Author: Liu Jiaolian

《Week 14: Trump's Tariffs Hit the Wall, Repeatedly Jumping and Playing with the Market》 reviewed two large-scale harvesting scenes since the beginning of this year, one was the Trump meme at the beginning of the year, and the other was the recent tariffs. What is deeply worrying is that the reckless and repeated harvesting will only cause the market to continue to bleed. The continued deterioration of basic liquidity has turned the good news into a trap that lures more and kills more, trapping every stupid leek who believes in the good news of the market maker's future market.

When the U.S. stock, U.S. bond, and the U.S. dollar are in a triple kill situation, smart capital will begin to flee the U.S. dollar assets in a panic.

Jiaolian mentioned in today's 4.13 Jiaolian internal reference"Week 14: Emperor Chuan's tariffs hit the wall and he keeps jumping around to fool the market" that The Kobeissi Letter analyzed that the surge in U.S. Treasury yields forced Emperor Chuan to make repeated concessions.

The Kobeissi Letter analyzed: For weeks, President Trump insisted that he would never postpone the tax increase, even though the stock market had evaporated more than $12 trillion. However, just 12 hours after the bond market collapsed, the 90-day tariff deferral order was quickly implemented.

Before the so-called reciprocal tariffs were implemented on April 2, the 10-year Treasury yield was in a straight line decline. This means that the downward trend in interest rates has given room for the tariff war to continue.

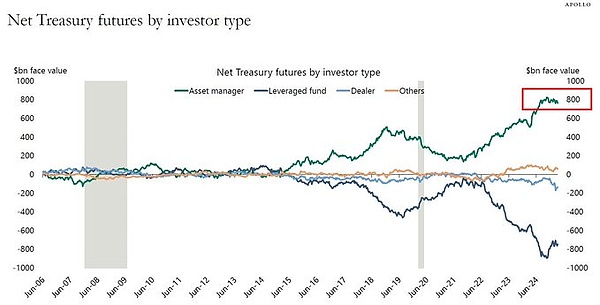

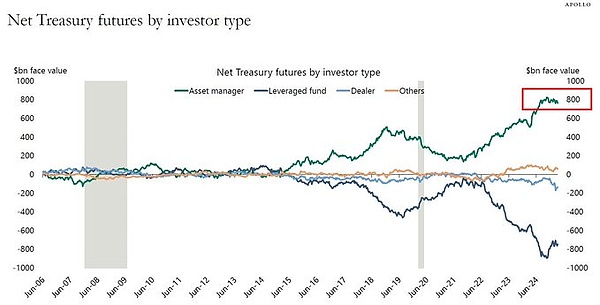

However, as increased volatility led to the unwinding of basis trades, the 10-year yield soared 65 basis points to 4.50%.

However, the situation suddenly changed on April 7th - as the stock market fell, interest rates began to soar.

As shown in the figure below, the divergence between the S&P 500 index and the 10-year US Treasury yield has reached a historic level.

Although bonds are regarded as safe-haven assets, their collapse is even faster than stocks.

Then at 10:15 a.m. EST on April 7, the first headlines about the 90-day tariff reprieve began to emerge.

The White House immediately declared this "fake news," but now the facts show that this is by no means false news.

Just as the 10-year Treasury yield soared, Trump was likely discussing the 90-day reprieve plan with his advisory team.

Two days later, on April 9, the 90-day tariff deferral order was officially announced.

Trump then basically confirmed that the move was due to volatility in the bond market: "I was paying close attention to the bond market. This market is very tricky. Look at it now, the trend is so beautiful."

This is clearly an interest rate-driven policy shift.

More specifically, at the end of the video clip he said: "Yes, I noticed some people starting to get antsy last night."

This refers specifically to the basis trade liquidation phenomenon mentioned above - Trump knows that if he does not intervene, the $800 billion basis trade liquidation will push the 10-year yield to 5%.

Due to the collapse of the basis trade, safe-haven funds once again quickly poured into the gold market.

And with the sharp weakening of the US dollar, global M2 denominated in US dollars hit a new high.

The storm is coming.

Catherine

Catherine