Author: Revc, Golden Finance

Ripple's native token XRP has once again attracted the attention of the global crypto market. Recently, the price of XRP has risen rapidly to $2.42 per coin, and its market value has exceeded $137 billion, making it the third largest crypto asset in the world. This wave of growth is not accidental, but the result of the combined effect of multiple forces, including favorable market policies, technological innovation and the continued development of the global crypto field.

Three driving forces for the price surge

1. ETF investment plan and new product layout

Ripple recently announced an investment in the renamed Bitwise Physical XRP ETP, which is an important step in promoting the mainstreaming of crypto assets. The launch of the ETF provides institutional investors with a safe and convenient XRP investment channel, which will help drive more traditional funds into the crypto market.

In addition, Ripple announced that it will launch the first tokenized money market fund on XRP Ledger and plans to launch a stablecoin RLUSD pegged to the US dollar. The addition of stablecoins will expand the actual application scenarios of XRP and further enhance the market's trust in its technology and ecosystem.

2. A clearer regulatory environment

Ripple's protracted legal dispute with the US Securities and Exchange Commission (SEC) may usher in a breakthrough. SEC Chairman Gary Gensler announced that he would step down in early 2025, and the potential crypto-friendly policies of the new US administration further boosted market confidence. In addition, the New York Department of Financial Services is about to approve Ripple's RLUSD stablecoin, which marks an important progress in Ripple's compliance development.

3. Active transactions of whale accounts

Data shows that large accounts holding 1 million to 10 million XRP have increased significantly in recent transactions. The activities of these whale accounts have driven market momentum and also indicate that institutional investors are optimistic about the future potential of XRP. At the same time, the performance of mainstream crypto assets such as Bitcoin and Ethereum has strengthened the overall sentiment of the market, further consolidating the upward trend of XRP.

Short-term risk signal: warning of MVRV ratio

XRP's market value to actual value (MVRV) ratio has recently soared to 217%, indicating that the market may be at risk of short-term overvaluation. MVRV is an important indicator of market overheating, and an excessively high ratio usually indicates the possibility of profit-taking and price corrections. However, this adjustment does not necessarily weaken the long-term value of XRP, but provides a more stable foundation for its subsequent price growth.

Technology and Governance Analysis of Ripple

1. Efficient Technical Architecture

Ripple's payment network RippleNet relies on XRP Ledger to provide an efficient and low-cost solution for cross-border payments. Its technical features include:

-Ripple Protocol Consensus Algorithm (RPCA): avoids the high energy consumption of Proof of Work (PoW) and Proof of Stake (PoS), and relies on the voting of verification nodes to reach consensus.

-High throughput and low fees: XRP Ledger can process 1,500 transactions per second, and the fee for each transaction is only 0.00001 XRP, which is much lower than Bitcoin and Ethereum.

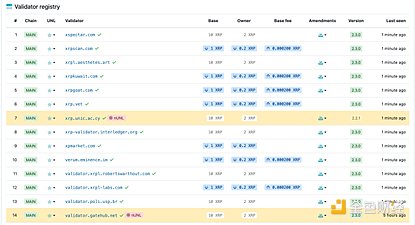

2. Centralized governance model Although Ripple has excellent technical performance, its governance model has long been controversial for being "centralized":

- Centralized node distribution: Ripple Labs directly or indirectly controls about 20% of the verification nodes and has a great influence on the selection of the Unique Node List (UNL).

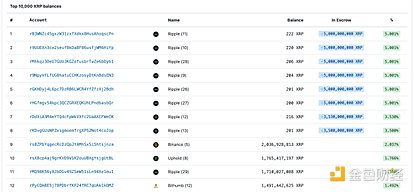

-XRP supply concentration: Ripple Labs holds more than 50% of XRP and unlocks it regularly through a custody mechanism. This distribution mechanism enhances its control over market supply and demand, but also weakens the credibility of decentralization.

FutureChallenges

1. The challenge of globalization and regulatory compliance

Although the regulatory environment in the US market may improve, policy complexity in other regions remains an obstacle to Ripple's globalization. Especially in the context of the implementation of the European MiCA regulatory framework, Ripple needs to increase its compliance investment to ensure the legality of its products worldwide.

2. Technological innovation and competitive pressure

Ethereum's payment channels and DeFi applications are gradually expanding their market share, which poses a challenge to XRP's competitive position. Ripple needs to continue to advance technological iteration to maintain its core advantage in the field of efficient payment.

3. Market volatility and selling pressure risk

Ripple's upcoming 1 billion XRP may cause a short-term impact on the market. In addition, high whale positions may exacerbate price fluctuations when market sentiment is unstable.

Summary

Ripple and XRP are at a critical stage of rapid development. From ETF investment, the launch of stablecoins, to the continuous expansion of cross-border payment networks, Ripple has demonstrated a strong driving force in the mainstreaming of crypto assets and technological applications. However, its centralized governance model and token distribution mechanism are still important factors that restrict its recognition by a wider range of users. Compared with community-driven networks such as Ethereum, Ripple's governance appears to be more "corporate". Although its governance process includes feedback from community nodes, Ripple Labs has a dominant voice. This "top-down" governance approach may be contrary to the concept of a decentralized community.

In the future, Ripple's success will depend on its ability to flexibly respond to global regulatory trends and its efforts to further decentralize network governance and token holdings. XRP Ledger's technological advantages in the payment field give it the opportunity to become the standard for enterprise-level payments. This "function-first" approach may attract user groups that do not regard decentralization as their first demand. If Ripple can balance the needs of decentralization and enterprise applications, its long-term potential will continue to be recognized by the market.

In addition, investors can also pay attention to crypto projects and listed companies affected by the policies of the new US government. With the relaxation of the regulatory environment, the improvement of institutional recognition, and the launch of a new round of investment layout, these companies and projects are expected to usher in good growth performance.

Alex

Alex

Alex

Alex Hui Xin

Hui Xin Kikyo

Kikyo Brian

Brian Joy

Joy Hui Xin

Hui Xin Joy

Joy Brian

Brian Hui Xin

Hui Xin Brian

Brian