Original: Liu Jiaolian

Overnight, BTC finally broke through 63k and tested MA30 before rebounding and pulling back to 64k. In July, it took a cosine curve. After opening at 62k, it first dived to 53k, then eagle-shot the sky, drawing a beautiful arc, and stepped back and pulled up twice, approaching 70k, and closed at 66k. On the first day of August, it dived, fell more than 5% within the day, flew directly to MA30, and then pulled up again, breaking away from the 62k "ground",...

This roller coaster-like market really made the hearts of retail investors sitting on the roller coaster reach their throats. In the end, I couldn't even shout, and I could only hold the shaking handles tightly with both hands in horror, watching the guys on the car who were not fastened with seat belts being thrown into the air, crashing into the tracks, pillars, trees and rocks, and falling to their deaths with their brains splattered, bloody and bloody.

The timid people closed their eyes and only heard the whistling wind around them, as well as the constant screams and groans, and their hearts were about to jump out of their chests.

The old leeks took advantage of this discount opportunity to increase their positions. After all, the days of increasing positions below 70,000 dollars are getting fewer and fewer.

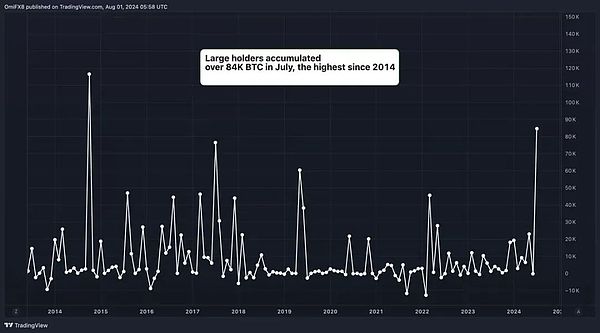

It is said that in July 2024, the giant whale address accumulated 84,000 BTC, the most since 2014.

The opportunity for discounts in July is created by several negative factors:

1. Miner liquidation;

2. German government liquidation;

3. Mt.Gox compensation.

On-chain signs show that miner liquidation has come to an end, and BTC has successfully completed a self-elimination and self-revolution of its core forces, welcoming a new journey in a healthier and more powerful state; the German government has cleared its positions and the selling pressure has been completely digested; Mt.Gox's compensation progress has been completed by 70%, and the next selling pressure will be smaller and smaller.

When the negatives are exhausted, there will only be positives ahead.

At the end of this bear market and the beginning of the bull market, in the range of $60,000 to $70,000, Mt.Gox, the biggest "gray rhino" time bomb in the history of BTC's first 15 years of development, was completely dismantled, which is definitely a great benefit to the unimpeded development of BTC in the next 15 years.

You know, every time the price of BTC increases 10 times, the explosive power of this time bomb will increase 10 times. If you can dismantle it at $60,000, don't leave it until $600,000.

Looking forward, the following favorable factors will drive BTC to embark on a new journey in the next 15 years:

1. The Federal Reserve is about to start a new round of monetary easing cycle;

2. Crypto ETFs are more widely accepted, and their scale continues to expand, gaining the favor of more institutions and young investors;

3. BTC will inevitably enter the political agenda of major powers in the world;

4. As BIS allows central banks around the world to include crypto assets in their balance sheets in 2025, G20 countries have begun to compete to accept BTC as a national strategic reserve;

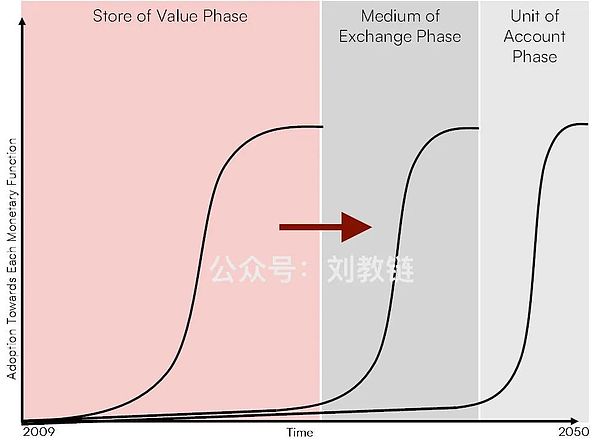

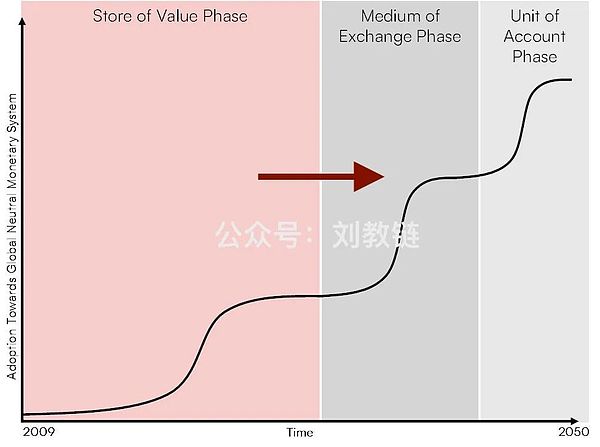

5. BTC will try to complete a "phase change", a leap from SoV (store of value) to MoE (medium of exchange).

In the past two years, I have seen some so-called KOLs talking about the so-called BTC "dividend disappearance theory" - roughly meaning that BTC has been developing for 15 years, and it has come to an end. It has risen from worthless to 70,000 dollars, and has also been listed on the world's top US stock market ETF. There will be no greater room for development in the future, and so on.

In fact, let Jiaolian translate for you. The implicit and implicit meaning of this statement is to advise you, the dizzy newbie and the stupid leek, not to buy BTC. What should you do if you want to get rich? Of course, you should buy the XXX altcoin recommended by the KOL who told you this high-sounding talk.

If you believe it, you will be fooled. If you buy it, you will be cut. The deeper you believe, the deeper you will be fooled. The more you buy, the more you lose. Of course, the more you lose, the more the KOL who recommends you to buy XXX altcoin will earn. After all, there is nothing strange about the formula of zero-sum game in mathematics: The total income of the sickle = the total loss of all fools. The teaching chain must firmly say that the so-called "disappearing dividend theory" of BTC must be nonsense or lies. People who say this are either stupid, or liars, which is bad. In other words, either their IQ is so low that they cannot understand the phase change of BTC, or their IQ is very high, but they want to do bad things and want to harvest the money in your pocket. Whether it is stupid or bad, the only correct way is to not listen to or believe it and stay away from such people as soon as possible.

Jiaolian believes that because BTC will continue to change phases, the development dividends of BTC will continue to grow over the 130 years (2009-2140) of its growth period, wave after wave, wave after wave, wave after wave, wave after wave, wave after wave, wave after wave, endless and inexhaustible.

Thinking that BTC will end when it develops into electronic gold and value storage, or even that the US stock ETF is the end of BTC's career, and that being accepted by traditional finance is the highest honor, and that it stops continuing the revolution and struggle, is looking at the problem from a static and mechanical perspective, rather than a dynamic and developmental perspective. The conclusion drawn from this must also be divorced from the objective laws of historical development and the truth of the facts.

In the past few years, especially before 2018, there was another voice that believed that BTC should not enter the development stage of SoV first, but advocated directly realizing the vision of payment currency mentioned in the first sentence of the first paragraph of the first chapter of the Satoshi Nakamoto white paper, allowing BTC to directly enter the development stage of payment tools, completely ignoring the legal conflicts in compliance and the paradox of how to make payments without acceptance in logic, and competing head-on with today's traditional Internet micropayments, which is obviously a serious mistake of opportunism and adventurism.

So we also see that it is not easy to scientifically explore the internal laws and development direction of new things that have never been seen in history and are developing rapidly, and to have a correct understanding and accurate grasp of them. In this process of cognition and practice, there are often some people who make the mistake of right-wing conservatism, and there will always be others who make the mistake of left-wing opportunism.

The success of crypto investment is based on the success of crypto business, and there is absolutely no reason that BTC's business has failed, but individual investors' investments have succeeded. Therefore, if you want to achieve success in personal investment, you must resolutely fight against all kinds of wrong ideas, conduct serious research and criticism, recognize which road to take to achieve success in the crypto business, and unswervingly and persistently follow the right path.

JinseFinance

JinseFinance

JinseFinance

JinseFinance JinseFinance

JinseFinance CharlieXYZ

CharlieXYZ Bitcoinist

Bitcoinist Beincrypto

Beincrypto Bitcoinist

Bitcoinist Bitcoinist

Bitcoinist Cointelegraph

Cointelegraph Cointelegraph

Cointelegraph Cointelegraph

Cointelegraph