The team said that it is studying token issuance, suggesting that there will be plans for coin issuance and airdrops at that time. For users of the old version of SynFutures and participants in past activities, local officials said that there will also be corresponding rewards in the future.

Source: https://www.synfutures.com/

04 Team and Background

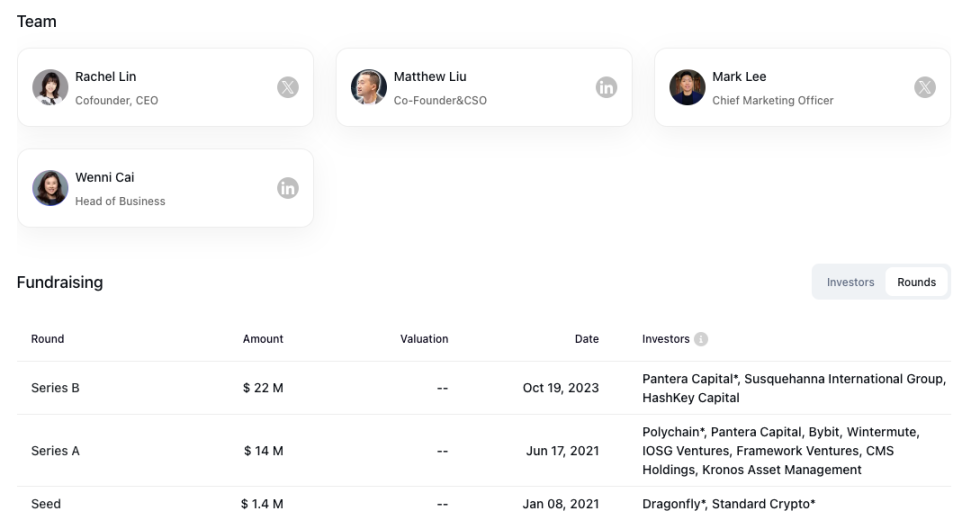

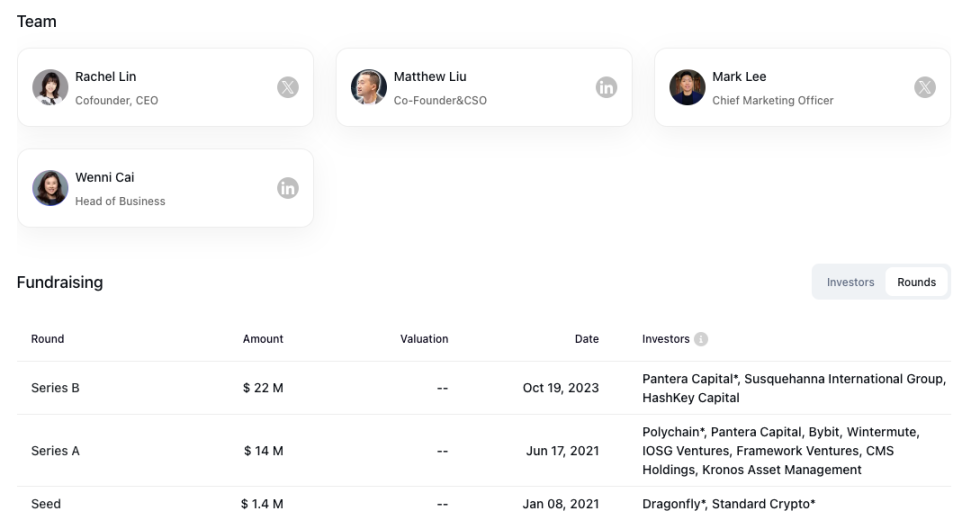

The founding team of SynFutures has backgrounds in international first-tier investment banks, Internet companies and encryption OGs, and has won the favor of investors including Pantera, Polychain, Standard Crypto, Dragonfly, Framework, SIG, Hashkey, IOSG, Bybit, Wintermute, CMS, Woo, etc., and has raised more than US$38 million to date.

Source: https://www.rootdata.com/Projects/detail/SynFutures?k=MzAyMA%3D%3D

05 Summary and Outlook

In the fierce competition in the decentralized finance (DeFi) derivatives market, SynFutures stands out with its innovative technologies and strategies.

By introducing an order book and matching mechanism on the entire chain, a unified liquidity model, and a stability mechanism focused on user protection, SynFutures not only provides users with a safe, transparent and efficient trading environment, but also ensures its competitiveness and attractiveness in the industry.

In addition, SynFutures has demonstrated its commitment to long-term development and ecosystem construction through generous incentive plans and deep investment in the Blast and Base ecosystems.

Generous airdrop rewards, trading competitions and other activities, as well as the continuous innovation of products such as Vault, have not only attracted the active participation of a large number of users, but also injected new vitality into the market. This kind of feedback to users and ecological partners has strengthened SynFutures' connection with users and the ecosystem and promoted the continued prosperity of its ecosystem.

Through technological innovation, user protection mechanisms, incentive strategies, and clear future planning, SynFutures has successfully built a trading platform that is both safe and reliable and vibrant. These advantages enable SynFutures to not only meet the needs of current users, but also foresee and adapt to future market changes, heralding its continued leadership in the field of decentralized trading platforms.

Weatherly

Weatherly