Author: Chloe, ChainCatcher

Binance has recently been embroiled in another scandal involving an employee suspected of insider trading. On December 7th, a Binance employee allegedly used their position to promote newly issued tokens on official social media for personal gain. This is not the first time Binance has been involved in internal corruption; a similar case occurred in March of this year. Even though the company has emphasized zero tolerance and responded actively, the market has criticized altcoins as veritable Ponzi schemes. Retail investors not only have to contend with institutional investors but also with internal employees using their positions for arbitrage.

Just after the token was launched, the official account posted a related post

On December 7th, a token called "Year of the Yellow Fruit" (abbreviated as YEAR) was launched on BNB Chain at 1:29 AM. Less than a minute later, at 1:30 AM, the official Binance Futures X account @BinanceFutures posted a related tweet, with text and images hinting at the token's potential.

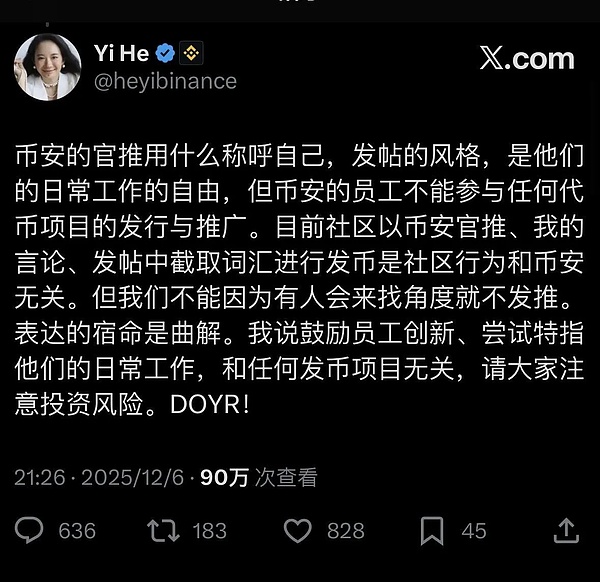

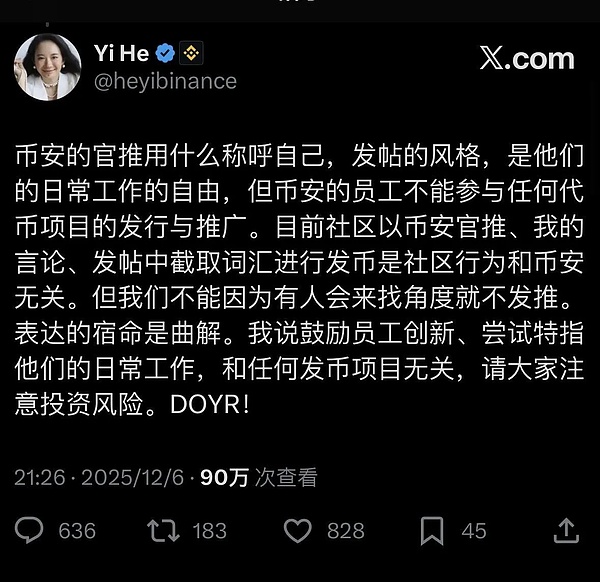

According to data, the coin surged over 900% after the post was published, peaking at $0.0061, with a fully diluted valuation (FDV) of $6 million. However, as of press time, it has fallen over 75.3% to $0.001507. This coincidental timing has led the community to suspect that the employee who posted the post attempted to manipulate the market and abuse their position for personal gain. According to DLNews, the inspiration for the "Year of the Yellow Fruit" token originated from a post on Binance's official account on December 4th, titled "2026: the year of the yellow fruit." The post quoted speeches by former Goldman Sachs executive Raoul Pal and Coin Bureau founder Nic Puckrin at Binance Blockchain Week, encouraging traders to "plant and expect a bountiful harvest," a sentiment echoed in the images and text posted by an internal employee. Binance stated that its preliminary investigation has confirmed that an internal employee is suspected of abusing their position for personal gain. The employee has been immediately suspended, and the company is proactively contacting the relevant authorities in the employee's jurisdiction to pursue legal action. Furthermore, a reward of $100,000 will be distributed equally among all users who provide valid reports, based on the promised bounty. Ironically, just the day before the incident, He Yi posted that Binance employees were prohibited from participating in the issuance and promotion of any tokens, only to be publicly contradicted the statement the very next day when an internal employee was exposed for engaging in insider trading. This reflects the problem that, because on-chain addresses do not require KYC (Know Your Customer) verification, and in the absence of regulation, exchanges find it difficult to supervise all employee actions. Even with full monitoring of work computers and mobile phones, this leaves a huge loophole for insider trading. Similar cases have occurred at major exchanges such as Coinbase and OKX.

Two insider trading incidents in one year pose challenges to exchange's internal risk control

In March of this year, Freddie Ng, a Binance employee (former BNB Chain business developer, later joined the Binance Wallet team), had advance knowledge of the impending rise in the UUU token price and is suspected of using insider information to trade. He purchased approximately $312,000 worth of UUU tokens with 10 BNB through his secondary wallet (0xEDb0...), and then transferred all the tokens to a money laundering wallet (0x44a...).

Miyuki

Miyuki