Specialized vs. General-Purpose ZK: Which is the Future?

ZK Stack, dedicated vs. general-purpose ZK: Which one is the future? Golden Finance, the line between dedicated and general-purpose ZK is blurring.

JinseFinance

JinseFinance

Author: Impossible Finance; Compiled by: TechFlow

Decentralized Physical Infrastructure Network (DePIN ) represents a transformative approach to building and extending infrastructure networks, which are divided into two main types: physical and digital. The DePIN project is unified by a core philosophy and aims to build a more open, decentralized and transparent infrastructure network in various fields. Compared with the traditional web2 model, this method has obvious advantages, mainly for the following reasons:

Resource Utilization and Cost Efficiency. The DePIN project leverages two key facts to gain this critical competitive advantage: leveraging existing underutilized devices, and reducing the upfront cost and risk for new hardware investors through token incentives and already acquired demand.

Localized service provision: Distributed resources within the DePIN framework are good at understanding and meeting the needs of the local market Specific needs and wants. For example, in a decentralized cloud gaming framework, identifying regional game preferences can provide popular on-demand games, thereby enhancing service flexibility and user satisfaction.

Reliability and reduced risk of failure: Decentralized networks inherently reduce the risk of single points of failure , thereby improving the reliability and resilience of the services provided.

Accelerate innovation: The decentralized and permissionless nature of the DePIN network promotes the rapid development of innovation . The further alignment of multiple parties behind a common goal (and assets) incentivizes the development of third parties.

In 2023, the DePIN field experienced explosive growth, with more than 755 projects and a market value of US$32 billion. This surge highlights the strong demand for decentralized infrastructure and investor confidence in it. It is worth emphasizing that the service demand for generalized computing structures is on the rise, reaching utilization rates of 40-70% in the past year. This makes this sub-sector the highest revenue generator in the DePin sector, achieving annual revenue of $27.5 million in 2023.

In addition, it is worth noting that the growth of the GPU computing field is beyond DePin. Demand for processing power currently exceeds available supply, driven primarily by emerging technology areas such as artificial intelligence (AI), telecommunications and cloud gaming, which require large amounts of computing power. This issue is driving global competition to acquire GPU resources dominated by companies such as Meta, OpenAI, Alibaba and others; the main focus is on the highest performance grade processors, especially the H100 GPU developed by Nvidia.

Therefore, the North American GPU cloud market, as the leader of this trend, is expected to grow rapidly from US$3.2 billion in 2023 to US$25.5 billion in 2030, The compound growth rate reached 34.8%.

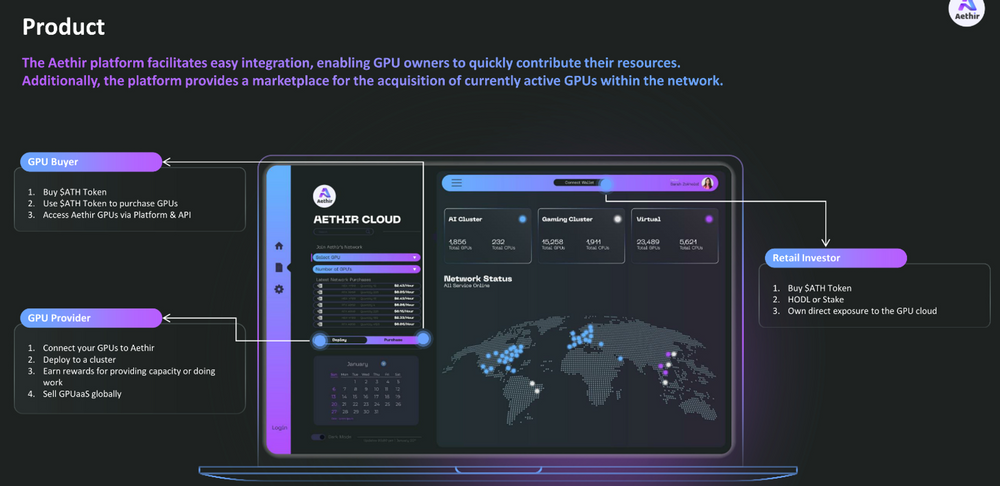

Aethir Cloud is a decentralized platform that connects computing processing Service providers and consumers, with a focus on compute-intensive applications that rely on GPU hardware, aiming to become an aggregator of GPUs for the masses.

In terms of GPU computing supply, Aethir Cloud consists of a network of enterprises, data centers, miners, and retail GPU providers. In terms of GPU computing needs, Aethir is targeting the enterprise segment in the following verticals: AI training, AI inference, gaming, and virtual devices (mainly mobile phones).

One of the key innovations that enables Aethir's strategy to meet the needs of the enterprise market is resource pooling, which brings together dispersed contributors under a unified interface to serve large customers around the world. A key implication of resource pools is that GPU providers can freely connect or disconnect from the network, allowing data centers with idle hardware to participate in the network during downtime. This flexibility results in higher utilization for GPU providers while enabling Aethir to offer lower prices to its consumers.

Additionally, Aethir's alignment with the web3 ethos and the launch of the $ATH token will enable network participants to co-own the platform and reduce financial risk for network participants at an early stage. This will allow Aethir to scale quickly, especially in the early stages of its lifecycle.

The core of the Aethir ecosystem runs on three key backend infrastructures that are critical to operations:

Containers: As the foundation of the Aethir network, containers are the actual place where the cloud is used. It acts as a virtual endpoint, executing and rendering applications (e.g. rendering games for players, performing inference tasks for AI consumers, powering virtual phones). The purpose of containers is to ensure that the cloud experience is instant and responsive, providing a "zero latency" experience. This is accomplished by offloading the workload from the local device to the container (e.g., offloading all game execution and command processing).

Checker: Checker ensures the integrity and performance of containers within the Aethir network. Validating the container specifications provided by the container provider is critical to maintaining the quality of service of the network.

Indexer: As the core of the Aethir network, the indexer matches consumers with suitable containers to ensure the reliability of cloud applications and services. Quick Start. The goal is to provide "second-level" service - the transition from consumer request to actual delivery (e.g. player making request to game screen) should happen in the shortest possible time. This requires concise signaling and efficient scheduling.

These three basic elements (containers, inspectors and indexers) work together to ensure the smooth operation of the Aethir ecosystem. More information about these three key roles can be found in their gitbooks.

User examples: telecommunications companies, hardware-intensive digital enterprises.

User pain point: underutilized hardware.

Aethir’s value proposition:

Sell hardware capacity through the GPUaaS model to improve utilization.

Achieve global coverage by pooling resources with the Aethir network to achieve enterprise-level contracts with economies of scale.

Provide flexible terms for hardware operators seeking to connect to the network.

Token incentives reduce the risk of capital expenditures.

User example: Mining infrastructure investors.

Aethir’s value proposition:

Reach enterprise customers globally.

Ecosystem support simplifies and assists operations.

Reduced risk of capital expenditure:

Ability to invest incrementally.

Due to serving global needs and receiving token rewards, the network utilization rate is high.

Higher returns: Get service fees + token rewards.

User Example : Retail users with spare hardware.

Aethir’s value proposition:

Get rewards for contributing GPU processing power to the network.

Hold/stake $ATH to gain direct access to the growth of the Aethir ecosystem.

Run a checker node and get rewards for contributing to network decentralization and quality of service.

User type: p>

AI training

AI inference

Game

Virtual computing

Aethir’s value proposition:

Improve performance

Low latency global service

Local Compute options

High-performance platform and API integration

Competitive and dynamic pricing that decreases further with adoption and scale.

Global coverage, huge and dynamic supply.

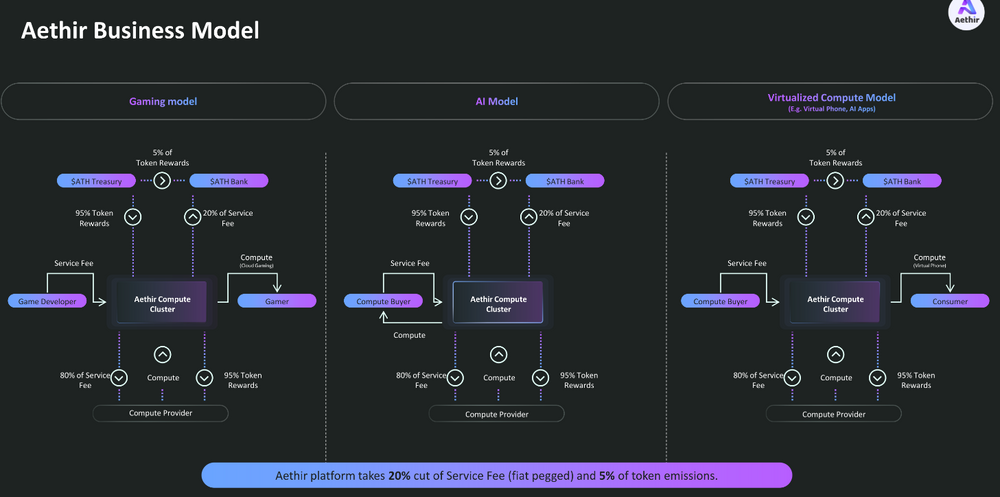

Aethir acts as a marketplace and aggregator , which facilitates connections between supply-side players such as node operators and GPU providers and users and organizations from compute-intensive industries such as artificial intelligence, virtual computing, cloud gaming and cryptocurrency mining. By providing institutional and retail users with access to these computing resources, Aethir provides a cost-effective alternative to traditional Web2 opponents and competitors. Revenue generation within the Aethir ecosystem follows a structured model where a 20% service fee, denominated in $ATH tokens, applies to payments made by customers to vendors. Additionally, Aethir receives 5% of the total $ATH token issuance as part of its indexer’s grant and operating program. To ensure fairness and competitiveness, Aethir allocates 50% of total ATH tokens to token incentives to benefit node operators and supply-side entities, ensuring that the annual interest rate is attractive for entry into the emerging ecosystem, and for the long-term ecosystem as a whole Sustainability.

Node operators within the Aethir ecosystem have multiple ways to generate revenue, divided into three forms of rewards:

Service Fee: A computing buyer or demand-side entity pays a service fee to purchase computing power. Payments will be converted into ATH tokens, with 80% of the fees paid by the node operators, while Aethir retains 20% of the platform share.

Rendering Proof of Work: As an additional reward, operate nodes for completing computing tasks within the ecosystem Vendors provide token incentives. This encourages supply-side entities to join Aethir’s ecosystem and provide valuable processing and computing work. Proofs of rendering work are only distributed to containers after completing the computation task.

Proof of Capacity: Compute providers earn proof of rendering capabilities by demonstrating readiness to provide compute services. Even without active work, providers receive rewards as an incentive to join the ecosystem, reducing the risk of participation.

Aethir operates in three main areas, and the same business model applies to all three areas:

< ul class=" list-paddingleft-2">Cloud gaming model: Provide computing resources for the growing cloud gaming industry.

AI mode: Aethir’s platform provides specialized infrastructure for AI applications, allowing users to leverage The computing power required to train and infer complex AI models.

Virtualized computing mode: Focusing on virtualized computing, Aethir provides flexible and scalable computing resources for a variety of virtualized applications and workloads.

Aethir has validated market demand for enterprise-grade GPUaaS customers in AI model training, virtual computing and gaming, with 3 existing contracts expected to reach annual recurring revenue in the first quarter of 2024 Sex revenue (ARR) exceeds $20 million.

Specifically, Aethir has implemented:

Signed contracts with the world's largest game studios, with annual recurring revenue of $5 million to $7 million and a player base of 150 million.

Signed a contract with WellLink, with annual recurring revenue of $5 million to $7 million, the largest with more than 64 million monthly active users Cloud gaming company.

Contract with the world's largest telecommunications company, annual recurring revenue of $5 million (may rise to $1390 in the near future Ten thousand U.S. dollars).

Another 10 contracts in the gaming sector are expected to be completed in the first quarter of 2024

Aethir leverages its strong value proposition to free up GPU capacity from existing infrastructure resources , while also being able to attract direct hardware investment commitments to become network participants.

Aethir's cloud currently has $24 million worth of equipment spread across 25 locations and 13 countries. Additionally, Aethir has secured the equivalent of $10 million in equipment to expand infrastructure through 2024.

It’s worth emphasizing that Aethir is strategically focused on ensuring access to H100 devices. As artificial intelligence gains a lot of traction in web2 and web3 and therefore the demand for H100 chips grows exponentially, Aethir has been able to aggregate over 3000 nodes that are already connected to Aethir's network. They are also working on a deal to increase this number to 50,800 units over the next six months. This will make Aethir the only decentralized provider able to use hardware of this scale.

Here is a summary of the equipment Aethir currently owns:

Left is the GPU model, and the right is the quantity

Community support is a clear indicator of Aethir's growing popularity, having over 170,000 followers to date across various social media platforms. In addition, as the Aethir platform continues to grow and contracts are added, Aethir is expected to have 10 million monthly active users (MAU) in 2024. The expected user growth highlights the market's enthusiasm for Aethir's innovative cloud computing solutions.

In terms of investment, Aethir has successfully invested in The $9 million raised includes venture capitalists and family offices such as Animoca, Maelstorm Fund, IVC, Framework, Sanctor Capital and Merit Circle. This investment demonstrates the confidence these entities have in Aethir's vision to change the cloud computing landscape.

In addition, Aethir has established strategic partnerships with key players in its industry:

Nvidia partners through launch program

Cooperate with Well Link, the world's largest telecommunications company, and other major players in the telecommunications field (confidentiality is required under the agreement)

With global Partnering with top gaming studios including the largest studios

Deploying on Arbitrum and engaging with key Web3 like Gam3s.gg and Seedify who cooperate.

Seed round (token Round, early 2022), valuation of US$60 million

Pre-A round (token round, early 2023), valuation of US$150 million

Network access diversity: Aethir is based on containers The service introduces a range of network access options. This includes point-to-point direct connections and server-assisted connections, which are suitable for various operating scenarios and provide a more adaptable solution than traditional cloud rendering solutions.

Transparent Evaluation Framework: Aethir has established a transparent and objective evaluation framework for evaluating the specifications of containers and the quality of services provided. . This represents a shift towards a more dynamic assessment approach, with Aethir having a system for assessing compute power specifications, setting up a standardized application and container assessment framework to ensure consistency across a variety of uses. Additionally, checkers within the network ensure quality is delivered to users in a consistent manner. Finally, a comprehensive service quality assessment protocol covers the entire process from the beginning to the end of the session.

Enhanced low-latency technology: Aethir has made significant progress in minimizing end-to-end latency, which is essential for delivering real-time cloud rendering Experience matters. Key innovations include:

Utilizing predictive algorithms such as Kalman filtering to ensure event stability input, resulting in a latency reduction of 7 to 15 milliseconds relative to competitors.

Implements advanced video capture technology directly from the GPU, minimizing VSync latency (16.6 milliseconds reduction at 60 frames) .

Adopt a region of interest (ROI) encoding strategy to optimize the video encoding process on the Aethir platform to improve the bit rate and network transmission capabilities More balanced compared to competitors, improving user experience.

Apply terminal super-resolution technology and integrate Google's Oboe to enhance image and audio quality, further reducing the impact of users on poor network conditions delays, which are particularly evident in developing countries.

Customize video rendering and playback to suit various chips and operating systems to ensure latency control.

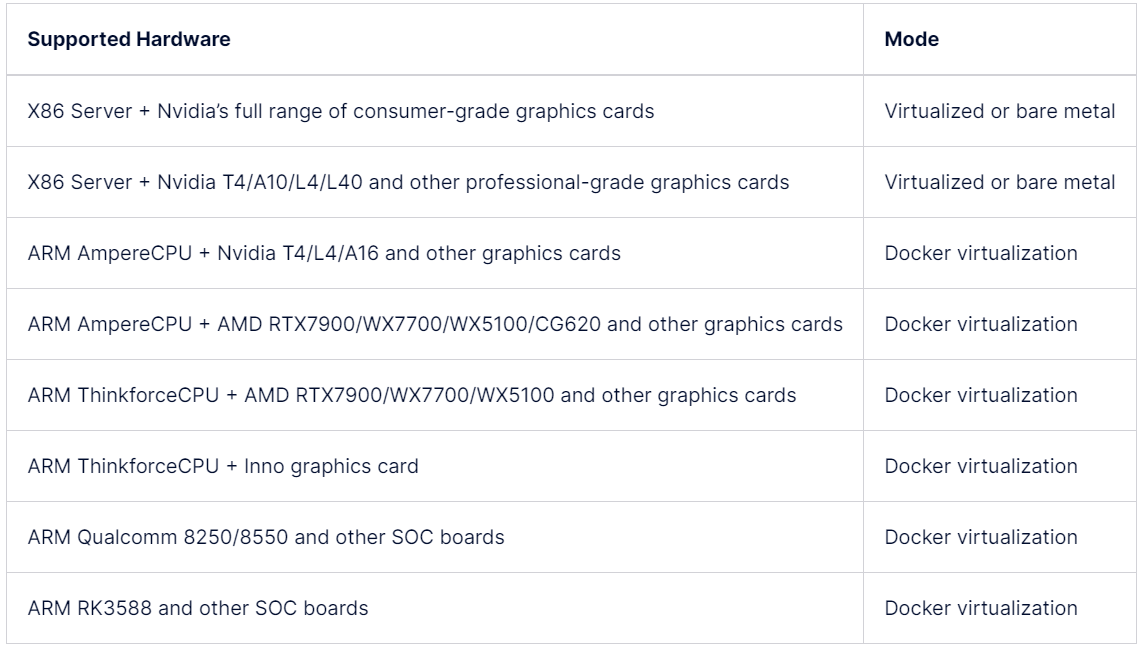

Hardware access diversity: Aethir has broad hardware access scope, enabling it to reach beyond many currently supported hardware sources.

The hardware range supported by Aethir includes:

Supported hardware is listed on the left, modes are listed on the right

Aethir's strategy enhances the capabilities of its cloud rendering service, It improves the platform's hardware compatibility, innovative network connection solutions and a sound evaluation system, while ensuring high quality and low latency of user experience.

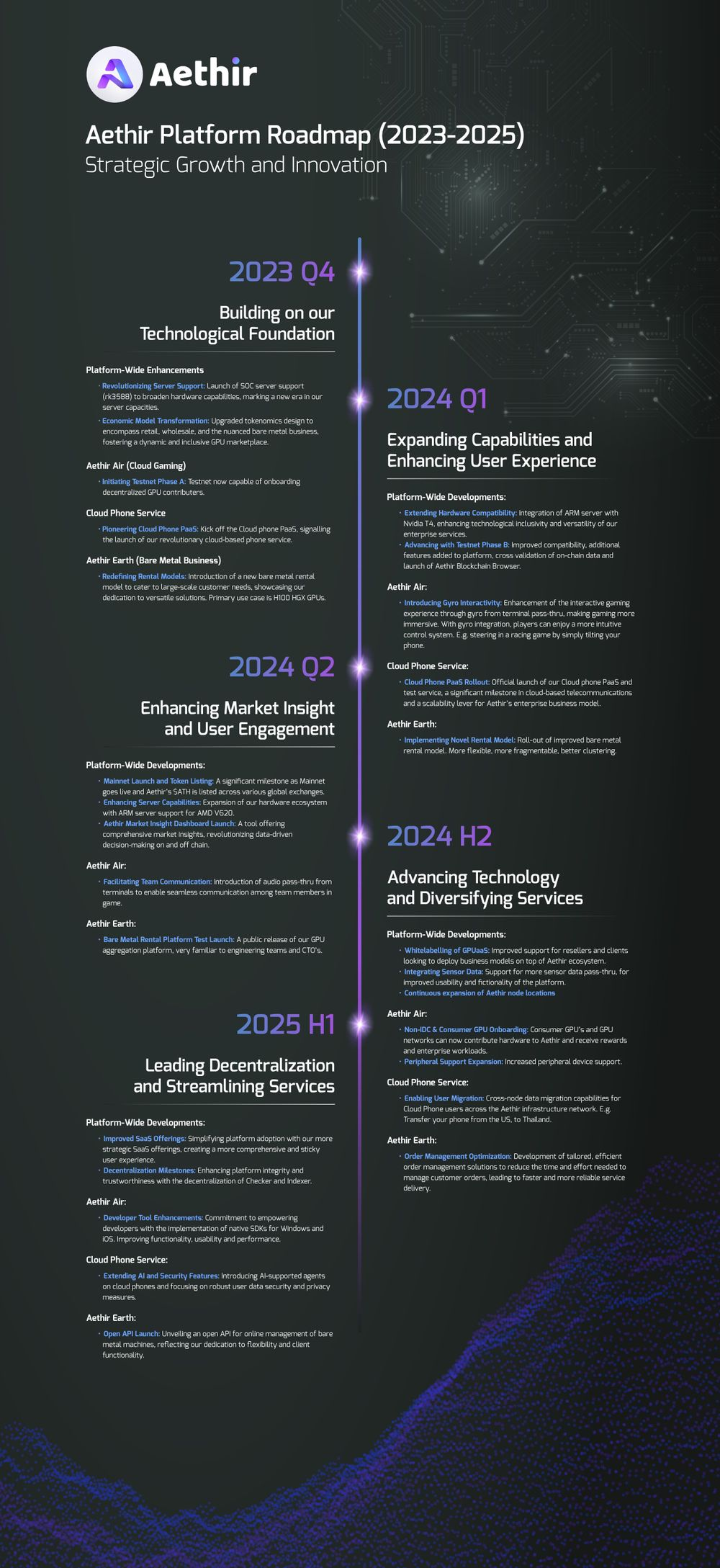

Aethir’s roadmap is based on the rapid development of four key areas in the future And the strategy is formulated:

Platform development: Aethir will focus on As the platform continues to evolve, upcoming developments are aimed at expanding hardware support and improving the platform’s token economic model. The roadmap also outlines the decentralization of key roles such as inspectors and indexers, and the promotion of GPU as a Service (GPUaaS) alongside Software as a Service (SaaS) applications, aiming to consolidate the platform’s infrastructure and Expand its use case scenarios.

Aethir Air: In the cloud gaming vertical, Aethir focuses on optimizing games for users and developers experience. Innovations include integrating the end device's gyroscopic control into the game, improving interactivity and providing players with a more immersive and intuitive gaming experience, such as tilting the device to turn in a racing game. Additional improvements target in-game communications, aiming to ensure smooth and uninterrupted audio exchanges between players.

Aethir Earth: Aethir Earth focuses on bare metal business to meet large-scale customer demand for H100 GPU . The roadmap envisions increased efficiency and flexibility in order management and resource allocation. Developing open API interfaces is a key goal to streamline these processes, positioning Aethir as a versatile provider capable of serving a variety of customers, from niche players to industry giants, with a commitment to evolving these products over the next two years.

Cloud Smartphone Services: Technological advancements in this area aim to build a borderless cloud intelligence Mobile platform service (PaaS) emphasizes user security and privacy. Future developments include facilitating user migration capabilities, allowing for seamless cross-node data transfer within the Aethir infrastructure network. For example, users will be able to easily migrate their cloud mobile services internationally, demonstrating Aethir's vision for global connectivity and a user-centric cloud service experience.

As mentioned above, Aethir is providing solutions across AI, gaming and virtualization Compute and other dynamic enterprise use cases to build a distributed GPU-based computing infrastructure.

In this context, Aethir will compete head-on with traditional and decentralized cloud GPU providers. The following image provides an overview of the current situation among centralized providers.

Although the focus of this section is on the DePin GPU space, we highlight the following key challenges faced by centralized providers that are being addressed by Aethir and DePin competitors that may result in a competitive Maintain ongoing advantage:

Pricing and cost structure: Centralization The prices offered by the vendor are high and the pricing structure is confusing, especially for on-demand use. Hidden costs, such as paying for both a cloud provider and additional services such as NVIDIA DGX Cloud.

Service Availability: Service availability is incomplete for some machine types, which makes it difficult to meet enterprise-level or powerful requirements Scaling services with computing demands becomes challenging.

Infrastructure and integration limitations: Some services require GPUs to be connected to specific Standardize virtual machines, potentially leading to inefficient setups. Limitations on integration with other cloud services or on-premises systems.

Limited GPU options and specialization: Many vendors are highly specialized and offer limited GPU model and configuration, this solution is not suitable when flexibility is required.

On the other hand, in the decentralized competitive landscape, it is worth emphasizing that storage-focused networks and Complementary role of GPU-focused networks.

In the first group, projects like Arweave and Filecoin choose not to compete in the GPU cloud computing space, but instead build synergies to complement the space the output of other participants within. On Filecoin Day 2023, the Filecoin Foundation stated that the AI that Filecoin focuses on will come from data generated by AI, and that the growth of AI data will be beneficial to Filecoin. The Fair protocol is a decentralized AI model and computing market built on Arweave, which will serve as a supplementary layer for unverified data on the AI computing platform, and similar logic has been established within the Aethir ecosystem.

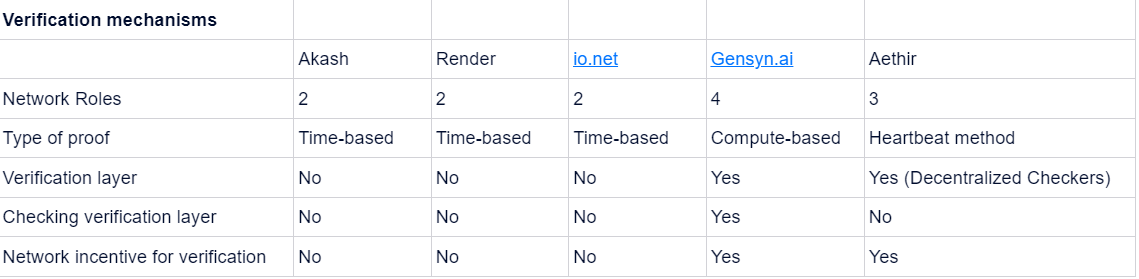

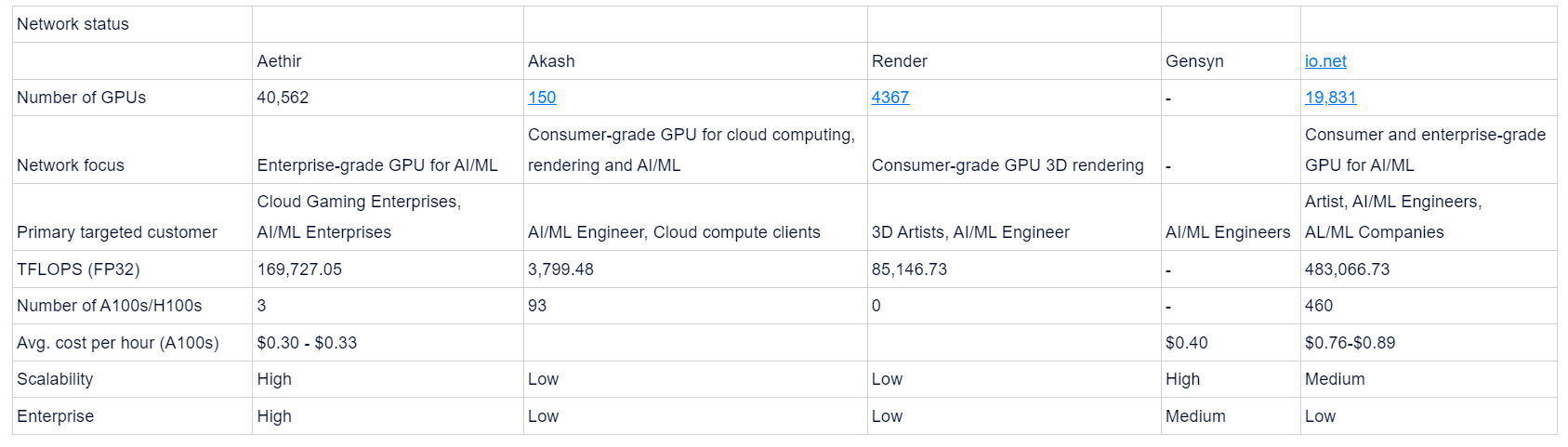

Concerning the latter, in this report we will focus on analyzing the direct competitors in the field of decentralized GPU networks, while reviewing Render, Akash, Gensyn and io.net as a baseline.

Render Network mainly focuses on rendering services. The number of GPUs currently connected to the network is 4367, representing over 82k TFLOPS.

The newly approved Render Network Proposal 004 (RNP-004) demonstrates the project's initial interest in leveraging Render Network nodes for AI/ML workloads. The recent approvals of RNP-007, RNP-008 and partnership with io.net further demonstrate Render's commitment to increasing network utilization by making its underutilized GPUs available for additional computing tasks.

As of February 2024, according to data from Cloudmos and Akash Stats, Akash Network currently has a capacity of 150 GPUs, including almost 100 A100 chips and several RTX 3000 and 4000 series, which are useful for consumer-level AI/ML training and rendering tasks.

In June 2023, Akash announced the establishment of a cloud GPU network, they stated:

"The Akash GPU testnet has already attracted interest from vendors with NVIDIA H100, A100 and other leading data center and consumer GPU models."

At the time of writing, there are no H100 GPUs listed for rent on the Akash web platform.

Gensyn.ai is a decentralized GPU network focusing on AI applications .

Gensyn is built on top of their own network, following a layer 1 trustless protocol structure. Additionally, to verify and validate computational efforts, Gensyn employs a combination of probabilistic learning proofs, graph-based accurate positioning protocols, and Truebit-style incentivized gaming techniques. Gensyn also utilizes staking and slashing incentives to ensure honest behavior by network participants.

The Gensyn network is currently in Devnet mode and there are no public statistics on the size of its network.

IOnet's decentralized application is built on Solana and mainly focuses on Consumer and enterprise-grade AI/ML. Network validation uses a time locking mechanism to ensure quality of service with the connected GPU provider.

According to publicly available information, more than 18k GPUs have been connected to the IONet network, representing more than 483k TFLOPs. It is worth noting that IONet already has 460 H100 GPUs. IOnet currently targets AI/ML engineers and companies as the primary users of its services.

The table below highlights the design tradeoffs and current networks of Aethir, Gensyn, and IONet state.

It is worth emphasizing that Aethir is exclusively equipped with enterprise-class GPUs, and its network entry barriers are very high. As a result of this strategy, Aethir has proven its ability to secure service agreements with major enterprise customers and acquire H100 chips. Io.net's approach, on the other hand, puts them ahead in raw number of connected GPUs.

Finally, the efficiency of Aethir's approach allows them to offer the best A100 equipment rental rates at a cost of $0.33 per hour.

Parameter performance of Akash, Render and other networks

Mark Rydon: Co-founder and CEO, Mark has worked at NOTA Platform, Flux Capital, Gaas LTD, Kulture Athletics, Inc. and Bechtel Corporation hold key positions.

Daniel Wang : Co-founder and Chief Business Officer, previously served as IVC (Venture Partner), YGG SEA (Chief Information Officer), Riot Games (International Publishing Management Director) and Riot Games China (Operations Director).

Kyle Okamoto : Chief Technology Officer, Kyle previously served as CEO and General Manager of Ericsson's IoT, Automotive and Security businesses , CEO of Edge Gravity and chief network officer of Verizon Media.

Paul Thind: Chief Commercial Officer. Paul currently serves as the Chief Commercial Officer of Aethir. He co-founded and served as the CEO of Triggerspot Inc. Officer and has served as a consultant to Creadits and Trick Studio.

ATH token as the core of the Aethir ecosystem

As the primary currency for transactions within Aethir, it facilitates payments for AI applications, cloud gaming, and virtualized computing.

Governance role

As it progresses toward a DAO, ATH allows token holders to propose, debate, and vote on changes, underscoring Aethir's commitment to decentralization.

Node operator staking

New node operators join the ecosystem by staking ATH tokens, aligning economic interests with Aethir’s goals and demonstrating a commitment to quality service.

Safety and quality assurance

Token volatility

One of the main challenges inherent in decentralized physical infrastructure networks (DePIN) It is the significant impact of local token price action and volatility on the supply of hardware and computing resources in the ecosystem, as well as user demand. As supply-side participants are incentivized through token rewards, they face the reality that price fluctuations can significantly impact their profitability and returns. This volatility also extends to the demand side, especially when payments for services are made in native tokens. Therefore, Aethir addresses this challenge by allowing payments to be made using fiat currencies while transactions are completed in ATH tokens, ensuring that despite ecosystem growth and ATH price fluctuations, end users can still price competitively against Web2 and Web3 competitors. Obtain computing resources and services.

Network preparation: Aethir’s approach to GPU integration

DePIN projects often hit a roadblock to growth because GPU integration relies heavily on consumer contributions, and the bootstrapping of consumer hardware, which often delays network maturity. This makes it difficult for networks targeting only retail supply to keep up with demand. Aethir overcomes this issue by partnering with institutional resource providers such as Internet Data Centers (IDCs) to overcome initial network setup challenges and ensure continued availability of online nodes. This strategic move not only accelerates the network's maturity but also maintains high-quality service standards from the outset.

In addition, while many cloud computing competitors focus on leveraging retail consumer GPUs to increase computing power, Aethir navigates the declining demand for retail GPUs and the resulting Potential risks associated with low utilization of resources. Considering that most computing needs, especially for AI training, require enterprise and institutional grade GPUs, Aethir's strategic alignment with its three core business models (cloud gaming, artificial intelligence, and virtualized computing) effectively ensures Optimal utilization of computing resources. Additionally, existing contracts with key players in the gaming and mobile industries ensure a sufficient balance of demand to match the resources on offer.

Aethir’s dedication to execution

Execution risk is also a Significant questions as Aethir continues to solve multiple complex challenges within the industry and balance multiple business models such as cloud gaming, artificial intelligence and virtualized computing. Despite the potential complexities that may come with undertaking such a broad operation, Aethir has proven its ability to execute and deliver effectively, with over 40,000 nodes currently active in its ecosystem. Even with a track record of integrating nodes into the ecosystem, doing three different operations simultaneously is a massive feat, and it will be difficult to ensure that all pieces are delivered.

Global artificial intelligence needs and Web3 solutions: the demand for artificial intelligence services Demand is surging, especially for enterprise-class GPUs like the H100, with AI investments set to reach $68.7 billion by 2023. This trend, along with the $600 billion addressable market, suggests a promising crossover into the web3 AI space. Aethir differentiates itself by bridging the gap between high-performance computing needs and web3 AI technology.

The right product at the right time: The current market environment shows that there is a clear unmet need for processing power. And Aethir has proven its product-market fit to meet this need.

Aethir’s strategic advantage: Aethir has successfully launched 3,000 H100s and is expected to increase by the second half of 2024 through current discussions to 50,800 H100. Partnerships with major telecommunications providers, game publishers and WellLink provide Aethir’s platform with access to potentially reach 10 million monthly active users.

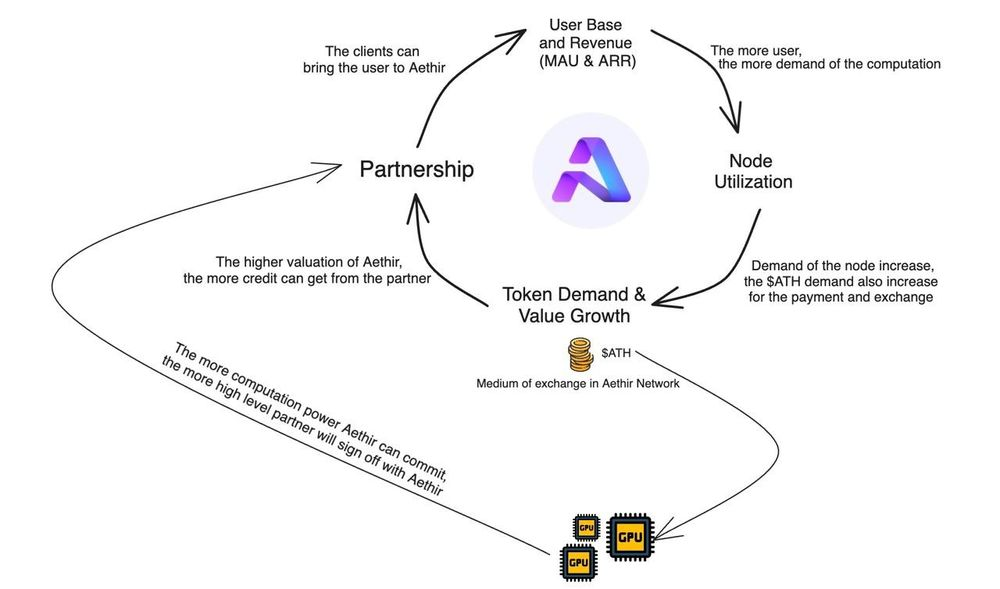

Aethir’s Flywheel: Partnerships drive Aethir expects annual recurring revenue to exceed $20M in Q1 2024, with projected year-end ARR At $114 million, this number is expected to grow with the expansion of current contracts and the announcement of new contracts for cloud computing. In comparison, the entire DePin industry only generated $24 million in ARR. With the aforementioned partnerships, it enables Aethir to increase node utilization, token demand, and further attract more contracts and investors, creating a sustainable and self-reinforcing cycle of growth.

Founder Market Fit: Aethir’s founders are experienced managers with experience in artificial intelligence, cloud computing, Web3 and It has a successful record in all areas of gaming.

Cloud gaming in developing countries: Aethir targets underdeveloped/developing regions, using cloud gaming to bridge hardware affordability gap. Focus on the large user base in Southeast Asia and South America and introduce well-known IP to new markets, emphasizing digital inclusion and market expansion.

ZK Stack, dedicated vs. general-purpose ZK: Which one is the future? Golden Finance, the line between dedicated and general-purpose ZK is blurring.

JinseFinance

JinseFinanceMany people still confuse FHE with ZK and MPC encryption technologies, so this article will compare these three technologies in detail.

JinseFinance

JinseFinanceSolana’s “Actions and Blinks” simplify transactions and voting operations through browser extensions, while Farcaster on Ethereum enhances social network interoperability and user data privacy protection through decentralized protocols.

JinseFinance

JinseFinanceAs the Aethir GPU DePIN system continues to grow, the ecosystem is expected to continue to create a new paradigm in the field of DePIN GPU computing infrastructure and reshape the landscape of cloud computing.

JinseFinance

JinseFinanceIn the AI field, IO and Aethir are two important decentralized computing projects, following different development paths.

JinseFinance

JinseFinanceApril 18, 2024 - Aethir launched the Aethir Edge product powered by Qualcomm at the official Token 2049 launch event in Dubai.

JinseFinance

JinseFinance JinseFinance

JinseFinanceTesla CEO Elon Musk and Meta CEO Mark Zuckerberg have agreed to a cage fight- but their feud goes far beyond that.

Clement

ClementThe DeFi space continues to bring up disruptive innovations that cut across different industries and economies. The internet community has ...

Bitcoinist

BitcoinistWhen crypto bull market profits dry up, the best way to keep gains coming is by using leverage to open ...

Bitcoinist

Bitcoinist