In the past period of time, Alliance DAO has gained great influence by successfully incubating Web3 consumer applications such as Pump.fun and Moonshot. This article first summarizes Alliance DAO's investment philosophy for the Web3 consumer track and puts forward its own observations on this track to review the current mainstream paradigm of Web3 consumer applications, the challenges they face and potential opportunities, and finally summarizes our thoughts on the investment theory of Web3 consumer applications.

Alliance DAO's incubation of Web3 consumer track

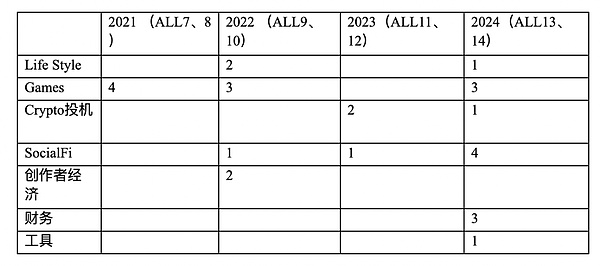

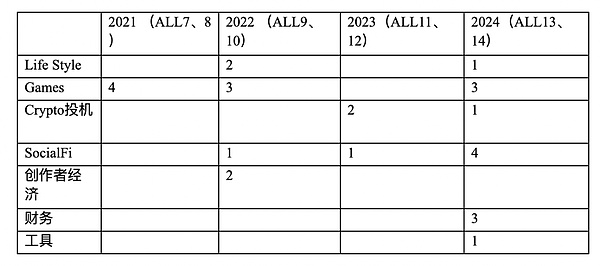

Since its launch, Alliance DAO Accelerator has incubated or invested in 28 Web3 consumer applications. They can be roughly divided into 7 categories:

1. Life Style category

3. Crypto Speculation Category:

4. SocialFi class:

5. Creator Economy:

Definition: A Web3 content distribution platform that provides a new economic model for content creators (text, video, art, etc.);

Quantity: 2;

Specific projects:

Koop: Koop enables any creator, collector, or community to organize and fundraise through NFT art or Collector Passes. Funds from Collector Passes form each community's treasury (or bank) to support their projects and missions on-chain. Communities can then directly manage their finances, leverage the unique skills of their members, and govern their organizations in a fun and social way.

CreatorDAO: CreatorDAO is a decentralized autonomous organization (DAO) focused on accelerating creators' careers and empowering them with shared access to capital, technology, and community. CreatorDAO provides creators with mentorship, the professional tools they need to grow their brands, and a community invested in each other's success.

6. Financial category:

7. Tools:

From the development trend of investment preferences, Alliance DAO began investing in and incubating Consumer projects in 2021. From 2021 to the first half of 2023, its main investment and incubation directions focused on Games and creator economy projects. From the second half of 2023 until 2024, its preferences switched to Crypto speculation, SocialFi, and finance.

The author tracked some articles and podcasts published by Alliance DAO, and summarized its investment philosophy on the Web3 consumer track, as follows:

1. First, it believes that the basic tools of the ecosystem have become increasingly perfect, and more application layers are needed to bring real value and capabilities to the ecosystem;

2. The founding team should focus on PMF. Usually, there are two risks in the market verification process: product-side risk and market-side risk. The market-side risk of Consumer projects is greater, so it is necessary to consider avoiding the introduction of tokens too early, which may distort the PMF verification results.

3. The target users of Web3 consumer applications can be divided according to the coordinates of acceptance of Web3. The left side is non-Web3 ordinary users and the right side is Web3 Native users. The Web3 elements in the application design for users on the left are mainly to reduce customer acquisition costs through "advertising tokens" and seize more market share. Users on the right need to focus on assetizing new targets to bring additional investment and speculation needs, or solve the unique needs of Web3 native users. From the results, its current preference is more inclined to the latter.

4. It is clear that the user portraits of the Solana ecosystem and the EVM ecosystem are different. The former is more conducive to the success of Consumer applications. There are four reasons:

A more vibrant community: Solana users are very enthusiastic about participating in new projects, especially those with speculative potential, which may be related to the wealth effect;

Stronger and more efficient ecological resource support: The core members of the Solana ecosystem embrace the community more, have strong community mobilization capabilities, and respond more quickly to support new projects.

Faster and low-cost infrastructure: Aims to build an on-chain Nasdaq, with low transaction costs and high confirmation speed. Because the basic components are not decentralized and are more user-friendly, the learning cost for new users is relatively low.

Higher product competition barriers: Due to the use of non-EVM technology selection, the copy cost of Solana DApp is higher.

What are Web3 consumer applications?

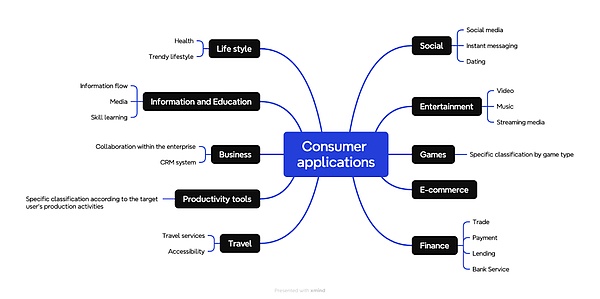

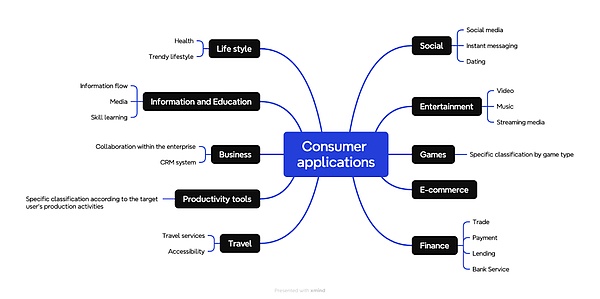

So-called consumer applications, that is, To C applications in the Chinese context, means that your target users are most ordinary consumers, not enterprise-level users. Open your App Store, and all the applications in it belong to this category. Web3 consumer applications refer to consumer-oriented software applications with Web3 features.

Usually, according to the classification in most App Stores, we can roughly divide the entire consumer application track into the following 10 categories, and each category will have different subdivisions. Of course, as the market matures, many new products will combine multiple features to a certain extent in order to find their own differentiated selling points, but we can still make a simple classification according to their core selling points.

Web3 consumer application paradigms and their opportunities and challenges

Based on the analysis of Allinance DAO's investment philosophy and my own observations, I believe that there are three common paradigms of Web3 consumer applications:

1. Utilize the technical characteristics of Web3 infrastructure to optimize the problems existing in some traditional consumer applications:

This is a relatively common paradigm. We know that a lot of investment in the Web3 industry revolves around infrastructure construction, and application creators who adopt this paradigm hope to use the technical characteristics of the Web3 infrastructure to enhance the competitive advantage of their own products or provide new services. Generally, we can classify the benefits brought by these technological innovation directions into the following two categories:

2. Using encrypted assets to design new marketing strategies, user loyalty programs or business models:

Similar to the first point, application developers who adopt this paradigm also hope to increase the competitive advantage of their products in a relatively mature and market-proven scenario by introducing Web3 attributes. It's just that these application developers are more interested in introducing crypto assets and taking advantage of the extremely high financial attributes of crypto assets to design better marketing strategies, user loyalty programs, and business models.

We know that any investment target has two values, commodity attributes and financial attributes. The former is related to the use value of the target in a certain actual scenario, such as the habitable attributes of real estate assets, while the latter is related to its transaction value in the financial market. This transaction value in the field of crypto assets usually comes from speculative scenarios brought about by circulation and high volatility. Crypto assets are an asset category with financial attributes far higher than commodity attributes.

In the eyes of most such application developers, the introduction of encrypted assets can usually bring three benefits:

3. Fully serve Web3 native users and solve the unique pain points of this part of users:

The last paradigm refers to consumer applications that fully serve Web3 native users. According to the direction of innovation, it can be roughly divided into two categories:

Thoughts on the investment theory of Web3 consumer applications

Next, I will introduce our thoughts on the investment theory of the Web3 consumer application track, which can be roughly divided into five core viewpoints:

1. How to transcend the speculation cycle is the primary consideration of Web3 consumer applications

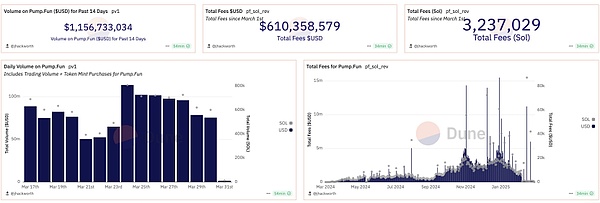

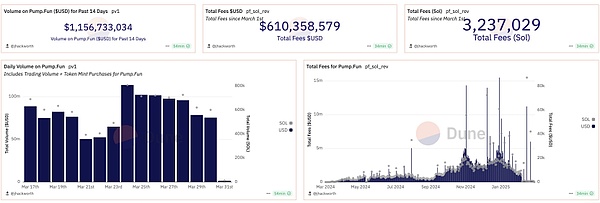

As one of the most successful Web3 consumer applications in the last cycle, Friend.Tech's development path can give us a lot of inspiration. According to Dune data, Friend.Tech currently has a cumulative Protocol Fee of $24,313,188. The total number of users (Traders) has reached 918,888. For a Web3 application, this data performance is very impressive.

However, the development of this project has encountered relatively large challenges, and the reasons are multifaceted. First of all, in product design, Friend.Tech introduced the design of Bonding Curve, which introduced speculative attributes to social applications, and attracted a large number of users in the short term by relying on the wealth effect. However, in the medium and long term, this approach also raises the threshold for users to enter the community, which is contrary to the current practice of most Web3 projects or KOLs relying on public domain traffic to establish influence. In addition, Friend.Tech over-bundled the token with the practicality of the product, resulting in too many Web3 speculative users in its products, which distracted users from the practicality of the products and ultimately led to the current situation.

Therefore, for most Web3 consumer applications, after accumulating a large number of users, they need to carefully think about how to find PMF, maintain user engagement, help projects transcend the speculative cycle, and build a sustainable business model. If these problems can be effectively solved, Web3 consumer applications can gain real Mass Adoption.

2. How to evaluate Web3 consumer applications during the investment process?

In general, the investment evaluation of Web3 consumer applications mainly starts from two aspects. The first aspect is to analyze the market potential of the product from its operating data. It can be roughly divided into two dimensions:

User data:For most consumer applications, user data is always the most important, because sufficient user groups are the prerequisite for consumer applications to explore business models. Therefore, similar to most traditional Web2 consumer application evaluations, we can use traditional evaluation indicators such as the number of active users, user growth rate, and user retention rate to determine whether it has found PMF. In addition, for Web3 consumer applications of different categories and stages, the focus will also be different. Taking Web3 Social applications as an example, user retention rate will be more important. Investors generally start from the niche market. When they find that an application has a very strong retention rate within a user range with unique characteristics, it means that it has investment value. Of course, it is also necessary to carefully identify the water in the data during the evaluation process to avoid bot users from misjudging PMF.

Conversion data:In addition to user data, conversion data is also needed to judge its potential commercial value, such as AUM and User spend. If a project has many users, but the AUM is small, or the average spending of a single user is small, it means that the commercial value is relatively limited. Of course, not all revenue data are the same, and the quality of revenue will also vary greatly. If the revenue structure is based on real income, it means that the users here are paying for the products they provide, rather than mining their tokens. Such a business model will be more sustainable.

The second aspect is the judgment of the team, which mainly focuses on three aspects. The first is the technical strength of the team, which is the core of their ability to build a product moat and thus form a competitive advantage. Secondly, the team needs to have a strong sense of the market and be open to it, so that it can identify market opportunities in a timely manner, which users' needs are not met, and adjust the business direction in a timely manner. Finally, team resources are also important, such as partnerships with other applications, partnerships with KOLs, etc., which determine the success rate of the issuance process.

3. How to define a successful Web3 consumer application

From the perspective of investors, how to define a successful Web3 consumer application is also an interesting question, or is the success of Web3 consumer applications driven by revenue or token prices? In general, the two are interrelated. If a project cannot generate revenue continuously, then in the end, the tokens it issues will not have much future. But this evaluation criterion also depends mainly on your investment period. If the overall investment period is short, the judgment of the token price is more important, and at this time, the judgment of the token economics. If it is a long-term value investment, the performance of revenue data and the sustainability of the revenue structure are more important.

4. "Application Factory Model" may be a more certain business strategy for Web3 consumer applications

Referring to the development of China's Web2 industry, ByteDance has developed many successful consumer applications. Their business strategy is to constantly try and fail, develop a large number of different types of products, let the market choose a few successful directions, and continue to invest resources to expand their business. For them, the key to the success of this strategy is that they have accumulated a large number of user resources, reducing their trial and error costs. And this experience can be applied to the Web3 industry.

Therefore, from this perspective, similar projects such as Friend.Tech still have opportunities in this cycle. At least in the short term, they have shown attractiveness, attracted a large number of users, and have good revenue capabilities, which will help them become Web3 application factories, so their subsequent development is also worth paying attention to. 5. What are the characteristics of the next successful Web3 consumer application? We believe that in the next cycle, successful Web3 consumer applications will appear in the following three paradigms. The first paradigm is to rely on the fun of the product to attract some crypto KOLs to adopt it first, and then use the KOL's own influence to bring their fans to the platform to help the project complete the cold start. Kaito is a representative of this paradigm. The team has strong technical capabilities and innovative incentive mechanisms to control a large number of mindshares in the crypto community, helping them to have good penetration in different communities. At the same time, it hits the pain point of how Web3 projects can effectively acquire users in the marketing process. After accumulating a large number of C-end users, it has established accurate user portraits for each user through mindshare, helping Web3 companies to conduct precision marketing through the Kaito platform, which will make its business model more sustainable and get rid of short-term speculation cycles.

The second paradigm is to start from the real needs of Web3 users and rely on product strength to directly win the market. Since tokens are not introduced too early, they will be able to get rid of the interference of speculative users in the process of PMF and establish a higher user retention rate, such as Polymarket, Chomp, etc.

The third paradigm is the innovation of business model. Grass has given us a lot of inspiration in this regard. It uses users' idle computing resources to help them find sources of value capture in fields such as artificial intelligence and monetize them with tokens. Although Grass is more inclined to the 2B model in terms of business model, this "sharing economy" thinking can also be used in the design of Web3 consumer applications.

6. Which categories of projects are more likely to become the first batch of Web3 consumer applications to find PMF in the crypto industry

Currently, combined with market trends and investor preferences, the Web3 consumer applications that are most likely to find PMF may appear from the following categories:

First, Web3 social applications are still favored by the market. We know that most Web3 projects attach great importance to and rely on social media for marketing, and compared with traditional investors, cryptocurrency investors also prefer to use social media to obtain information and form value networks. Therefore, the importance of Web3 social applications is self-evident. Through the discovery of assetization or niche market needs, and learning from the experience and lessons of friend.tech, introducing a more sustainable business model and stronger user retention rate, it will help Web3 social applications get rid of the suspicion of excessive speculation and find PMF.

Secondly, on-chain trading tool applications also have good potential. With the continuous development of MEME, investors are paying more and more attention to on-chain transactions. The popularity of on-chain trading tools such as OKX Wallet and GMGN proves the strong market demand for this. With the large-scale adoption of mainstream trading tools, the yield of homogeneous trading strategies will show a downward trend, so users' customized needs will continue to increase. If differentiated on-chain trading tools or investment strategies can be provided to these users, the market potential of related products is also good.

Payment applications are also one of the categories worth looking forward to in the future. With the passage of the bill related to payment stablecoins some time ago. The regulatory pressure that payment applications previously carried has been released. Therefore, we have reason to believe that. In the future, Web3 payment applications will build competitive barriers in cross-border payments, idle funds and other scenarios by relying on the advantages of low cost and high settlement efficiency brought by blockchain technology.

Finally, the development of DeFi is also worth paying attention to. First of all, as one of the few scenarios that have found PMF, DeFi has become an indispensable category in the Web3 industry. We can see from the success of Hyperliquid that users still have demand for decentralized attributes. With the continuous improvement of infrastructure, the performance limitations of previous decentralized applications will be broken. In financial application scenarios with high requirements for execution efficiency such as high-frequency trading, DeFi will bring the same performance as CeFi products, so we have the opportunity to see more products like Hyperliquid impacting the original CeFi system.

Jasper

Jasper