Written by: 0xWeilan

When BTC is accepted by many countries and grows into an asset with a market value of more than 2 trillion US dollars, with spot and derivatives trading volumes of tens of billions of US dollars in 24-hour trading, the factors affecting its price and even cycle have become more diverse.

This monthBTC prices have shown a complex situation of cross-influence of multiple factors such as "reciprocal tariff conflicts, geopolitical conflicts, economic and employment data, and expectations of Fed rate cuts".

However, in a longer time and space range, only the internal currency holding structure (long and short hands) and institutional allocation (capital inflow) are the two main factors that affectBTC's cyclical operation and even stage fluctuations.

From this perspective, since November last year, BTC has been fluctuating for 8 months after entering the $90,000-110,000 space box. The essence is the high-level shock wash after the interest rate cut stopped in the high-interest environment. Historical long-term shipments, new institutions continue to absorb funds.

When the subsequent

BTC price will rise again depends on the forward-looking transactions under the expectation of interest rate cuts and the price expectations of long-term hands. Macro-finance: Geopolitical conflicts disrupt the situation, but do not change the economic and employment trends

The US stock market and BTC trading paradigm in June revolved around many factors such as "high interest rate pressure and the probability of interest rate cuts, economic and employment data, tariff uncertainty and geopolitical conflicts".

After BTC led the US stock market rebound in May to hit a record high of $112,000, under the background of full pricing and uncertainty, the selling force continued to increase after the opening of June, pushing BTC down again, and re-verified the support of $100,000 on June 5. In addition to the selling pressure, the panic caused by the escalation of the "reciprocal tariff war" between the United States and China is also an important factor in the price correction, which is manifested in the BTC Spot ETF channel funds turning from a large inflow in May to a phased outflow. On June 9, the United States and China resumed negotiations in London. By the end of the month, the two heads of state signed documents again, and the impact of the "reciprocal tariff war" on the market gradually faded.

In the middle of the month, the conflict in the Middle East re-emerged, and geopolitical conflicts became the main factor for the high volatility of BTC this month.

On June 13, Israel launched an air strike on Iran, killing more than a dozen Iranian senior officials and nuclear scientists. The cause of the conflict was that Israel believed that Iran was close to building a nuclear bomb. From June 21 to 22, the US B2 fighter jets directly intervened in the conflict and bombed three Iranian nuclear facilities. The market is worried that the Iran-Israel conflict will escalate into a regional war, which will in turn affect shipping in the Strait of Hormuz and push up global oil prices. As panic escalated, BTC fell to $98,225.01 on June 22, hitting the lowest point of the month, but the market quickly rebounded to above $105,000 with the relative restraint of all parties and the statement of the US government that "the action has been completed". On the 25th, US President Trump announced that Israel and Iran had reached an agreement on a "comprehensive and complete ceasefire", and both sides expressed their acceptance of the ceasefire. The market's concerns about the impact of escalating conflicts on crude oil prices were quickly eliminated, and BTC fluctuated in a narrow range around $107,000.

The US economic and employment data released this month are not far from market pricing.

The May CPI annual rate of 2.4% and the core CPI annual rate of 2.8%, which were first announced in early June, increased by only 0.1% month-on-month, slightly lower than expected. The May PCE annual rate of 2.7% announced in late June was slightly higher than the expected 2.6%. The University of Michigan Consumer Confidence Index was 60.7, slightly higher than the expected 60.5. In terms of employment data, the unemployment rate rose slightly, and the wage growth rate was around 3.9%, which was a decline. The number of first-time unemployment claims fell back to 236,000 in the second half of June, but the scale of continued applications climbed to 1.974 million, the highest since November 2021, indicating that the difficulty of re-employment is increasing. Consumption and employment data show that the economy has cooled down, but not to the extent of recession, and inflation has rebounded slightly, but on a very small scale.

These data have driven changes in the CME FedWatch dashboard data: this year, the Federal Reserve has a probability of more than 90% to cut interest rates at least twice, at least 50 basis points.

As for the Federal Reserve, Powell went to the Senate and House of Representatives hearings in the second half of the month. Powell remained restrained and independent, and his view is still that the job market is still strong and inflation remains on the decline, but the impact of the equal tariff war has not yet been fully demonstrated, and there is still a possibility of rising. It emphasized that the Fed's responsibility is to stabilize prices and achieve full employment, rather than respond to political pressure.

However, in the face of Trump's call for a rate cut, different voices began to be heard within the Fed. Vice Chairman Bowman and Board of Governors Waller said separately that tariffs had little impact and inflation had fallen for three consecutive months, and that interest rates should be cut as soon as possible. The market understood this "as soon as possible" as July.

The change in the Fed's voice strengthened the expectation of a rate cut in September (and implied a small possibility of a rate cut in July), together with the expectation of the passage of the "Big and Beautiful Act" (including tax cut provisions), which pushed US stocks and BTC to rebound again after the 23rd. As of June 27, the US Nasdaq and S&P 500 indexes hit record highs.

By the end of the month, the price of crude oil, which had soared during the Iran-Israel conflict, had fallen sharply to around $66, and gold had also fallen back to $3,300 per ounce, indicating that risk aversion had greatly weakened.

In the May report, we pointed out that "it is expected that the US stock market and BTC will likely remain volatile in the next two months, and the expectation of a rate cut in August may not push the US stock market and BTC to a record high. This judgment includes the optimistic ending of the 'reciprocal tariff war' and the relatively 'mild' recession of the US economy."

The various data and stock market trends released by the United States in June "operated" within this judgment framework, but the U.S. stock market hit a new high ahead of schedule, slightly stronger than expected. The reason lies in the change in the overall tone of the Federal Reserve. The end of the Iran-Israel conflict due to the intervention of the United States has strengthened the low level of the U.S. capital market, as well as the expectation of the passage of the "Big and Beautiful Act". For the future market, in the absence of geopolitical conflicts and sudden deterioration of economic and employment data, the market may strengthen ahead of schedule. With the continuous record highs of U.S. stocks, BTC may enter the next stage in the first month of Q3.

Crypto assets: shock wash has reached 8 months

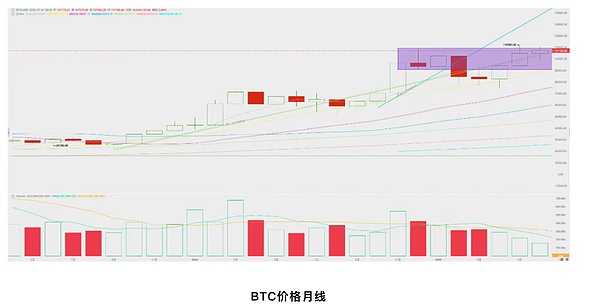

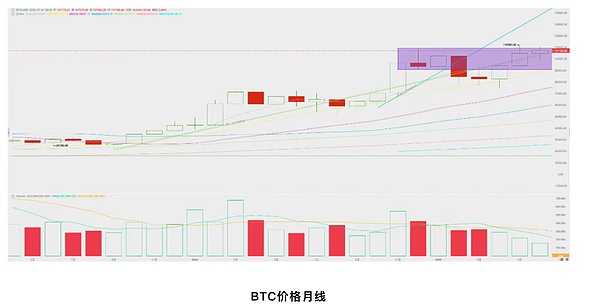

In May, BTC opened at $104,645.87 and closed at $107,173.21, up $2,527.34 for the whole month, or 2.42%, with an amplitude of 11.87%, and trading volume has declined for three consecutive months.

Based on the technical indicators and price range that we focus on, BTC operated within the Trump bottom (90,000-110,000 US dollars) throughout the month, and after 8 months of volatility, it converged the volatility range to 100,000-110,000. Most of the time throughout the month, it operated above the "bull market's first rising trend line", and only briefly fell below this support around June 22, when the "US bombed Iran's nuclear facilities", showing that the confidence of the bulls was relatively sufficient.

Since last November, BTC entered the 90,000-110,000 range, and has been fluctuating and consolidating for 8 months, with the trading volume shrinking day by day. This range is priced by factors such as Trump's friendly attitude towards BTC and crypto assets, the positive effects of the stablecoin bill, and the allocation of BTC by many listed companies. We believe that the 8-month consolidation in this range can be understood as a big suction cup for BTC at its historical high. During this period, short-term and long-term investors have cashed out, while institutions have directly purchased and allocated BTC.

Therefore, this range is solid enough, and more chips have been transferred to long-term funds. BTC is gradually ready to move up the ladder. Due to sufficient wash-out and more chips entering the hands of institutions, the next pull-up may be completed quickly in the short term. We originally expected this breakthrough to be completed in August or September, but if the expectation of interest rate cuts is driven by forward-looking buying of funds or accelerated structural allocation, it is not ruled out that the pull-up may be advanced to July.

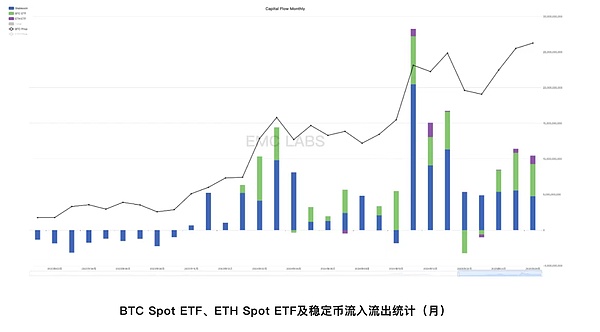

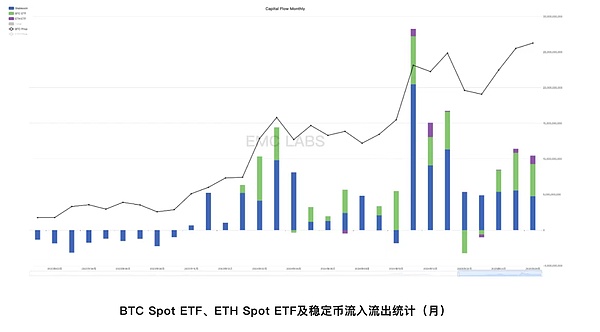

Funds: Over 10 billion US dollars flowed into the market

This month, the total net inflow of funds into stablecoins and BTC Spot ETF channels was 10.469 billion US dollars, including 4.670 billion US dollars in stablecoins and 4.622 billion US dollars in BTC Spot ETF channels. Compared with the inflow of 11.415 billion US dollars last month, it has shrunk slightly, but it is still relatively sufficient.

From the daily statistics, we can find that the inflow of funds in the BTC Spot ETF channel weakened at the beginning of the month, and there was an outflow at one point, and there was zero inflow on June 19 and 20, which corresponded to the macro events of the renewed conflict in the US-China tariff war and the suspected involvement of the United States in the Iran-Israel conflict.

For the rest of the time, BTC Spot ETF maintained a relatively strong inflow, which is also the material support for the BTC price to rise despite the shocks and long-term reduction this month.

In addition, ETH Spot ETF channel funds inflow in June was $1.178 billion, which was also a significant increase from the previous month. Behind this is the fact that stablecoins will usher in great development with the support of the United States, and the SEC meeting officially relaxed the mandatory review of the founders of DeFi protocols. Whether it is stablecoins or DeFi, the biggest beneficiary public chain is undoubtedly Ethereum.

Since last year, BTC Spot ETF channel funds and direct institutional allocation have become the main forces determining BTC's upward pricing.

According to incomplete statistics, there are more than 140 public companies in the world that have started BTC and other encrypted asset allocations. In addition to Strategy and Metaplanet, a large number of new companies are joining this allocation craze recently, such as GameStop, Twenty One Capital and Trump Media & Technology Group Corp. Trump Media, owned by US President Trump, has completed the fundraising of $2.5 billion in allocation funds.

As the largest buyer in this round of bull market, the scale of institutional allocation has become one of the decisive forces in determining the height of BTC prices in this round of bull market.

Chip structure: Cycle long-term holders may start the third round of selling

Another decisive force in determining the height of BTC prices in this round is the scale of long-term selling.

According to the historical law of BTC for more than ten years, during the development of the bull market, funds surged in, and long-term holders would gradually sell off their accumulated chips during the price decline to lock in profits. In the past few cycles of bull markets, such selling often occurred twice, but this round of bull market is different.

In this round of bull market, the second large-scale sell-off of long-handed investors started in October last year and ended in January, running for only 4 months, which is much lower than in the past. EMC Labs believes that the reason behind this is that the market turmoil caused by the "reciprocal tariff war" has affected the purchasing enthusiasm of the main buyers (institutional customers) in this round of bull market, and prices have begun to fall.

As a whole, long-handed investors rarely sell their chips in a trend decline. In a trend of decline, long-term investors often choose to hoard more chips. Therefore, from February to June, long-term investors not only stopped selling, but also hoarded more than 740,000 BTC. While abiding by their own discipline, they objectively played a stabilizing role and reduced the speed and magnitude of BTC's decline.

When the panic caused by the chaos of the equal tariff war dissipated, the U.S. stock market stabilized, and the buying power of the BTC Spot ETF channel returned, BTC was able to return to the $105,000 level.

According to daily statistics, the high position of long-term investors was on June 22, and then with the rapid rebound of BTC prices, long-term investors began to reduce their holdings slightly. Once the price breaks through the previous high and rises to a higher level in the next few months, long-term investors will usher in the third round of large-scale reduction. The scale and intensity of its selling will jointly determine the length of this round of bull market and the height of BTC prices with institutional allocation.

Conclusion

eMerge Engine shows that BTC Metric is 0.625, and BTC is in the bull market.

This round of BTC bull market presents many different performances from the past, such as serious lack of confidence in a high interest rate environment, the first time that institutions play the leading role and retail investors are marginalized, and the BTC bull market fails to drive a comprehensive bull market in Crypto.

As BTC gradually becomes a mainstream asset, many past experiences and cognitions will become invalid, and a small number of rules may last longer. The only thing that remains unchanged may be the cycle rate.

In the March report, we pointed out that "the opposite is the movement of the Tao. If the tariff policy does not deteriorate too much, the US economy shows signs of recession but not serious, and the Fed cuts interest rates again in June, it is highly likely that BTC, which has already experienced a sharp drop in valuation, will turn around in Q2."

At the end of June, we saw that both US stocks and BTC have reversed and hit or once hit a record high.

We are strongly optimistic about the market in the third quarter. Volatility is inevitable, but BTC will hit a record high and achieve the fourth wave of this bull market.

Kikyo

Kikyo