Fund freezing and return data

With the great efforts of InMist Intelligence Network partners With support, SlowMist assisted customers, partners, and public hackers to freeze funds totaling more than $12.5 million in 2023.

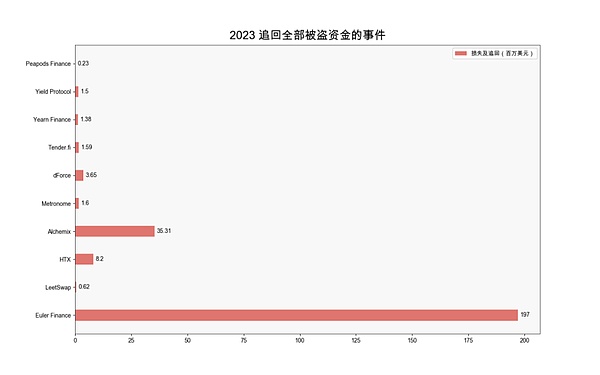

In 2023, there were 31 incidents in which the lost funds were still fully or partially recovered after being attacked. The total stolen funds were approximately US$384 million, of which US$297 million was returned, accounting for 77% of the stolen funds. Of the 31 incidents, 10 protocols had their funds returned in full.

(2023 incident of recovery of all stolen funds)

What is anti-money laundering

Anti-money laundering is the government using legislative and judicial power to mobilize relevant organizations and commercial institutions to identify possible money laundering activities , a systematic project to dispose of relevant funds and punish relevant institutions and individuals, thereby achieving the purpose of preventing criminal activities. Judging from international experience, the main activities of money laundering and anti-money laundering are carried out in the financial field. Almost all countries place the anti-money laundering of financial institutions at the core. The international community's anti-money laundering cooperation is mainly in the financial field. In recent years, money laundering criminal activities have taken on diversified and concealed forms. The criminal trend of using virtual currencies to cover up the sources of illegal funds has become increasingly obvious. Anti-money laundering is becoming the biggest challenge faced by regulatory compliance agencies.

Blockchain Anti-Money Laundering Situation

In 2023 , the world of cryptocurrency continues to experience turmoil. During the last crypto bull run, every move by two industry giants, SBF and CZ, seemed to have a profound impact on the market. In November, however, a federal jury convicted SBF on charges of fraud and conspiracy stemming from FTX's collapse. Just weeks later, Binance accepted the charges, paid a $4.3 billion fine, and CZ agreed to relinquish control of Binance. As the cryptocurrency industry has experienced ups and downs between the turbulent "cold winter" and the bear market, governments and international organizations have also shown a more cautious attitude towards this, and regulatory policies for cryptocurrency in various countries are still gradually taking shape.

Stablecoin Regulation

According to the release on December 19 According to PwC's 2023 Global Cryptocurrency Regulation Report, as many as 25 countries/regions have enacted stablecoin legislation or regulation in 2023, including Austria, the Bahamas, Denmark, Estonia, Finland, France, Germany, Greece, Japan, Luxembourg, Portugal, Spain, Sweden, Switzerland, etc.

The vast majority of countries that have enacted stablecoin laws have also secured or implemented all other reviewed regulations, including cryptocurrency regulatory frameworks, licensing or registration, and financial Action Working Group Travel Rules. According to the report’s analysis, countries such as the United States, the United Kingdom, and Canada have not yet finalized legislation on stablecoins, nor have they yet formulated a regulatory framework for cryptocurrencies. Data shows that some crypto-friendly countries, such as Singapore and the United Arab Emirates, have adopted all cryptocurrency-related regulations except stablecoins.

Of the countries analyzed, approximately 18%, or only 8 jurisdictions, have not initiated any stablecoin regulation at all. These countries include Bahrain, Brazil, India, Taiwan, Turkey and others. 23% of jurisdictions reviewed, including Australia, Hong Kong, and Singapore, have initiated stablecoin regulatory processes and are actively adopting stablecoin laws.

SEC Enforcement Actions

U.S. Securities and Exchange Commission (SEC) ) announced fiscal year 2023 enforcement results in November. The SEC filed a total of 784 enforcement actions, a 3% increase from 2022, the report shows. Enforcement actions generated a total of $4.949 billion in fines, the second-highest total in history behind the $6.4 billion in 2022. The SEC said fiscal year 2023 was a productive year for enforcement efforts. The cases it focuses on involve areas such as cryptocurrency, cybersecurity, misrepresentation by listed companies, and market manipulation.

According to statistics, the following are the enforcement actions taken by the SEC against some large exchanges in the encryption ecosystem:

SEC prosecuted NFT issuers Impact Theory and Stoner Cats 2 under federal securities laws, which marks the expansion of SEC regulatory goals. The SEC alleged in both cases that the NFTs sold were unregistered securities. After the charges were filed, both companies agreed to settle with the SEC, paying approximately $6.1 million and $1 million, respectively.

Trading platform Kraken reached a settlement with the US SEC for US$30 million over Kraken's pledge services is an unregistered security that meets the definition of an investment contract.

The SEC reached a settlement agreement with Nashville-based crypto services company Linus Financial for allegedly failing to Registers the issuance and sale of its retail cryptocurrency lending products.

SEC’s lawsuit against Coinbase alleges that the exchange has been operating an unregistered securities exchange, an unregistered broker-dealer and an unregistered clearing agency. Coinbase subsequently filed a motion to dismiss the lawsuit, with a ruling expected in January 2024.

SEC claims that Ripple’s token XRP is a security, Judge Torres presiding over the case The ruling made it clear that XRP is not a security in itself. Soon after another judge, Rakoff, denied a motion that would have affected the matter, and the ruling remains divided and pending.

In June, the SEC filed a civil lawsuit against Binance , accusing Binance of being an unregistered exchange and illegally supplying and selling securities to U.S. investors. The SEC has consistently rejected Binance’s request to drop the lawsuit, and the “battle” between the SEC and Binance is still ongoing.

Anti-Money Laundering Sanctions

On April 2, the U.S. Treasury Department sanctioned three North Koreans who provided support for money laundering by the North Korean hacker team Lazarus Group.

On May 25, Binance assisted U.S. law enforcement agencies in seizing and freezing $4.4 million. Accounts related to North Korean organized crime.

On August 24, according to a press release from the U.S. Department of the Treasury, the Department of Justice investigated Roman Semenov and Tornado The indictment was filed against Cash's second co-founder, Roman Storm, who was arrested today by the FBI and Internal Revenue Service on charges of conspiracy to launder money, conspiracy to operate an unlicensed money transmission business, and conspiracy to violate sanctions. The Treasury Department said that even after knowing that the Lazarus Group was laundering hundreds of millions of dollars worth of stolen virtual currency through its mixing service for the benefit of North Korea, the founders of Tornado Cash continued to develop and promote the service and took no meaningful action. measures to reduce its use for illegal purposes.

On October 18, the U.S. Treasury Department imposed sanctions on several individuals and entities, saying These individuals and entities support Hamas’ terrorist operations and include a Gaza exchange and a business called “Buy Cash Money and Money Transfer Company.” The U.S. Treasury Department said the company has a long history of providing financial support to terrorist groups. Buy Cash had previously been linked to wallets seized by Israel's National Counter-Terrorism Financing Authority in 2021 and was accused of "providing funds, supplies to Hamas." , technology, services or support”, the assets traded by the organization include Bitcoin.

On October 31, the Japanese government decided at a cabinet meeting to freeze participation in Palestinian armed politics The faction Hamas provided funds to nine Hamas personnel and the assets of a virtual currency trading company.

On November 22, the U.S. Department of Justice announced that Binance and Changpeng Zhao were involved in a $4 billion resolution. Pleaded guilty to federal charges. In its announcement of the settlement with Binance, the U.S. Treasury Department stated that in addition to imposing a $3.4 billion civil penalty on Binance, the Financial Crimes Enforcement Network (FinCEN) will impose a five-year supervision on Binance and require significant compliance commitments , including ensuring Binance completely exits the United States.

On November 29, the U.S. Treasury Department sanctioned the cryptocurrency mixing service Sinbad. The service supports transactions related to North Korean hacking groups. Sinbad’s website was also seized by the FBI, the Dutch Financial Intelligence Bureau, the Dutch Prosecutor’s Office and the Finnish National Investigation Agency. Sinbad.io (Sinbad, Sinbad) is a virtual currency mixer and the main tool for laundering North Korean money for the Lazarus Group. Sinbad was responsible for facilitating the laundering of millions of dollars in stolen virtual currency and was the preferred mixing server for the Lazarus Group. Sinbad operates on the Bitcoin blockchain and indiscriminately facilitates illicit transactions by obfuscating their origin, destination, and counterparties. Some industry experts consider Sinbad to be another version of the Blender.io mixer.

Others

China

China has always maintained strict policies on cryptocurrencies. China announced a complete ban on cryptocurrency trading in 2021 and halted all cryptocurrency-related business activities. On November 13, the Financial Stability Bureau of the People's Bank of China published a column article "Effectively Prevent and Resolve Financial Risks, and Firmly Hold the Bottom Line of No Systemic Risks." The article pointed out that the rectification work in areas such as virtual currency transactions has been basically completed, and domestic virtual currency transactions must be resolutely curbed. Currency trading speculation. In December, the People's Bank of China released the "China Financial Stability Report (2023)", which conducted a comprehensive assessment of the soundness of China's financial system in 2022. The report explains the risks of crypto assets and states that it will continue to crack down on illegal financial activities such as virtual currency trading and speculation. In addition, the report summarizes China’s regulation of crypto-assets and the dynamics of global regulation of crypto-assets. The report stated, “In recent years, regulatory authorities in many countries and international organizations have begun to assess the risks of crypto assets and introduced regulatory policies and response measures. Generally speaking, in accordance with the principle of “same business, same risks, same supervision”, the development of crypto asset businesses is consistent with their risk levels. Proportional supervision and minimizing regulatory data gaps, reducing regulatory fragmentation and eliminating regulatory arbitrage.”

Although China has vigorously curbed cryptocurrency, while standardizing supervision, China continues to encourage the exploration and application of blockchain and digital currency-related technologies, and Make timely responses and adjustments to emerging issues. According to data, since the digital renminbi was first launched in January 2022, as of the end of June, the transaction volume of the central bank’s digital renminbi has been approximately 1.8 trillion yuan. On December 2, the People's Bank of China and the Central Bank of the United Arab Emirates renewed a currency swap agreement of RMB 35 billion/AED 18 billion (USD 4.9 billion) in Hong Kong, extending the bilateral currency swap agreement for five years to promote Financial and economic connections. The two parties also signed the "Memorandum of Understanding on Strengthening Cooperation on Central Bank Digital Currency" to further strengthen technical cooperation in the development of central bank digital currency. On October 9, six departments including the Ministry of Industry and Information Technology, the Cyberspace Administration of China, the Ministry of Education, the National Health Commission, the People's Bank of China, and the State-owned Assets Supervision and Administration Commission of the State Council jointly issued the "Action Plan for the High-Quality Development of Computing Infrastructure", proposing By 2025, in terms of computing power, the computing power scale will exceed 300 EFLOPS, the proportion of intelligent computing power will reach 35%, and the eastern and western computing power will develop in a balanced and coordinated manner. In December, the Ministry of Industry and Information Technology stated in its reply to Proposal No. 02969 of the First Session of the 14th National Committee of the Chinese People’s Political Consultative Conference that, in addition to its previous statement that it would “formulate a Web 3.0 development strategy document in line with my country’s national conditions” and other measures to improve top-level design, it would also strengthen Web3.0 technology research and supervision, carry out international exchanges and cooperation on Web3.0 and increase technology publicity and promotion.

Hong Kong, China

< p style="text-align: left;">Hong Kong, a regional financial hub, is transforming itself into a cryptocurrency hub. On June 1, Hong Kong’s virtual currency licensing system was officially opened. Platforms interested in engaging in virtual asset business can apply for a license from the Hong Kong Securities and Futures Commission and be supervised by it. On December 22, the official website of the Hong Kong Securities and Futures Commission announced the "Circular on Funds Involving Virtual Assets Recognized by the SFC", replacing the "Circular on Virtual Asset Futures Exchange Traded Funds" issued on October 31, 2022. At the same time, it is pointed out: For virtual assets (such as Bitcoin, Ethereum) that are allowed to be traded on licensed trading platforms, licensed institutions can issue and manage corresponding spot ETFs, and trade them on licensed trading platforms or recognized financial institutions. Subscription and redemption can be carried out in two ways: physical goods and cash. On the other hand, in view of the JPEX thunderstorm incident, the CEO of the Hong Kong Securities and Futures Commission said that the JPEX incident fully reflects the importance of supervision and that Hong Kong’s direction of developing the Web3 ecosystem will not change, and virtual asset trading is an important part of the Web3 ecosystem. Digital finance and virtual asset activities can bring benefits to financial markets. It is understood that the China Securities Regulatory Commission and the Police have established a working group on virtual asset trading platforms to share information on suspicious activities and irregularities on virtual asset trading platforms and work together to bring violators to justice. On December 22, the Hong Kong Securities and Futures Commission issued the "Joint Circular on Virtual Asset-related Activities of Intermediaries" and the "Circular on SFC-Authorized Funds Investing in Virtual Assets", and stated that it is "ready to accept the recognition of virtual asset spot ETFs" Apply". United States

The United States has relatively flexible policies on cryptocurrency. Although regulatory policies are constantly updated, there is no comprehensive ban on the trading, purchase, and sale of cryptocurrencies. At the same time, in view of the impact and potential risks of cryptocurrency, the United States is further strengthening supervision to ensure the stability of the financial system and the protection of consumers.

EU

p>The EU's regulatory policy on cryptocurrency is still under discussion and revision, trying to find a balance between ensuring financial security and promoting technological innovation. It is worth mentioning that the European Union announced new sanctions on cryptocurrency companies and projects led by Russian citizens in December, intensifying its crackdown on Russian encryption company executives.

Japan

p>Japan is relatively open when it comes to cryptocurrency, and Japan already has complete procedures and regulations to control and support the cryptocurrency market. In 2023, the Japanese National Tax Agency issued a general tax treatment document on NFTs. In addition to listing cases for taxation of NFTs, the guide also released cases for the collection of consumption taxes and other situations. Separately, the Bank of Japan stated that it will make a final decision on the issuance of CBDC by 2026.

South Korea

South Korea has clear regulations on cryptocurrencies, including registration requirements, compliance reviews and financial consumer protection. At the same time, South Korea is also promoting various innovative projects related to blockchain. In 2023, the Bank of Korea (BOK) announced details of its retail central bank digital currency (CBDC) pilot program, stating that 100,000 selected South Korean citizens will join the pilot in the fourth quarter of 2024. In addition, South Korea’s Financial Services Commission (FSC) announced in December a legislative notice on the implementation orders and regulatory provisions of the Virtual Asset User Protection Act and other laws. The law aims to protect virtual asset users and establish a sound virtual asset market transaction order. It stipulates the definition of virtual assets, objects excluded from virtual assets, and stipulates that virtual asset operators must safely keep and manage users’ deposits and virtual assets. assets. In view of this background, the Korean Financial Supervisory Service announced that it will establish a new "Virtual Assets Supervision Bureau" and a "Virtual Assets Investigation Bureau" to prepare for the upcoming implementation of the "Virtual Asset User Protection Act" in July 24.

Singapore

Singapore’s legislation on cryptocurrency has always been relatively forward-looking. The Monetary Authority of Singapore (MAS) issued a report on cryptocurrencies in 2023. Consultation paper on the Consumer Protection Handbook, to be followed by final guidance. Singapore has always supported and participated in international financial cooperation. For example, the Monetary Authority of Singapore (MAS) has established a group of policymakers composed of Japan's Financial Services Agency (FSA), the UK's Financial Conduct Authority (FCA) and the Swiss Financial Market Supervisory Authority (FINMA). Project Guardian to promote cooperation in cross-border financial development asset tokenization. At the same time, the Monetary Authority of Singapore (MAS) also launched a digital asset and decentralized finance (DeFi) service pilot in 2023.

Summary

In summary, due to the complexity of cryptocurrency itself, regulatory policy has become a complex discussion involving financial stability, consumer protection, and anti-money laundering. However, what is certain is that with the popularization of blockchain and cryptocurrency technology, more governments and institutions are getting involved, and the implementation of regulatory policies is also shifting to a more specific and global direction. It is believed that the gradual clarification of regulatory rules will help virtual asset service providers and financial institutions combat money laundering and fund raising by criminals; it will also help with sanctions screening and transaction monitoring. As a leading security company in the blockchain industry, we will also respond more actively to national regulatory policies and continue to vigorously promote technological applications related to regulatory compliance.

Full report download:

https://www.slowmist.com /report/2023-Blockchain-Security-and-AML-Annual-Report(CN).pdf

Edmund

Edmund

Edmund

Edmund JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance Xu Lin

Xu Lin JinseFinance

JinseFinance Coindesk

Coindesk Finbold

Finbold Beincrypto

Beincrypto Cointelegraph

Cointelegraph